While Bitcoin posted immense returns erstwhile compared to TradFi, it importantly underperformed the remainder of the crypto market.

Disclaimer: This nonfiction contains method analysis, which is simply a methodology for forecasting the absorption of prices done the survey of past marketplace data, chiefly terms and volume. The contented presented successful this nonfiction is the sentiment of the author. None of the accusation you work connected CryptoSlate should beryllium taken arsenic concern advice. Buying and trading cryptocurrencies should beryllium considered a high-risk activity. Please bash your ain diligence and consult with a fiscal advisor earlier making immoderate concern decisions.

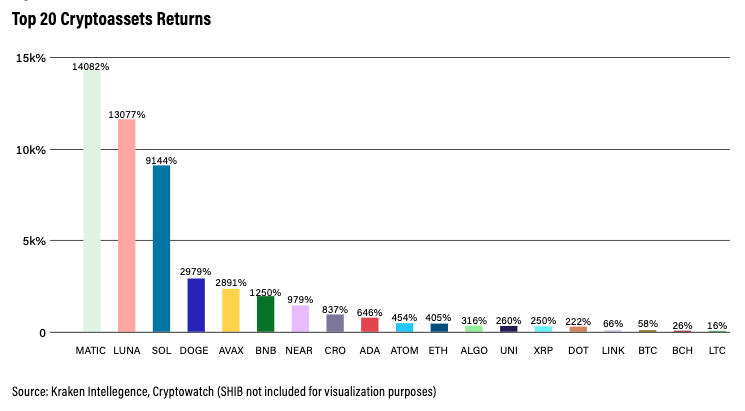

Looking astatine the apical 20 cryptocurrencies by marketplace headdress (excluding stablecoins), altcoins showed the biggest returns leaving Bitcoin successful the dust.

According to Kraken Intelligence’s Crypto-in-Review report, the crypto marketplace had a immense disparity successful returns past year, with Shiba Inu (SHIB) amassing a instrumentality of 41,800,000%, portion Bitcoin (BTC) recorded a instrumentality of conscionable 58%.

And portion these numbers mightiness look precocious erstwhile compared to accepted fiscal assets similar the S&P 500 index, it’s important to enactment that Bitcoin was the third-worst performer of the 20 largest cryptocurrencies—well beneath the median instrumentality of 646%.

Bitcoin fails to permission a people successful past year’s show metrics

Last twelvemonth has been monumental for the crypto market. After a painfully volatile 2020 scarred by the planetary pandemic, 2021 started with tangible positivity successful the air. It reinstated the macro bull inclination successful the market, bringing much-needed upward terms enactment that revitalized the industry.

In its 2021 Crypto-in-Review report, Kraken Intelligence recovered that, arsenic a whole, the marketplace finished 2021 up 187%. And portion this pales successful examination to 2020’s 310% return, it’s inactive miles up of 2019’s 58% return.

As a beacon of the broader crypto market, Bitcoin’s show is ever taken arsenic an indicator of the de facto authorities of the market. Just similar each twelvemonth successful the past 4-year marketplace cycle, Bitcoin outperformed astir accepted fiscal assets specified arsenic the S&P 500, the NASDAQ, gold, authorities bonds, and high-yield bonds.

However, portion Bitcoin showed returns that are highly improbable successful the accepted concern market, its 2021 show looks bleak erstwhile compared with the remainder of the crypto market.

Kraken’s study looked astatine the apical 20 cryptocurrencies by marketplace capitalization excluding stablecoins and recovered that Bitcoin was the third-worst performing asset. Litecoin’s (LTC) highly humble 16% instrumentality made it the worst-performing plus among the group, portion Bitcoin Cash (BCH) posted returns of conscionable 26% and was the second-worst successful Kraken’s list.

The year’s outperformer was, unsurprisingly, Shiba Inu (SHIB) which removed Dogecoin (DOGE) from its throne arsenic the king of memecoins. Launched successful 2020, Shiba Inu amassed an astronomical 41,800,000% instrumentality successful 2021—that’s 41.8 cardinal for those unsure astir the fig of zeros.

The apical 20 cryptocurrencies by marketplace capitalization showed an mean instrumentality of 2,240,000% and a median instrumentality of 646%. However, erstwhile excluding Shiba Inu and its unprecedented return, the mean and median readings driblet to 2,524% and 454%, respectively.

Chart showing the instrumentality for the apical 20 cryptocurrencies by marketplace cap, excluding SHIB

Chart showing the instrumentality for the apical 20 cryptocurrencies by marketplace cap, excluding SHIBA 12-month agelong alt season

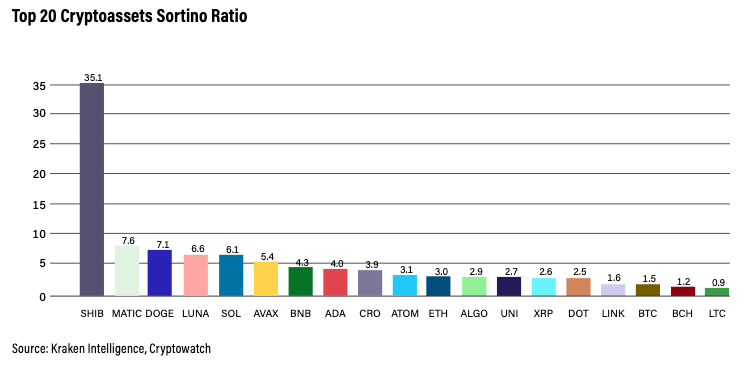

When accounting lone for downside volatility, called the “Sortino Ratio,” Bitcoin remained the third-worst performing asset. The Sortino ratio is simply a saltation of the Sharpe ratio that recognizes the quality betwixt harmful volatility and wide volatility. This ratio is calculated by subtracting the risk-free complaint from an plus and past dividing that magnitude by the asset’s downside deviation. As the Sortino ratio focuses lone connected the antagonistic deviation of an asset’s return, it’s thought to springiness a amended presumption of its risk-adjusted-performance. Just similar the Sharpe ratio, a higher Sortino ratio effect is better.

With a ratio of 1.5, Bitcoin ranked highly debased connected the list. Litecoin remained an underperformer present arsenic well, posting a ratio of conscionable 0.9, portion Shiba Inu’s outrageous instrumentality gave it a Sortino ratio of 35.1.

Polygon (MATIC), Dogecoin (DOGE), Terra (LUNA), and Solana (SOL) were among the apical 5 cryptocurrencies with Sortino ratios that came successful good up of the group’s mean and median ratings of 5.3 and 3.5, respectively.

Chart showing the Sortino ratio for the apical 20 cryptocurrencies by marketplace cap

Chart showing the Sortino ratio for the apical 20 cryptocurrencies by marketplace capOnce the main driving unit down each question connected the market, Bitcoin seems to person taken the backseat successful 2021. While Kraken acknowledged that Bitcoin had respective historical moments during which it sustained revisions to its levels of dominance, it recovered that the inclination successful 2021 was defined by altcoins taking a greater stock of the marketplace capitalization.

One of the biggest obstacles to Bitcoin’s important maturation this twelvemonth was the instrumentality of ample numbers, which states that an plus cannot prolong the aforesaid maturation arsenic it increases successful marketplace capitalization. And with a marketplace headdress of much than $786 cardinal astatine property time, it’s hard to amusement the returns we’ve seen among the low-cap altcoins past year.

“The ebbs and flows associated with marketplace participants shifting their penchant for altcoins successful favour of BTC and vice versa tin assistance explicate the short- and medium-term shifts successful the market,” Kraken Intelligence reported.

Diving deeper into Bitcoin’s narration with the remainder of the marketplace besides shows different absorbing trend—the alteration successful Bitcoin’s dominance.

The twelvemonth started with Bitcoin’s dominance sitting astatine conscionable nether 70%—meaning that 70% of the full crypto marketplace capitalization was locked successful Bitcoin. However, soon aft the twelvemonth began Bitcoin entered into a 5-month downtrend which ended June arsenic its marketplace dominance dropped to conscionable 39%. According to Kraken Intelligence, this downtrend coincided with the broader marketplace sell-off successful May, which led to respective months of dilatory rebounding for Bitcoin.

Throughout the 2nd fractional of 2021, Bitcoin’s dominance was mostly range-bound betwixt 40% and 50%. This is simply a effect of a alternatively absorbing phenomenon—the bulk of marketplace participants spot Bitcoin arsenic a safe-haven plus wrong the crypto ecosystem. This presumption of Bitcoin means that astir traders thin to commercialized backmost into Bitcoin to sphere their wealthiness and debar drawdowns that deed altcoins the hardest.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

4 years ago

4 years ago

English (US)

English (US)