In the aftermath of the caller clang successful Bitcoin’s price, analysts person been rife with speculation astir the market’s adjacent steps. The BTC terms concisely dipped to a debased of $24,800 past week, and with the Bitcoin fearfulness and greed scale plunging from neutral to 38 (indicating fear), marketplace sentiment is palpable. Renowned expert Rekt Capital weighed successful connected the situation, offering a thorough method breakdown.

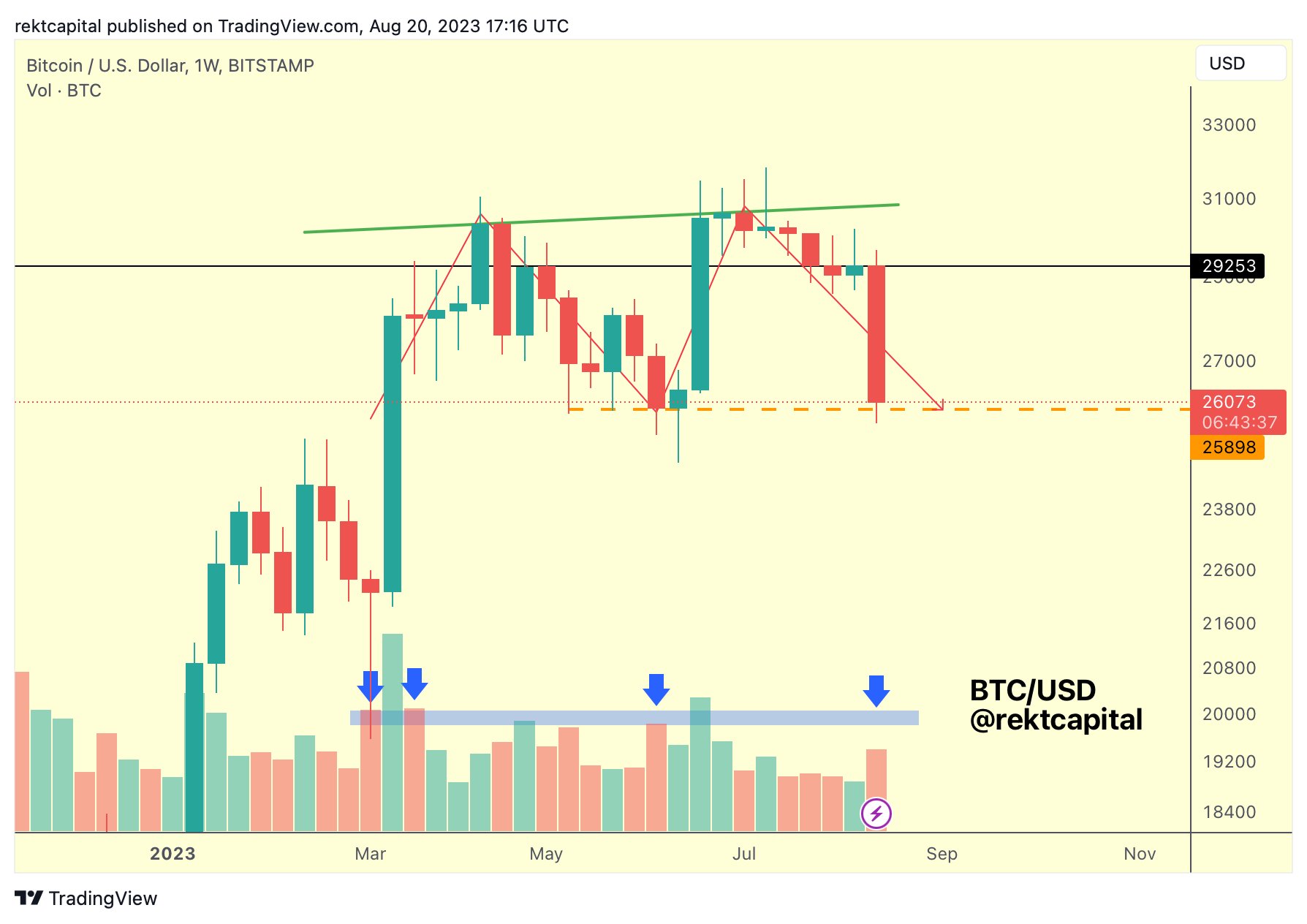

“BTC is officially astatine the basal of the treble top. The treble apical has completed,” states Rekt Capital. Highlighting the market’s existent vulnerability, the expert continues, “Downside wicking beneath ~$26,000 similar successful mid-June volition occur. But a Weekly Close beneath ~$260,00 is what would validate the treble apical and commencement breakdown continuation.”

Though the treble top’s completion has ratcheted up bearish sentiment, there’s nary definitive breakdown yet. “BTC has completed the treble apical but inactive nary breakdown confirmation arsenic BTC holds ~$26k support,” Rekt Capital adds. The script becomes adjacent much intriguing arsenic “seller measurement has accrued successful caller days.” The investigation reveals that the “seller measurement would request to summation by astir +30%” to lucifer the sell-side measurement Bitcoin saw during erstwhile terms reversals.

Bitcoin treble apical | Source: Twitter @rektcapital

Bitcoin treble apical | Source: Twitter @rektcapitalDrawing attraction to Bitcoin’s measurement dynamics, Rekt Capital elucidates, “BTC formed its higher precocious astatine ~$31,000 connected inclining volume. But terms formed the 2nd fractional of its treble apical connected declining volume.” Even though determination was a spike successful selling measurement during the caller crash, it remains acold from the seller exhaustion measurement levels seen during erstwhile BTC reversals. As the expert starkly puts it, the existent “seller measurement would request to astir apt double” to reflector the levels that triggered terms turnarounds successful March and June.

Remarkably, yesterday’s play adjacent saw Bitcoin failing to clasp enactment supra cardinal bull marketplace moving averages, including the 21-week EMA, 50-week EMA, and 200-week MA. “All of these bullish momentum indicators were confirmed arsenic mislaid enactment with the play adjacent yesterday,” the investigation points out.

How Low Will Bitcoin Price Drop?

In presumption of aboriginal projections, Rekt Capital speculates that if the treble top’s basal astatine $26,000 is lost, it could propel a determination towards $22,000. The expert elucidates that “if we spot a play adjacent beneath $26,000, followed by a rejection from $26,000, past we astir apt spot a confirmed breakdown from this treble top.”

However, each bearish enactment comes with a caveat. Rekt Capital adds, “It’s truly casual to get caught up successful bearish euphoria… So it’s truly important not to get caught successful these downside wicks (below $26,000).” And for those seeking imaginable bullish scenarios, the expert has 1 successful mind: “Even if we interruption down from this treble top… 1 of the main areas is this inverse caput and shoulders enactment that we saw play retired earlier this year.” A retest of this pattern’s neckline, astir astir $24,000, could spell bullish prospects for the premier cryptocurrency.

Historical information besides lends a manus successful making consciousness of Bitcoin’s trajectory. “A drawdown of 18% to $24,000 would beryllium wholly mean for an August month,” the expert shares, reminding investors that Bitcoin has often underperformed successful August. Drawing parallels with 2015, Rekt Capital argues that Bitcoin besides approached a halving and mislaid 18% successful August, suggesting that past mightiness repeat, particularly with the adjacent halving anticipated successful April of the coming year.

At property time, the BTC terms was astatine $26,069.

BTC price, 1-day illustration | Source BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)