Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin traders are preparing for a jam-packed and perchance turbulent week. From looming tariffs to whale-sized BTC bid activity, present are 5 large factors that marketplace participants request to support connected their radar.

#1 US Tariffs Poised To Escalate On April 2

The planetary signifier is bracing for what US President Donald Trump has dubbed “Liberation Day” connected April 2. According to The Kobeissi Letter (@KobeissiLetter), the administration’s program for “reciprocal tariffs” promises to beryllium a watershed infinitesimal successful ongoing planetary commercialized disputes.

“President Trump has been discussing this Wednesday, April 2nd, for weeks. This is simply a time that helium has named ‘Liberation Day’ wherever wide caller tariffs are coming. We judge April 2nd volition beryllium the biggest escalation of the commercialized warfare to date,” The Kobeissi Letter writes via X.

These tariffs volition furniture connected apical of a slew of existing US duties that span steel, aluminum, Canadian goods, Mexican goods, and galore Chinese imports. The Kobeissi Letter points retired that 25% levies connected car imports and connected countries purchasing Venezuelan lipid volition besides instrumentality effect this week. With retaliatory measures from Canada, China, the EU, and Mexico successful the pipeline, they pass of a “massive commercialized war,” intensifying uncertainty for planetary markets.

Beyond commercialized specifics, the coming days could spot ostentation unit intensify owed to higher user costs connected imported goods. Citing an uptick successful the Economy Policy Uncertainty Index, The Kobeissi Letter highlights: “Policy uncertainty is presently supra conscionable astir immoderate situation successful modern US history. We are seeing ~80% HIGHER uncertainty levels than 2008. As a result, marketplace swings are widening, and we expect an highly volatile week.”

Add successful President Trump’s latest threats regarding Iran—where “secondary tariffs” and imaginable levies connected Russian lipid are connected the table—and determination are aggregate planetary flashpoints that whitethorn provender into marketplace volatility.

#2 Bitcoin Whale Activity

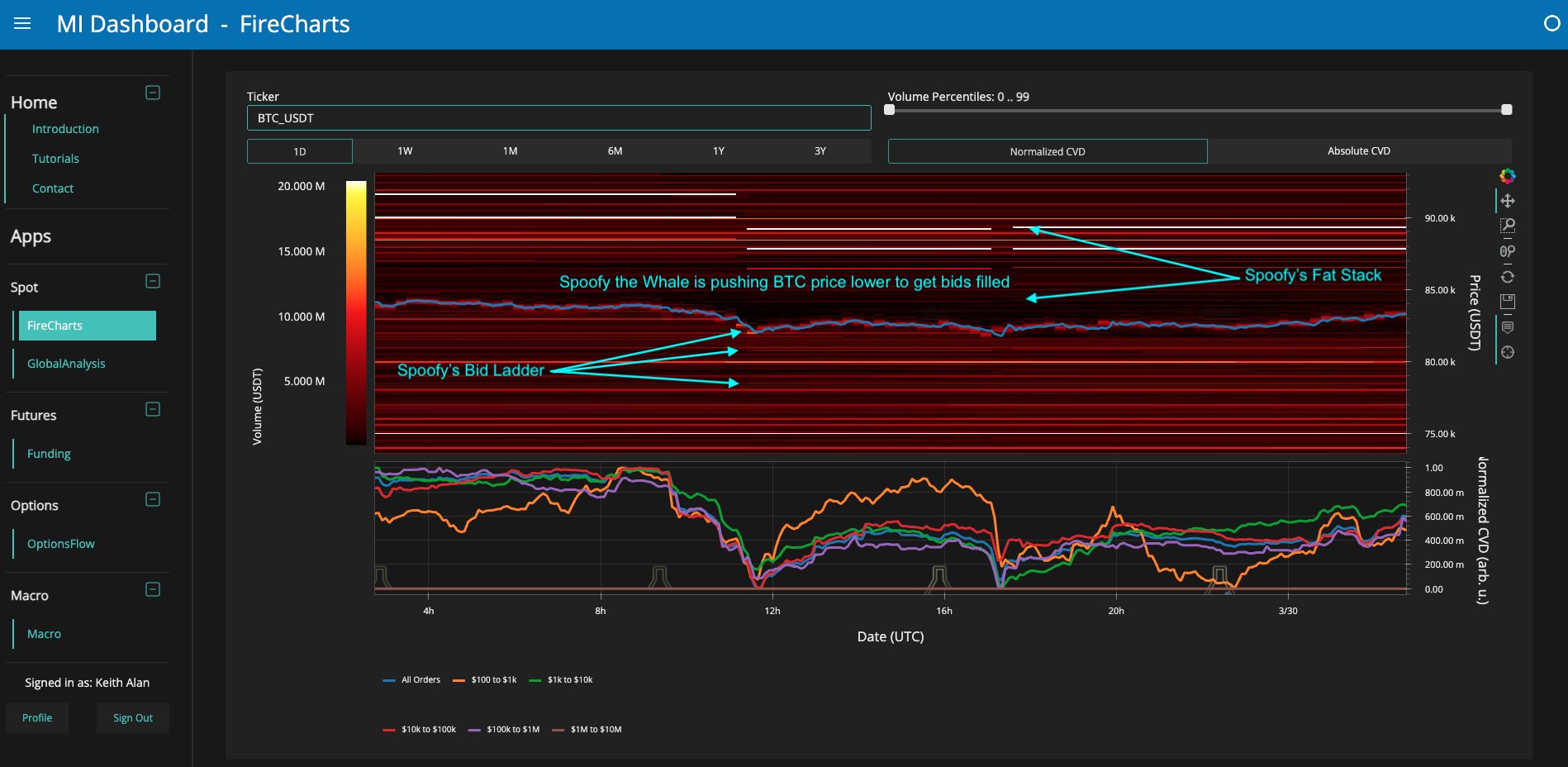

In the Bitcoin arena, large-scale liquidity maneuvers stay a focal point. Keith Alan (@KAProductions), co-founder of Material Indicators, drew attraction to a imaginable whale strategy successful action—attributed to a fig helium dubs “Spoofy the Whale.”

“My archetypal hint that thing was up came with a series of micro movements that seemed to beryllium a small antithetic than his emblematic terms accommodation of his monolithic blocks of inquire liquidity. At a person look I noticed a ladder of BTC bid liquidity perfectly aligned and moving with the inquire liquidity. While I person nary existent mode of confirming that it is the aforesaid entity utilizing inquire liquidity to herd terms into their ain bids, it surely appears that Spoofy has been buying this dip and has bids laddered down to $78k,” Alan wrote connected Sunday.

Firecharts Bitcoin illustration | Source: X @KAProductions

Firecharts Bitcoin illustration | Source: X @KAProductionsHe besides noted the convergence of respective quality events—Sunday’s play close, Monday’s monthly close, and the expected tariff implementation midweek—that whitethorn catalyze further terms swings. While acknowledging BTC could inactive spell lower, helium underlined the whale’s evident committedness to accumulating astatine existent levels: “In the expansive strategy of things, nary of this means BTC terms can’t spell lower, but it does mean that the whale that has been suppressing BTC terms for the past 3 weeks is utilizing a DCA strategy to bargain this dip…and truthful americium I.”

#3 Bitcoin Bearish Flag Breakdown

Technical expert Kevin (@Kev_Capital_TA) is warning traders to support a adjacent oculus connected pivotal enactment levels pursuing a bearish flag breakdown: “We were tracking this bearish emblem signifier each past week and arsenic we tin spot we had a breakdown of that weakness. If BTC does suffer the aureate pouch present astatine $81K and follows done with that measured determination target, past the $70K–$73K scope … would beryllium the ‘Measured Move’ target.”

Still, Kevin posits that, fixed wide antagonistic sentiment astir April 2 (“Armageddon Day” successful immoderate corners of the media), determination is simply a anticipation of a contrarian twist: “Will the Tariff implementation connected April 2nd beryllium a uncommon ‘sell the rumor bargain the quality event’? … Everyone thinks the satellite is abruptly going to end.”

He besides added: “A small spot of agelong liquidity astatine the $78K-$80K level but a batch of foodstuff successful the $87K-$89K (Dark Yellow) scope for marketplace makers to transact successful close earlier the CNBC proclaimed “Armageddon Day” connected April 2nd. Makes maine wonder.”

BTC/USDT liquidation heatmap | Source: X @Kev_Capital_TA

BTC/USDT liquidation heatmap | Source: X @Kev_Capital_TA#4 Seasoned Players Accumulate

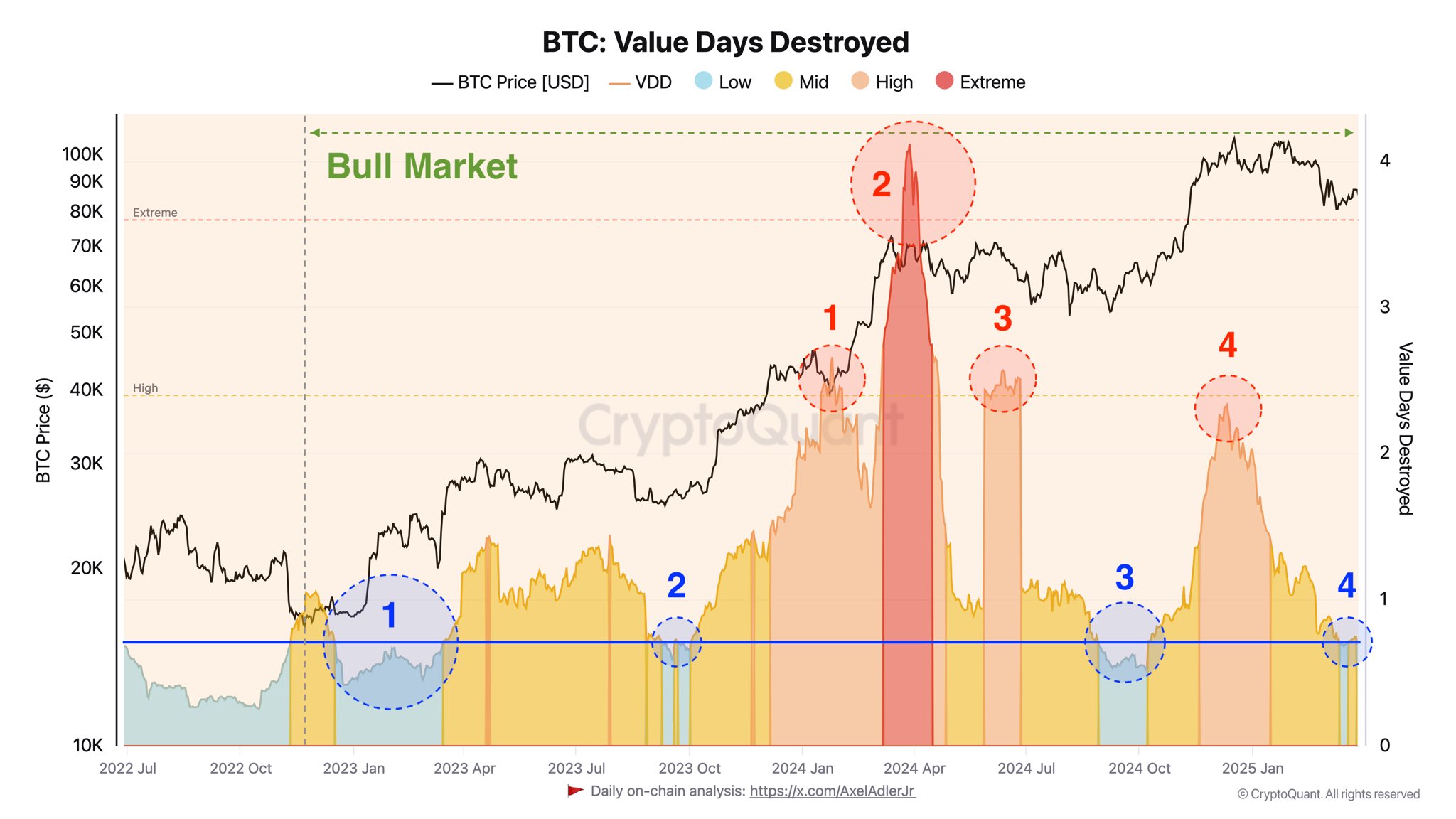

From an on-chain perspective, Axel Adler Jr, an expert astatine CryptoQuant, observes that experienced marketplace participants are moving into a caller accumulation phase. Drawing from the Value Days Destroyed (VDD) indicator, Adler identifies a bid of 4 chiseled accumulation periods since aboriginal 2023, marking the existent rhythm arsenic ripe for imaginable semipermanent upside:

“The lack of important selling successful the existent signifier demonstrates the assurance of these experienced players that the existent BTC terms level is not favorable for profit-taking.” Adler underlines that humanities information shows debased VDD periods often precede terms increases, suggesting a bullish medium-term outlook—provided macro factors, including planetary economical argumentation shifts, bash not derail marketplace sentiment.

Bitcoin VDD | Source: X @AxelAdlerJr

Bitcoin VDD | Source: X @AxelAdlerJr#5 CME Gap

Lastly, traders request to ticker the CME (Chicago Mercantile Exchange) spread formation, which has been a notable diagnostic successful Bitcoin’s terms action. Rekt Capital (@rektcapital) highlighted the caller filling of a spread betwixt $82,000 and $85,000: “BTC has filled the wide CME Gap country from $82k–$85k. Moreover, Bitcoin volition astir apt make a marque caller CME Gap implicit this play … Which could acceptable BTC up for a determination into astatine slightest $84k adjacent week.”

Bitcoin CME Gap | Source: X @rektcapital

Bitcoin CME Gap | Source: X @rektcapitalCME gaps often enactment arsenic magnets for terms action, and Rekt Capital’s investigation suggests a imaginable retracement to capable recently formed gaps oregon a continuation determination that takes BTC higher, depending connected however broader marketplace forces unfold this week.

At property time, BTC traded astatine $82,010.

BTC drops lower, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC drops lower, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

5 months ago

5 months ago

English (US)

English (US)