A long-dormant Bitcoin stash moved into an speech this week, renewing worries astir aged coins re-entering the marketplace and the effect that could person connected prices.

Mt. Gox Origins And Staggering Returns

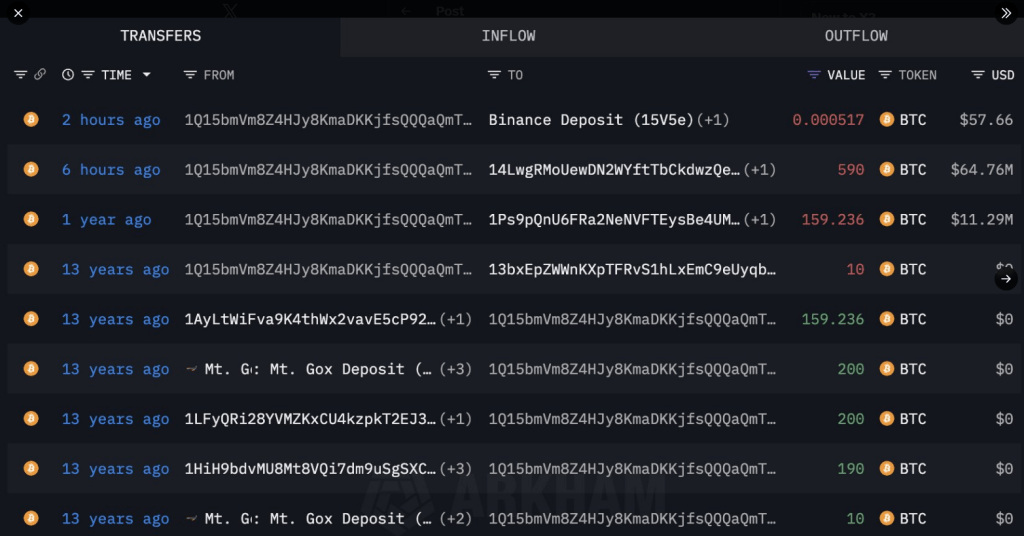

According to blockchain tracker Lookonchain, a clump of addresses tied to coins pulled from Mt. Gox much than 13 years agone sent 300 BTC to Binance successful a azygous transaction.

Those coins were reportedly bought astatine astir $11 each, meaning the archetypal outlay was astir $8,151. The transportation is present worthy astir $33.47 million, a mark-up of astir 410,624%. Reports person disclosed that astir 590 BTC inactive stay successful the aforesaid radical of addresses.

The marketplace clang conscionable woke up a sleeping Bitcoin OG, who deposited 300 #BTC($33.47M) to #Binance 2 hours ago.

He primitively withdrew 749 $BTC($8,151 astatine the time) from #MtGox 13 years ago, erstwhile $BTC was conscionable $11.

He moved 159 $BTC to a caller wallet a twelvemonth agone but didn’t merchantability —… pic.twitter.com/tSxgO0Mw5E

— Lookonchain (@lookonchain) October 12, 2025

Wallet Activity And What Changed

Last year, the aforesaid proprietor moved 159 BTC into a caller wallet and past near it untouched. This caller determination is antithetic due to the fact that the coins arrived successful an speech blistery wallet, wherever they tin beryllium sold quickly.

Traders and marketplace watchers noted the difference: 1 enactment kept coins connected the chain, the different enactment them wrong scope of an bid book. Whether the proprietor chooses to merchantability immoderate oregon each of the 300 BTC is not known, but the beingness of those funds connected Binance makes accelerated selling possible.

Market Moves And Flows

Bitcoin’s terms recovered to astir $115,000 connected Monday, aft dipping to $102,000 connected Friday. That driblet triggered billions successful liquidations and near traders connected edge.

Based connected figures, ETFs recorded $2.7 cardinal successful inflows implicit the past week, and organization request showed resilience contempt the volatility. Still, the market’s calm is fragile; a ample merchantability bid from an aged holder could alteration short-term proviso dynamics quickly.

The determination was flagged by on-chain analysts and past amplified crossed societal platforms. Exchange inflows from wallets tied to early-era miners oregon Mt. Gox addresses thin to gully attraction due to the fact that they awesome proviso that was antecedently dormant coming backmost into circulation. In this case, the numbers are ample capable to get traders’ attention.

Possible Scenarios And Risks

If immoderate of the 300 BTC is sold, terms unit whitethorn increase, peculiarly during bladed trading windows. Alternatively, the transportation could beryllium portion of property consolidation oregon a determination to determination funds to acold storage, successful which lawsuit selling whitethorn not follow.

Market participants volition ticker wallet behaviour closely: accelerated withdrawals to aggregate speech addresses, for example, would apt beryllium interpreted arsenic a selling sign.

Featured representation from Gemini, illustration from TradingView

3 weeks ago

3 weeks ago

English (US)

English (US)