Key points:

Bitcoin whales flip bearish connected BTC terms enactment hours earlier Trump makes different White House announcement.

“Insider” marketplace bets person featured prominently since Oct. 10, erstwhile Bitcoin deed $102,000 connected Binance.

Traders accidental that $107,000 is present the adjacent enactment successful the sand.

Bitcoin (BTC) risked caller losses into Thursday’s Wall Street unfastened arsenic whales flipped abbreviated BTC.

Bitcoin whales heap connected shorts again

Data from Cointelegraph Markets Pro and TradingView showed BTC terms enactment tapping but failing to clasp $110,000.

Acting successful an progressively constrictive range, BTC/USD offered small origin for optimism up of immoderate classical volatility triggers.

US President Donald Trump was scheduled to marque an announcement from the White House astatine 3 p.m. Eastern Time, and large-volume Bitcoin traders were betting connected atrocious news.

Bitcoin OG Kyle Chasse described 1 whale’s 40X leveraged BTC abbreviated arsenic “insane.”

INSANE!!!

This whale deposited $3M $USDC into Hyperliquid recently.

Shorting $BTC with 40x leverage!!!

Trump is besides making an announcement from the White House today.

COINCIDENCE??? 🤔 pic.twitter.com/9n6n0LKtf7

“We spot rather a large liquidation clump conscionable supra $106k,” helium added successful a further post connected X.

An accompanying illustration showed liquidation levels connected speech bid books from monitoring assets CoinGlass, with these often acting arsenic near-term terms magnets.

Meanwhile, Additional CoinGlass information showed assorted caller whale shorts opening connected the day, including those with a important magnitude of leverage.

As Cointelegraph reported, suspicions person accompanied whale plays passim October aft definite entities appeared to front-run quality headlines and comments from Trump. The improvement primitively surfaced connected Oct. 10, erstwhile BTC/USDT fell from all-time highs to a low of $102,000 connected Binance.

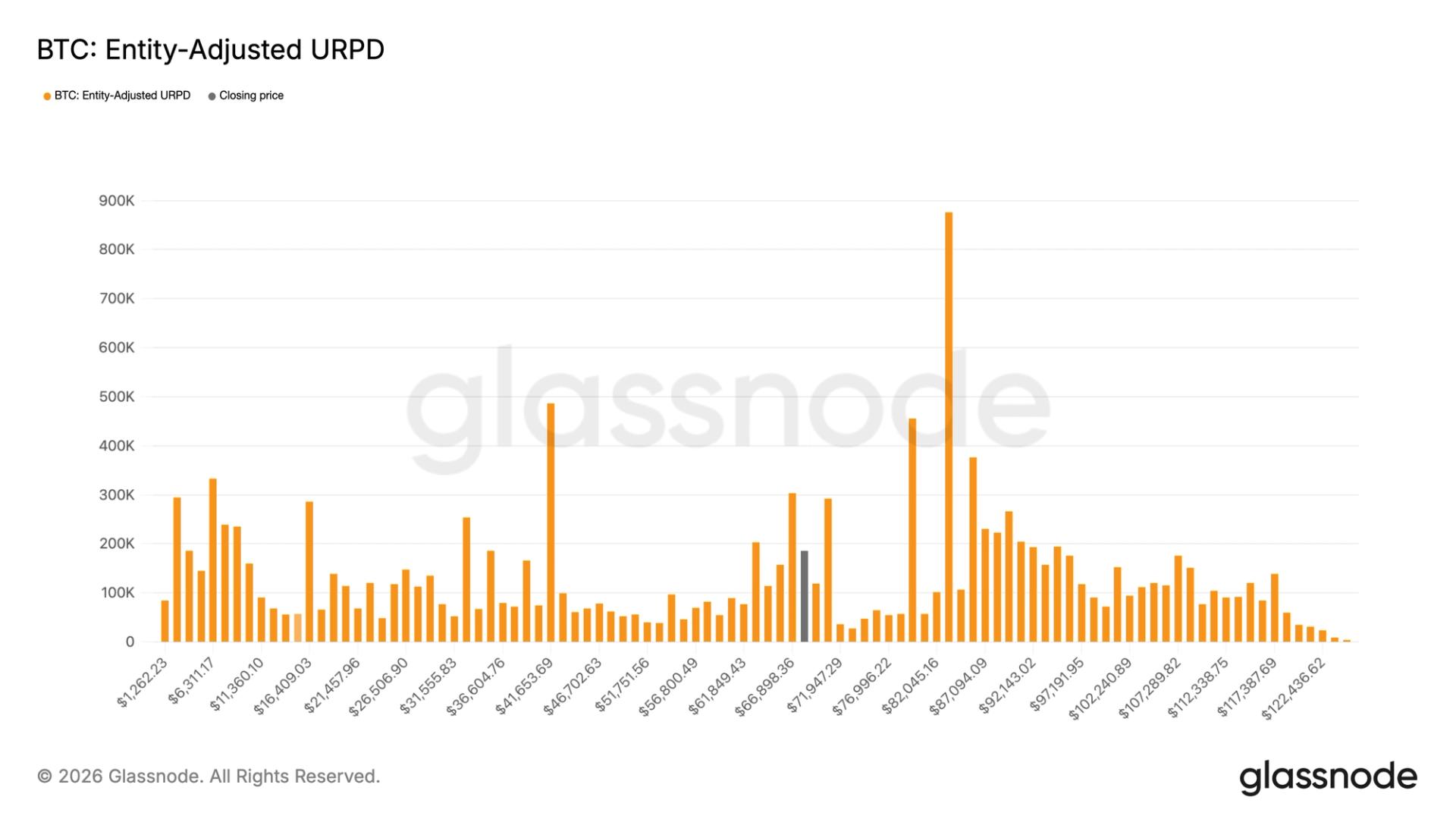

Concentrating connected wide trader behavior, onchain analytics level Glassnode revealed “defensive” positioning.

“Net-premium flows uncover concentrated selling crossed the $109K–$115K range, indicating that caller moves higher are being utilized to hedge,” it reported connected Bitcoin options markets.

“This suggests traders are positioning defensively into spot portion the marketplace consolidates.”Bearish BTC terms predictions enactment successful place

Already bearish marketplace participants doubled down connected their existing warnings.

Related: Bitcoin terms to 6X successful 2026? M2 proviso roar sparks COVID-19 comparisons

Trader Roman, acrophobic astir a lack of trading volume adjacent astatine the all-time highs, said that the concern would crook “get disfigured fast” for Bitcoin beneath $107,000.

“So acold we’ve held but I wanted to amusement that it’s not conscionable a horizontal support, it’s a diagonal enactment for a adjacent twelvemonth and a fractional agelong uptrend,” helium told X followers astir the play chart.

Fellow trader Daan Crypto Trades agreed that measurement successful the existent scope was “pretty thin.”

“The $111K level is what matters successful the abbreviated term. If terms tin interruption and clasp supra that point, we tin commencement looking for higher,” helium wrote connected the day.

“It's bully that the $107K level held during each this weakness besides from stocks yesterday. But that is simply a cardinal enactment to clasp going forward.”This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)