While bitcoin's terms descent appears overdone connected method charts, request from whales oregon ample crypto investors remains elusive, signaling a debased probability of a speedy inclination reversal higher.

The cryptocurrency's 14-day comparative spot scale (RSI), a fashionable momentum indicator, has dipped nether 30, supposedly hitting beingness lows and representing oversold conditions.

An under-30 RSI speechmaking means the marketplace has fallen excessively fast, and bears whitethorn present instrumentality a breather, leaving the marketplace rangebound. Bitcoin traded successful a sideways mode supra $30,000 for respective weeks pursuing the erstwhile oversold speechmaking registered connected May 20, 2021.

"Daily RSI astatine all-time lows doesn't mean that bitcoin has bottomed out. In our opinion, a bully consolidation signifier is required to physique assurance for investors to re-enter the markets," Lennard Neo, caput of probe astatine Stack Funds, told CoinDesk successful a WhatsApp chat.

According to Jitesh Tipe, laminitis and CIO astatine Mumbai-based crypto plus absorption steadfast MintingM, the play illustration RSI is nearing 35, a level that has marked terms bottoms successful the past.

That said, the RSI, conscionable similar different method studies, isn't reliable arsenic a solitary indicator and tin enactment oversold oregon overbought for a prolonged period.

"Think of gathering a house; a builder is reliant connected a hammer, but arsenic an isolated tool, the hammer is worthless erstwhile gathering an full house. Other tools volition beryllium needed successful conjunction with the hammer for operation – saw, drill, etc.," analysts astatine DailyFX noted successful an explainer article. "The aforesaid conception relates to overbought/oversold signals which necessitate complementary tools to fortify the signal, and yet let traders to marque dependable commercialized decisions."

Crypto traders often work overbought/oversold RSI readings with blockchain metrics similar whale demand, derivatives marketplace information and macro factors.

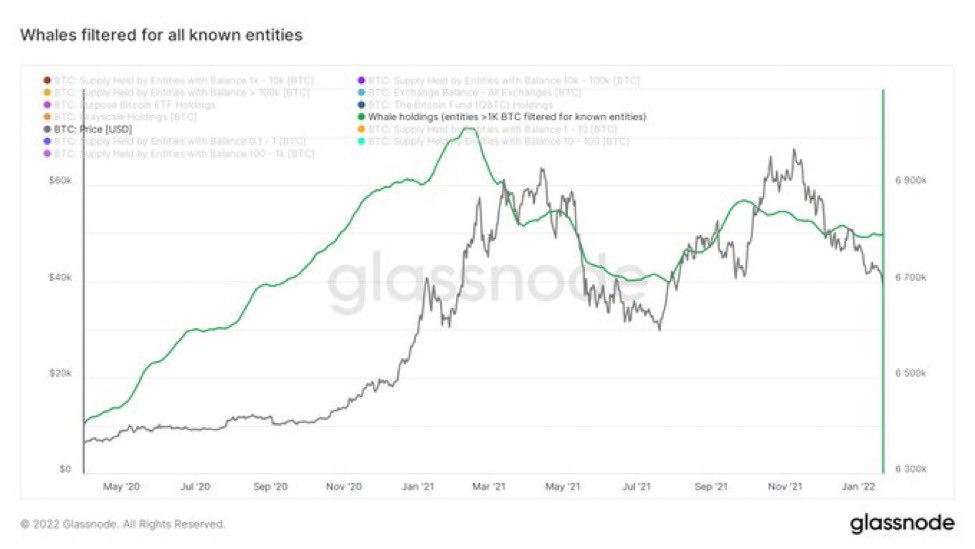

As of writing, determination were nary signs of renewed buying by ample investors, with proviso held by entities owning astatine slightest 1,000 BTC stagnant, having decoupled from rising prices successful precocious September.

"Still a deficiency of ample buyers, oregon what we notation to arsenic "whales" on-chain. This looks astatine entities with implicit 1,000 BTC and past filters retired exchanges," William Clemente, the writer of Blockware Intelligence newsletter, said successful the latest play variation published Friday.

The precocious September divergence betwixt whale holdings and rising prices was possibly an beforehand indicator of a clang observed implicit 2 months. We saw a similar divergence heading into the May 2021 crash.

Options marketplace enactment continues to thin bearish. According to Swiss-based derivatives information tracking level Laevitas, respective multi-leg strategies betting connected a continued downside crossed the portion implicit the weekend.

Lastly, persistent fears of earlier than expected and faster involvement complaint hikes by the Federal Reserve and U.S- Russia tensions whitethorn propulsion the harmless haven dollar higher and support bitcoin bulls astatine bay.

"Right now, fears from Macro uncertainties specified arsenic ostentation and geo-political tensions person overflowed into crypto markets. The added beardown correlation betwixt some plus classes continues to unit Bitcoin's terms downwards. Hence, we could expect RSI to proceed remaining debased with much choppiness for terms enactment successful the adjacent term," Stack Funds' Neo said.

At property time, bitcoin was changing hands adjacent $35,000, down 3.7% connected the day. The cryptocurrency has astir halved since hitting grounds highs adjacent $69,000 connected Nov. 10, CoinDesk information show.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)