Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Speculation implicit a purported White House program to intermission tariffs for ninety days connected each countries but China sent markets into a frenzy earlier today, triggering abrupt terms reversals crossed equities, Bitcoin and cryptocurrencies. In a quick-fire bid of conflicting updates, the rumor initially floated astatine astir 10:10 AM ET, sparked momentum successful hazard assets, and was yet deemed “fake news” by the White House.

The Kobeissi Letter (@KobeissiLetter) described the chronology connected X, noting: “What conscionable happened? At 10:10 AM ET, rumors emerged that the White House was considering a ‘90-day tariff pause.’ At 10:15 AM ET, CNBC reported that Trump is considering a 90-day intermission connected tariffs for ALL countries but for China. By 10:18 AM ET, the S&P 500 had added implicit +$3 TRILLION successful marketplace headdress from its low.”

However, lone 7 minutes later, astatine 10:25 AM ET, reports emerged that the White House was ‘unaware’ of Trump considering a 90-day pause. “At 10:26 AM ET, CNBC reports that the 90-day tariff intermission headlines were incorrect. At 10:34 AM ET, the White House officially called the tariff intermission headlines ‘fake news.’ By 10:40 AM ET, the S&P 500 erased -$2.5 TRILLION of marketplace headdress from its high, 22 minutes prior. Never successful past person we seen thing similar this,” The Kobeissi Letter writes.

The specified proposition of a impermanent reprieve from tariffs managed to displacement sentiment rapidly successful some equity and crypto markets. BTC, which was trading astir $75,805 astatine the time, soared by astir 7.2% to surpass $81,200 wrong fractional an hour. Once confirmation arrived that nary specified intermission was planned, the gains evaporated astir arsenic accelerated arsenic they had arrived, pulling Bitcoin backmost to astir $77,560.

The abrupt crook of events unleashed a question of commentary among crypto observers. Pentoshi (@Pentosh1) remarked that “The fake quality tweet showed there’s a batch of sidelined superior astatine slightest for alleviation rally and the hazard is to the upside connected immoderate affirmative quality astatine slightest temporarily.”

Will Clemente III cautioned: “Bear take: Liquidity is atrocious and this volatility mightiness interruption something. Bull take: This header was the cointelegraph intern BTC ETF header but for equities.”

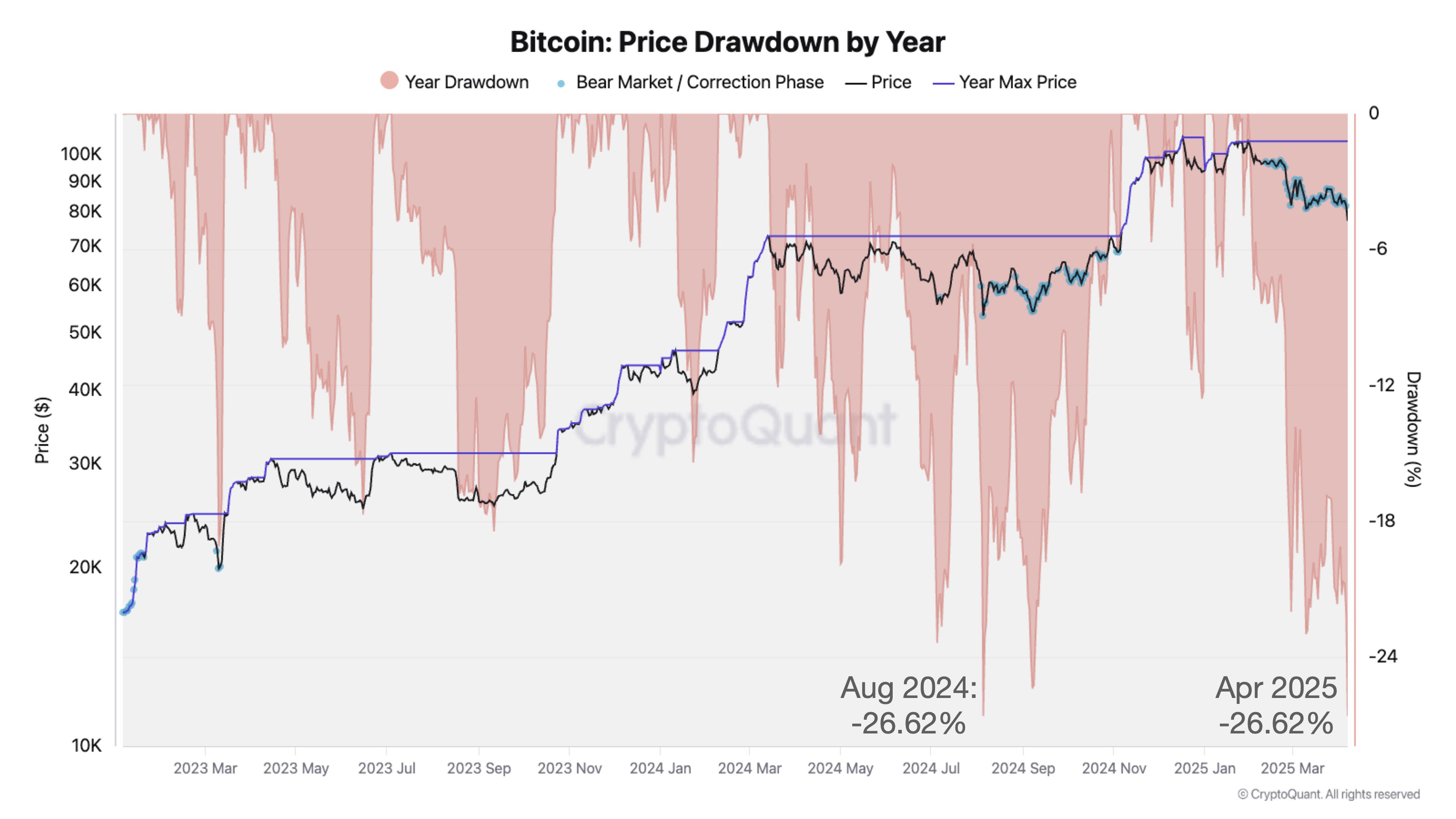

Julio Moreno, Head of Research astatine CryptoQuant, remarked that “Bitcoin’s existent terms drawdown is astir to go the largest of the existent cycle,” illustrating his constituent with a illustration that showed BTC’s correction reaching -26.62%, matching the standard of August 2024’s correction.

Bitcoin terms drawdown by twelvemonth | Source: X @jjcmoreno

Bitcoin terms drawdown by twelvemonth | Source: X @jjcmorenoMacro expert Alex Krüger (@krugermacro) invoked BlackRock CEO Larry Fink’s reflection that different 20% marketplace driblet is not retired of the question, saying: “That’s the thing. Under mean circumstances, probability of specified scenarios oregon things specified arsenic stagflation are truthful debased you tin conscionable brushwood them off. Trump opened up the near process => thing is possible. We are 1 header distant from a 7% candle successful either direction.”

Podcast big Felix Jauvin (@fejau_inc) agrees: “What’s truthful brainsick astir this crash vs different is its wholly self-willed and could beryllium reversed successful an instant connected 1 tweet. Has determination ever been thing similar that?”

In the midst of the turmoil, European Union Commissioner Ursula von der Leyen reaffirmed a willingness to question solutions, stating, “Europe is acceptable to negociate with the US,” including the anticipation of zero-for-zero tariffs connected concern goods.

At property time, BTC traded astatine $78,824.

BTC hovers beneath $80,000, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC hovers beneath $80,000, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

8 months ago

8 months ago

English (US)

English (US)