Bitcoin whales are witnessing a historical exodus. @CryptoVizArt, a elder researcher astatine Glassnode has shed airy connected the important shifts wrong the whale cohort successful a caller analysis.

Bitcoin Whales’ Impact: Unveiling The Numbers

In a singular revelation, the research highlights the important interaction of whales connected caller marketplace activity. According to the data, “34% of merchantability unit successful the past 30 time was from Binance whales.” These influential entities person been instrumental successful shaping the caller marketplace dynamics.

Moreover, the probe besides highlights a inclination successful whale behavior: a noteworthy diminution successful the full equilibrium of whale entities connected exchanges. In the past 30 days, the study states, “Whale Flow to Exchanges witnessed the largest monthly equilibrium diminution successful history, hitting -148,000 BTC/month.” This melodramatic diminution marks a important displacement wrong the whale cohort, raising intriguing questions astir their motives and strategies.

As the marketplace witnessed the rally supra $31,000, the influx of whale funds to exchanges surged remarkably. Glassnode’s information reveals that whale inflow volumes reached an awesome +16,300 BTC/day, signifying their progressive engagement successful caller marketplace movements. Notably, this whale dominance accounted for 41% of each speech inflows, which is comparable to some the LUNA clang (39%) and the nonaccomplishment of FTX (33%).

Throughout June and July, whale inflows person sustained an elevated inflow bias of betwixt 4,000 to 6,500 BTC/day. Among each exchanges, Binance emerged arsenic the superior destination for whale inflows. The study discloses that astir 82% of whale-to-exchange flows were heading into Binance. In contrast, Coinbase accounted for 6.8%, and each different exchanges relationship for 11.2%.

While the wide equilibrium of whales whitethorn person declined, @CryptoVizArt’s investigation points to intriguing interior dynamics wrong the whale cohort. As immoderate whales accrued their balances, others experienced declines. This improvement led the researcher to present the conception of ‘Whale Reshuffling,’ suggesting that not each whales travel the aforesaid strategy.

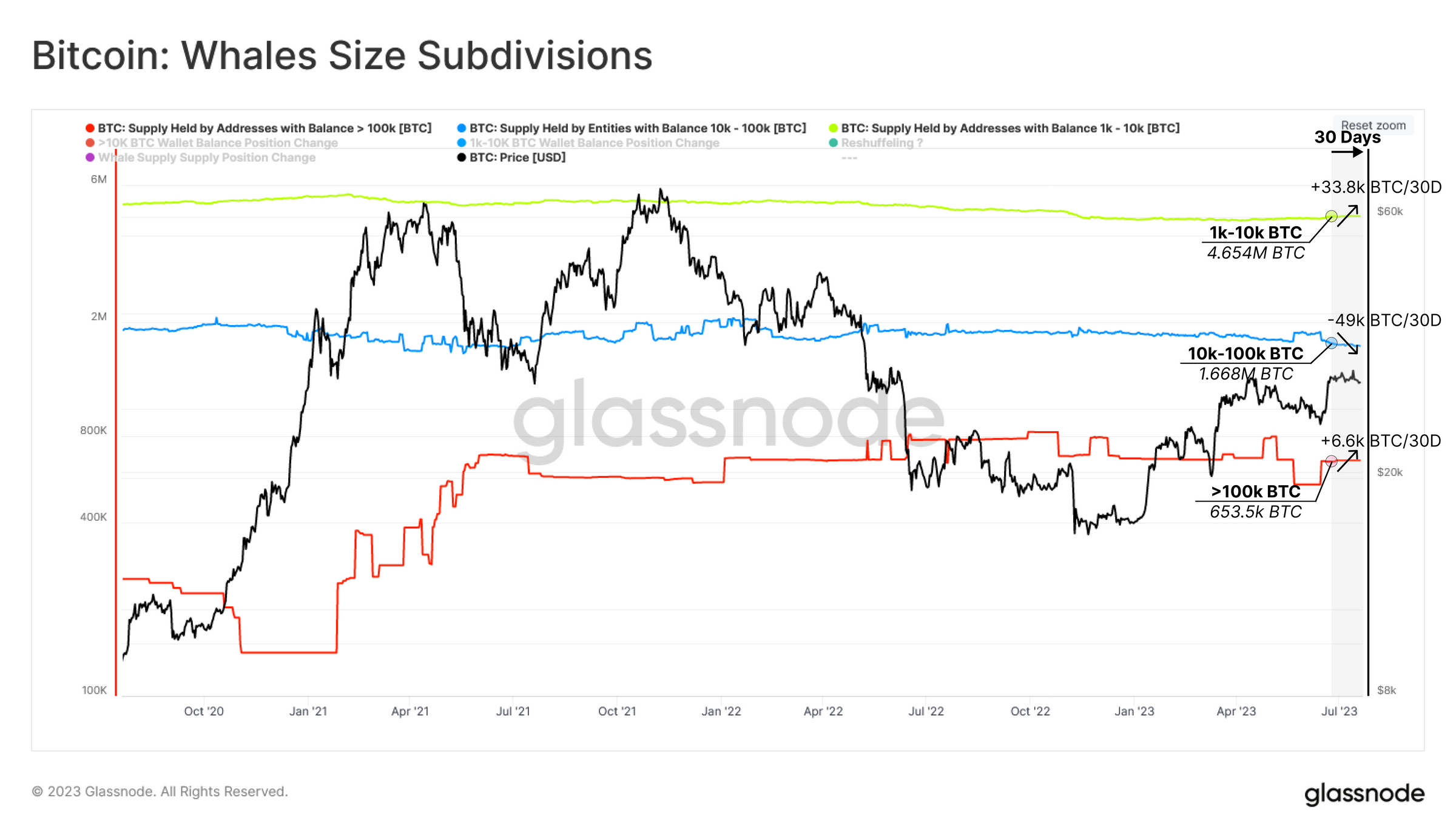

The introspection of the whale cohort implicit the past 30 days shows that whales with much than 100,000 BTC person recorded an summation of +6,000 BTC, whales with 10k-100k BTC person decreased their relationship equilibrium by -49.0k BTC and whales with 1k-10k BTC person accrued their relationship equilibrium by +33.8k BTC. However, successful aggregate, the whale radical has seen conscionable -8.7k BTC successful nett outflows.

Bitcoin whale size subdivisions | Source: Glassnode

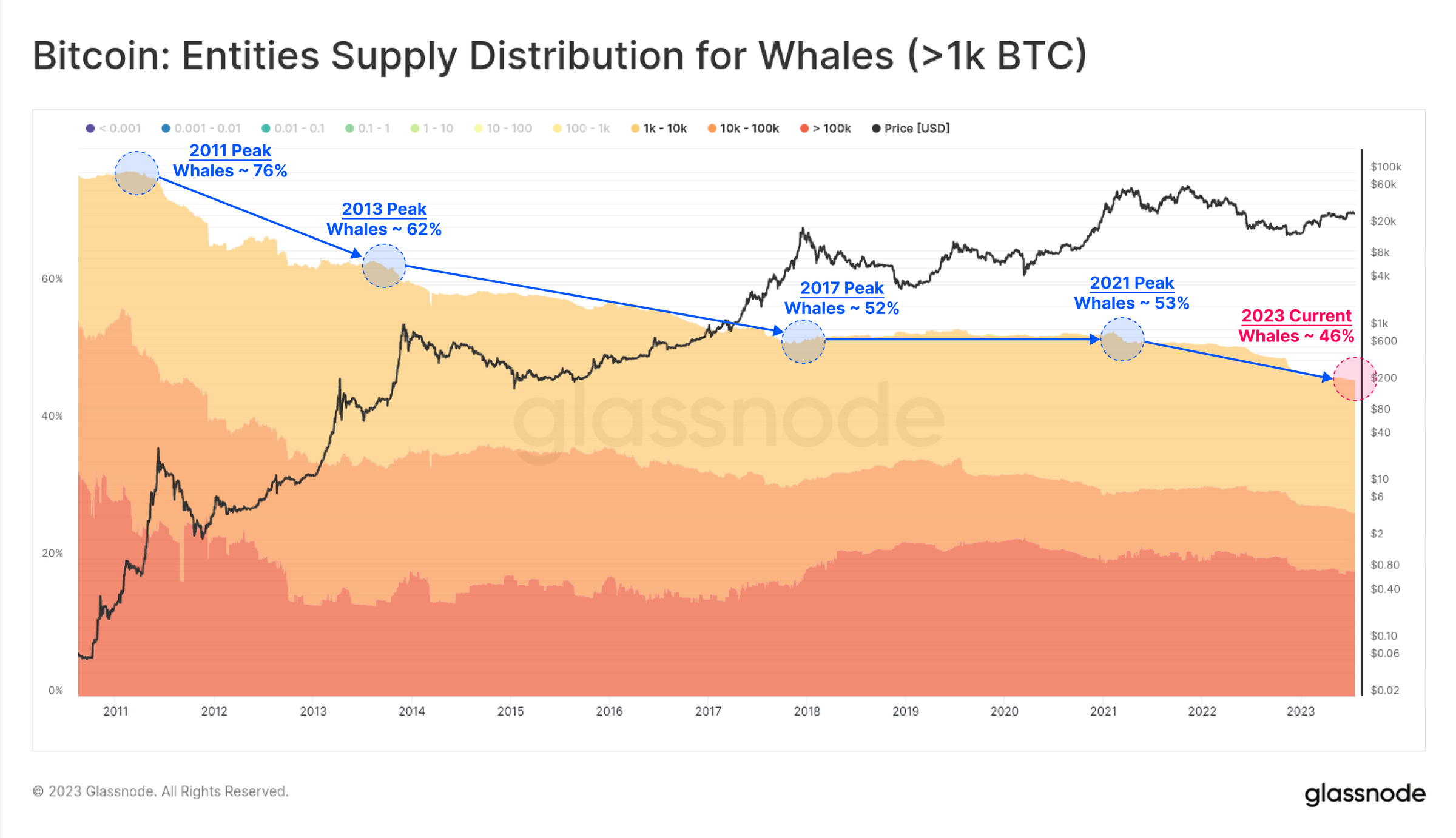

Bitcoin whale size subdivisions | Source: GlassnodeRemarkably, whale entities present relationship for lone 46% of the full supply, down from 63% astatine the opening of 2021. Since the aboriginal days of Bitcoin, a dependable downward inclination tin beryllium observed.

Bitcoin whales % of full proviso | Source: Glassnode

Bitcoin whales % of full proviso | Source: GlassnodeShort-Term Holders: The Driving Force

The probe besides sheds airy connected the dominance of short-term holders (STHs) among the whale entities. The information indicates that STHs correspond a important information of caller trading activity, actively trading the market. This behaviour is evident arsenic marketplace rallies and corrections pb to notable upticks successful nett oregon nonaccomplishment among this group.

Short-Term Holder (STH) Dominance crossed Exchange Inflows has exploded to 82%. This is drastically supra the semipermanent scope implicit the past 5 years (typically 55% to 65%). “From this, we tin found a lawsuit that overmuch of the caller trading enactment is driven by Whales progressive wrong the 2023 marketplace and frankincense classified arsenic STHs”, states the analyst. Each rally successful 2023 has seen heightened nett taking.

BTC whale transactions tin truthful presently beryllium a bully indicator. However, peculiar attraction besides needs to beryllium paid to the STHs, which volition yet tally retired of bullets astatine immoderate point.

At property time, the BTC terms stood astatine $29,203.

BTC terms hovers supra $29k, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms hovers supra $29k, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Fernando Gutierrez / Unsplash, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)