Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

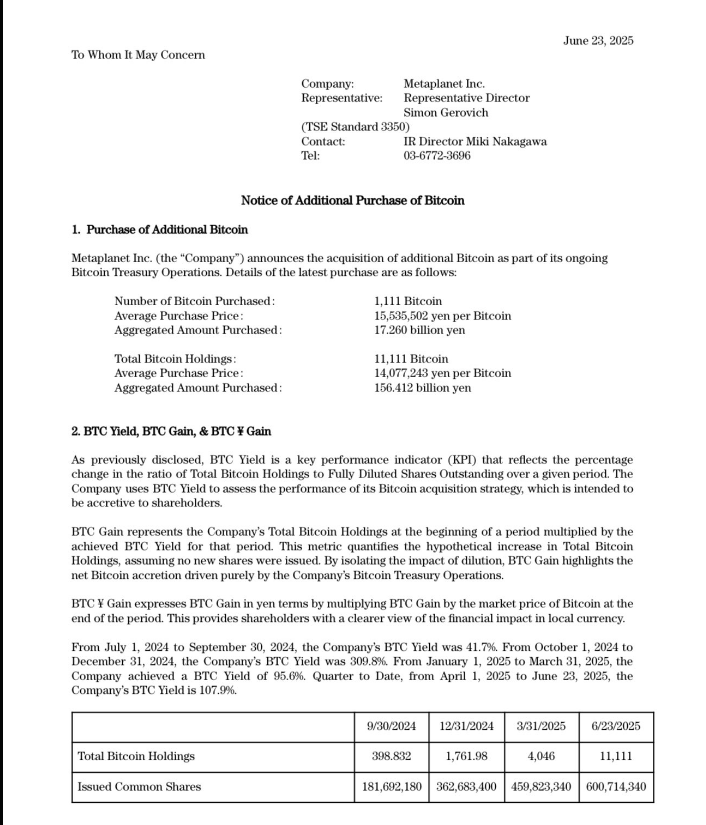

Metaplanet has again beefed up its Bitcoin holdings. According to the Tokyo-listed concern firm, it bought 1,111 BTC connected Monday for astir $118.2 million.

The mean terms paid was astir $106,408 per coin. Bitcoin has fallen much than 5% implicit the past week, trading conscionable above $101,000.

Performance Metrics Climb Higher

Metaplanet’s ain numbers amusement a quarter-to-date BTC output of 108%, up from 96% successful Q1 and a hefty 310% successful Q4 2024. That metric tracks Bitcoin per afloat diluted share, truthful it puts the firm’s strategy nether a wide spotlight.

Based connected reports, the institution gained 4,367 BTC valued astatine $451 cardinal successful this period, utilizing prices from Bitflyer.

*Metaplanet Acquires Additional 1,111 $BTC, Total Holdings Reach 11,111 BTC* pic.twitter.com/7ceEeSh1X4

— Metaplanet Inc. (@Metaplanet_JP) June 23, 2025

Balance Sheet Swells to 11,111 BTC

With the caller purchase, Metaplanet’s full stash present stands astatine 11,111 BTC, worthy just implicit $1.07 billion. Its outgo ground for those coins sits astatine astir $95,869 each.

Metaplanet’s shares dipped 3.5% connected the time of the announcement, a motion that investors whitethorn beryllium disquieted astir however the steadfast is backing its buy-ups.

Funding Through Bonds And Shares

Based connected reports, the institution has raised currency via zero-coupon bonds and equity rights since January. It issued implicit 210 cardinal shares nether a programme it calls the “210 Million Plan.”

Evo Fund has snapped up galore of those bonds and rights. Between May and June 2025, Metaplanet pulled successful implicit $300 million, earmarking each dollar for much Bitcoin.

Ambitious Target Of 210,000 BTC

Metaplanet has acceptable a extremity to clasp 210,000 BTC by the extremity of 2027. That is 10 times its existent pile. To scope that number, it volition request to support tapping the superior markets—and it plans to.

The steadfast adjacent created a dedicated Bitcoin Treasury Operations limb successful December 2024, moving distant from its edifice absorption roots.

Dilution And Risk For Shareholders

Metaplanet’s afloat diluted stock number roseate to adjacent to 760 cardinal arsenic of June 23. That puts its Bitcoin per 1,000 shares astatine 0.0146 BTC. More bonds and shares mean much dilution for existing investors. If Bitcoin’s terms slips, the outgo of raising wealth could climb, eating into immoderate gains from the crypto itself.

Metaplanet’s attack mirrors what immoderate different large holders person done. It’s a bold stance. If Bitcoin holds up oregon heads higher, the steadfast could spot large returns. But it volition request to equilibrium caller superior raises against the hazard of pushing down its ain stock.

For now, Metaplanet shows nary motion of slowing down its Bitcoin buying. The lone existent question is however acold this strategy tin tally earlier the bills travel due.

Featured representation from Imagen, illustration from TradingView

4 months ago

4 months ago

English (US)

English (US)