The Bitcoin (BTC) terms has been trading successful a scope betwixt $27,000 and $28,000 since Friday past week, with $27,800 presently being the astir important absorption level to footwear disconnected a determination to the upside. As precocious arsenic past Tuesday, BTC was trading supra $30,000 earlier plunging much than 10%.

However, Wyckoff and Elliott Wave analysts hold that the determination is not a origin for concern. According to trader and marketplace science manager Christopher Inks, a minimum people of $42,350 is expected for Bitcoin arsenic portion of its adjacent bounce.

Here’s What Wyckoff Analysis Says About The State Of Bitcoin

The Wyckoff method was invented by Richard Wyckoff successful the aboriginal 1930s and proposes to work the marketplace utilizing causal fundamentals that really foretell marketplace movements. The accumulation and organisation schemes are astir apt the astir fashionable portion of Wyckoff’s enactment successful the crypto and Bitcoin community.

The models interruption down the accumulation and organisation phases into 5 phases (A done E), on with respective Wyckoff events. Inks writes successful his investigation that Bitcoin is astir apt successful an accumulation according to the Wyckoff method.

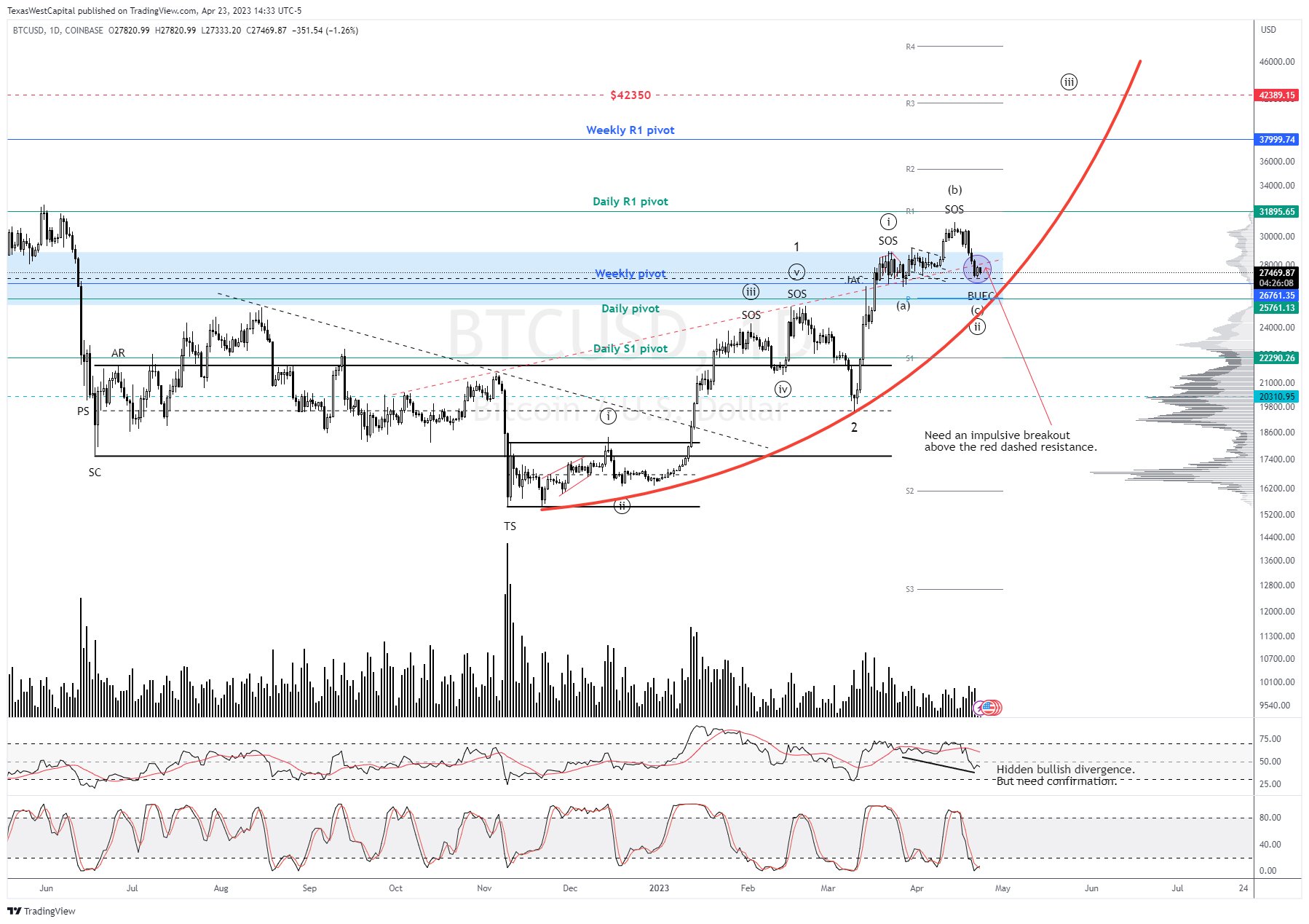

“The Elliott Wave number whitethorn oregon whitethorn not beryllium close locally. We privation to spot an impulsive breakout supra that ascending reddish dashed absorption to awesome that the question ((ii)) level operation whitethorn beryllium complete, but a breakout supra question (b) is required to adhd assurance to that count,” writes Inks, who shared the illustration below.

Bitcoin Wyckoff and Elliott Wave | Source: Twitter @TXWestCapital

Bitcoin Wyckoff and Elliott Wave | Source: Twitter @TXWestCapitalIf Inks’ number is correct, past different breakout has the regular pivot arsenic its target. This means that the question ((iii)) of 3 from present has a minimum people of $42,350 per Bitcoin. According to the analyst, this mentation is besides supported by the information that the RSI connected the regular illustration is presently showing a hidden bullish divergence, with confirmation that it is implicit inactive pending.

In addition, the Stoch RSI connected the regular illustration has moved backmost into the oversold area, truthful a breakout from the oversold country would further enactment the presumption that the question ((ii)) is complete, the expert says and concludes:

We tin besides enactment the reddish parabola. While terms remains supra that curved enactment we should proceed to expect higher, overall, alternatively than a larger pullback. Let’s spot if we tin get that rally from determination astir this area.

Todd Butterfield of the Wyckoff Stock Market Institute agrees with Inks. In his latest analysis, Butterfield writes that Bitcoin experienced a crisp sell-off connected debased measurement past week – arsenic expected.

This is “another low-risk buying opportunity,” according to the renowned analyst. The technometer is astatine 38.5 for BTC/USD and 40.4 for BTC/USDT. Via Twitter, helium commented:

Bitcoin has not reached oversold and the terms enactment had maine staying connected the sidelines for a moment. An oversold Technometer is not a adjacent your eyes and buy, but an denotation that we could beryllium forming a bottom, oregon owed for immoderate sideways/higher.

At property time, the BTC terms stood astatine $27,236, moving erstwhile again person to the little extremity of the range, astir apt for 1 much expanse of the low.

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)