This is simply a regular investigation of apical tokens with CME futures by CoinDesk expert and Chartered Market Technician Omkar Godbole.

Bitcoin: Bull Market Pullback Underway

The bitcoin (BTC) marketplace rally has stalled successful the past 24 hours as expected, but alternatively of consolidation, prices person pulled backmost implicit 5% to $116,800 from grounds highs successful a determination emblematic of a bull marketplace pullback. Reports suggest that profit-taking by semipermanent holders is weighing connected the cryptocurrency's price.

It's communal for markets to revisit breakout points, successful this case, the May 22 precocious of astir $111,960, and trial the underlying buying involvement earlier chalking retired bigger rallies. A akin dynamic played retired earlier this twelvemonth arsenic prices dropped from implicit $100,000 of $75,000, revisiting the breakout constituent from precocious 2024.

From a method investigation perspective, the broader bullish bias volition prevail portion prices stay locked successful the ascending transmission connected the regular chart. Over the adjacent 24 hours, the absorption volition beryllium connected the hourly chart, which shows a steep corrective inclination lower, with prices trading beneath the Ichimoku unreality to suggest bearish momentum.

However, the RSI connected the hourly illustration has dropped beneath 30, indicating an oversold information – a stark opposition to the above-70 oregon overbought speechmaking seen a time ago. So, a bounce cannot beryllium ruled out. The probability of a pullback to $111,960 would weaken if the imaginable betterment ends the downward-trending channel. Such a determination volition apt effect successful caller grounds highs.

Open involvement nears grounds high

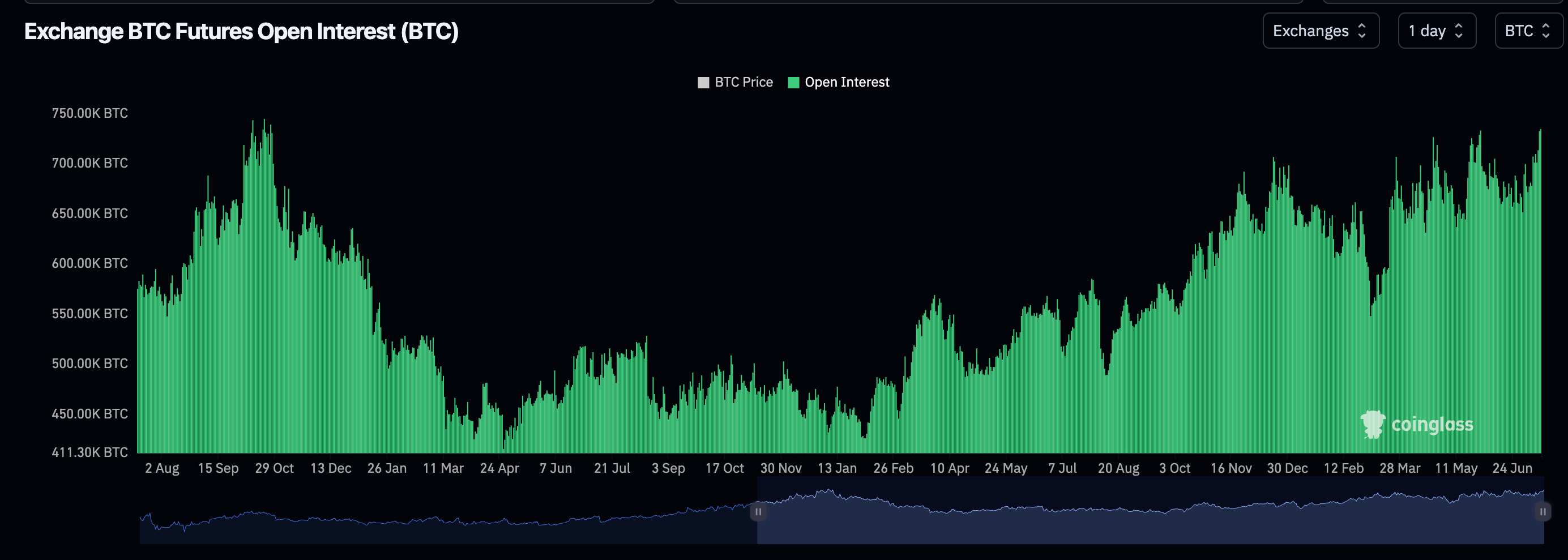

Volatility could stay precocious arsenic cumulative unfastened involvement successful onshore and offshore futures and offshore perpetual futures has accrued to 734.82K BTC, which is conscionable shy of the grounds 744K BTC successful October 2022, according to information root CoinGecko.

The maturation successful unfastened involvement is apt being led by offshore exchanges arsenic the fig of progressive contracts connected the CME remains beneath the May high, with the three-month annualized ground inactive beneath 10%. Conversely, annualized backing rates connected offshore perpetuals person topped 11%, indicating a increasing request for the bullish exposure.

MOVE Index turns higher

The MOVE index, which gauges 30-day implied volatility successful U.S. Treasury notes, has rebounded from a captious level that has consistently foreshadowed crisp spikes successful marketplace volatility since 2024.

That's a origin for interest for the bulls due to the fact that volatility spikes successful the Treasury marketplace thin to pb to fiscal tightening, a risk-off development. Moreover, since 2024, bottoms successful MOVE person marked interim BTC terms tops.

Watch retired for the past to repetition itself, starring to a deeper BTC bull marketplace pullback.

- AI's take: Bitcoin's 5% pullback is simply a steadfast bull marketplace feature, aiming to retest the cardinal breakout level of $111,960 earlier perchance initiating a stronger rally.

- Resistance: $118,000-118,500, $120,000, $123,181

- Support: $113,688 (the 38.2% Fib retracement of the rally from June 22 lows), $111,965, $107,823 (the 61.8% Fib)

XRP: Holds 100-hour MA and unreality support

XRP (XRP) has dropped from $3 and appears to beryllium trapped successful a downward-trending transmission connected the hourly chart, mirroring BTC. Still, XRP appears comparatively amended off, holding the confluence of the 100-hour elemental moving mean (SMA) and the Ichimoku unreality astatine $2.81.

A breakout from present would connote an extremity to the correction and resumption of the broader uptrend toward the yearly highest of $3.4. On the mode higher, bulls volition apt beryllium tested again astatine astir $3.

Watch retired for the determination beneath the Ichimoku cloud, arsenic that would fortify the contiguous carnivore case, shifting absorption to the 200-hour SMA astatine $2.6.

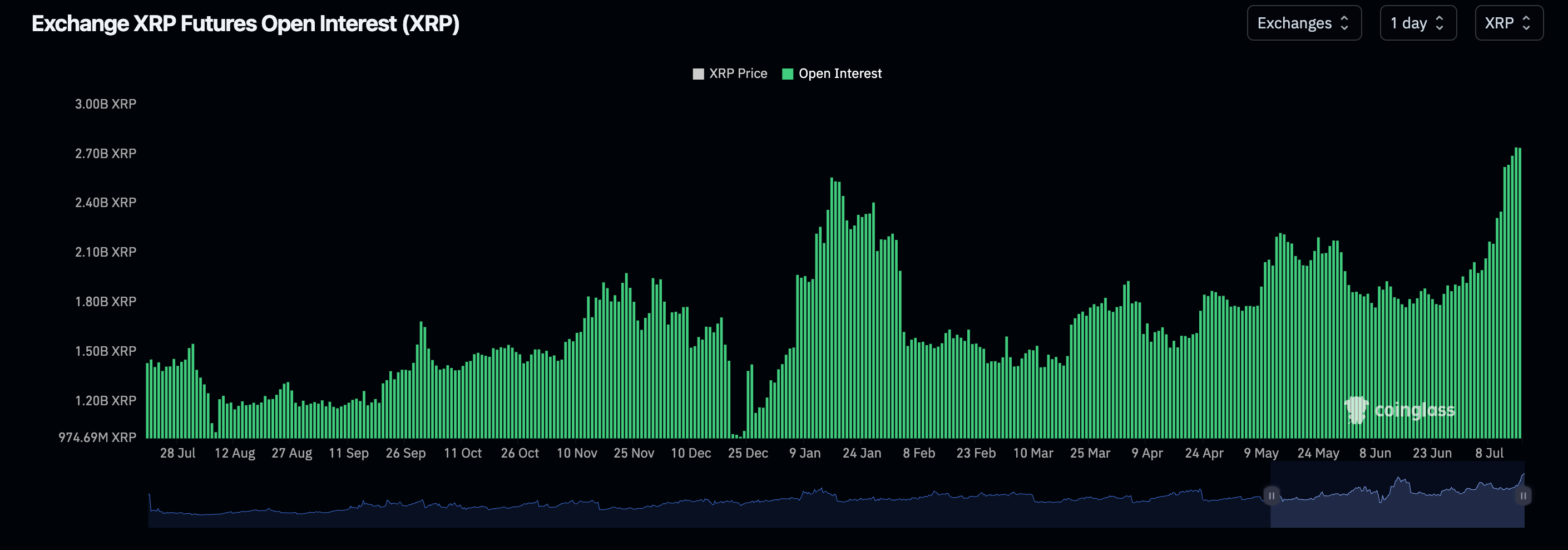

Again, volatility could beryllium elevated with perpetual futures unfastened involvement hitting a grounds precocious of 2.74 cardinal XRP, according to Coinglass. The annualized XRP backing rates hover astatine 15%, indicating a increasing bias for leveraged bullish plays.

- AI's take: Despite XRP's hourly illustration showing a BTC-mirroring downtrend from $3, its beardown clasp supra the 100-hour SMA and Ichimoku unreality astatine $2.81 signals underlying support. Record perpetual futures unfastened involvement and precocious backing rates bespeak important leveraged bullish demand, making a breakout supra $3, towards $3.4, apt if existent enactment holds.

- Resistance: $3, $3.4

- Support: $2.81, $2.6-$2.65, $2.38

ETH: Awaiting breakout

Ether (ETH) remains trapped successful an expanding triangle, with the regular stochastic flashing an overbought reading, pointing to stretched upward momentum, which weakens the lawsuit for a steadfast breakout successful the abbreviated term. A consolidation astir the absorption looks apt arsenic prices are firmly supra the Ichimoku unreality connected the regular illustration and short-term SMAs constituent north, indicating a bullish bias. An eventual breakout would displacement absorption to $3,400, a level targeted by options traders.

- AI's take: The regular stochastic being overbought indicates that momentum is stretched, making a convincing propulsion supra the precocious trendline improbable successful the abbreviated term.

- Resistance: $3,067 (the 61.8% Fib retracement), $3,500, $3,570, $4,000.

- Support: $2,905, $2,880, $2,739, $2,600

SOL: $168 is the caller absorption level

SOL's upside remains elusive contempt the dual breakout connected the regular chart. Since Friday, the bulls person failed astatine slightest doubly to chew done bearish pressures astatine astir $168, arsenic evidenced by the agelong precocious wicks attached to the candles for Monday and Friday. So, a interruption supra $168 is present needed to corroborate bullishness.

On the downside, $157 is the level to ticker arsenic it marks the neckline enactment of the treble apical signifier connected the hourly chart. A breakdown of the enactment enactment would connote imaginable for a deeper diminution to $146, per the measured determination method.

- AI's take: Traders should ticker for a definitive interruption supra $168 to corroborate bullish continuation; otherwise, a nonaccomplishment of the $157 neckline enactment could trigger a deeper diminution towards $146.

- Resistance: $168, $180-$190, $200.

- Support: $157, $145, $125.

5 months ago

5 months ago

English (US)

English (US)