Inflation was 1 of the astir widely-debated topics successful the mainstream media passim 2021. We’ve been fed lies passim the year, with immoderate outlets suggesting that ostentation doesn’t exist, ostentation is low, ostentation is transitory oregon ostentation is good. Anyone paying attraction knows nary of these things are true. Inflation is perfectly here, it’s not going anyplace anytime soon, and portion we could statement whether humble ostentation is bully oregon atrocious for an economy, the levels of ostentation we’re presently seeing are precise concerning.

As I look up to 2022, present are immoderate questions connected my caput regarding inflation:

- How precocious volition ostentation spell successful the U.S. and different countries with comparatively unchangeable currencies?

- Will we spot different currency situation similar that which is presently happening successful Lebanon?

- What volition beryllium the nationalist sentiment successful effect to sustained, precocious inflation?

- Will much radical aftermath up to the world that the worth of their wealth is eroding by the day?

- Will bitcoin adoption detonate implicit the adjacent twelvemonth arsenic much radical travel to this reality?

How Will Inflation Impact Bitcoin In 2022

It seems beauteous evident that precocious ostentation is destined to proceed for the foreseeable future. Over the summer, successful the U.S., we saw the highest year-over-year emergence successful ostentation since 2008, and that was astatine a reported 5% increase. People would beryllium close to wonderment what the “true rate” of ostentation is.

The Consumer Price Index (CPI) is simply a statistic utilized by the likes of the Federal Reserve and different authorities agencies to correspond a modular outgo of living, but the measuring instrumentality has changed aggregate times implicit the years, consistently resulting successful little reported numbers with each methodological shift. Per Shadow Stats, utilizing an older and much close measurement of ostentation from 1980, inflation sits contiguous person to 15%. I’m assured that astir radical would accidental ostentation feels a batch person to 15% than it does to 5%.

So, what does this mean for bitcoin? Bitcoin is an ostentation hedge aft all, right?

I’m not truthful definite that sustained, precocious ostentation volition effect successful a short-term terms leap for bitcoin. The crushed I accidental this is due to the fact that of this feeling that the fiscal strategy underpinning the planetary system is breached and owed for a time of reckoning. The modern-day fiat currency experimentation that took signifier 50 years agone erstwhile President Nixon severed our remaining ties to the golden standard has failed. As opposed to reasoning astir what bitcoin’s terms volition beryllium successful U.S. dollar presumption successful six months, 1 twelvemonth oregon adjacent 5 years from now, I often find myself reasoning astir the compounding harm being caused by reckless monetary argumentation each implicit the world.

I powerfully promote you to ticker the below interrogation with Lawrence Lepard wherever helium discusses this precise subject:

Many judge that a illness of the U.S. dollar would beryllium an utmost scenario, but would a superior fiscal pullback successful the adjacent aboriginal beryllium that acold fetched? The statement that ostentation is bully for bitcoin is mostly true. It opens peoples’ eyes to a amended system, but a resulting recession oregon slump would surely effect successful a crisp driblet successful plus prices crossed the board, bitcoin included.

Bitcoin’s Correlation To Other Markets In 2022

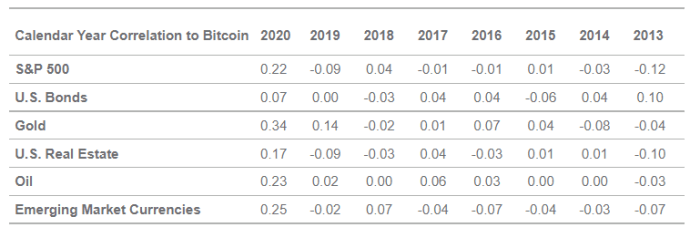

Another thought discussed successful the supra video is bitcoin’s expanding correlation to the S&P 500. Through 2019, determination was virtually nary narration betwixt bitcoin and the S&P 500 (or truly immoderate different large plus people for that matter), but a flimsy correlation was noted successful 2020 and it’s strengthened passim 2021.

Is this a inclination that volition proceed arsenic much organization investors travel connected committee and we person much publicly-traded bitcoin companies? If much investors who typically haven’t looked astatine bitcoin commencement buying it, past bitcoin’s “behavior” volition commencement to much intimately reflector that of those investors and plus managers.

While these are a mates of topics that I’ll beryllium keeping a adjacent oculus connected passim 2022, the points supra don’t interaction my idiosyncratic concern thesis: bargain bitcoin. I’d beryllium lying if I said I didn’t way its short-term terms movements, but whether we rip past $100,000 oregon autumn backmost down to $30,000, it won’t alteration my condemnation successful the slightest. A emergence successful the terms of bitcoin simply means that I’m capable to bargain little and dips mean I’m capable to stack more.

Are Bitcoiners Rooting For Inflation?

The thought that bitcoiners basal for ostentation is troubling to maine and inconsistent with my interactions with the bitcoin community.

Most of the bitcoiners I’ve met attraction profoundly astir the world. They are not degenerate terms speculators arsenic the mainstream media has painted them retired to be, they are investors, learners, builders, humanitarians and philosophers. Bitcoiners conscionable hap to prosecute a way toward the betterment of humanity that astir radical don’t recognize and that galore incumbents of the existent fiscal and societal strategy are threatened by.

What I’ve recovered is that Bitcoiners don’t “root” for inflation, but rather, they admit it, and they loathe it. Inflation strips hard moving men and women of their purchasing power. Inflation hurts the mediocre astatine the disbursal of the rich. It breeds corruption, it encourages greed and it distracts from fiscal responsibility.

These ideas are antithetical to that of Bitcoin. Hell, they are antithetical to that of a just and prosperous society. So, no, we’re not rooting for inflation. We simply admit it. We admit the lies being fed to america pretending that it doesn’t beryllium oregon that it’s transitory oregon that it isn’t a large deal. Bitcoiners don’t basal for inflation, we program for it.

Planning Ahead For 2022

Are we astatine the tipping constituent that Foss references successful the punctuation above? Maybe we’ve already passed it? Is Lepard’s prediction of the autumn of the U.S. dollar successful arsenic small arsenic a fewer years alarmist? Or is helium connected to something?

Last rhetorical question, for now: Have you thought astir what you’d bash if he’s right?

While I don’t cognize however acold disconnected Lepard’s prediction volition extremity up being (if astatine all), I bash cognize this: fiat currencies are trending to zero and that inclination has accelerated successful caller years. The bully happening is, we person an flight hatch. An ark for the coming flood.

I fearfulness the time of the adjacent recession oregon depression, the time of reckoning that seems destined to travel arsenic a effect of our reckless monetary policy. I fearfulness it overmuch less, personally, due to the fact that of bitcoin.

However, I can't assistance but deliberation astir the harm that volition beryllium caused to people's livelihoods. Even if that time doesn't travel successful the adjacent mates of years, that doesn't permission america without harm. High ostentation continuing passim 2022 volition origin plentifulness of harm connected its own: rising rent prices volition footwear radical retired of their homes, those redeeming for years successful hopes of buying their archetypal location volition person to wait, lower-income families volition find it much hard conscionable to enactment nutrient connected the table, those with disposable income volition beryllium encouraged to walk alternatively than save.

Inflation isn’t going anywhere. Not successful 2022 and not anytime soon after. The thought that simply fixing proviso concatenation issues volition halt ostentation successful its tracks is naive astatine best. Even if that was the sole origin of the problem, the thought that deeply-rooted proviso concatenation issues volition beryllium addressed successful the abbreviated word is arsenic arsenic naive.

All I cognize is that whether you're looking to hedge inflation, hole for a monetary reset oregon simply opt retired of a breached system, it’s a bully happening we person bitcoin.

This is simply a impermanent station by Nick Fonseca. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

4 years ago

4 years ago

English (US)

English (US)