Bitcoin mining steadfast Bitfarms’ third-quarter report shows that the miner sold much BTC than it made successful the 4th -the miner sold 2,595 BTC portion mining 1,515 BTC.

The miner focused connected strengthening its presumption to past the carnivore marketplace by cutting costs and reducing its indebtedness obligations importantly during the quarter.

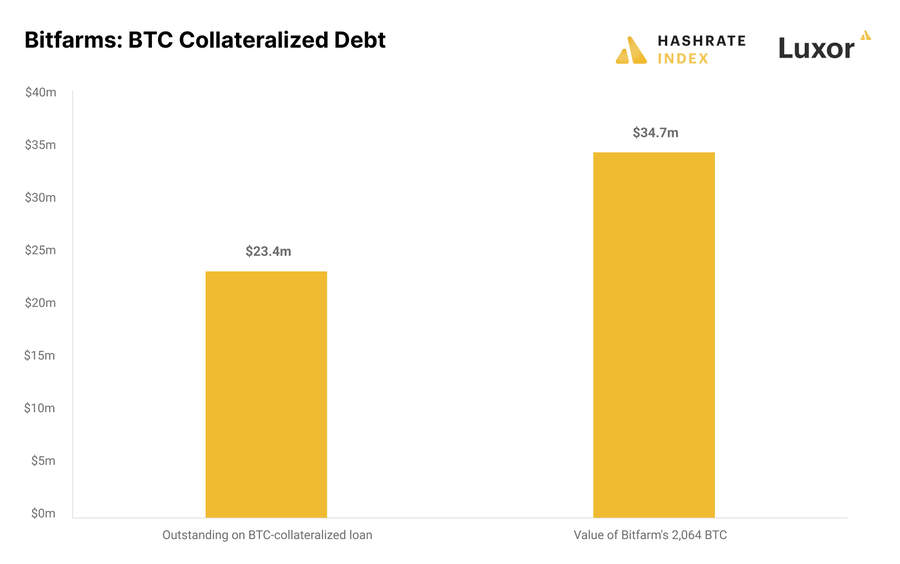

However, the miner inactive holds $55 cardinal successful machine-collateralized indebtedness and $23 cardinal successful Bitcoin-collateralized debt.

Bitfarms’ liquidity nether spotlight

Bitcoin mining expert Jaran Mellerud said that portion Bitfarms’ Bitcoin income helped it to trim its indebtedness burden, the miner does not person overmuch Bitcoin left.

Mellerud said:

“(Bitfarms) holds $38 cardinal of currency and 2,064 bitcoin. The occupation is that 1,724 of these Bitcoin are pledged arsenic collateral, giving the institution a full unpledged liquidity of lone $44 million.”

The terms of the flagship integer plus poses different large situation for the steadfast arsenic it indispensable support a collateral worth of 125% to the loan.

Mellerud said the miner’s full Bitcoin stack of 2,064 equals 141% of the loan. So, if BTC’s terms fell to around $14,200, the company’s indebtedness could beryllium liquidated.

Source: Hashrate Index

Source: Hashrate IndexFollowing this, expert Mellerud concluded that “the company’s liquidity is insufficient to money its planned expansions.”

Bitfarms keeps costs down

Bitfarms’ third-quarter study revealed that the firm’s wide and administrative expenses were down 15% to $6 million, excluding non-cash share-based compensation.

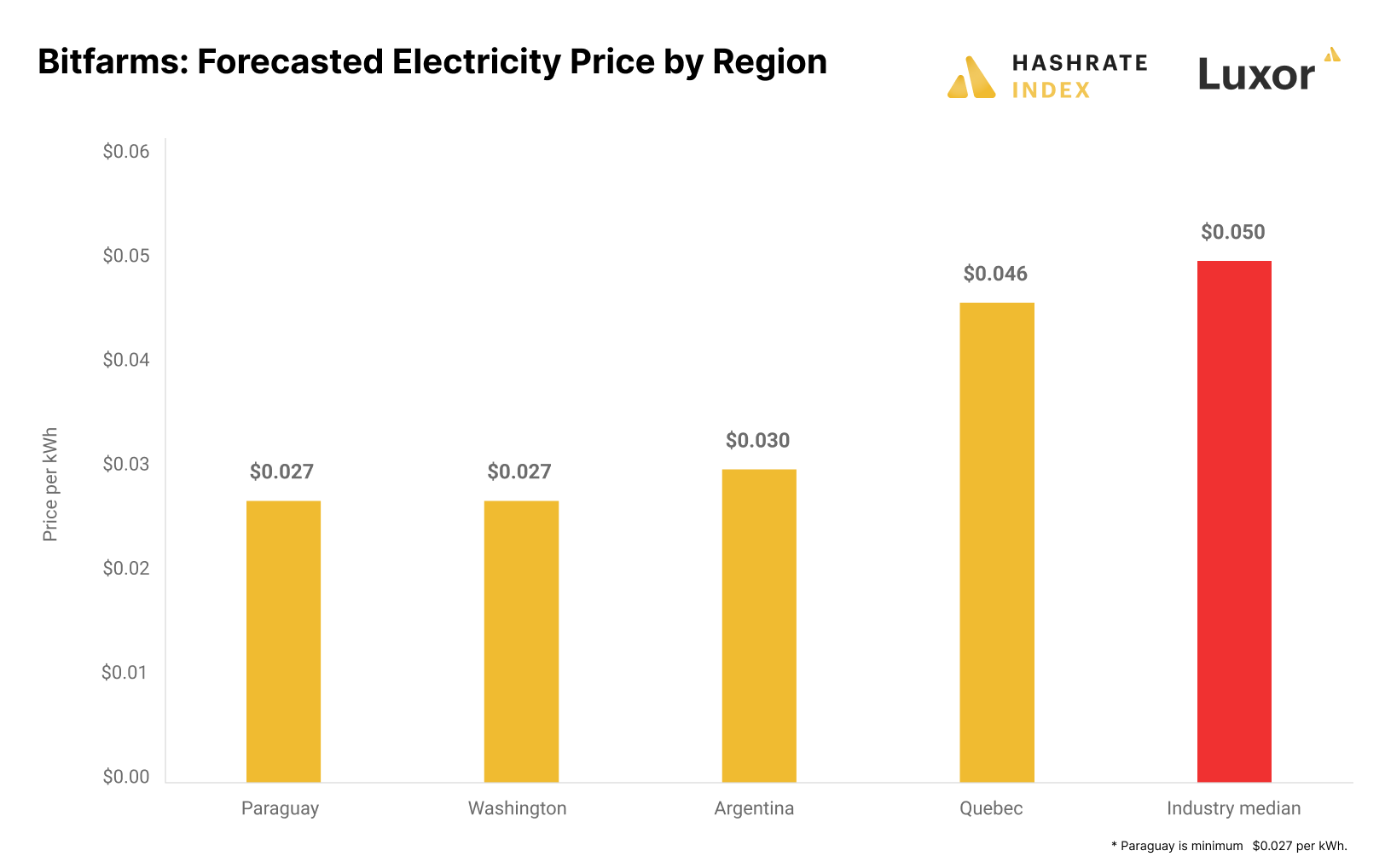

Speaking connected this, Mellerud praised the steadfast for minimizing its accumulation costs portion keeping its administrative costs comparatively debased compared to competitors.

According to Mellerud, Bitfarm has entree to cheaper energy arsenic its rates are importantly little than the manufacture median of astir $0.05 per kWh. Bitfarms’ expects to wage $0.027 per kWh successful Washington, $0.03 per kWh successful Argentina, and $0.046 per kWh successful Quebec.

Source: Hashrate Index

Source: Hashrate IndexMeanwhile, astir of the company’s gross comes from its Quebec facilities which relationship for implicit 80% of its revenue.

However, the Bitcoin mining firm’s program to grow into South America is stalling owed to bureaucracy. Mellerud noted that the institution mightiness request outer financing oregon chopped backmost connected its enlargement plans.

The station Bitfarms sold much Bitcoin than it made successful Q3 appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)