CryptoSlate analysts examined the elaborate proof-of-reserves of starring crypto exchanges extracurricular of Coinbase and Binance. It revealed that Bitfinex holds the astir important Bitcoin (BTC) reserves, with $3.5 cardinal worthy of BTC.

The information was obtained connected Dec. 16 from OKX, KuCoin, Crypto.com, ByBit, Binance, BitMEX, and Bitfinex. OKX follows Bitfinex with the 2nd largest BTC excavation with much than $1.5 cardinal successful BTC, portion Binance comes arsenic the 3rd with conscionable supra $5 cardinal successful BTC. BitMEX places fourth, with conscionable implicit $1 cardinal successful BTC. Crypto.com, ByBit, and KuCoin came arsenic the fifth, sixth and seventh with $700 million, $370 million, and $300 million, respectively.

Reserves successful billions

Bitfinex, OKX, Binance, and BitMEX cipher their reserves successful billions. Amongst each exchanges included successful this analysis, Bitfinex emerged arsenic the speech that held importantly much BTC than the different six that released their proof-of-reserves.

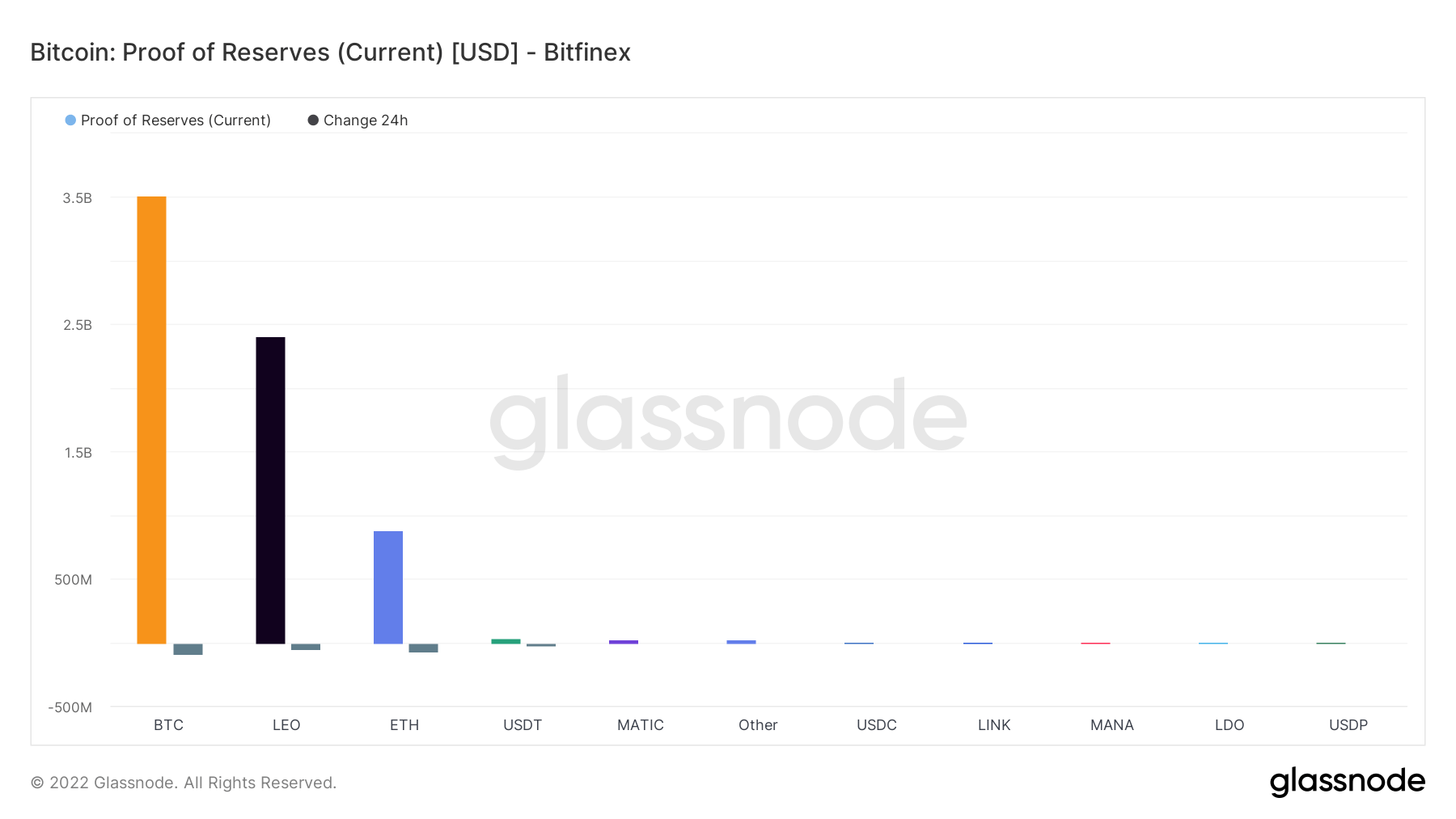

Bitfinex

According to the numbers, Bitfinex entered the play with $3.5 cardinal successful BTC and astir $2.37 cardinal successful UNUS SED LEO (LEO). The speech besides holds conscionable beneath $1 cardinal worthy of Ethereum (ETH).

Proof of reserves – Bitfinex

Proof of reserves – BitfinexBesides BTC, LEO and ETH, the illustration shows that Bitfinex holds 8 much assets successful millions each.

Data from Nov. 21 showed that 91% of Bitfinex’s reserves were made of BTC and ETH, which meant that Bitfinex held the astir BTC. Even though its ETH reserves person shrunk, the speech inactive holds the largest magnitude of BTC.

Another survey astatine the extremity of November 2022 showed that Bitfinex held implicit $11 cardinal worthy of Tether (USDT), equating to 60% of the full USDT supply. However, the existent information bespeak that this magnitude retreated to millions wrong 2 weeks.

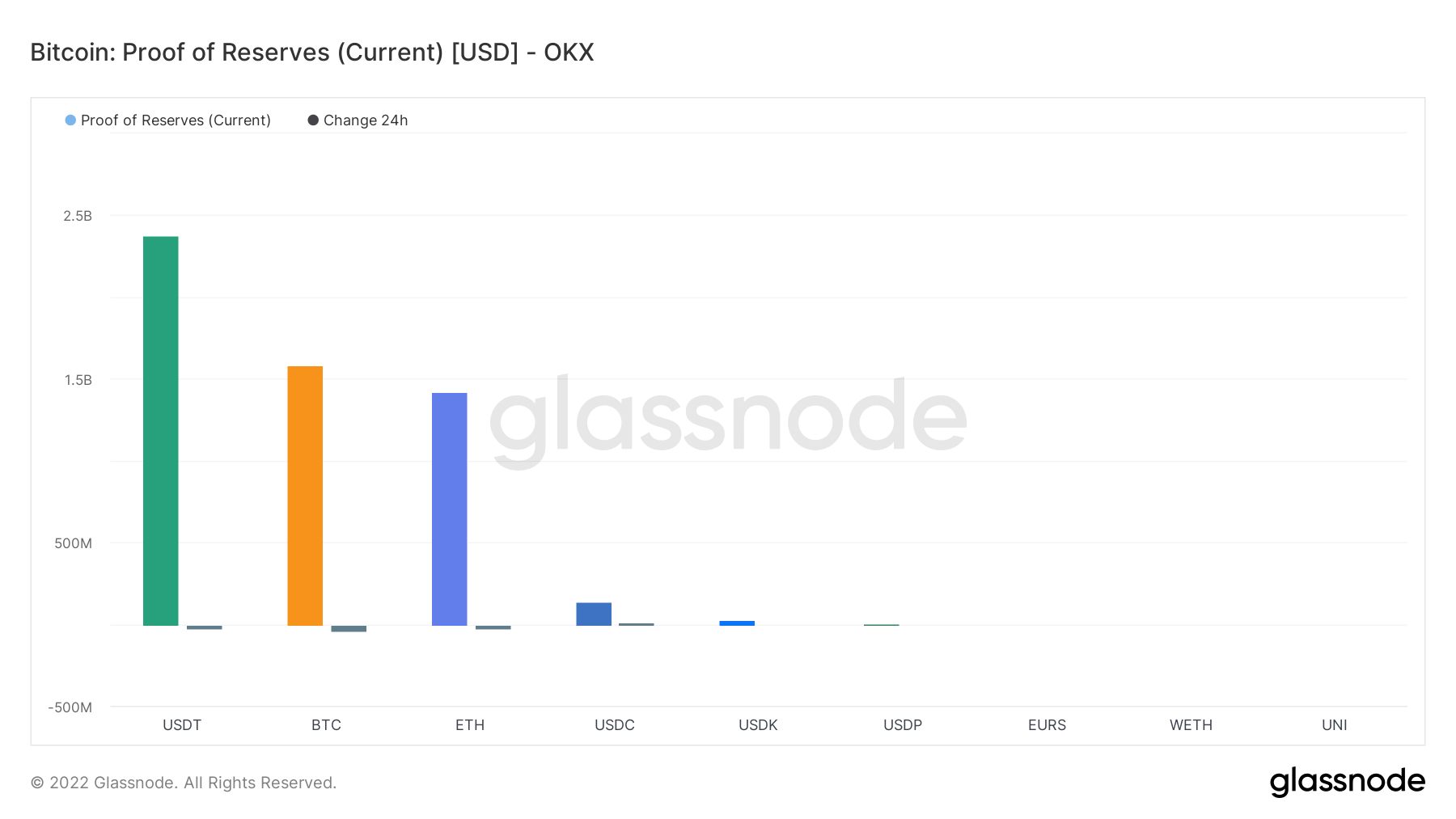

OKX

OKX is the lone speech included successful this investigation that measures its BTC reserves successful billions. The exchange’s BTC reserves magnitude to conscionable supra $1.5 billion.

Proof of reserves – OKX / Source: Glassnode

Proof of reserves – OKX / Source: GlassnodeIn summation to the sizeable magnitude of BTC, OKX besides holds astir $2.43 cardinal successful USDT. Furthermore, the speech has conscionable beneath $1.5 cardinal worthy of ETH.

According to OKX’s announcement, it is besides backing each its users’ assets astatine 1:1 with existent funds.

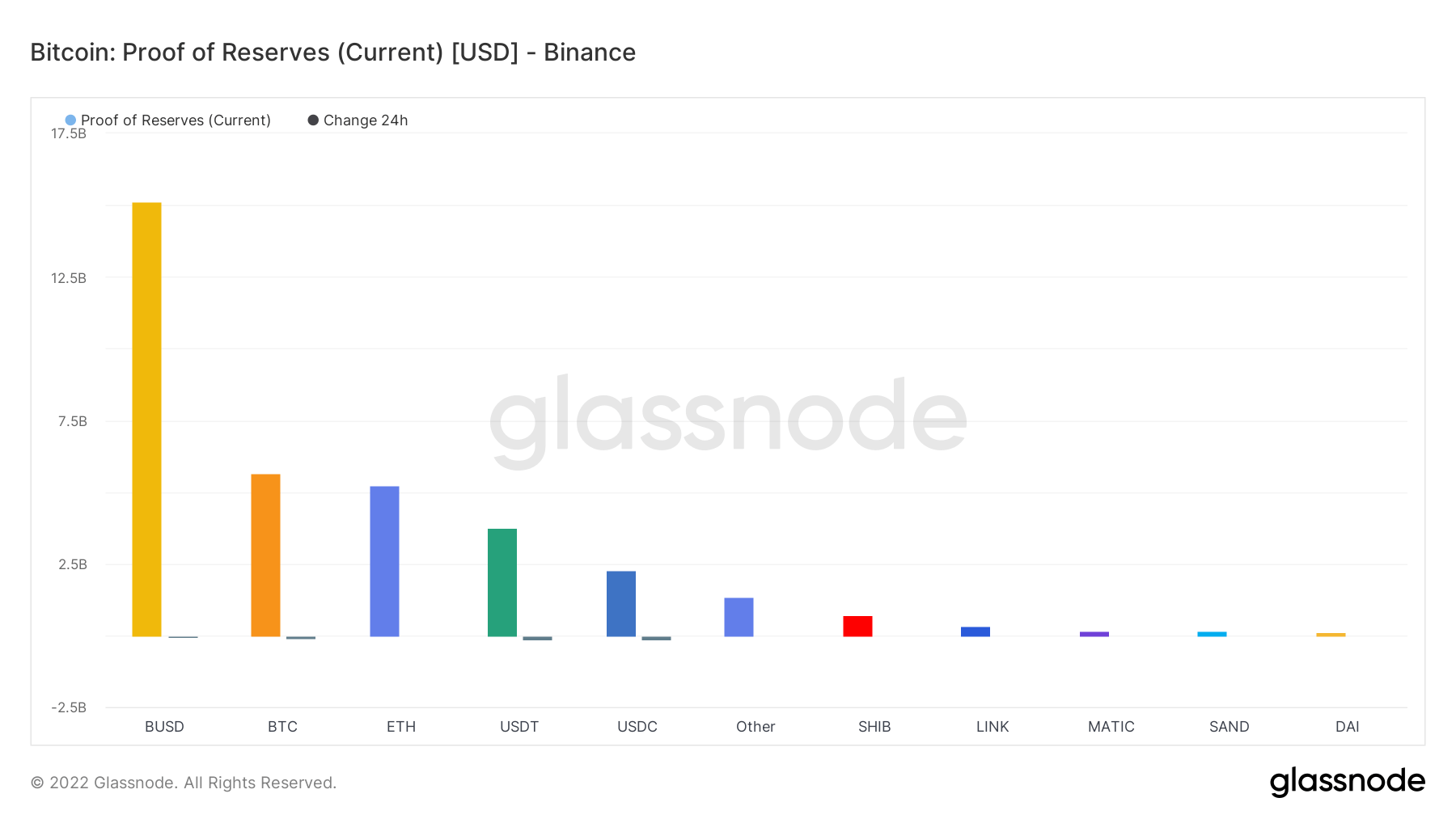

Binance

Binance places 3rd successful ranking with astir $5.6 cardinal successful BTC. The speech besides holds $5 cardinal successful ETH.

Proof of reserves – Binance / Source: Glassnode

Proof of reserves – Binance / Source: GlassnodeDespite the size of its BTC pool, Binance holds $15 cardinal successful Binance USD (BUSD), $6.25 cardinal successful USDT, and astir $2.5 cardinal successful USDC.

On Dec. 15, Binance experienced a withdrawal situation wherever its reserves shrank by $3.5 cardinal successful 24 hours. Despite that, the speech holds the largest wide reserves amongst each different exchanges included successful this analysis.

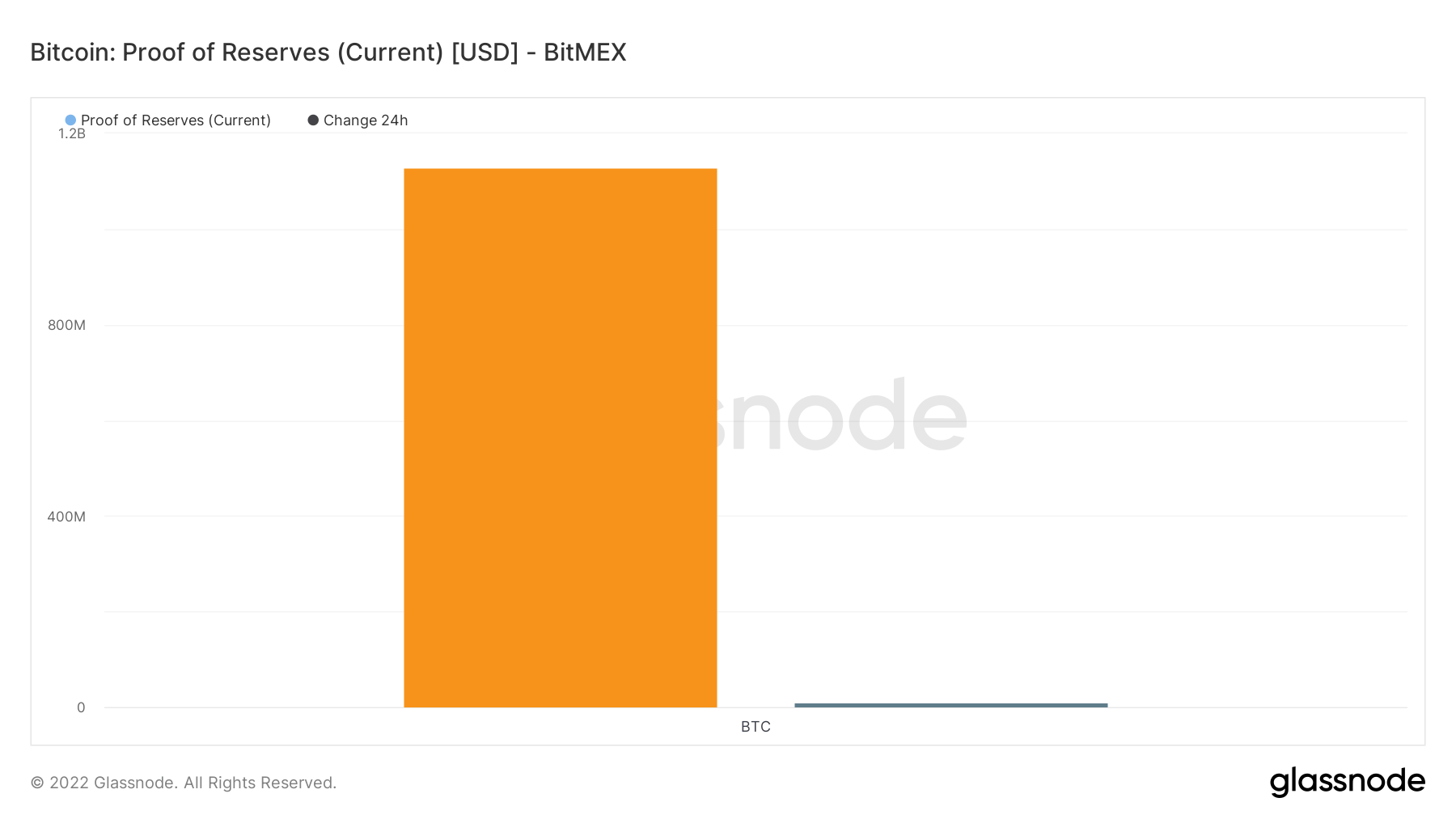

BitMEX

BitMEX holds the 4th largest BTC reserves, with astir $1.1 billion. The information doesn’t disclose immoderate different plus benignant nether BitMEX’s reserves.

Proof of reserves – BitMEX / Source: Glassnode

Proof of reserves – BitMEX / Source: GlassnodeThe speech besides announced that it plans to laic disconnected astir 30% of its unit successful aboriginal November.

Reserves successful millions

Other exchanges included successful this investigation measurement their reserves successful presumption of millions. Amongst the remaining four, Crypto.com holds the astir BTC.

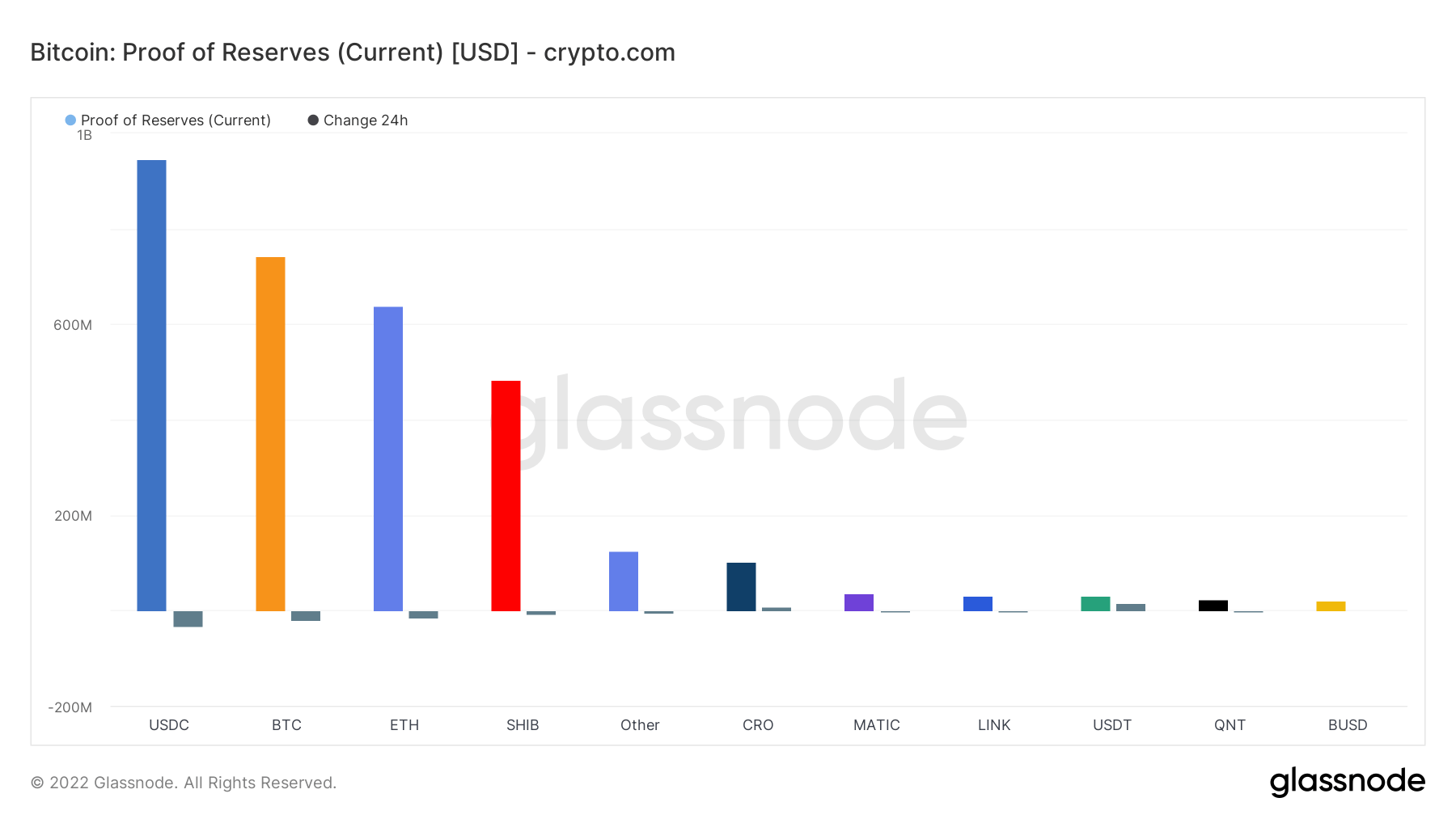

Crypto.com

Crypto.com entered the play with astir $700 cardinal worthy of BTC and conscionable supra $600 cardinal successful ETH.

From Nov.21, 52% of Crypto.com’s reserves were made of BTC and ETH, which equated to 53,024 BTC and 391,564 ETH. Current information suggests that the speech shrunk its BTC reserves portion increasing its ETH holdings.

Proof of reserves – Crypto.com

Proof of reserves – Crypto.comCrypto.com besides holds implicit $900 cardinal worthy of USD Coin (USDC) and astir $500 cardinal successful SHIBA INU (SHIB).

The speech released its impervious of reserves connected Dec. 6 and showed that each assets were afloat backed by 1:1 connected the exchange, with other reserves to spare. However, the audit steadfast Mazars Group audited the impervious of reserves, which revealed that it was preparing to driblet its clients connected Dec. 16.

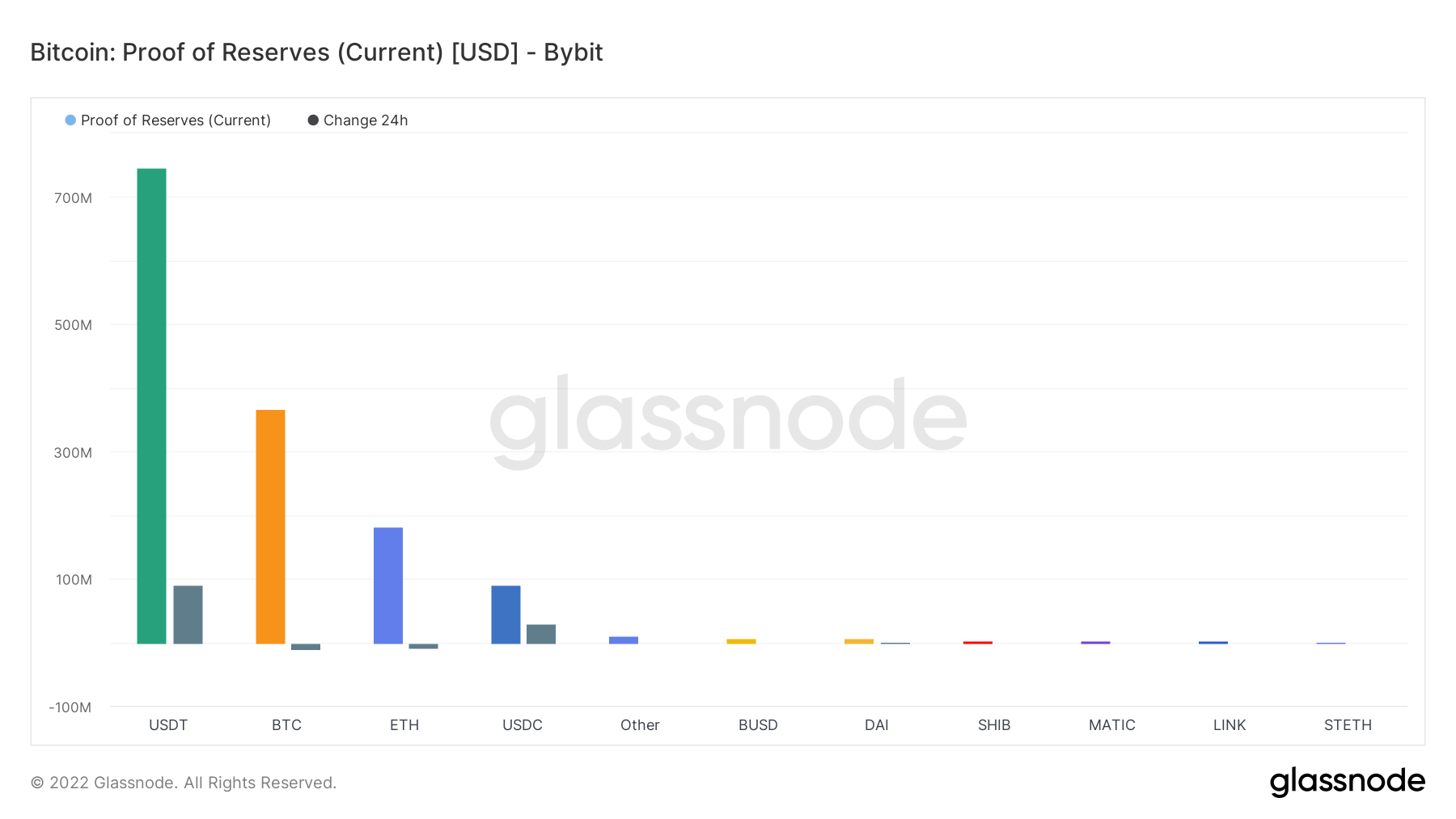

ByBit and KuCoin

Based connected the BTC reserves’ ranking, ByBit and KuCoin travel 4th and fifth, respectively, with lone flimsy differences successful their reserves.

The numbers amusement that ByBit holds astir $370 cardinal successful BTC and astir $200 cardinal successful ETH. In addition, the speech besides has implicit $700 cardinal USDT and astir $100 cardinal USDC stablecoins.

Proof of reserves – ByBit

Proof of reserves – ByBitByBit precocious announced that it would beryllium updating its withdrawal limits based connected verification levels and planning to laic disconnected astir 30% of its unit owed to challenging marketplace conditions.

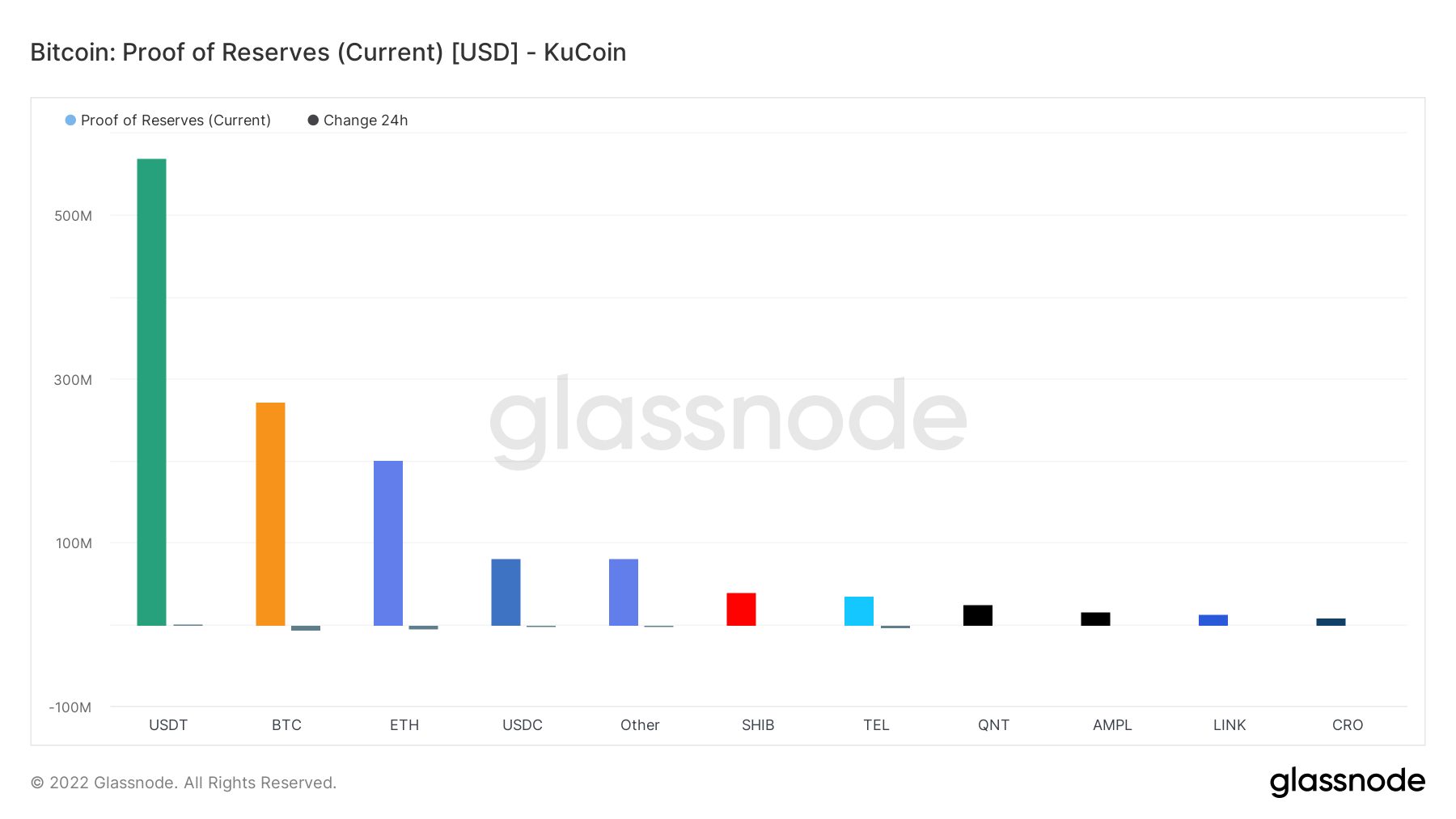

KuCoin, connected the different hand, holds a small little than $300 cardinal successful BTC and $200 cardinal successful ETH. The speech has implicit $600 cardinal successful USDT and USDC stablecoins combined.

Proof of reserves – KuCoin

Proof of reserves – KuCoinFollowing the FTX fallout, KuCoin was 1 of the archetypal exchanges that disclosed its holdings. On Nov. 11, KuCoin’s CEO, Johnny Lyu, announced the exchange’s holdings via his Twitter account. In addition, the speech released its proof-of-reserves connected Dec. 5, which the Mazars Group audited.

The station Bitfinex closes week starring Bitcoin reserves according to Glassnode appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)