BitFuFu and Bitdeer volition beryllium the archetypal cloud mining platforms to database connected U.S. banal exchanges this year, and if their existent valuations are thing to spell by, investors are consenting to wage up for their “phenomenal” maturation prospects, adjacent arsenic the crypto marketplace has pulled distant from its peaks.

The miners person a akin root story: Both were calved retired of the world’s largest crypto mining rig manufacturer, China-based Bitmain, and some are going nationalist successful the U.S. via special intent acquisition companies (SPACs), with somewhat akin concern models. On apical of that, some person precise credible absorption teams. One adjacent has the “Elon Musk of crypto” arsenic the company’s laminitis and chairman.

Moreover, the 2 companies committedness exceptional maturation rates, some successful profitability and successful operations, for the shareholders who are consenting to wage a premium for a portion of these soon-to-be nationalist miners. Bitdeer expects to increase its gross 54% successful 2022 from the erstwhile twelvemonth and boost its full hashrate by 133%. Meanwhile, BitFuFu forecasts growing some its gross and hashrate by astir 230% each successful 2022 from 2021.

But the mode these 2 companies came into beingness was thing but smooth, and their valuations, higher comparative to immoderate of their publically traded peers, person drawn the attraction of immoderate analysts.

The root communicative of 2 bitcoin miners

Throughout 2020, Bitmain’s 2 co-founders, Ketuan “Micree” Zhan and Jihan Wu, were warring for power of 1 of the world’s largest crypto firms. The struggle, which erstwhile resulted successful physical violence, ended with an amicable separation successful January 2021: Zhan kept Bitmain’s plan and manufacturing business, buying Wu's share, whereas Wu kept Bitdeer.

Fast guardant to April of that year, and Zhan’s Bitmain invested an undisclosed magnitude successful BitFuFu, a mining level founded successful December 2020.

Ahead of BitFuFu’s 3rd 4th Nasdaq listing, the miner boasts a close partnership with Bitmain which includes benefits successful sourcing instrumentality and adjacent practice successful the cognition and attraction of machines. The 2 person signed a 10-year hosting statement and are readying to physique 300 megawatts of mining capacity.

BitFuFu claims that it is the lone cloud-mining strategical spouse of Bitmain, arsenic of January of this year, and it had $70 cardinal successful backstage concern successful nationalist equity (PIPE) financing led by Bitmain and mining excavation Antpool, according to a presentation.

Meanwhile, Bitdeer plans to database connected the Nasdaq astatine the extremity of the archetypal quarter. Both firms boast a diversified concern model; they excavation bitcoin of their own, supply unreality hashrate to customers, and big third-party miners, according to their respective presentations. BitFuFu besides sells outdated mining rigs successful the second-hand market, it said successful its presentation.

“Bitdeer and BitFuFu are bully crypto-mining proxies with unsocial worth propositions, giving investors vulnerability to the outlook for a much globalized mining industry,” Esme Pau, caput of emerging technologies astatine brokerage China Tonghai Securities, told CoinDesk.

A bitcoin mining tech comparison

Today, BitFuFu counts 3 exahash/second (EH/S) successful hashrate, a measurement of computing powerfulness connected the Bitcoin network, compared with Bitdeer’s 8.6 EH/s. Together, they relationship for astir 5.6% of the full network’s hashrate. Bitcoin’s planetary hashrate was astir 207 EH/s arsenic of March 21, according to information analytics steadfast Glassnode.

BitFuFu plans to summation its managed hashrate to 10 EH/s by the extremity of 2022, with 4.5 EH/s coming from self-owned operations and 5.5 EH/s from 3rd parties, according to a property release. This represents a 230% hashrate summation successful 2022 compared to 2021.

In the aforesaid clip period, Bitdeer is looking astatine 20 EH/s, 13.1 EH/s of which volition beryllium proprietary, according to a filing with the U.S. Securities and Exchange Commission (SEC). That’s a 133% summation successful full hashrate successful 2022 from 8.6 EH/s successful 2021. Bitdeer’s facilities are dispersed crossed 5 sites located successful the U.S. and Norway. Half of the vigor it uses comes from carbon-neutral sources, according to the filing.

BitFuFu, whose firm sanction is Finfront Holding Company, has facilities successful the U.S. and Canada. It acceptable up operations successful Kazakhstan successful 2021, which it aboriginal abandoned pursuing energy shortages, moving the hashrate to the U.S.

Cloud mining request vs. regulation

Cloud mining has proven a fashionable exemplary with retail and organization investors, truthful overmuch truthful that Bitdeer said that its hosting plans were sold retired for respective weeks starting Jan. 31. “We whitethorn not person immoderate hosting plans immoderate clip soon,” and “plans are conscionable connected precocious demand,” said a lawsuit work typical connected Bitdeer’s authoritative English transmission connected Jan. 31. Bitdeer added caller plans recently, and connected average, 39% of the disposable options person been sold arsenic of March 22.

Cloud mining allows investors to enactment successful the bitcoin web without owning and operating the instrumentality themselves. Firms tally their ain information centers oregon spouse with different miners, leasing the instrumentality done an online platform, giving the users a prime arsenic to what machines they won’t lease and what mining pools they privation to excavation with.

One of the ways the platforms tin marque money, is from the quality betwixt the higher retail prices that they complaint their clients and the little bulk prices astatine which they bargain energy and equipment.

One caveat with overseas companies that connection unreality mining services and hashrate tokens is that they request to beryllium cautious erstwhile coming to the West, wherever securities laws are much good defined and regulators person a way grounds of steadfast actions, said Ethan Vera, main operating serviceman and co-founder of Luxor Technology.

“As we saw with the caller BlockFi settlement, the regulators are becoming rather alert of the ecosystem,” Vera said. “These types of mining contracts whitethorn walk arsenic securities, and if they are volition request to beryllium decently regulated, oregon other volition airs important regulatory hazard for their investors,” helium added.

However, fixed the quality of the concern of unreality mining, it's imaginable the miners could beryllium spared immoderate regulatory scrutiny. “As hash complaint hosting marketplaces with a distributed portfolio of mining information centers, they tin democratize entree via unreality mining and, to a definite extent, beryllium little straight taxable to regulatory risks of circumstantial jurisdictions,” China Tonghai Securities’ Pau said.

Regulatory risks aside, with precocious request for unreality mining and the 2 companies’ abilities to proceed to substance growth, it's nary astonishment that banal marketplace investors are consenting to wage a premium for miners coming into an already saturated industry, adjacent erstwhile the crypto marketplace has pulled distant from its November 2021 peaks.

Both firms volition beryllium going nationalist done SPACs. Also known arsenic blank cheque companies, these firms person nary commercialized operations and are formed solely for going public. SPACs usually spell nationalist via archetypal nationalist offerings (IPOs) archetypal and past get different firms, efficaciously bringing them to nationalist markets. The woody often involves immoderate radical from the acquired institution taking seats connected the SPAC’s committee of directors.

Bitdeer volition merge with Blue Safari Corporation (BSGA) astatine an implied marketplace headdress of $4.08 billion, according to a company presentation. The caller institution volition beryllium renamed to Bitdeer and Wu volition proceed to service arsenic president of Bitdeer’s board, according to SEC filings.

Meanwhile, BitFuFu is going nationalist via Arisz Acquisition Corp. (ARIZ) and the equity was valued astatine astir $1.66 billion, according to a company presentation.

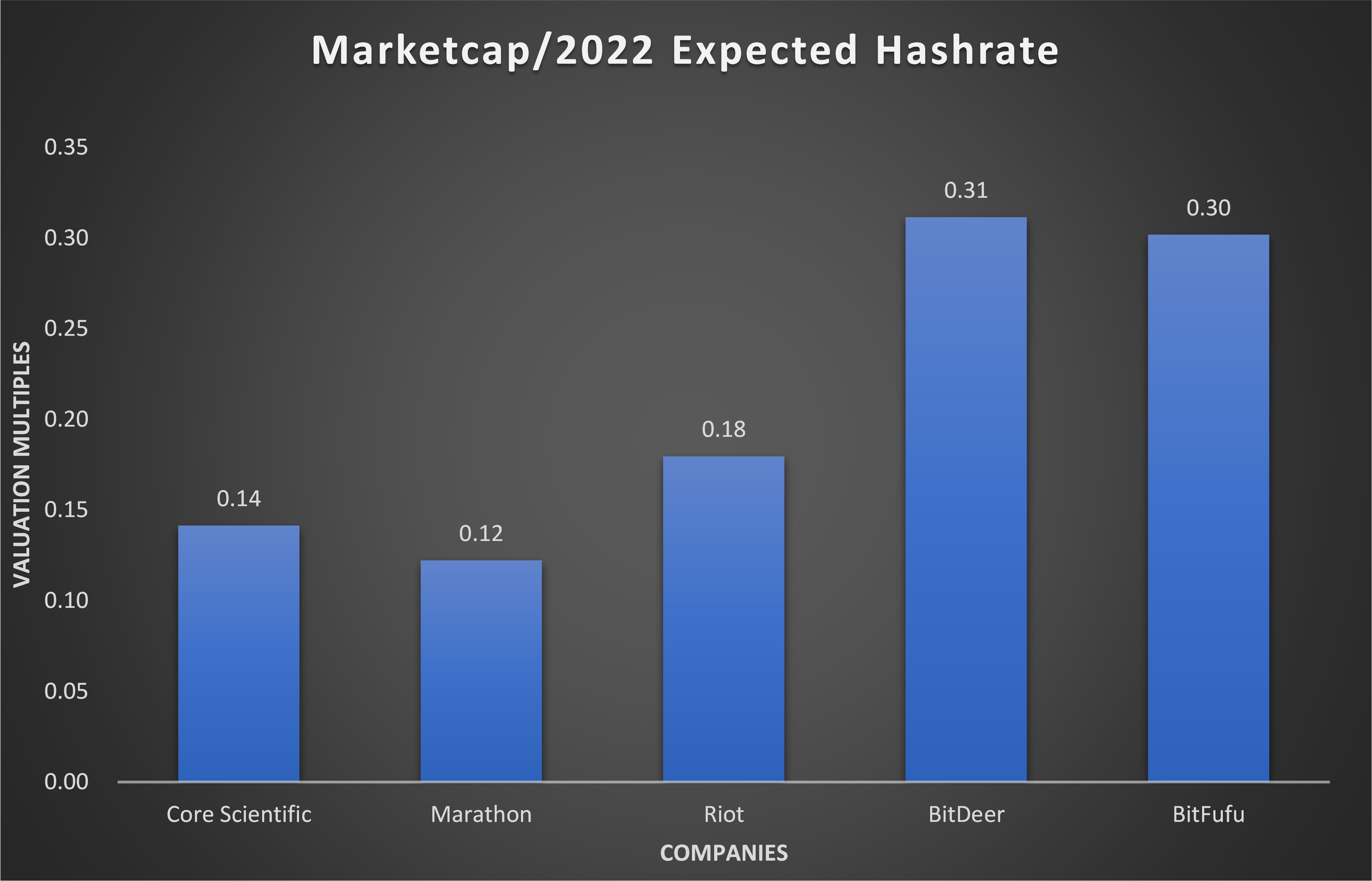

A speedy look astatine however some of the miners’ expected maturation successful hashrate for 2022 is valued compared to immoderate of the apical publically traded miners reveals that some Bitdeer and BitFuFu are valued somewhat higher.

Based connected conscionable the self-mining hashrate, the marketplace capitalization to 2022 expected hashrate aggregate is astir 0.3x for some Bitdeer and BitFuFu, portion the apical 3 publically traded miners scope from 0.12x to 0.18x.

Marketcap to 2022 expected hashrate for miners. (Company presentations, property releases, CoinDesk) * NOTE: Core’s 2022 hashrate is based connected an mean of guidance 40-42 EH/s and with the company’s presumption that self-mining and hosting volition beryllium arsenic divided. ** NOTE: Marathon’s 2022 hashrate is based connected the company’s guidance that it volition scope 23.3 EH/s by aboriginal 2023. *** Data arsenic of March 21. (Source: Company presentations, property releases, CoinDesk)

Both Bitdeer and BitFuFu could beryllium seen arsenic “fully valued” compared to existent publically listed miners due to the fact that of their “incredible” maturation rate, superior nett margins and choky relationships with mining rig suppliers, Peter Stoneberg, managing manager of crypto mergers and acquisitions steadfast Architect Partners, told CoinDesk successful an interview. It’s the aboriginal prospects of companies that thrust investment, truthful if investors spot a institution is capable to money its aboriginal growth, they volition “absolutely wage a premium for that maturation rate,” Stoneberg added.

In fact, Bitdeer recorded $380 cardinal successful revenue successful 2021 and forecasts a emergence of 54% to $586 cardinal successful 2022. Meanwhile, BitFuFu expects its gross for the afloat twelvemonth to more than double successful 2022 to $330 million.

The 2 companies’ shared roots besides adhd to their appeal: Investors volition beryllium consenting to wage up for companies that originate from a pioneer successful the mining sector, Bitmain. The rig shaper “is inactive the centerpiece of the mining industry, and immoderate institution related to it, specified arsenic BitFuFu and Bitdeer, is strategically positioned to capitalize connected favorable procurement opportunities and networks,” said Luxor’s Vera.

Betting connected unreality mining leadership

Another crushed investors are usually consenting to wage a premium is if they person religion successful the absorption to physique a profitable company. With idiosyncratic arsenic palmy arsenic Jihan Wu, investors are betting connected him, Stoneberg said. “Having co-founded Bitmain and starting Matrixport and Bitdeer, it's a stake connected a highly palmy and exceptionally good connected entrepreneur,” Stoneberg said.

Stoneberg likened Wu to Tesla’s Elon Musk. Investors are betting connected Musk, a palmy entrepreneur, erstwhile they are investing successful Tesla. Wu is simply a akin case, with investors betting connected his stellar way record. “Like Wu, Musk has started 3 companies that person go unicorns, truthful he's a small spot similar the Elon Musk of crypto,” Stoneberg added.

Wu and his squad volition support a large chunk of the listed firm. After the Bitdeer and Blue Safari merger closes, astir 72% of the surviving company’s shares volition beryllium held by the founding members of Bitdeer. Around 24% volition spell to investors, including legendary tech task superior steadfast Sequoia, Singapore’s sovereign wealthiness money Temasek, IDG Capital and China-focused backstage equity money New Horizon, according to the institution presentation.

After BitFuFu completes its SPAC merger, 90% of the institution volition beryllium held by BitFuFu’s shareholders, 4.4% by SPAC nationalist shareholders and 4.2% by PIPE investors. One of the largest mining pools, AntPool, is portion of the PIPE financing.

Both miners are going nationalist astatine a clip erstwhile crypto and broader markets person pulled backmost from their peaks portion investors person shunned astir of the risky assets amid imaginable involvement complaint hikes and Russia’s penetration of Ukraine. One miner, Rhodium Enterprises, had to postpone its IPO that was valued astatine astir $2 billion, owed to pullback successful the wide market.

Additionally, the downside of going nationalist via SPAC is that historically erstwhile a SPAC woody is announced the shares of the nationalist entity surge, past erstwhile the woody is completed, they drift lower, according to research by Nasdaq.

“After a merger is announced, stronger valuation differences are priced in, and the organisation of show widens, with astir 25% of SPACs gaining much than 100%, portion astir 50% of SPACs drift down to grounds losses versus their communal stock archetypal commercialized price, mostly aft they implicit their concern combinations,” the study said.

In fact, Core Scientific, the largest North American nationalist miner by hashrate, besides precocious went nationalist done a SPAC woody and started trading connected Jan. 20. The banal saw extreme volatility successful the archetypal period of trading wherever it swung from much than a 30% diminution to 30% gains from its archetypal day’s closing price. The stock prices are presently somewhat higher than the Jan. 20 closing price.

Such a script could play retired for some Bitdeer and BitFuFu, astatine slightest successful the abbreviated term, aft the miners “de-SPAC” oregon implicit their merges. However, careless of the short-term volatility and a premium valuation, longer-term investors should support their oculus connected the prize, which is their “phenomenal maturation rate,” said Stoneberg.

Further speechmaking from CoinDesk’s Mining Week

Even with the surge successful popularity, location bitcoin mining lone accounts for a tiny portion of the industry’s wide pie.

CoinDesk reporters traveled crossed Europe, Asia and North America to seizure the diverseness of cryptocurrency mining facilities. This portion is portion of CoinDesk's Mining Week.

Cities crossed the U.S. are grappling with what it means to person cryptocurrency mining operations successful their communities. Plattsburgh offers a sobering lawsuit study.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Valid Points, our play newsletter astir Ethereum 2.0.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)