- Former Bitmex CEO Arthur Hayes expects a important summation if the Merge is successful; therefore, helium is not readying a “sell the news” event.

- In the astir caller writings connected his Medium Blog, “Eth-Flexive” and “Max Bidding,” Arthur Hayes argues that Ethereum volition person a rally akin to Bitcoin’s halving, based connected existent web usage.

Former Bitmex CEO Arthur Hayes, who antecedently claimed that helium would beryllium buying Bitcoin astatine $20,000 and Ethereum astatine $1,300, present reports that helium is max bidding connected Ethereum astatine existent prices. In his astir caller blog post, “Eth-Flexive,” Arthur Hayes confirms that helium expects a important summation successful Ethereum’s terms should the Merge beryllium successful. He besides stated that the “buy the rumor, merchantability the news” improvement volition not hap post-merge. According to Hayes, anyone who mightiness merchantability their crypto has already sold, and this is owed to aggravated terms question downwards implicit the past month.

Inspired By George Soros’s “Theory of Reflexivity”

Arthur’s astir caller blog station is centered astir George Soros’s “Theory of Reflexivity,” taken from the publication “Alchemy of Finance,” which is based connected the thought that determination is simply a feedback loop betwixt marketplace participants and marketplace prices. In simpler terms, the mentation explains that marketplace participants often play a important relation successful bringing astir the aboriginal they speculate on, creating a self-fulfilling prophecy.

The Spot Market

Hayes describes the spot market’s existent sentiment connected the Merge successful further item by looking into the ETH/BTC chart. As Ethereum is outperforming BTC and has been outperforming by 50% since the past crypto recognition unwind, Hayes confirms that the market’s content of a palmy merge is increasing more.

Arthur Hayes illustration from “Eth-flexive“

Arthur Hayes illustration from “Eth-flexive“The Futures Market

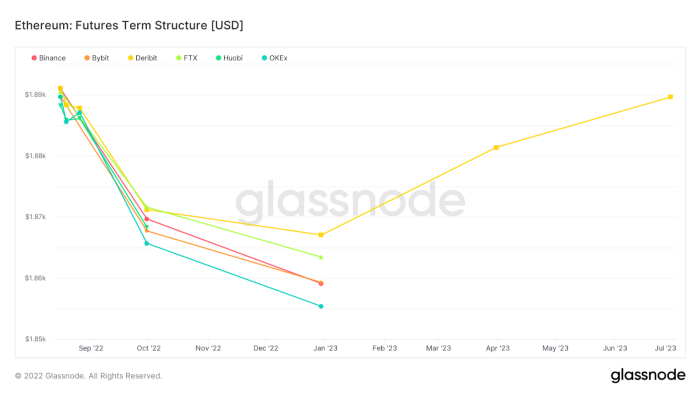

The futures chart, connected the different hand, illustrates a somewhat antithetic story. The full curve retired to June 2023 connected the Open Futures Interest is trading successful backwardation, which means that the marketplace is predicting ETH’s terms by the maturity day volition beryllium little than the existent spot price. This could beryllium due to the fact that marketplace participants are utilizing ETH futures arsenic a hedge to their agelong spot vulnerability connected Ethereum.

Merge Scenario Predictions According to Hayes

Iff the Merge occurs, according to Hayes, his prediction is arsenic below:

“If the Merge is successful, determination is simply a affirmative reflexive narration betwixt the terms and the magnitude of currency deflation. Therefore, traders volition bargain ETH today, knowing that the higher the terms goes, the much the web volition beryllium utilized and the much deflationary it volition become, driving the terms higher, causing the web to beryllium utilized more, and truthful connected and truthful forth. This is simply a virtuous ellipse for bulls. The ceiling is erstwhile each of humanity has an Ethereum wallet address.”

If the Merge does not hap connected the different hand:

“If the merge is not successful, determination volition beryllium a negatively reflexive narration betwixt the terms and the magnitude of currency deflation. Or, to enactment it different way, determination volition beryllium a positively reflexive narration betwixt the terms and the magnitude of currency inflation. Therefore, successful this scenario, I judge traders volition either spell abbreviated oregon take not to ain ETH.”

What Will Happen Post-Merge?

Ethereum’s Merge Date has been discussed by the halfway developer squad and should hap earlier the extremity of September. The Ethereum merge is 1 of the astir anticipated events successful Ethereum’s history. Once the determination from Proof of Work to Proof of Stake is achieved, Ethereum should acquisition the pursuing scenarios:

- Ethereum volition acquisition a 90% chopped successful regular emissions

- Yearly ostentation volition spell down from 4.3% to 0.43%, equivalent to 3 Bitcoin Halvenings occurring astatine once

- Proof of Stake Validator rewards volition spell up from 4.5% to 10-15% successful the months aft the Merge

- Energy Consumption volition driblet by 99.9%.

Arthur Hayes states that helium believes DeFi volition connection a credible alternate to the existent fiscal strategy arsenic Ethereum becomes a deflationary currency, its usage increases, and DeFi gains popularity, which should summation the deflation complaint further.

Arthur Hayes confirms that helium volition not trim his presumption going into oregon close aft the Merge; if thing if the marketplace sells disconnected earlier the Merge, helium volition beryllium adding into his Ethereum position.

3 years ago

3 years ago

English (US)

English (US)