In his latest essay titled “Black oregon White?”Arthur Hayes, co-founder and erstwhile CEO of crypto speech BitMEX, lays retired an investigation predicting that Bitcoin could soar to $1 million. Hayes argues that forthcoming US economical policies nether the 2nd word of Donald Trump could acceptable the signifier for unprecedented Bitcoin growth.

Hayes draws parallels betwixt the economical strategies of the United States and China, coining the word “American Capitalism with Chinese Characteristics.” He suggests that, akin to China’s attack nether Deng Xiaoping and continued by Xi Jinping, the US is moving toward a strategy wherever the government’s superior extremity is to clasp power, careless of whether policies are capitalist, socialist, oregon fascist.

Why The Fiat System Is Broken

“Similar to Deng, the elite that regularisation Pax Americana attraction not whether the economical strategy is Capitalist, Socialist, oregon Fascist, but whether implemented policies assistance them clasp their power,” Hayes writes. He emphasizes that America ceased being purely capitalist successful the aboriginal 20th century, noting, “Capitalism means that the affluent suffer wealth erstwhile they marque atrocious decisions. That was outlawed arsenic aboriginal arsenic 1913 erstwhile the US Federal Reserve was created.”

Hayes critiques the humanities displacement from “trickle-down economics” to nonstop stimulus measures, peculiarly those implemented during the COVID-19 pandemic. He distinguishes betwixt “QE for the rich” and “QE for the poor,” highlighting however nonstop stimulus to the wide colonisation spurred economical growth, whereas quantitative easing chiefly benefited affluent plus holders.

“From 2Q2020 until 1Q2023, Presidents Trump and Biden bucked the trend. Their Treasury departments issued indebtedness that the Fed purchased utilizing printed dollars (QE), but alternatively of handing it retired to affluent [individuals], the Treasury mailed checks retired to everyone,” helium explains. This led to a alteration successful the US debt-to-nominal GDP ratio, arsenic the accrued spending powerfulness of the mean national stimulated existent economical activity.

Looking ahead, Hayes anticipates that Trump’s return to powerfulness volition usher successful policies focused connected re-shoring captious industries to the US, financed by expansive authorities spending and slope recognition growth. He references Scott Bassett, whom helium believes volition beryllium Trump’s prime for Treasury Secretary, noting that Bassett’s speeches outline plans to “run nominal GDP blistery by providing authorities taxation credits and subsidies to re-shore captious industries.”

“The program is to tally nominal GDP blistery by providing authorities taxation credits and subsidies to re-shore captious industries (shipbuilding, semiconductor fabs, car manufacturing, etc.). Companies that suffice volition past person inexpensive slope financing,” Hayes states.

He warns that specified policies would pb to important ostentation and currency debasement, adversely affecting holders of semipermanent bonds oregon savings deposits. To hedge against this, Hayes advocates for investing successful assets similar Bitcoin and gold. “Instead of redeeming successful fiat bonds oregon slope deposits, acquisition gold (the boomer fiscal repression hedge) oregon Bitcoin (the millennial fiscal repression hedge),” helium advises.

Hayes supports his statement by analyzing the mechanics of monetary argumentation and slope recognition creation. He illustrates however “QE for the poor” tin stimulate economical maturation done accrued user spending, arsenic opposed to “QE for the rich,” which inflates plus prices without contributing to existent economical activity.

“QE for mediocre radical stimulates economical growth. The Treasury handing retired stimmies encouraged the plebes to bargain trucks. Due to the request for goods, Ford was capable to wage its employees and use for a indebtedness to summation production,” helium elaborates.

Furthermore, Hayes discusses imaginable regulatory changes, specified arsenic exempting banks from the Supplemental Leverage Ratio (SLR), which would alteration them to acquisition an unlimited magnitude of authorities indebtedness without further superior requirements. He argues that this would pave the mode for “infinite QE” directed astatine productive sectors of the economy.

“If Treasuries, cardinal slope reserves, and/or approved firm indebtedness securities were exempted from the SLR, a slope could acquisition an infinite magnitude of debt without having to encumber themselves with immoderate costly equity,” helium explains. “The Fed has the powerfulness to assistance an exemption. They did conscionable that from April 2020 to March 2021.”

How Bitcoin Could Reach $1 Million

Hayes believes that the operation of assertive fiscal policies and regulatory changes volition effect successful an detonation of slope credit, starring to higher ostentation and a weakening US dollar:

The operation of legislated concern argumentation and the SLR exemption volition effect successful a gusher of slope credit. I person already shown however the monetary velocity of specified policies is overmuch higher than that of accepted QE for affluent radical overseen by the Fed. Therefore, we tin expect that Bitcoin and crypto volition execute arsenic well, if not better, than they did from March 2020 until November 2021.

In specified an environment, helium asserts that Bitcoin stands to payment the astir owed to its scarcity and decentralized nature. “This is however Bitcoin goes to $1 million, due to the fact that prices are acceptable connected the margin. As the freely traded proviso of Bitcoin dwindles, the astir fiat wealth successful past volition beryllium chasing a harmless haven,” helium predicts. Hayes backs this assertion by referencing his customized scale that tracks US slope recognition supply, demonstrating that Bitcoin has outperformed different assets erstwhile adjusted for slope recognition growth.

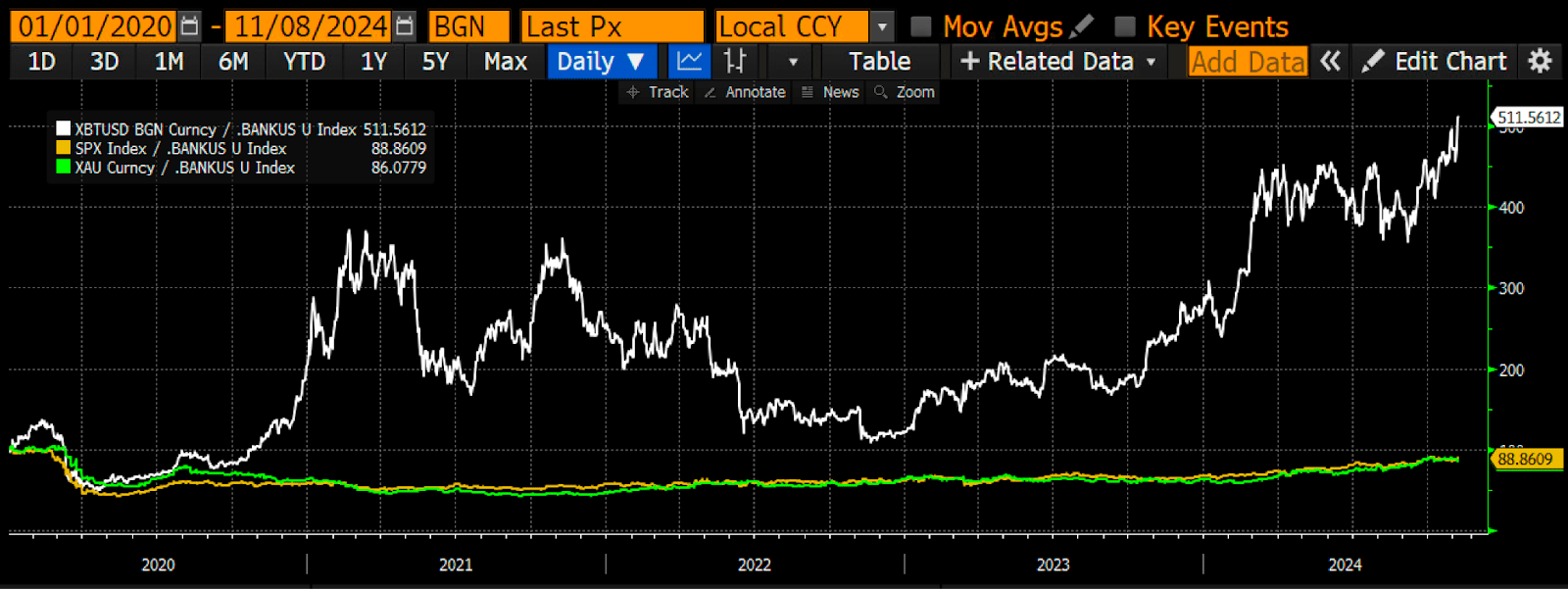

BANKUS U Index / Bitcoin vs golden vs SPX | Source: Arthur Hayes

BANKUS U Index / Bitcoin vs golden vs SPX | Source: Arthur Hayes“What is [..] important is however an plus performs erstwhile deflated by the proviso of slope credit. Bitcoin (white), the S&P 500 Index (gold), and golden (green) person each been divided by my slope recognition index. The values are indexed to 100, and arsenic you tin see, Bitcoin is the standout performer, rising implicit 400% since 2020. If you tin lone bash 1 happening to antagonistic the fiat debasement, it is Bitcoin. You can’t reason with the math,” helium asserts.

In concluding his essay, Hayes urges investors to presumption themselves accordingly successful anticipation of these macroeconomic shifts. “Get long, and enactment long. If you uncertainty my investigation of the interaction of QE for mediocre people, conscionable work up connected the Chinese economical past of the past 30 years, and you volition recognize wherefore I telephone the caller economical strategy of Pax Americana, “American Capitalism with Chinese Characteristics,” helium advises.

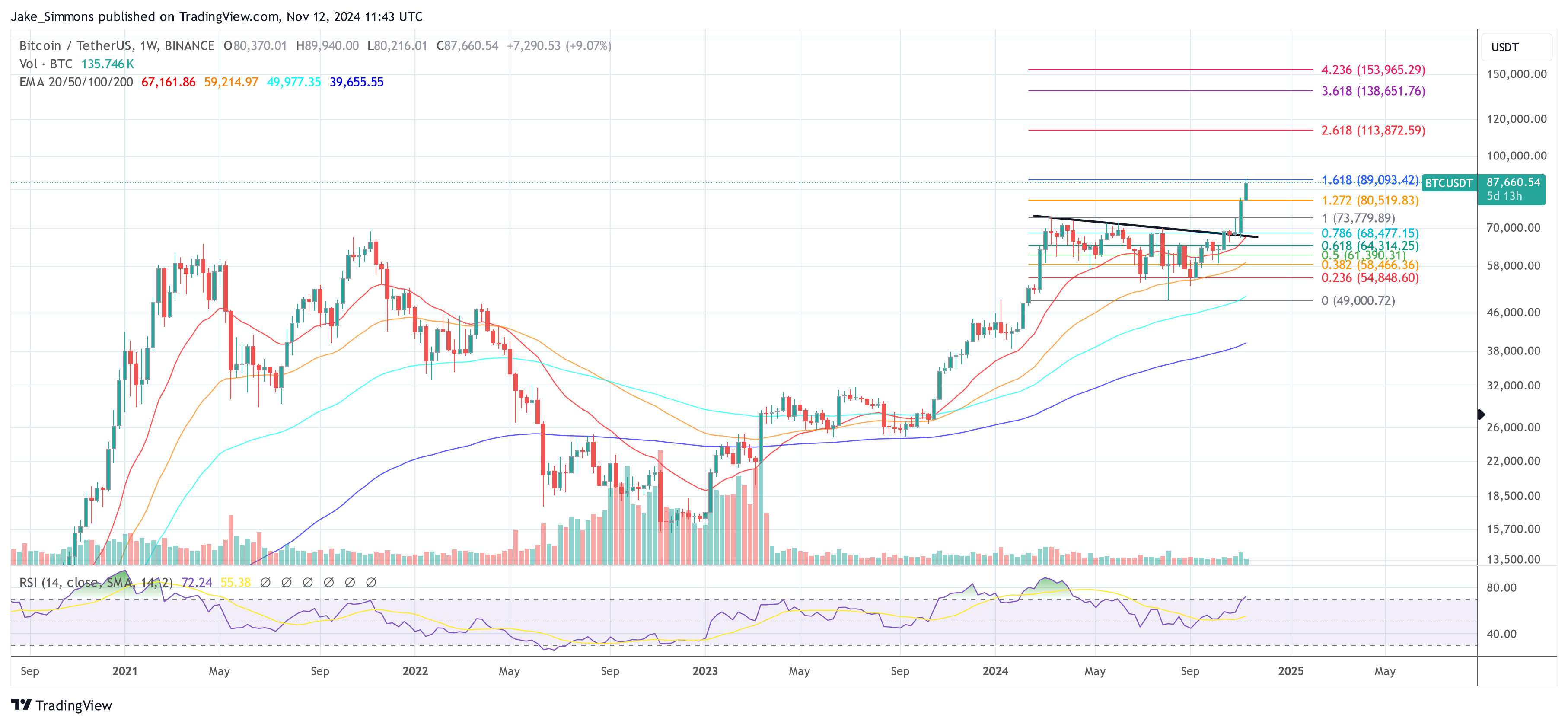

At property time, BTC traded astatine $87,660.

Bitcoin price, 1-week illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation from YouTube, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)