Ethereum has reclaimed the $3,000 level aft a beardown marketplace absorption to improving macro conditions, offering investors a much-needed displacement successful momentum. The determination comes conscionable days aft the Federal Reserve officially ended Quantitative Tightening (QT), a argumentation displacement that instantly boosted liquidity expectations crossed each hazard assets. With markets present pricing successful an imminent involvement complaint cut, assurance has begun to return, and ETH is 1 of the archetypal large assets to respond.

This rebound reflects much than conscionable macro relief. According to information from Arkham, shared by Lookonchain, Bitmine continues to accumulate Ethereum astatine existent prices, reinforcing bullish sentiment astatine a infinitesimal erstwhile galore traders stay cautious. Bitmine’s persistent buying passim the correction has go 1 of the astir influential signals for on-chain analysts, suggesting that ample players spot semipermanent worth adjacent arsenic the marketplace wrestles with volatility.

Reclaiming $3,000 places Ethereum backmost supra a cardinal intelligence level, and the operation of supportive macro argumentation and whale accumulation provides a stronger instauration than the marketplace had conscionable weeks ago.

Bitmine and Linked Wallets Expand Ethereum Holdings

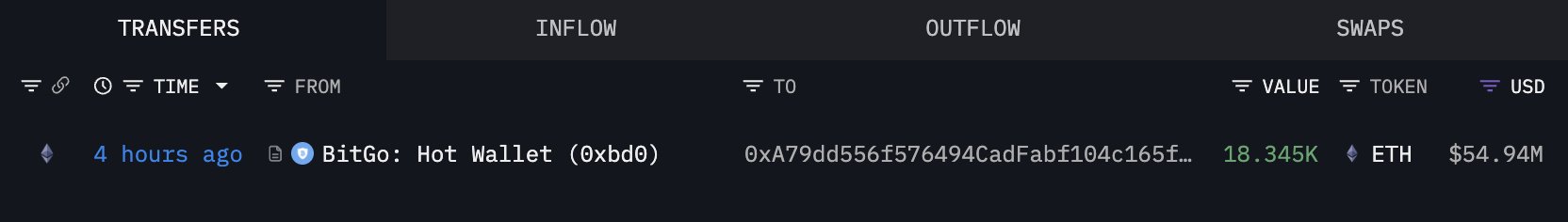

According to data from Arkham reported by Lookonchain, Bitmine has purchased different 18,345 ETH, worthy astir $54.94 million, conscionable a fewer hours ago. This marks yet different ample bargain successful a increasing bid of assertive accumulation moves that Bitmine has made passim the correction. Their continued willingness to bargain astatine existent levels signals beardown assurance successful Ethereum’s semipermanent value, adjacent arsenic the marketplace navigates heightened volatility.

Bitmine-Linked Wallet Transfers | Source: Arkham

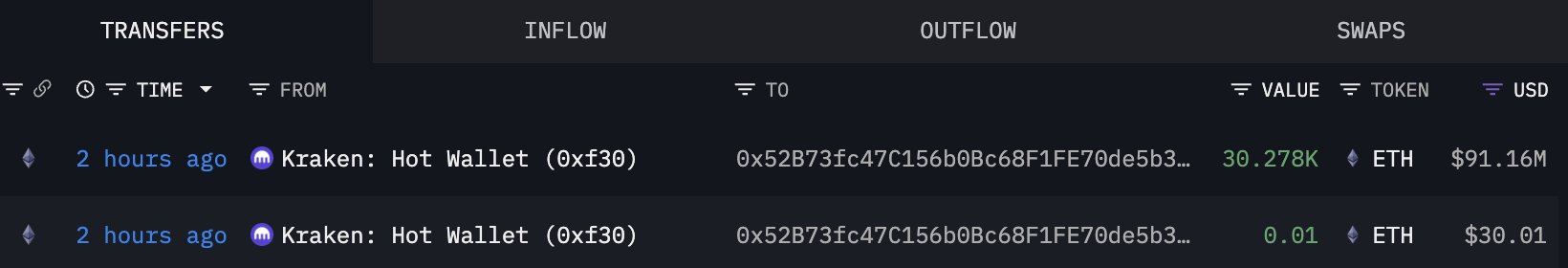

Bitmine-Linked Wallet Transfers | Source: ArkhamShortly aft this report, Lookonchain highlighted enactment from a recently created wallet, 0x52B7, which withdrew 30,278 ETH—valued astatine $91.16 million—from Kraken. The size and timing of the withdrawal person led analysts to speculate that this wallet whitethorn beryllium linked to Bitmine oregon portion of a broader accumulation strategy.

Large withdrawals from exchanges typically bespeak that the proprietor intends to clasp the assets off-exchange, often for semipermanent retention oregon staking, alternatively than preparing to sell.

Bitmine-Linked Wallet Transfers | Source: Arkham

Bitmine-Linked Wallet Transfers | Source: ArkhamIf the wallet is so connected to Bitmine, this would bring their latest combined accumulation to astir 50,000 ETH successful a azygous day. Such behaviour suggests strategical positioning up of imaginable macro-driven upside oregon interior assurance successful Ethereum’s recovery.

This benignant of synchronized whale enactment often precedes important terms shifts, reinforcing the thought that ample players are preparing for a stronger marketplace phase.

ETH Reclaims $3,000 But Still Faces Key Resistance

Ethereum’s 3-day illustration shows a notable betterment aft reclaiming the $3,000 level, but the broader inclination inactive carries signs of fragility. The caller bounce followed a heavy corrective determination that sent ETH from the $4,500 portion down to the $2,700–$2,800 enactment zone, wherever buyers yet stepped successful with conviction. The beardown little wicks astir this country corroborate that request remains active, but Ethereum has yet to afloat retrieve its bullish structure.

ETH consolidates astir cardinal level | Source: ETHUSDT illustration connected TradingView

ETH consolidates astir cardinal level | Source: ETHUSDT illustration connected TradingViewPrice present trades conscionable beneath the 50 SMA, which sits adjacent the $3,100–$3,150 zone—an important short-term absorption level. A cleanable interruption supra this moving mean would awesome renewed momentum and summation the chances of retesting the $3,400–$3,600 range. Meanwhile, the 100 SMA and 200 SMA stay somewhat supra price, reflecting the broader downtrend that has dominated since September.

Volume has picked up somewhat during the recovery, but it remains muted compared to the selling spikes seen during the drawdown. This indicates cautious buying alternatively than assertive accumulation astatine these levels. To corroborate a inclination reversal, ETH indispensable adjacent supra the 50 SMA and past situation the clump of absorption astir $3,200–$3,300.

Featured representation from ChatGPT, illustration from TradingView.com

2 months ago

2 months ago

English (US)

English (US)