Ethereum is trading astatine captious terms levels aft a crisp 10% diminution from the $4,750 mark, reflecting increasing uncertainty crossed the broader crypto market. The caller correction has pushed ETH toward the $4,300 enactment zone, a level that bulls are present fiercely defending to forestall a deeper retracement. Despite the pullback, on-chain information suggests that ample holders stay confident, signaling that this dip whitethorn beryllium portion of a steadfast marketplace reset alternatively than the commencement of a downtrend.

According to caller data, Bitmine continues its assertive accumulation of ETH, adding to its holdings adjacent arsenic prices fluctuate. This dependable inflow from organization players highlights beardown condemnation successful Ethereum’s semipermanent fundamentals, peculiarly arsenic the web maintains dominance successful DeFi and astute declaration activity.

Still, sentiment among retail traders remains mixed. Some fearfulness that sustained weakness beneath $4,300 could trigger different question of selling pressure, portion others spot this arsenic a imaginable accumulation accidental earlier the adjacent large move. As Ethereum stabilizes astatine these levels, the coming days volition beryllium important to find whether the marketplace resumes its bullish momentum oregon enters a prolonged consolidation signifier amid heightened volatility.

Ethereum Accumulation Continues As Bitmine Strengthens Its Position

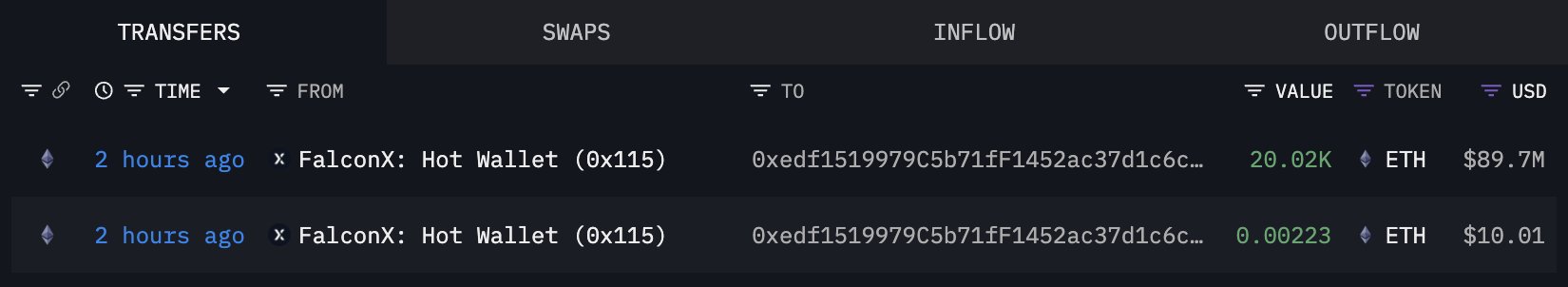

According to data shared by Lookonchain, organization accumulation astir Ethereum remains beardown contempt caller marketplace volatility. Just a fewer hours ago, Bitmine received different 23,823 ETH (worth $103.68 million) from BitGo, marking yet different important inflow of capital. This determination comes lone 2 days aft Bitmine acquired 20,020 ETH ($89.7 million) via FalconX, underscoring their accordant strategy of gathering vulnerability during terms dips alternatively than chasing rallies.

Bitmine buying ETH from BitGo | Source: Lookonchain

Bitmine buying ETH from BitGo | Source: Lookonchain Bitmine buying ETH from Falcon X (October 8) | Source: Lookonchain

Bitmine buying ETH from Falcon X (October 8) | Source: LookonchainSuch accumulation patterns are often seen arsenic a motion of assurance successful Ethereum’s semipermanent fundamentals, peculiarly from organization investors who presumption ETH arsenic a halfway plus wrong the broader integer economy. While short-term sentiment remains cautious aft the caller correction, these inflows suggest that astute wealth continues to spot worth astir existent prices.

The coming days volition beryllium captious for Ethereum’s method structure. Bulls indispensable support the $4,300 enactment portion to support momentum and acceptable up a imaginable betterment toward the $4,600–$4,750 absorption area. A beardown defence present could pave the mode for a caller all-time high, confirming renewed capitalist assurance and establishing $4,300 arsenic a cardinal accumulation level.

Bulls Defend $4,300 Support

Ethereum (ETH) is presently trading adjacent $4,325, showing signs of consolidation aft a 10% diminution from its caller precocious of $4,750. The 12-hour illustration reveals that ETH has fallen beneath the 50-day moving mean (blue line), signaling short-term weakness, portion the 100-day (green) and 200-day (red) moving averages are inactive trending upward — a motion that the broader uptrend remains intact.

ETH consolidation continues | Source: ETHUSDT illustration connected TradingView

ETH consolidation continues | Source: ETHUSDT illustration connected TradingViewThe $4,300 level present acts arsenic a cardinal enactment zone, with bulls attempting to found a basal and forestall further downside pressure. If this level holds, the adjacent people would beryllium a retest of $4,500–$4,600, wherever sellers are apt to reappear. However, a interruption beneath $4,250 could exposure Ethereum to a deeper pullback toward the $4,000 intelligence level, an country that antecedently served arsenic a beardown accumulation portion successful precocious September.

Momentum indicators suggest that selling unit is easing, aligning with the caller on-chain information showing continued accumulation from ample entities specified arsenic Bitmine. This reinforces the thought that organization assurance remains strong, adjacent amid volatility. For now, holding supra $4,300 is captious — a palmy defence could people the instauration for Ethereum’s adjacent propulsion toward caller highs.

Featured representation from ChatGPT, illustration from TradingView.com

2 months ago

2 months ago

English (US)

English (US)