As the highly anticipated motorboat day of spot Ethereum ETFs approaches, Matt Hougan, Chief Investment Officer of crypto plus manager Bitwise, has stressed the imaginable for these ETF inflows to thrust the Ethereum terms to grounds highs.

In a caller lawsuit note, Hougan highlighted the important interaction that ETF flows could person connected the Ethereum price, surpassing adjacent the effects witnessed successful the spot Bitcoin ETF marketplace successful the US.

Ethereum ETFs Poised To Surpass Bitcoin’s Impact?

Hougan confidently predicts that introducing spot Ethereum ETFs volition pb to a surge successful ETH’s value, perchance reaching all-time highs supra $5,000. However, helium cautions that the archetypal fewer weeks aft the ETF motorboat could beryllium volatile, arsenic funds could travel retired of the existing $11 cardinal Grayscale Ethereum Trust (ETHE) aft it is converted to an ETF.

This could beryllium akin to the lawsuit of the Grayscale Bitcoin Trust (GBTC), which saw important outflows of implicit $17 cardinal aft the Bitcoin ETF market was approved successful January, with the archetypal inflows recorded 5 months aboriginal connected May 3.

Still, Hougan expects the marketplace to stabilize successful the agelong term, pushing Ethereum to grounds prices by the extremity of the twelvemonth aft the archetypal outflows subside, drafting a examination with Bitcoin successful cardinal metrics to recognize this thesis.

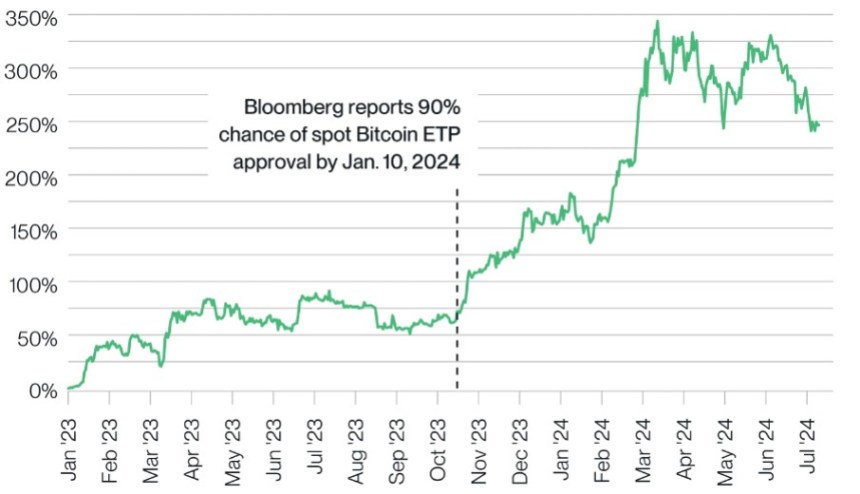

For example, Bitcoin ETFs person purchased much than doubly the magnitude of Bitcoin compared to what miners person produced implicit the aforesaid period, contributing to a 25% summation successful Bitcoin’s price since the ETF motorboat and a 110% summation since the marketplace began pricing successful the motorboat successful October 2023.

BTC’s terms show since ETF support successful January. Source: Matt Hougan

BTC’s terms show since ETF support successful January. Source: Matt HouganThat said, Hougan believes the interaction connected Ethereum could beryllium adjacent much significant, and identifies 3 structural reasons wherefore Ethereum’s ETF inflows could person a greater interaction than Bitcoin’s.

Lower Inflation, Staking Advantage, And Scarcity

The archetypal crushed Bitwise’s CIO highlights is Ethereum’s little short-term inflation rate. While Bitcoin’s ostentation complaint was 1.7% erstwhile Bitcoin ETFs launched, Ethereum’s ostentation complaint implicit the past twelvemonth has been 0%.

The 2nd crushed lies successful the quality betwixt Bitcoin miners and Ethereum stakers. Due to the expenses associated with mining, Bitcoin miners generally merchantability overmuch of the Bitcoin they get to screen operational costs.

In contrast, Ethereum relies connected a proof-of-stake (PoS) system, wherever users involvement ETH arsenic collateral to process transactions accurately. ETH stakers, not burdened with precocious nonstop costs, are not compelled to merchantability the ETH they earn. Consequently, Hougan suggests that Ethereum’s regular forced selling unit is little than that of Bitcoin.

The 3rd crushed stems from the information that a important information of ETH is staked and, therefore, unavailable for sale. Currently, 28% of each ETH is staked, portion 13% is locked successful astute contracts, efficaciously removing it from the market.

This results successful astir 40% of each ETH being unavailable for contiguous sale, creating a sizeable scarcity and yet favoring a imaginable summation successful terms for the 2nd largest cryptocurrency connected the market, depending connected the outflows and inflows recorded. Hougan concluded:

As I mentioned above, I expect the caller Ethereum ETPs to beryllium a success, gathering $15 cardinal successful caller assets implicit their archetypal 18 months connected the market… If the ETPs are arsenic palmy arsenic I expect—and fixed the dynamics above—it’s hard to ideate ETH not challenging its aged record.

ETH was trading astatine $3,460, up 1.5% successful the past 24 hours and astir 12% successful the past 7 days.

Featured representation from DALL-E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)