Following past week’s launch of 11 spot Bitcoin speech Traded-Funds (ETFs) successful the United States, Matt Hougan, Chief Investment Officer (CIO) astatine Bitwise, has offered a compelling perspective connected the imaginable interaction of these ETFs connected the Bitcoin market. His remarks travel astatine a captious juncture, with the adjacent Bitcoin halving lawsuit anticipated successful mid-April 2024.

Spot ETFs Could Have Impact Like 1.4 Bitcoin Halvings

Hougan draws a parallel betwixt the interaction of Bitcoin ETFs and the Bitcoin halving events. He states, “Crypto natives person a bully intelligence exemplary for the interaction of Bitcoin ETFs connected the market: The halving.” He further explains the humanities context, “Roughly each 4 years, the magnitude of caller bitcoin being created falls successful half. Bitcoin’s terms has historically risen successful the twelvemonth +/- surrounding the halving.”

In April, erstwhile the artifact fig hits 740,000, the reward volition autumn from 6.25 to 3.125 BTC. Highlighting the supply-demand dynamics of Bitcoin, Hougan remarks, “Bitcoin’s terms is acceptable by supply and demand. If you trim caller supply, that should beryllium (and historically has been) bully for prices.” He past quantifies the interaction of the adjacent halving, “At existent prices, it volition region astir $7 cardinal successful caller proviso from the marketplace each year.”

Moving to the halfway of his analysis, Hougan compares the expected inflows from ETFs to the halving effect. He notes that estimates for ETF inflows vary, but galore radical deliberation that these products volition propulsion successful determination astir $10 cardinal per twelvemonth for the foreseeable future.

“If that happens, that means the nonstop interaction of the ETF connected Bitcoin’s supply/demand equilibrium is thing similar 1.4 halvings,” Hougan claims.

However, helium cautions astir the timing of these impacts, saying:

Note that ‘halvings’ don’t interaction prices overnight. If the adjacent halving takes spot connected April 22, we don’t expect prices to summation sharply connected April 23. Historically, prices person risen successful +/- the twelvemonth surrounding each halving. The aforesaid volition beryllium existent for ETFs.

An Even Greater Scope?

Hougan besides highlights the indirect benefits of ETFs. According to him, these products could person indirect benefits that aren’t captured successful his analogy. “IMHO, the ETF is simply a important affirmative for regulation, semipermanent education, etc. It volition substantially summation the fig of radical funny successful crypto, and truthful person a multiplier effect.”

Concluding his thoughts, Hougan says, “Still, the halving is simply a beauteous bully intelligence exemplary for the nonstop interaction of ETFs: ~1.4 halvings, positive the important ancillary benefits. We’ll instrumentality it.”

Hougan’s estimation of $10 cardinal per twelvemonth of nett inflows for the spot Bitcoin ETFs is rather conservative. Analysts from Standard Chartered predicted a fewer days agone that determination volition beryllium inflows of $50 cardinal to $100 cardinal this year. If $100 cardinal does so travel into the ETFs, the products could adjacent person an interaction arsenic beardown arsenic 14 BTC halvings.

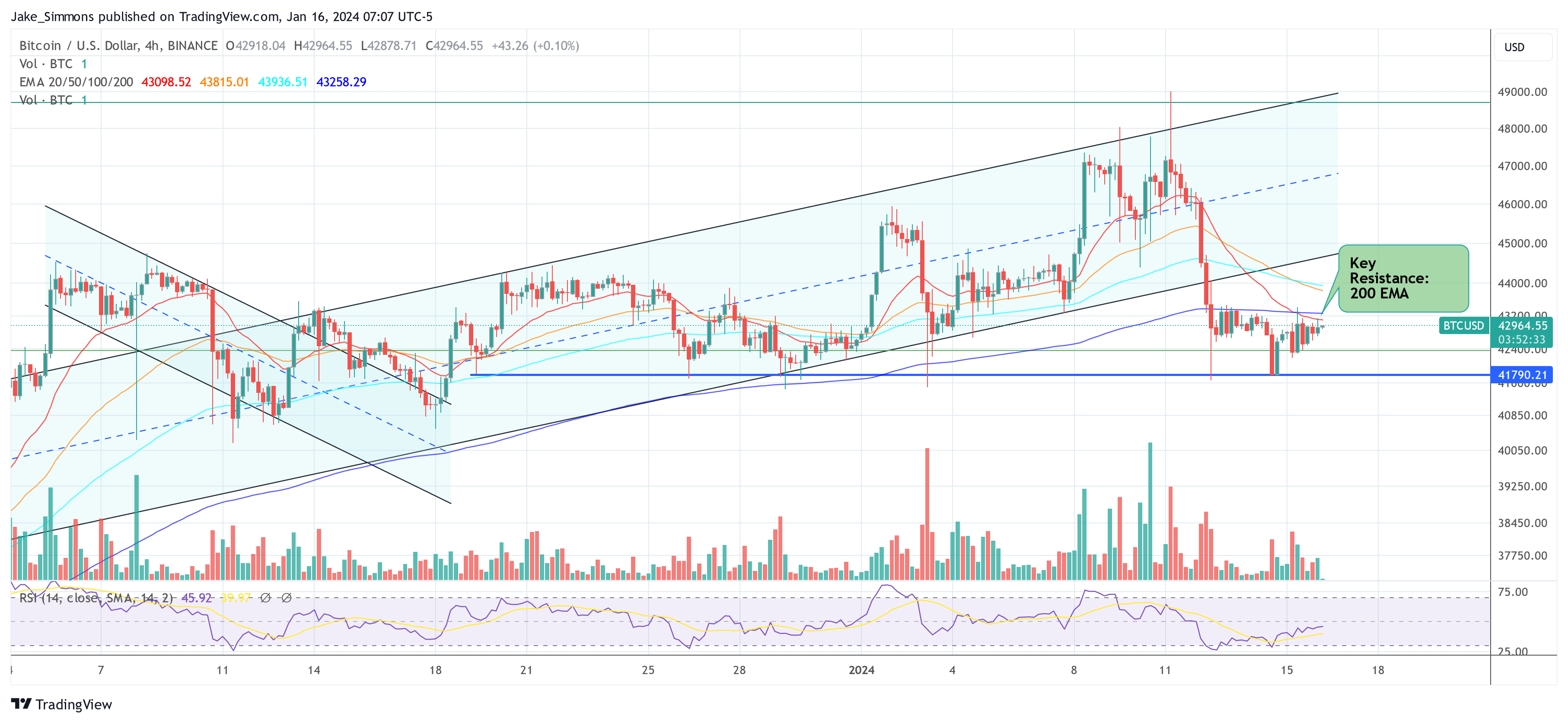

At property time, BTC traded 42,964.

BTC terms needs to interruption the 200-EMA, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms needs to interruption the 200-EMA, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E 3, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)