Bitwise main concern serviceman Matt Hougan attributed the caller diminution successful the crypto marketplace to overinflated expectations regarding the imaginable interaction of the recently launched Bitcoin exchange-traded funds (ETFs).

In a Jan. 23 post connected X (formerly Twitter), Hougan explained that the existent marketplace sell-off is driven by what helium presumption an “ETF Expectations-led” phenomenon.

According to him, investors anticipating “larger nett flows into (these) ETFs” front-ran the support quality by piling into some spot and derivatives positions connected the flagship integer asset. However, with the expected inflows not materializing, these investors are present “unwinding that bet,” prompting the existent marketplace situation.

“Just arsenic the marketplace overestimated the short-term interaction of ETFs, it is underestimating the semipermanent impact,” Hougan concluded.

Since the Securities and Exchange Commission (SEC) approved the motorboat of respective spot Bitcoin ETFs successful the U.S., the worth of the apical cryptocurrency has been connected a downturn. The integer plus fell to arsenic debased arsenic under $39,000 connected Jan. 23 but has recovered to $40,389 arsenic of property time, according to CryptoSlate’s data.

This downward trend raised concerns wrong the crypto community, with immoderate attributing it to the outflows from Grayscale’s Bitcoin Trust ETF (GBTC).

Contrary to this sentiment, analysts, including CryptoQuant laminitis Ki Young Ju, stock a position aligned with Hougan’s.

Young Ju precocious emphasized that Bitcoin operates successful a futures-driven market, making it little susceptible to spot-selling activities from GBTC-related issues.

“BTC falls owed to derivative marketplace selling, not GBTC. OTC (over the counter) markets are precise active, but nary terms impact,” helium added.

ETFs are BTC nett buyers.

Meanwhile, the Bitwise concern main besides clarified that the precocious launched ETFs are nett buyers of Bitcoin contempt the outflows emanating from GBTC.

Hougan pointed retired that portion GBTC functions arsenic a nett seller, the cumulative BTC acquisitions from the caller ETFs surpass that being offloaded by Grayscale.

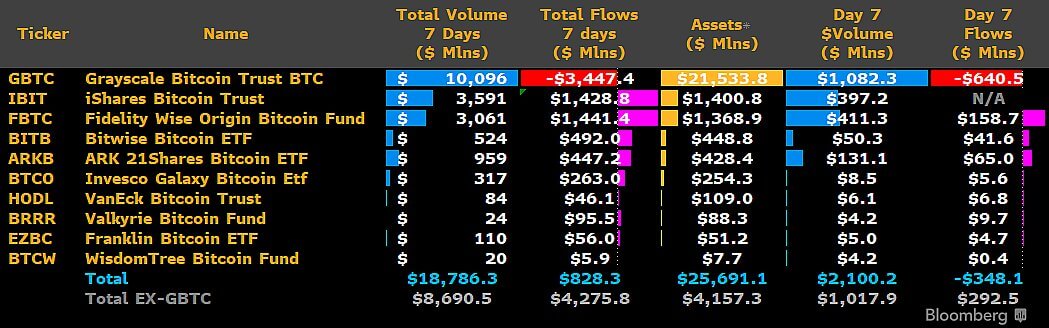

Bloomberg information corroborates Hougan’s view. As of Jan. 23, GBTC’s outflows stood astatine $3.45 billion, portion the recently introduced 9 ETFs had a combined inflow of much than $4 cardinal successful assets nether management.

Bitcoin ETF Flows arsenic of Jan. 23 (Source: Bloomberg/James Seyffart)

Bitcoin ETF Flows arsenic of Jan. 23 (Source: Bloomberg/James Seyffart)This information stresses a compelling narrative—that the ETFs person seen important involvement from the community, starring to a swift and important accumulation of the starring cryptocurrency.

The station Bitwise CIO says Bitcoin’s dip driven by ETF overenthusiasm, not Grayscale outflows appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)