Like peering wrong a location done antithetic windows, speechmaking immoderate 1 quality communicative oregon information constituent whitethorn connection a utile position connected the crypto markets, but nary connected its ain tin springiness you the afloat picture. For Crypto Long & Short this week, I wanted to instrumentality 3 seemingly unconnected stories from the past week oregon truthful and necktie them together.

CoinDesk’s Ian Allison reports that BlackRock whitethorn beryllium readying to offer crypto trading to its clients done Aladdin, the $10 trillion plus manager’s integrated concern absorption platform. This cuts against what CEO Larry Fink said successful July (which conveniently happened astir the time I past wrote for this newsletter). Fink indicated determination was “little demand” for crypto assets from clients, which wasn’t truly astonishing fixed those clients see pension funds, endowments and different types of blimpish superior with infinite clip horizons. However, 1 of Ian’s sources said of BlackRock: “They spot each the travel that everyone other is getting and privation to commencement making immoderate wealth from this.” Still, it is simply a spot astonishing that the imaginable Aladdin offering appears to widen beyond bitcoin, though it’s unclear which different “crypto assets” BlackRock would connection to clients. Bitcoin had solidified itself arsenic crypto’s “blue-chip” plus astir the clip MassMutual made a $100 cardinal purchase successful 2020.

You’re speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Sunday.

Maybe crypto’s full marketplace headdress settling determination betwixt $1.5 trillion and $3.0 trillion for the past twelvemonth oregon truthful changed minds astatine BlackRock. Maybe it was Jump Trading yet diving into crypto successful September. Maybe capable Zoomers pestered their high-net-worth parents astir cryptocurrencies astatine meal tables until it deed a tipping point. Whatever the catalyst, I deliberation the quality is acold much important than radical are giving it recognition for. BlackRock wouldn’t research thing if determination wasn’t request for it. On apical of that, Aladdin powers the backmost bureau for astatine slightest $20 trillion of assets, equivalent to 10% of planetary stocks and bonds. Most importantly, you can’t disregard the gravity that could yet beryllium BlackRock signaling that “crypto is OK.”

I cognize investors are autarkic thinkers, but it definite helps erstwhile the $10 trillion elephantine corroborates your views.

Where is this bitcoin going?

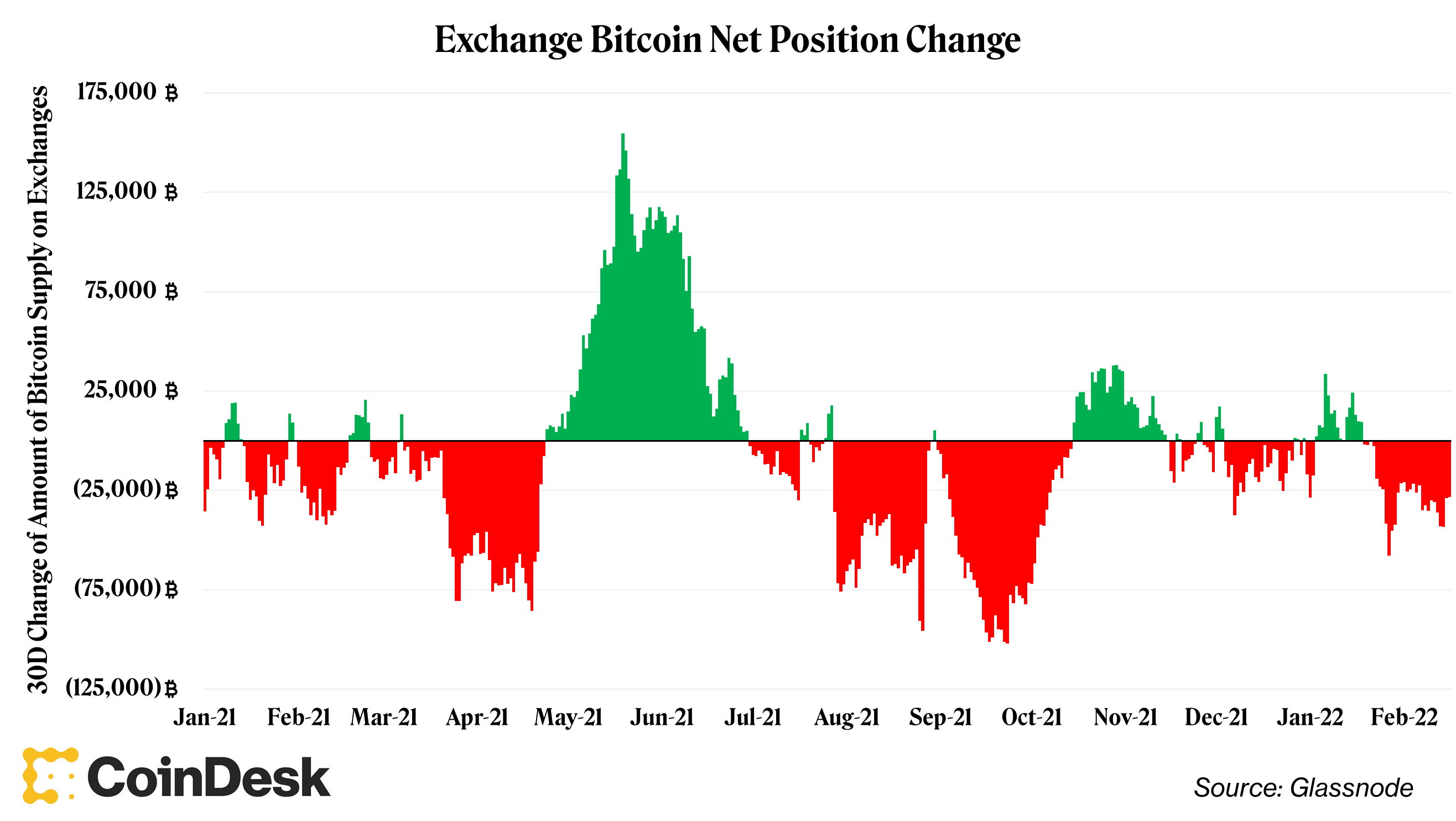

The magnitude of bitcoin held connected exchanges has gone down each time since Jan. 22 of this year. This caught my oculus successful Glassnode’s play on-chain metrics report, which you should decidedly cheque retired if prime information investigation excites you.

Exchange Bitcoin Net Position Change (Glassnode)

This benignant of worldly happens successful cycles for bitcoin. Sometimes investors privation to de-risk and merchantability coins, truthful inflows to exchanges spike. Other times, investors privation to hold, truthful outflows from exchanges to much imperishable (“cold”) retention spike. It’s nary astonishment that this three-week play of outflows happened during bitcoin’s run-up from $33,000 to $45,000 due to the fact that less bitcoins connected exchanges theoretically eases selling pressure.

So is anyone selling bitcoin?

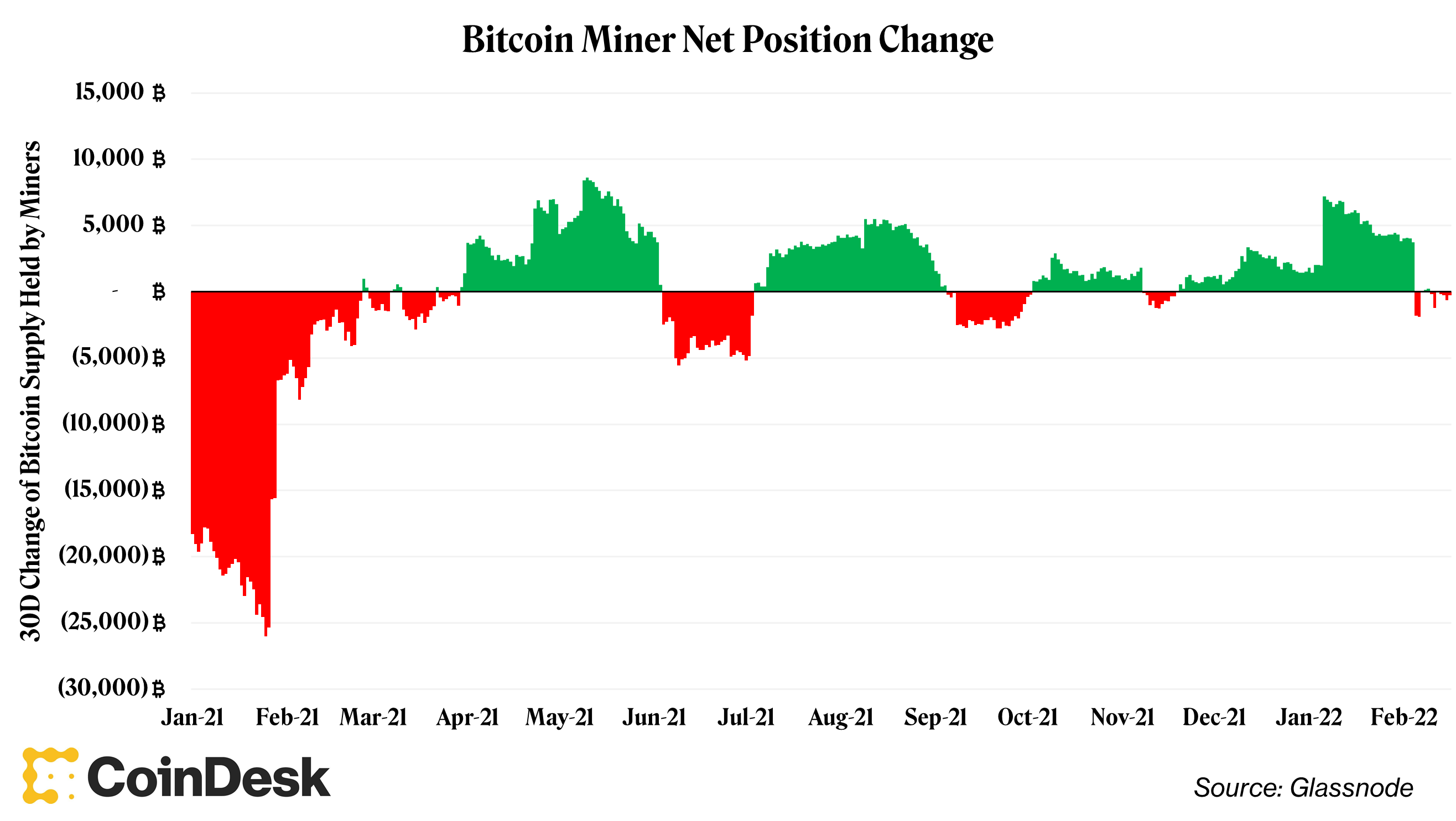

If idiosyncratic is, it surely isn’t publically traded bitcoin miner Marathon (NASDAQ : MARA). At least, that’s according to a tweet the institution sent retired past Monday successful effect to a Bloomberg nonfiction that suggested miners were selling coins successful a “worrying motion of a shakeout.” In theory, miners marque wealth by mining bitcoin and instantly selling it for the section currency successful bid to wage expenses (most utilities and landlords don’t judge magic net money). In reality, a fig of these are well-capitalized firms that don’t request to merchantability bitcoin continuously

Yet, contempt Marathon’s tweet, miners did mostly merchantability coins starting Feb. 5 done this play pursuing accumulation since Nov. 19. But to telephone this enactment “worrying” seems mistaken. Shorter periods of nett selling from miners isn’t truly associated with the benignant of terms weakness that would interest a seasoned investor. To boot, the past prolonged play of nett selling by miners was from January to March 2021, a play which was punctuated by astounding terms show and the archetypal clip bitcoin broke $60,000.

Bitcoin Miner Net Position Change (Glassnode)

Everything is delicately tied together

The 3 preceding narratives are loosely tied together.

Some radical deliberation bitcoiners are attempting to rebuild the fiscal strategy with code, and that on the mode these coders are learning wherefore things are the mode they are. I partially agree, but I mostly disagree. Bitcoin is antithetic and the strategy these devs are gathering is successful its ain category. This is precisely wherefore it makes full consciousness that BlackRock is getting progressive successful bitcoin and different cryptos.

Miners are the commercialized infrastructure of Bitcoin. Without them, transactions couldn’t hap and caller bitcoin couldn’t beryllium issued. However, miners aren’t the ones facilitating the bid books that springiness it a terms successful dollars, ether, dogecoin oregon whatever. That’s the occupation of exchanges, traders and marketplace makers. Some whitethorn spot miners arsenic analogous to the U.S. Federal Reserve and Treasury Department, minting currency for circulation into the economy. However, miners are besides likened to Visa due to the fact that they alteration transaction settlement. But also, not really. The constituent is, Bitcoin doesn’t perfectly acceptable into immoderate container we person close now.

Ancillary businesses astir miners see the crypto exchanges that facilitate secondary marketplace trading betwixt crypto assets. Exchanges are important – they are among the astir valuable companies successful the abstraction – successful that they springiness comparative worth to bitcoin and by extension, the multitudes of alternate crypto assets that were inspired by it.

In its relation arsenic an plus manager, BlackRock counts itself arsenic 1 of the astir important parties successful facilitating the authorities securities trading that gives U.S. monetary argumentation teeth. This is simply a vaunted presumption successful the planetary system not to beryllium taken lightly. That said, beyond helping determination fiscal instruments arsenic needed for the Fed, BlackRock takes portion successful different ancillary businesses wherever it tin marque money, specified arsenic buying and selling equities, commodities and existent property connected behalf of those businesses oregon its investors.

But BlackRock is inactive conscionable that: an ancillary concern astir the Fed and the economical machine. An ancillary concern with a full batch of superior (and single-family homes). In all, crypto simply represents a caller plus people that BlackRock hasn’t had the pleasance of making wealth successful yet. That’s wherefore it looks to beryllium extending beyond bitcoin. BlackRock doesn’t request crypto, yet, but it definite won’t wounded it to get progressive now.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)