BlackRock, the world’s largest plus manager with much than $9 trillion successful assets nether management, has sent ripples done the cryptocurrency marketplace with its caller filing for a Bitcoin Exchange-Traded Fund (ETF). Despite being location to immoderate of the largest cryptocurrency exchanges, the United States does not person immoderate ETFs tracking Bitcoin’s spot terms owed to regulatory constraints.

An ETF is simply a handbasket of securities—such arsenic stocks—that tracks an underlying index. In the lawsuit of a Bitcoin ETF, it would beryllium designed to way the spot terms of Bitcoin. This provides a important vantage to investors arsenic it allows them to summation vulnerability to the terms of Bitcoin without worrying astir the challenges of buying and storing the cryptocurrency themselves. Like different ETFs, the Bitcoin ETF could beryllium bought and sold connected accepted banal exchanges.

The anticipation of an manufacture titan similar BlackRock launching a Bitcoin ETF has sparked a renewed question of Bitcoin accumulation wrong the U.S., arsenic evidenced by on-chain information from Glassnode.

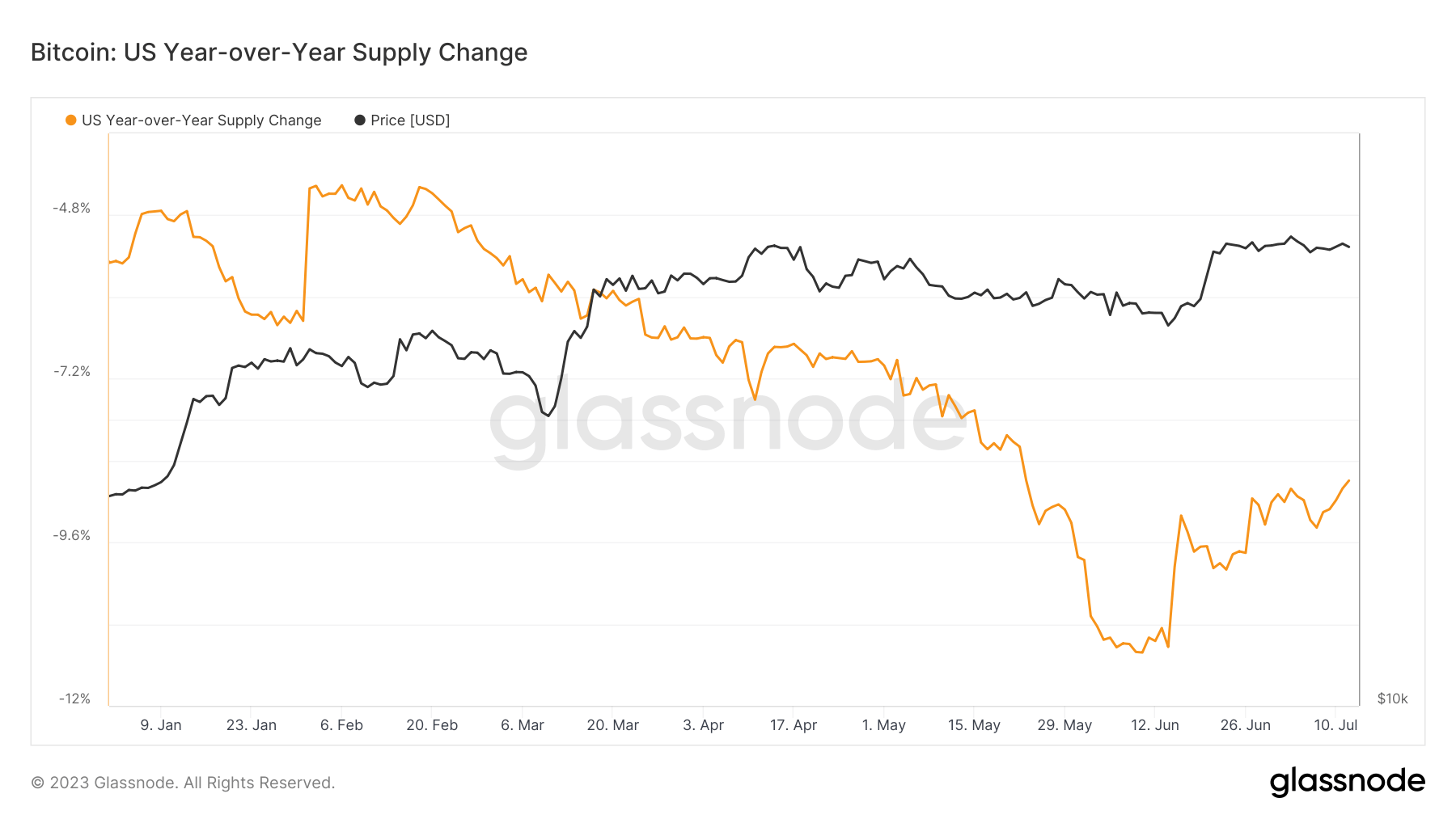

Glassnode’s information reveals an summation successful the equilibrium of Bitcoin held by U.S. entities since the commencement of this month, contempt a downward inclination observed year-on-year. Notably, the initiation of this surge appears to align with the announcement of BlackRock’s Bitcoin ETF filing.

Graph showing the YoY Bitcoin proviso alteration successful the U.S. successful 2023 (Source: Glassnode)

Graph showing the YoY Bitcoin proviso alteration successful the U.S. successful 2023 (Source: Glassnode)To find the geographical determination of Bitcoin entities, Glassnode compares transaction timestamps with the moving hours of antithetic geographical regions. Through this method, they tin find the astir apt determination of an entity, which provides a broader knowing of determination Bitcoin proviso dynamics.

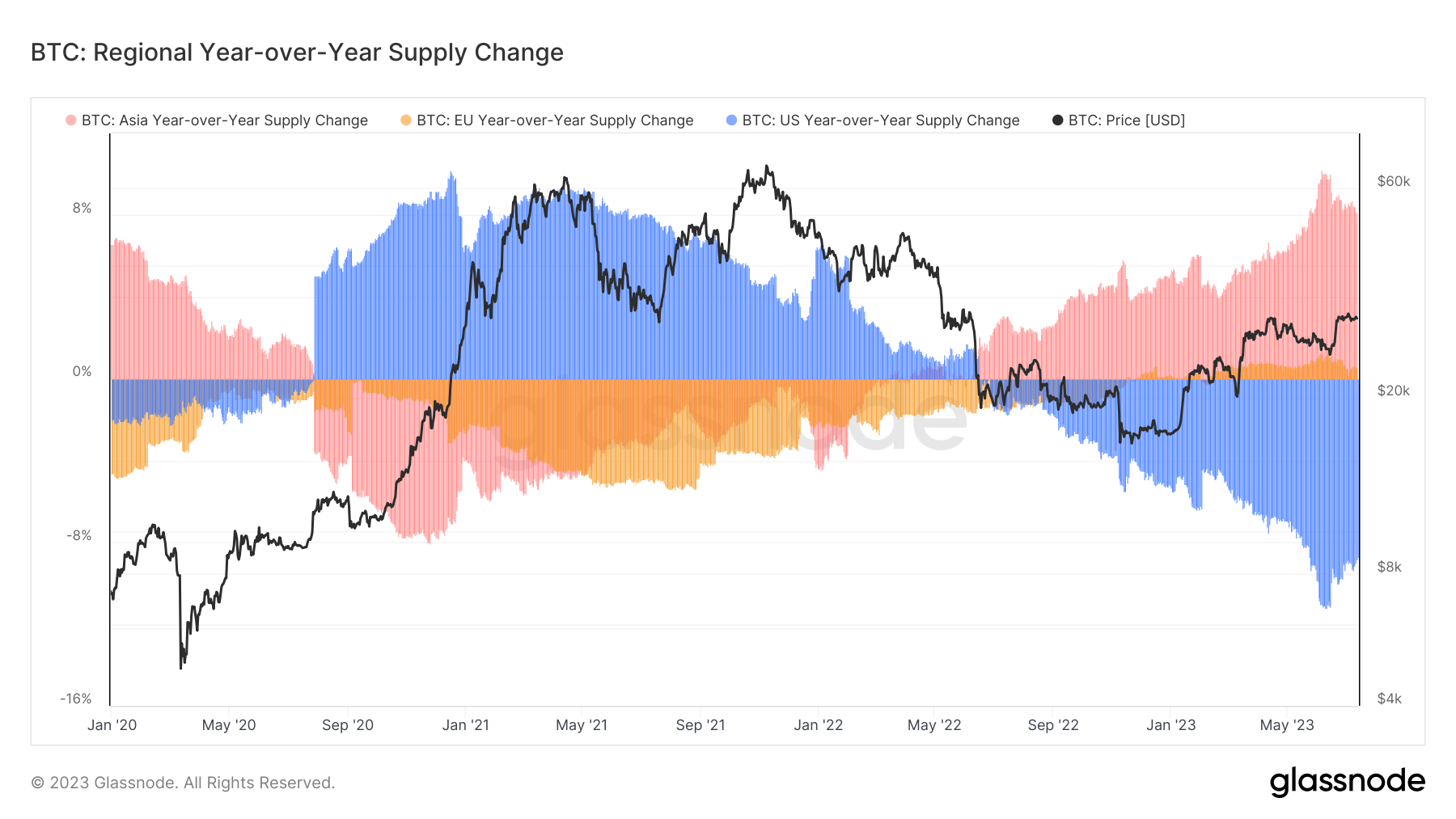

Graph showing the YoY alteration successful Bitcoin proviso successful Asia, the E.U., and the U.S. from January 2020 to July 2023 (Source: Glassnode)

Graph showing the YoY alteration successful Bitcoin proviso successful Asia, the E.U., and the U.S. from January 2020 to July 2023 (Source: Glassnode)The revival of Bitcoin accumulation successful the U.S. could awesome a pivotal displacement for the cryptocurrency market, considering the extended power of the U.S. marketplace connected Bitcoin’s price. Glassnode uses 2 models to cipher this influence: 1 examines cumulative terms show during trading hours successful the EU, U.S., and Asia; the different compares cumulative show by portion against the aggregate total. According to these models, the U.S. exerts a determination marketplace power of 139.2%, a disproportionately precocious fig that underscores the salient relation of the U.S. successful planetary Bitcoin trading.

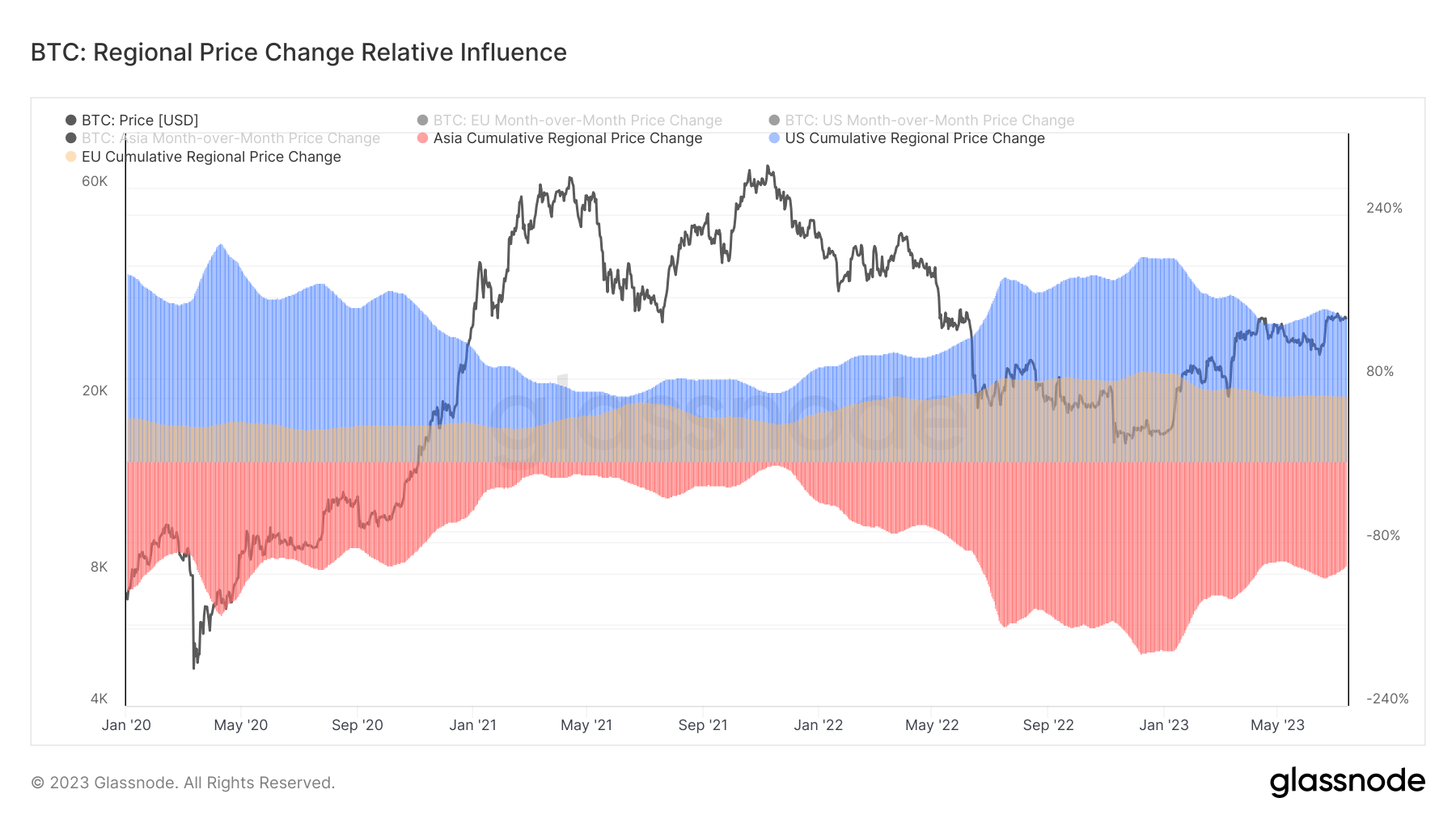

Graph showing the comparative determination power connected Bitcoin’s terms alteration from January 2020 to July 2023 (Source: Glassnode)

Graph showing the comparative determination power connected Bitcoin’s terms alteration from January 2020 to July 2023 (Source: Glassnode)The value of BlackRock’s Bitcoin ETF filing goes beyond conscionable terms dynamics. While a Bitcoin ETF, peculiarly 1 launched by a fiscal behemoth similar BlackRock, could perchance usher successful a caller epoch of institutional and retail concern successful Bitcoin, perchance creating higher marketplace liquidity, it’s besides important to see imaginable regulatory challenges and risks associated with broader cryptocurrency adoption.

The station BlackRock’s Bitcoin ETF filing fuels U.S. accumulation appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)