BlackRock’s Bitcoin ETF has present posted 19 days of consecutive inflows, the longest inflow streak for the world's plus manager this year.

BlackRock’s spot Bitcoin ETF (IBIT) capped disconnected the trading week with different time of inflows, pulling successful $356.2 cardinal connected May 9. The money has present extended its inflow streak to 19 consecutive days — its longest tally of inflows truthful acold this year.

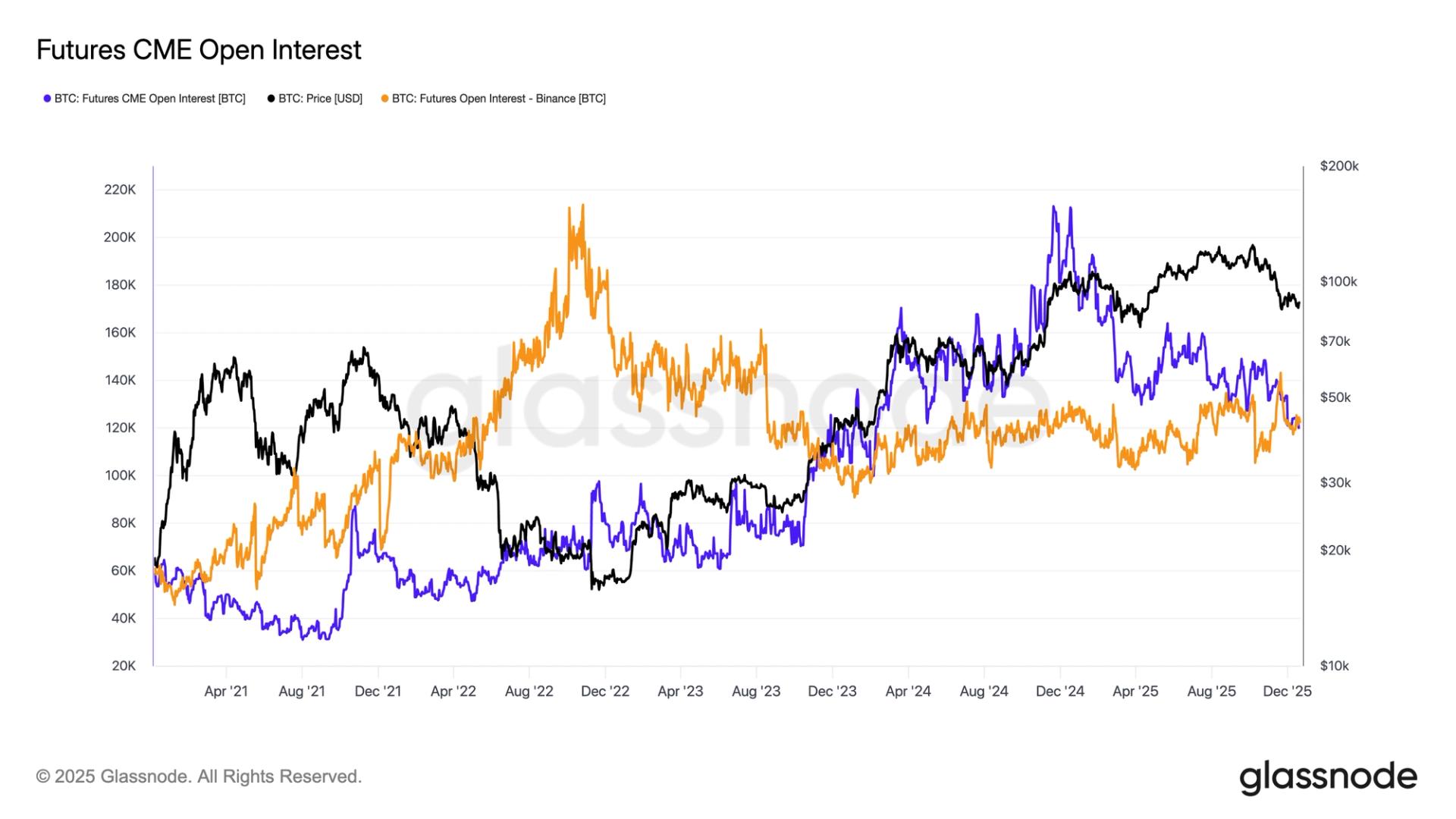

IBIT’s inflow streak has been ongoing since April 14, and has coincided with a volatile Bitcoin (BTC) market, with the plus trading betwixt $83,152 and $103,000 implicit the period. However, marketplace sentiment has been expanding aft the plus reclaimed and held supra the $90,000 terms connected April 23 earlier reclaiming the $100,000 terms connected May 8 for the archetypal clip since Feb. 1.

Bitcoin ETFs ticking on arsenic Bitcoin terms spikes

Over the past trading week alone, IBIT posted $1.03 cardinal successful inflows, according to Farside data.

Prior to the existent 19-day streak, IBIT’s longest inflow streak successful 2025 was a nine-day agelong surrounding US President Donald Trump’s inauguration connected Jan. 20, spanning from Jan. 15 to Jan. 28.

IBIT’s longest inflow streak since the spot Bitcoin ETFs launched successful January 2024 lasted 104 days, stretching from the motorboat day done April 23, 2024.

The streak coincided with Bitcoin reaching a caller all-time precocious of $73,679 successful March earlier pulling backmost into the mid-$60,000 range.

BlackRock’s Bitcoin ETF precocious won an award

On April 23, BlackRock’s spot Bitcoin ETF was named the “Best New ETF” astatine the yearly etf.com ETF awards. In an X station soon after, Bloomberg ETF expert Eric Balchunas said it “feels close to me.”

Related: Institutional investors proceed to scoop up Bitcoin supra $100K

Bitwise’s caput of European research, André Dragosch, precocious said Bitcoin’s expanding institutional adoption whitethorn provide the “structural” inflows indispensable to surpass gold’s marketplace capitalization and propulsion its terms beyond $1 cardinal by 2029.

“Our in-house prediction is $1 cardinal by 2029. So that Bitcoin volition lucifer gold's marketplace headdress and full addressable marketplace by 2029,” helium told Cointelegraph during the Chain Reaction regular X spaces show on April 30.

7 months ago

7 months ago

English (US)

English (US)