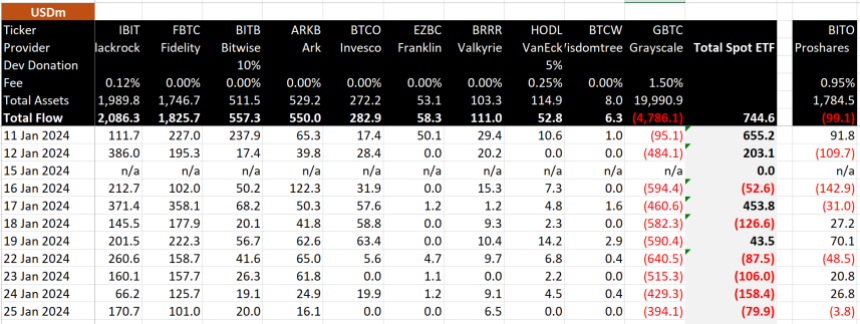

According to data from BitMEX Research, BlackRock’s Bitcoin spot ETF – IBIT – has present acceptable a caller record, achieving a full nett inflow of $2 billion. This feat allows IBIT to support its presumption arsenic the best-performing money of the bunch, pursuing the approval of 11 Bitcoin spot ETFs by the US Securities and Exchange Commission connected January 10.

BlackRock’s IBIT Maintains Dominance As Total Net Flows Reach $744.6 Million

On January 25, which marked the tenth trading time of the Bitcoin spot ETF market, BlackRock’s IBIT produced an unsurprising affirmative performance, notching $170.7 cardinal successful inflows. This summation allowed the concern money to determination into an exclusive database arsenic the archetypal Bitcoin spot ETF to amass $2 cardinal successful marketplace cap.

Commenting connected this feat, Bloomberg expert James Seyfarrt has credited the caller emergence successful BTC’s terms arsenic a large contributing factor. He said:

Yes, the #Bitcoin terms has pushed $IBIT‘s assets beyond $2 billion. This positive apt caller flows contiguous should mean it volition beryllium supra $2 cardinal astatine close.

Following the trading debut of BTC spot ETFs connected January 11, IBIT rapidly emerged arsenic an investor’s favorite, signaling the highest idiosyncratic regular inflows of the marketplace astatine $386 cardinal connected January 12. BlackRock’s BTC spot ETF has managed to clasp this investors’ attraction implicit the archetypal 2 trading weeks, evidenced by its accordant affirmative performances, which has culminated successful a full travel of $2.086 billion.

IBIT’s show is intimately followed by Fidelity’s FBTC, which recorded $101 cardinal successful inflows connected January 25, moving its full flows to $1.825 billion. Meanwhile, different Bitcoin spot ETFs with notable performances see Bitwise’s BITB and Ark Invest’s ARKB, some of which boast idiosyncratic cumulative AUMs of implicit fractional a cardinal dollars.

In different news, the outflows successful Grayscale’s GBTC stay a changeless trend; however, determination has been a notable diminution successful selling measurement implicit the past fewer days. At the clip of writing, GBTC’s full outflow is valued astatine $4.786 billion. In examination with a cumulative inflow of $5.53 billion, full flows successful the Bitcoin spot ETF marketplace basal astatine $744.6 million.

Source: BitMEX

Source: BitMEX

Bitcoin Price Overview

At property time, Bitcoin is presently trading astatine $41,725.19 pursuing a 4.52% terms summation successful the past day, according to data from CoinMarketCap. This caller uptick is rather significant, considering the asset’s erstwhile bearish form, marked by a 20% diminution implicit the past 2 weeks which resulted successful BTC’s dipping beneath $39,000.

Bitcoin’s terms has been negatively affected by GBTC’s monolithic outflows; however, arsenic the selling unit appears to beryllium decreasing, coupled with accordant affirmative performances of different ETFs, notably BlackRock’s IBIT, that crypto marketplace person could soon propulsion disconnected a marketplace recovery.

Featured representation from Reuters, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)