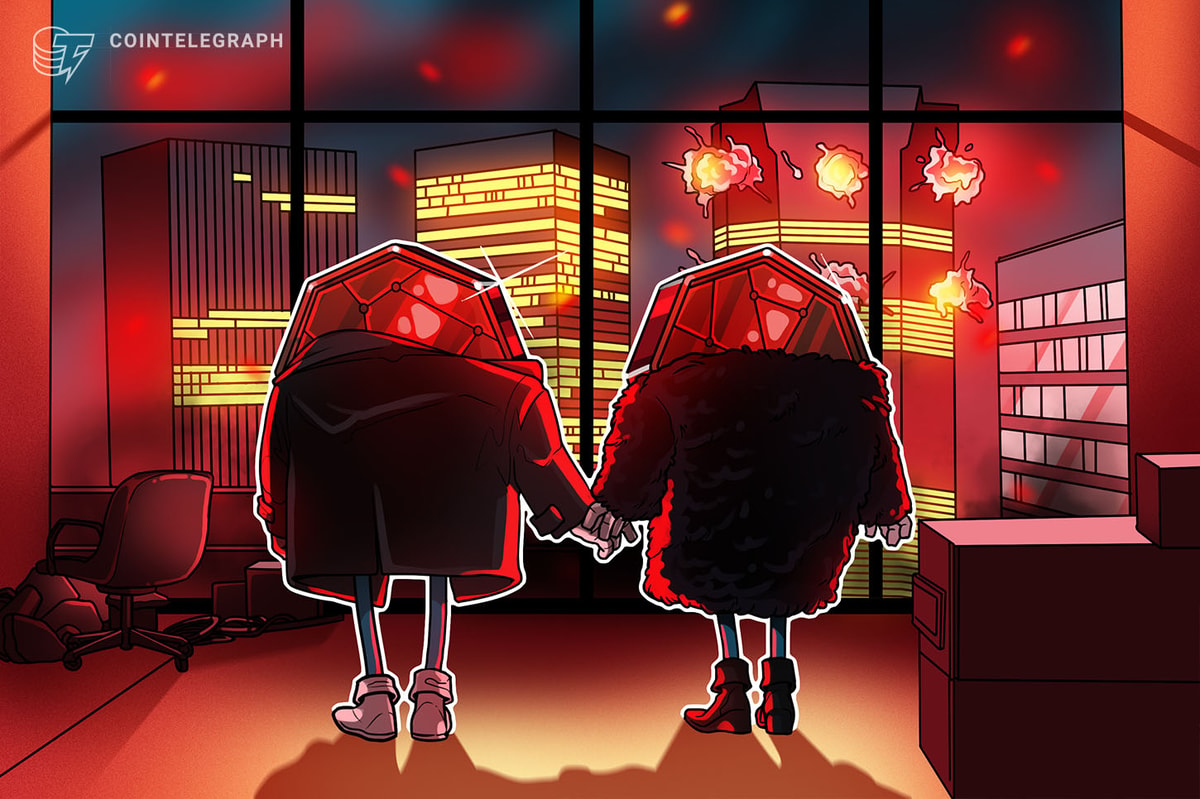

At slightest 2 concern firms person made caller filings for spot Bitcoin exchange-traded funds (ETF) pursuing concern colossus BlackRock’s determination to lodge a akin exertion for its ain spot Bitcoin ETF connected June 15.

New York-based plus absorption money WisdomTree is the astir caller concern steadfast to lodge a caller filing for a spot Bitcoin ETF.

According to a June 21 filing to the United States Securities and Exchange Commission (SEC), WisdomTree requested that the SEC let it to database its “WisdomTree Bitcoin Trust” connected the Cboe BZX Exchange nether the ticker “BTCW.”

WisdomTree has filed for spot bitcoin ETF h/t @NateGeraci pic.twitter.com/JwXj8rTs2X

— Eric Balchunas (@EricBalchunas) June 20, 2023WisdomTree has applied for a spot Bitcoin ETF doubly before. Its archetypal application was rejected by the SEC successful December 2021. It's 2nd exertion was rejected erstwhile again successful October 2022, with the fiscal regulator citing akin concerns of fraud and marketplace manipulation. At the clip of publication, WisdomTree oversees astir $83 cardinal successful assets.

One of the cardinal differences with BlackRock’s caller filing to the SEC is that it intends to participate into a “surveillance sharing agreement” with the Chicago Mercantile Exchange (CME) futures markets.

BlackRock’s connection cites the SEC’s support of a Bitcoin futures money by concern advisory steadfast Teucrium. That ruling noted that the CME “comprehensively surveils futures marketplace conditions and terms movements connected a existent clip and ongoing ground successful bid to observe and forestall terms distortions, including terms distortions caused by manipulative efforts.”

This has been echoed successful WisdomTree’s filing arsenic well, which states that it excessively is consenting to participate into specified a surveillance statement with “an relation of a US-based spot trading level for Bitcoin.”

Less than 4 hours aft WisdomTree filed its application, planetary concern manager Invesco “reactivated” its exertion for a akin product.

And present Invesco has reactivated their 19b-4 for their spot ETF https://t.co/D2zTpqrqJH

— Eric Balchunas (@EricBalchunas) June 20, 2023According to the 19b-4 document — which informs the SEC of a projected regularisation alteration — Invesco requested that the fiscal regulator let its “Invesco Galaxy Bitcoin ETF” merchandise to beryllium listed connected the Cboe BZX exchange.

The filing notes that a spot Bitcoin ETF which uses “professional custodians and different work providers,” removes the request for investors to trust connected “loosely regulated offshore vehicles” successful turn, allowing for investors to much readily “protect their main investments successful Bitcoin.”

While the SEC is yet to o.k. a azygous spot Bitcoin ETF product, Bloomberg’s elder ETF expert Eric Balchunas said that “BlackRock breathed caller beingness into the race,” successful effect to his ain tweet concerning the WisdomTree filing.

Fun fact: BlackRock's grounds of getting ETFs approved by the SEC is 575-1. That's different crushed this is truthful big, they don't play around. https://t.co/f7YIhGRmLf

— Eric Balchunas (@EricBalchunas) June 16, 2023Additionally, Balchunas said that crypto investors whitethorn person bully crushed to beryllium optimistic erstwhile it comes to BlackRock’s move, sharing that the concern steadfast has a “575-1” grounds of getting ETFs approved by the regulator.

Related: BlackRock’s Bitcoin ETF ‘is the champion happening to happen’ to BTC, oregon is it?

In summation to the caller enactment from WisdomTree and Invesco, rumors person begun circulating that the multi-trillion-dollar money manager Fidelity Investments is besides looking to capitalize connected the newfound frenzy for spot Bitcoin ETFs.

Related: BlackRock’s Bitcoin ETF ‘is the champion happening to happen’ to BTC, oregon is it?

According to a June 19 tweet from Arch Public co-founder @AP_Abacus, Fidelity Investment, which manages immoderate $4.9 trillion successful assets — whitethorn look to record for its ain spot Bitcoin ETF. Alternatively Abacus notes that the concern steadfast could marque an connection connected Grasyscale’s GBTC ETF product.

Cointelegraph reached retired to Fidelity for confirmation but did not person an contiguous response.

Magazine: Bitcoin is connected a collision people with ‘Net Zero’ promises

2 years ago

2 years ago

English (US)

English (US)