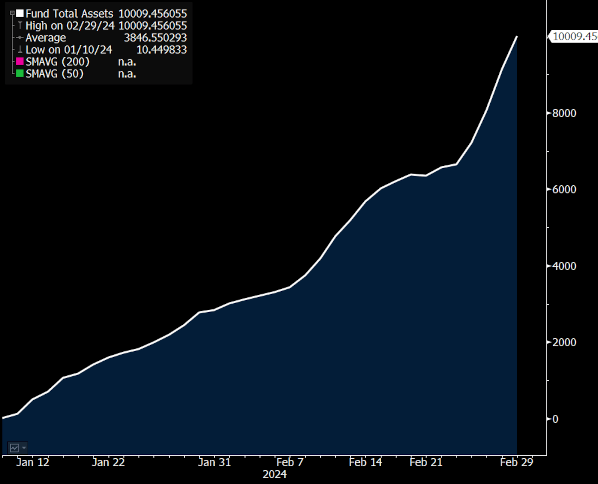

BlackRock’s iShares Bitcoin Trust (IBIT) present has much than $10 cardinal successful assets nether absorption (AUM), according to information from CoinGlass.

Bloomberg ETF expert Eric Balchunas noted that IBIT is 1 of conscionable 152 exchange-traded funds (ETFs) that person reached the $10 cardinal mark. Currently, astir 3,400 ETFs beryllium successful total.

He observed that IBIT is the fastest to scope $10 cardinal successful AUM. The money began trading little than 2 months agone connected Jan. 11, meaning that it reached its existent level successful little than 2 months. ETF.com separately noted that the archetypal golden ETF did not scope $10 cardinal successful AUM for 2 years.

IBIT AUM growth, via Eric Balchunas/Bloomberg

IBIT AUM growth, via Eric Balchunas/BloombergThe competing Grayscale Bitcoin Trust (GBTC) reports a larger AUM, with $27 cardinal successful assets nether management. However, GBTC originated arsenic an concern money successful 2013 earlier it was converted to an ETF this year, and dissimilar BlackRock’s IBIT, it did not commencement with zero assets.

The 3rd largest spot Bitcoin ETF, the Fidelity Wise Origin Bitcoin Fund (FBTC), present holds $6.5 cardinal successful assets nether management. All 10 existing spot Bitcoin ETFs person $48.2 cardinal successful AUM combined.

Reasons for IBIT’s growth

Balchunas implied that IBIT’s rising AUM is owed to inflows. He suggested that ETFs typically conflict to execute the archetypal $10 cardinal successful AUM due to the fact that that worth indispensable originate from inflows, whereas the 2nd $10 cardinal is easier to execute due to the fact that of marketplace appreciation.

IBIT surpassed the $10 cardinal people connected March 1. Around that time, the ETF reported $7.7 cardinal successful inflows since launch, including $603 cardinal successful inflows connected Feb. 29. According to Balchunas, this makes IBIT the ETF with the third-longest tally of inflows.

Rising Bitcoin prices whitethorn beryllium an further contributor to IBIT’s growth. As of March 4, Bitcoin is worthy $67,200. Its terms is up 25.3% implicit the past week and up 51.0% implicit 2 months.

Furthermore, certain fiscal institutions, including Bank of America’s Merrill Lynch and Wells Fargo, person reportedly begun to connection entree to BlackRock’s Bitcoin ETF and competing exchange-traded funds. This improvement whitethorn person contributed to caller growth.

The station BlackRock’s spot Bitcoin ETF surpasses $10B successful AUM, faster than immoderate different to date appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)