BlackRock has reportedly bought a staggering 11,500 Bitcoin from the disposable proviso during the latest dip since the motorboat of its spot Bitcoin ETF.

This magnitude is significant, considering that lone 900 BTC are issued daily. The acquisition by BlackRock efficaciously represents astir 13 days’ worthy of Bitcoin accumulation being absorbed by a azygous player.

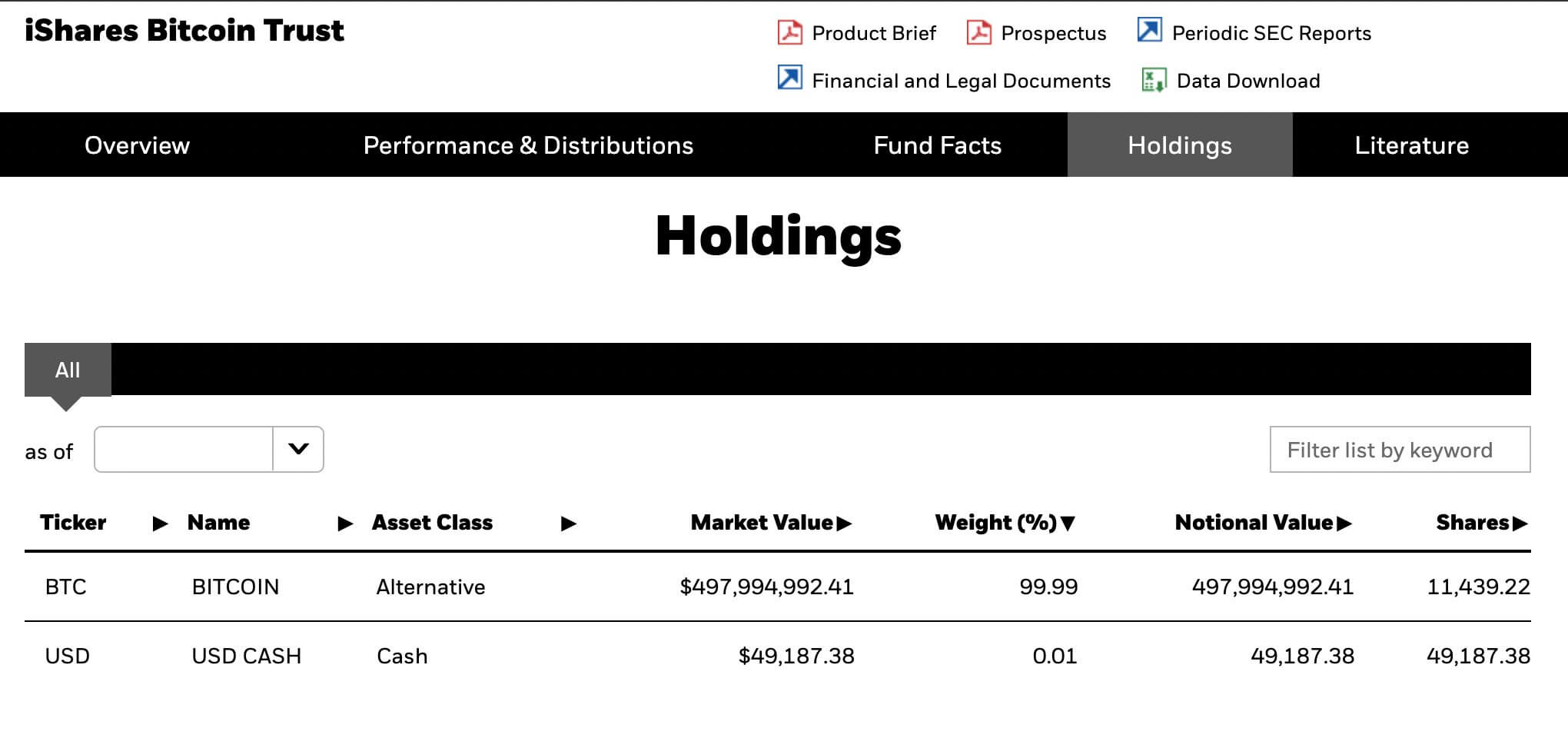

Blackrock Bitcoin ETF Holdings (Source)

Blackrock Bitcoin ETF Holdings (Source)The plus manager’s CEO, Larry Fink, precocious said his views connected Bitcoin person evolved importantly implicit the years, and helium present sees it arsenic a “viable plus class.”

Supply crunch

Based connected data, the iShares Bitcoin Trust (IBIT) Spot ETF managed lone astir 25% of the trading measurement implicit the aforesaid two-day period. From this, 1 could infer that astir 46,000 BTC were removed from the strategy implicit the past 2 days, with influences from different players similar Grayscale Bitcoin Trust (GBTC).

If this inclination continues, the Bitcoin marketplace could look a terrible proviso crunch. With an estimated 46,000 BTC being absorbed successful 2 days, which equates to 23,000 BTC per day, this complaint is astir 25.5x the regular accumulation of Bitcoin.

The important uptake by U.S. ETFs, not to notation the further request from retail investors and different planetary ETFs, suggests a tightening of disposable Bitcoin supply.

Despite the fluctuations successful Bitcoin’s price, the underlying plus remains resilient. Despite the precocious fees associated with GBTC, the palmy motorboat of the Bitcoin ETF is simply a beardown denotation of increasing organization interest. It could herald a caller epoch of scarcity successful the Bitcoin market.

ETF inflows deed $819M

The archetypal 2 trading sessions pursuing the support of caller Bitcoin exchange-traded funds (ETFs) experienced important inflows totaling $1.4 billion. After accounting for outflows from GBTC, the nett full inflows crossed each Bitcoin-related products amounted to $819 million.

A breakdown of this enactment shows a singular measurement of 500,000 idiosyncratic trades, contributing to a full trading measurement of $3.6 billion. BlackRock’s iShares Bitcoin Trust (IBIT) led the battalion successful this archetypal surge, which garnered $497.7 cardinal successful full flows.

The Fidelity Advantage Bitcoin ETF (FBTC) was adjacent behind, amassing $422.3 million. Bitwise (BITB) besides importantly impacted, attracting $237.90 cardinal successful investments.

In contrast, the Grayscale Bitcoin Trust (GBTC), a pre-existing product, saw an outflow of $579 cardinal during the aforesaid period. This displacement is partially attributed to investors opting for the caller Bitcoin ETFs offering lower fees.

This inclination aligns with earlier forecasts by ETF analysts, who anticipated that Bitcoin ETFs could pull astir $10 cardinal successful their archetypal twelvemonth of operation. It’s worthy noting that GBTC is 1 of the largest holders of Bitcoin, managing implicit $27 billion.

The station BlackRock scoops up 11,500 BTC during dip arsenic ETF leads the pack appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)