What to Know:

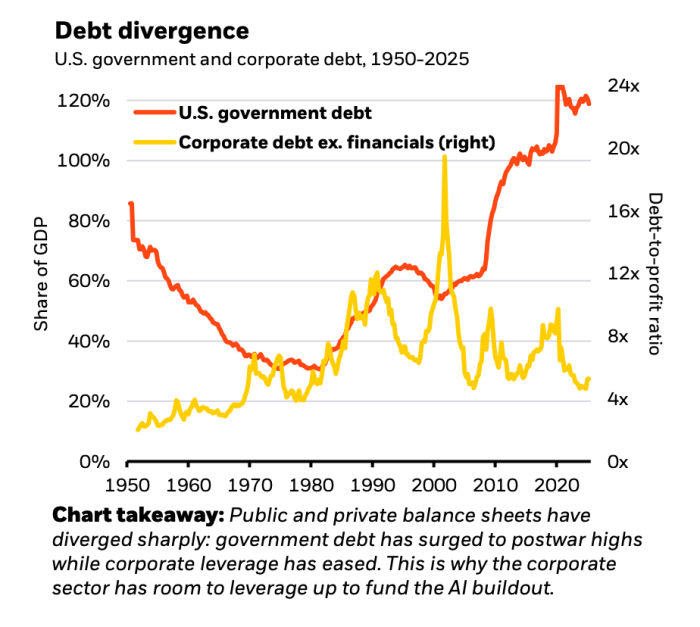

- Rising U.S. indebtedness and dense Treasury issuance are sidesplitting the charm of long-duration bonds, truthful institutions are looking toward Bitcoin and different integer assets arsenic hedges.

- As Bitcoin adoption grows, request is shifting distant from elemental terms bets toward existent infrastructure for accelerated payments, DeFi, NFTs, and gaming.

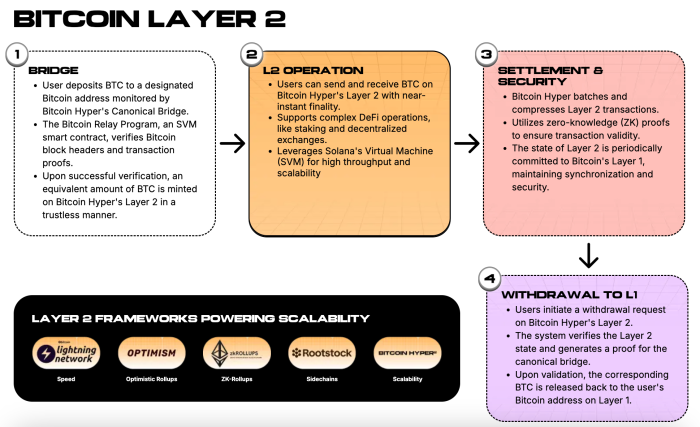

- Bitcoin Hyper ($HYPER) introduces a Bitcoin-anchored Layer 2 that uses the Solana Virtual Machine to hole Bitcoin’s dilatory transactions, precocious fees, and deficiency of astute contracts.

- Competition among Bitcoin Layer 2 networks volition vigor up arsenic macro pressures and organization inflows reward projects that premix Bitcoin’s spot with existent performance.

Surging US indebtedness and sticky deficits are nary longer a quiescent inheritance issue. They are starting to consciousness similar the full plot.

BlackRock’s caller AI-driven research makes it clear: nonstop Treasury issuance and rising involvement costs enactment unit connected semipermanent bonds.

When the conception of a risk-free plus starts wobbling, investors statesman asking the classical question: wherever bash we crook next?

Bitcoin keeps showing up successful those conversations. After the spot ETF wave, $BTC turned into a boardroom-friendly hedge.

If US indebtedness continues to climb, a supply-capped and rules-based plus starts looking beauteous good. That is the wide thought BlackRock is pointing toward.

Source: 2026 Investment Outlook by BlackRock

Source: 2026 Investment Outlook by BlackRockBut erstwhile institutions hold Bitcoin belongs successful the hedge bucket, the adjacent question hits fast: however bash you really usage $BTC wrong today’s high-speed markets?

On-chain Bitcoin is slow, artifact abstraction is tight, and fees tin spike into tens of dollars erstwhile the web gets busy. Great for acold storage. Not large for thing that needs to determination quickly.

It markets itself arsenic a high-performance Bitcoin Layer 2 built connected the Solana Virtual Machine (SVM), offering sub-second colony and astute contracts portion anchoring its information to Bitcoin.

If BlackRock’s macro outlook drives much superior into $BTC, Bitcoin Hyper aims to beryllium the level wherever that superior really generates results. Think payments, DeFi, gaming, NFTs, and more.

Why Debt Risks And Institutional Flows Favor High-Throughput Bitcoin Infrastructure

If the U.S. is heading toward chronic deficits, higher rates, and nonstop Treasury issuance, past long-duration bonds halt looking similar a harmless parking spot and commencement acting similar a accent test.

That is wherefore ample plus managers speech astir needing caller hedges. Bitcoin fits that role, arsenic bash golden and tokenized assets backed by existent collateral.

As institutions adhd Bitcoin exposure, the unit builds to marque $BTC usable, not conscionable thing you fastener successful a vault.

Lightning facilitates payments, but it does not enactment analyzable astute contracts oregon high-performance DeFi applications.

Ethereum rollups and Solana lick those problems, but they are not secured by Bitcoin, which matters to investors who privation their hedge and their infrastructure to beryllium based connected the aforesaid monetary foundation.

That is wherefore the contention among Bitcoin-aligned Layer 2s and sidechains is speeding up. Stacks, Rootstock, and others are trying to propulsion programmability person to Bitcoin, each making antithetic trade-offs.

Bitcoin Hyper is 1 of the new crypto projects taking a much ambitious approach: alternatively of gathering a caller system, it uses the Solana VM and anchors it to Bitcoin. It is similar taking a sports car motor and dropping it into a motortruck known for reliability.

Inside Bitcoin Hyper’s SVM Layer 2 And The Ongoing Presale

Bitcoin Hyper ($HYPER) focuses heavy connected speed.

The plan is modular: Bitcoin Layer 1 handles colony and information availability, portion an SVM-powered Layer 2 handles execution. Developers tin usage Rust and Solana-style tools, but the concatenation yet settles backmost to $BTC alternatively of $SOL.

The extremity is simple: propulsion beyond Solana speeds portion inheriting Bitcoin’s spot and marque power.

Bitcoin Hyper presently relies connected a azygous trusted sequencer. It batches transactions and anchors its authorities to the Bitcoin blockchain.

This setup allows highly low-latency confirmations, which works good for order-book DEXs, gaming loops, and NFT mints.

Fees purpose to enactment astatine fractions of a cent, not the accustomed on-chain $BTC spikes. A decentralized canonical span moves $BTC into wrapped assets for accelerated swaps, payments, lending, and staking.

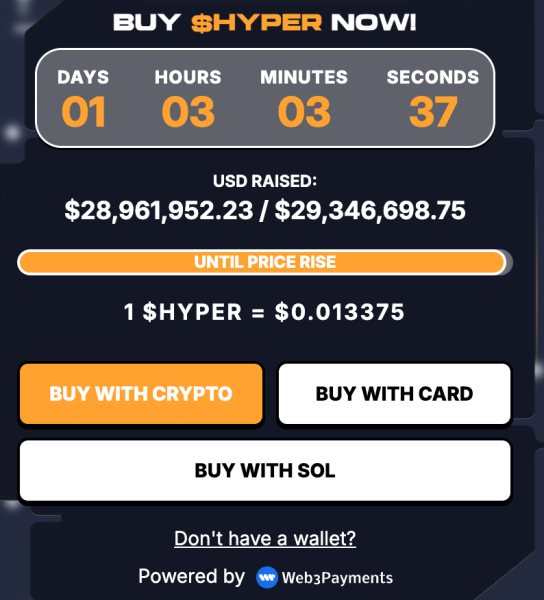

The presale is already large. Bitcoin Hyper has raised implicit $28.9M and you tin buy $HYPER present for conscionable $0.013375.

For Bitcoin holders and DeFi users, the transportation is straightforward. If organization wealth continues to travel into $BTC owed to macroeconomic risks, the adjacent signifier of the commercialized whitethorn manifest successful the infrastructure that makes Bitcoin really useful.

Bitcoin Hyper wants to beryllium that high-throughput SVM Layer 2 built for payments, gaming, and composable DeFi.

This nonfiction is for informational purposes lone and doesn’t connection financial, investment, oregon trading advice. Always bash your ain probe (DYOR) earlier investing successful crypto.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/blackrock-warns-on-us-debt-bitcoin-hyper-presale-accelerates

2 months ago

2 months ago

English (US)

English (US)