In Bloomberg Intelligence’s latest report, bitcoin is separating itself from hazard assets with expanding HODL behaviour and humanities patterns suggest a mild down-turn.

In Bloomberg Intelligence’s latest report, bitcoin is separating itself from hazard assets with expanding HODL behaviour and humanities patterns suggest a mild down-turn.

- Bloomberg Intelligence discussed bitcoin and different cryptocurrencies arsenic it relates to adoption, markets and defining plus classes.

- The study explains however bitcoin is separating itself from modular risk-assets and becoming a risk-off asset.

- Bloomberg Intelligence also discusses humanities patterns of Federal Reserve argumentation arsenic it relates to bitcoin and bear-markets, offering imaginable outlooks.

The latest Bloomberg Intelligence report for May discusses the adoption of bitcoin and different cryptocurrencies, markets, and the unprecedented advances of monetary technology.

The study stated that Bloomberg Intelligence's key takeaway from the Bitcoin 2022 league successful Miami was that “what’s happening to beforehand wealth and concern into the 21st period is unstoppable.”

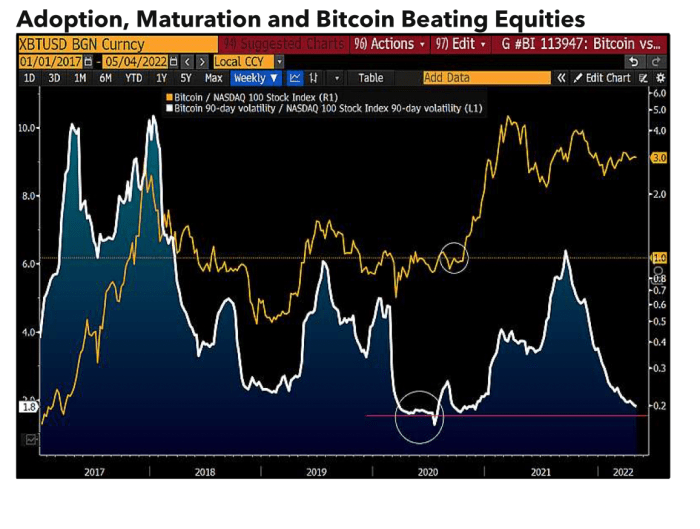

Early successful the report, Bloomberg Intelligence notes organization engagement and declining volatility successful bitcoin versus accepted hazard assets seems to amusement a wide divergence successful favour of bitcoin, allowing investors to abstracted from the communal pitfalls of accepted assets. Bloomberg Intelligence states “our presumption is not to subordinate ‘the inclination is your friend’ mantra”, explaining that investors who take not to astatine slightest partially-allocate whitethorn endure the worst.

The study further illustrates bitcoin’s divergence arsenic a modular risk-asset by comparing it to the year-to-date (YTD) numbers to May 3 for the Nasdaq 100 Stock Index. To that point. The Nasdaq 100 suffered a -20% downturn, portion bitcoin lone dipped -15%. Bloomberg Intelligence contends this to correspond bitcoin becoming a risk-off asset.

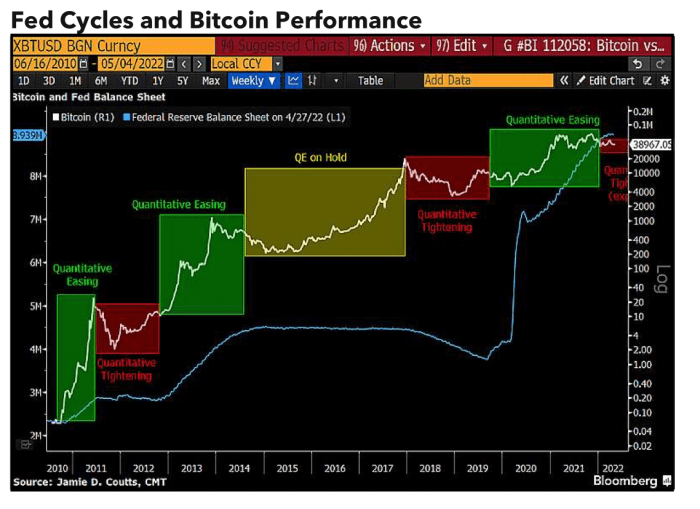

The separation from accepted assets becomes ever much important arsenic contiguous the satellite awaits the latest Federal Open Market Committee (FOMC) meeting. As the Federal Reserve continues with quantitative tightening, Bloomberg Intelligence notes that bitcoin is well-positioned to overtake a broader marketplace headdress against “potentially overextended equity prices.”

However, bitcoin seems to beryllium deviating from the cardinal banks argumentation decisions indicating a mild bear-market erstwhile compared to humanities bear-markets. As tin beryllium seen below, during past tightening phases, bitcoin rises. With holding, the plus stays level. For escaped easing practices, bitcoin historically rises.

While the study does authorities different expected leg-down arsenic the Federal Reserve has lone conscionable begun the tightening process, Bloomberg Intelligence points to “HODL behavior,” which shows much addresses and caller addresses alike are holding their bitcoin. This HODL mentality gives emergence to the anticipation of a overmuch milder down-turn than has antecedently been observed successful the look of antagonistic economical impacts from the Federal Reserve.

“We spot large imaginable for bitcoin to proceed doing what it has been doing for astir of its beingness – outperforming astir accepted plus classes,” the study said.

3 years ago

3 years ago

English (US)

English (US)