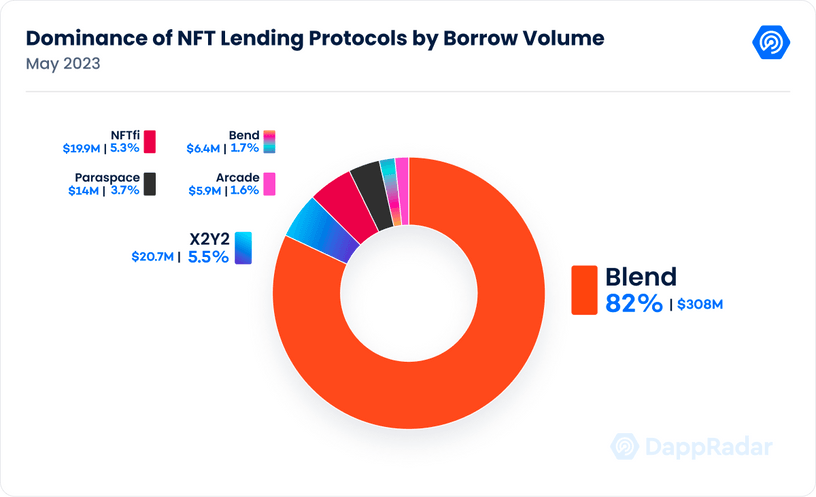

A caller survey by Dappradar discloses the May indebtedness volumes for non-fungible tokens (NFTs) reached a precocious of $375 million. The findings stress the important power of Blur wrong the NFT lending market, arsenic the NFT marketplace level constitutes 82% of the full worth settled successful the NFT lending sector.

Blur Emerges arsenic NFT Lending Giant, Capturing 82% of Market Share

Not agelong ago, Blur proclaimed its introduction into the NFT lending arena, and since then, it has logged $308 cardinal successful NFT indebtedness volume. This accusation stems from a May 25, 2023, study published by dappradar.com, indicating that 46.2% of the NFT marketplace’s transactions present impact indebtedness activities.

The dappradar.com study accentuates however Blur unveiled its lending initiatives connected May 1. On the aforesaid day, it registered 4,200 ether and has since escalated to 169,000 ether pursuing its inception. Dappradar’s expert notes that Blur’s play indebtedness measurement “outperformed different centralized platforms by astir 2.93 times.” Blur’s NFT indebtedness measurement equates to 82% of each NFT lending settlements passim the manufacture during a 22-day period.

Sara Gherghelas from Dappradar explains that portion Blur has monopolized NFT lending volumes crossed the sector, the trading measurement connected their level has diminished. “The trading measurement implicit the past 7 days was $104.35 million, a 15.93% diminution from the preceding week,” Gherghelas states. “This displacement suggests that Blur is presently being chiefly utilized for loans alternatively than trading. In fact, successful the past 7 days, astir fractional (46.20%) of Blur’s enactment originated from NFT loans, transacted by an mean of 306 unsocial regular users.”

The fluctuations successful commercialized measurement mightiness beryllium ascribed to Ethereum’s wide alteration successful NFT income implicit the past 30 days, sliding 26% little than past week. Conversely, Bitcoin-based NFTs person taken halfway stage, securing astir $175,084,024 successful NFT income implicit the erstwhile month, arsenic data from cryptoslam.io suggests. In spite of the surge successful Bitcoin-oriented NFT commercialized volume, 30-day income crossed 22 blockchains dipped 10.15% little than the preceding month’s figures.

What are your thoughts connected Blur’s dominance successful the NFT lending market? Share your opinions and insights successful the comments conception below.

English (US)

English (US)