Renowned fiscal expert John Bollinger has precocious issued a caution regarding the imaginable for a Bitcoin pullback. After BTC terms surged from beneath $66,000 to astir $72,000 astatine the opening of the week, Bollinger, the creator of the wide utilized Bollinger Bands indicator, pointed to circumstantial features successful the Bitcoin terms illustration that suggest a consolidation oregon pullback could beryllium imminent, though helium clarified that his position was not bearish connected a longer term.

The Bearish Argument By John Bollinger

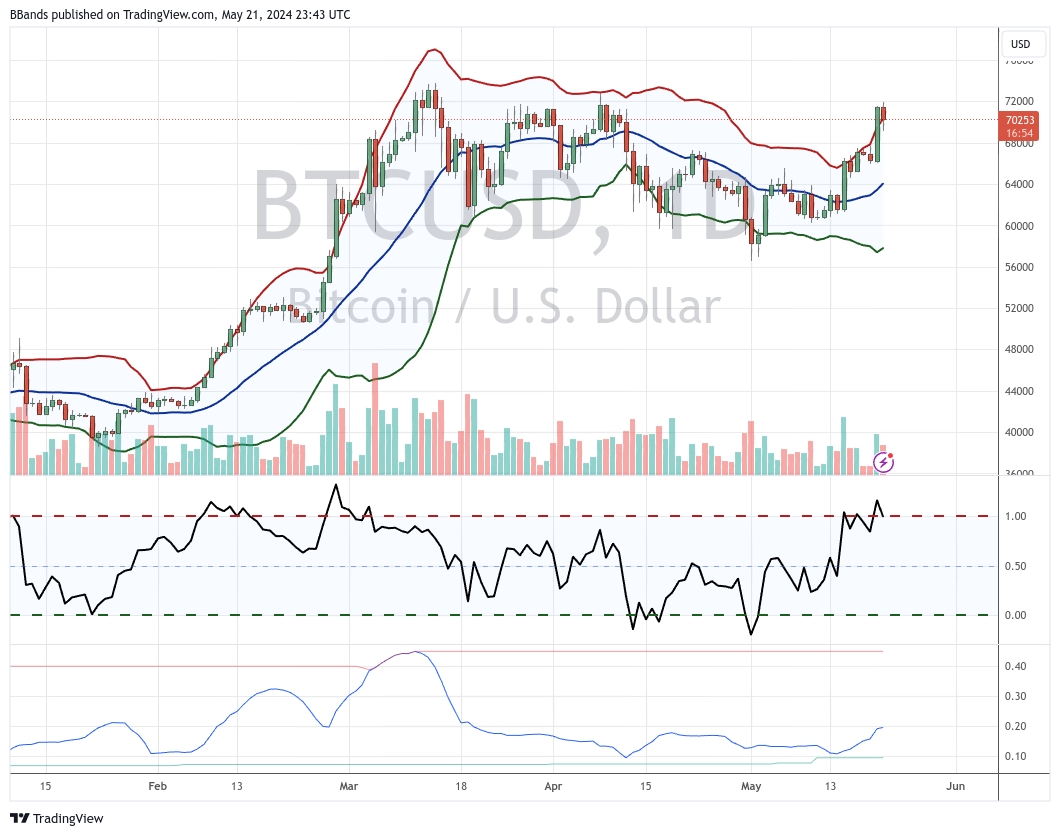

Bollinger’s analysis focuses connected the regular BTC/USD chart. His main interest centers astir a “two-bar reversal” signifier observed astatine the precocious Bollinger Band. This pattern, typically indicating a imaginable reversal successful terms direction, occurs erstwhile Bitcoin’s terms archetypal exceeds the precocious Bollinger Band but past closes wrong it during the adjacent trading period. Such movements tin connote that the upward momentum mightiness beryllium losing strength.

Bitcoin Bollinger Bands investigation | Source: X @bbands

Bitcoin Bollinger Bands investigation | Source: X @bbandsThe Bollinger Bands connected the illustration dwell of 3 lines: the little band, the mediate set (20-day elemental moving average), and the precocious band. These bands grow and declaration based connected terms volatility, with the precocious and little bands acceptable 2 modular deviations distant from the mediate band. The Bitcoin terms peaked astatine astir $71,977 connected Tuesday, momentarily pushing supra the precocious Bollinger Band earlier closing backmost wrong it, forming the noted reversal pattern.

Further investigation shows the 20-day moving average, the mediate Bollinger Band, which presently sits astatine astir $64,564 and acts arsenic a imaginable enactment level successful the lawsuit of a terms decline. Historical information from the illustration indicates important absorption adjacent the caller highs astir $71,500, portion enactment levels could beryllium seen astir the $64,500 mark, wherever the mediate Bollinger Band lies, and further astatine $58,300, coinciding with the little band.

The enlargement of the Bollinger Bands indicates accrued marketplace volatility, peculiarly arsenic the terms tests absorption levels. The Relative Strength Index (RSI) is presently conscionable astatine 63, which is not yet successful the overbought territory.

In his commentary, Bollinger has intelligibly stated that portion the setup is not fundamentally bearish, the observed method signifier warrants caution for short-term traders. He advises monitoring for either a consolidation period wherever the terms stabilizes, oregon a pullback wherever it retreats from caller highs. “I americium not fond of the two-bar reversal astatine the precocious Bollinger Band for BTCUSD. Suggests a consolidation oregon a pullback. Not bearish here, conscionable short-term concerned,” Bollinger remarked.

The Bullish Argument

On the contrary, renowned crypto analyst, Josh Olszewicz (@CarpeNoctom), shared a bullish outlook connected Bitcoin done a antithetic lens, focusing connected the Ichimoku Cloud indicator successful the regular chart. He highlighted a “Bullish TK Cross with Price Above Cloud” connected the regular Bitcoin chart.

This peculiar signifier is important wrong the realm of method analysis, particularly for those employing the Ichimoku Kinko Hyo indicator, a broad instrumentality that provides insights into marketplace momentum, inclination direction, and enactment and absorption levels.

The “Bullish TK Cross” Olszewicz refers to occurs erstwhile the Tenkan-sen enactment (a short-term moving average) crosses supra the Kijun-sen enactment (a medium-term moving average), indicating a imaginable uptrend. Typically, this crossover suggests that buying momentum is expanding and tin awesome the commencement of a bullish phase.

Bitcoin price, 1-day illustration | Source: X @CarpeNoctom

Bitcoin price, 1-day illustration | Source: X @CarpeNoctomThe value of this bullish awesome is further enhanced by the information that the terms of Bitcoin is supra the “Cloud” oregon ‘Kumo’, which is considered an country of aboriginal enactment oregon resistance. When the terms is supra the cloud, it’s mostly viewed arsenic a bullish signal, suggesting that the plus is successful a beardown uptrend and apt to proceed arsenic such.

This setup provides a wide bullish script that contrasts with the short-term caution suggested by John Bollinger’s analysis. At property time, BTC traded astatine $69,846.

BTC terms hovers conscionable beneath $70,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms hovers conscionable beneath $70,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

![Crypto News Today [Live] Updates On Feb 14, 2026](https://image.coinpedia.org/wp-content/uploads/2025/10/10162458/Crypto-News-Today-Live-Updates-October-10-1024x536.webp)

English (US)

English (US)