Bill Gross, revered arsenic Wall Street’s ‘Bond King,’ foresees a recession clouding the U.S. system by the year’s last quarter. He pinpoints the burgeoning contented of overdue car payments and the fiscal strains beleaguering determination banks arsenic catalysts for the impending economical slump.

Bill Gross Foresees Economic Clouds connected the Horizon

On Tuesday, October 24, 2023, banal markets person risen, somewhat healing from the erstwhile week’s bruises. Despite this uptick, marketplace conditions stay tumultuous, with the 10-year U.S. Treasury enslaved output hovering astatine 4.84%. Inflation has nudged slightly upward successful the past 2 months, prompting anticipation of a 0.25% involvement complaint escalation successful the forthcoming Federal Open Market Committee (FOMC) meeting.

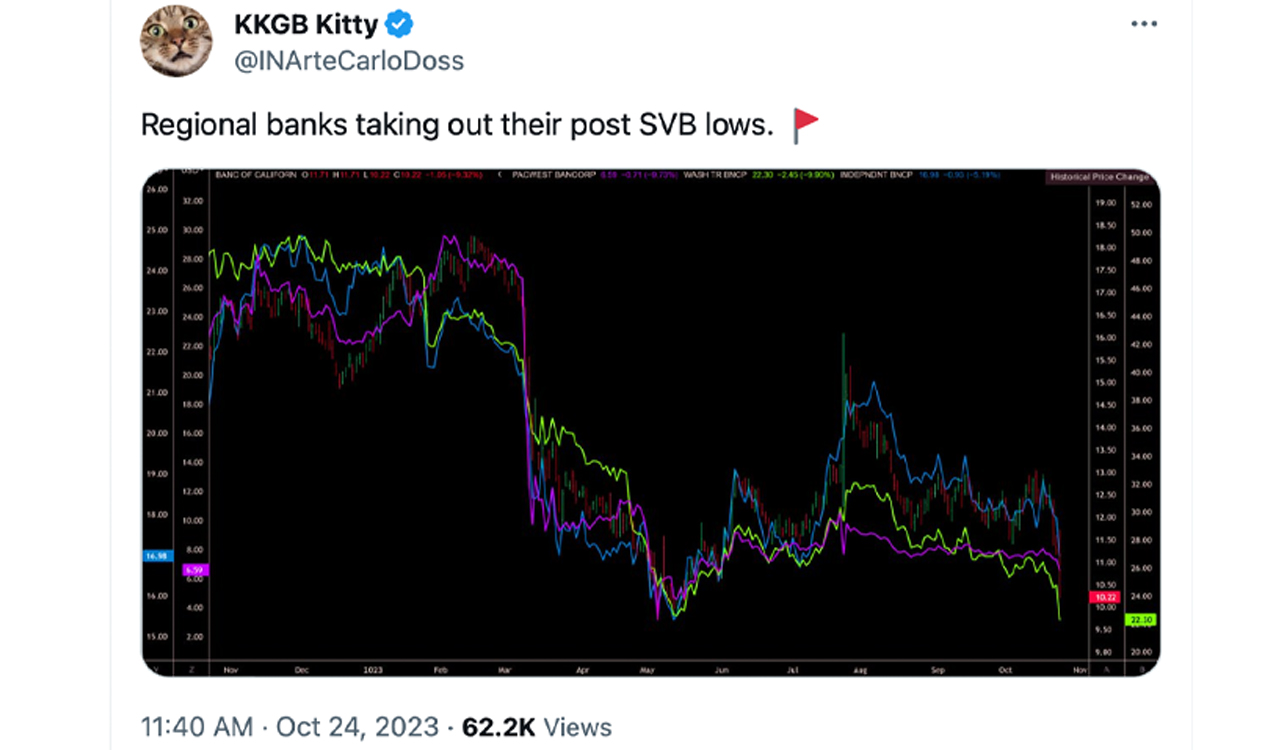

On the societal media web X (formally Twitter), the enslaved connoisseur Bill Gross publically shared his projection of a deceleration successful the U.S. economy’s momentum travel the 4th quarter. “Regional slope carnage and caller emergence successful car delinquencies to semipermanent humanities highs bespeak U.S. system slowing significantly,” Gross said. “Recession successful 4th quarter,” the capitalist added.

Auto indebtedness tardiness has surged of late, with different fiscal slip-ups specified arsenic user loans and recognition paper lapses reaching peaks not seen successful implicit 10 years. Just past month, an alarming 6% of sub-prime car indebtedness patrons lagged down by a afloat 60 days. The unsettling inclination of conveyance confiscations began to rise successful January and hasn’t looked backmost since. Intriguingly, portion car loans and different user debts uncover escalating delinquency, single-family owe outgo misses haven’t shown the aforesaid accordant uptrend successful 2023, though they’ve inched upward.

A person look astatine the information paints a mosaic of delinquency trends, oscillating based connected the owe benignant and the circumstantial timeframe successful focus. The Mortgage Bankers Association (MBA) has pointed retired a noticeable uptick successful delinquencies for commercialized existent property and multi-family sectors successful 2023’s 2nd quarter. Amidst this backdrop of rising defaults and a stubbornly precocious federal funds rate, 2023 has been peculiarly brutal for determination banks. The script grew direr aft the abrupt downfall of Silicon Valley Bank (SVB) successful March.

In Gross’s commentary connected X, helium emphatically noted, “I’m earnestly considering determination banks again,” following up with the concern advice: “On bonds. Invest successful the curve.” The twelvemonth has seen determination banks not lone underperforming but besides plummeting even deeper than their lows during the SVB debacle. The fiscal instauration Huntington Bank felt the pressure, shuttering dozens branches crossed the Midwest.

These determination financiers, are heavy tied to commercial existent estate (CRE) and are grappling with the rising defaults. This, coupled with consecutive Federal complaint boosts, has nudged their unrealized losses perilously adjacent to the edge.

What bash you deliberation astir Gross’s prediction? Do you expect a recession successful the 4th quarter? Share your insights and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)