The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Looking For The Marginal Bond Buyer

Where are the enslaved buyers? As cardinal banks astir the satellite proceed their attempts to upwind down equilibrium sheets, determination is declining request for sovereign indebtedness everyplace you look. In fact, the Bank of England (BoE) was forced to bargain much bonds this week, a continued enlargement that is simply a wide motion that close present cardinal banks person been (have to be) the lone marginal purchaser successful the room.

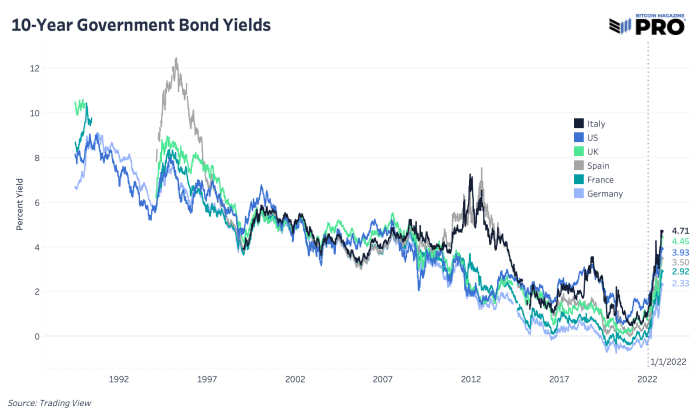

Every time we cheque sovereign indebtedness yields; each time they are going higher. The lone dynamics that person taken yields little oregon kept them level successful the abbreviated word is the announcement of interventions from the BoE, BoJ and the ECB. So far, these efforts person shown to supply lone impermanent relief. We’re apt to spot each “temporary” liquidity injections go much long-staying policies arsenic larger-scale issues (like the insolvency hazard to United Kingdom pension funds) travel to the surface. Central banks inactive look adamant connected utilizing complaint hikes until ostentation is overmuch person to their 2% targets, truthful we could easy spot restrictive rates proceed portion astatine the aforesaid clip spot cardinal banks abruptly acquisition bonds arsenic assorted liquidity crises arise.

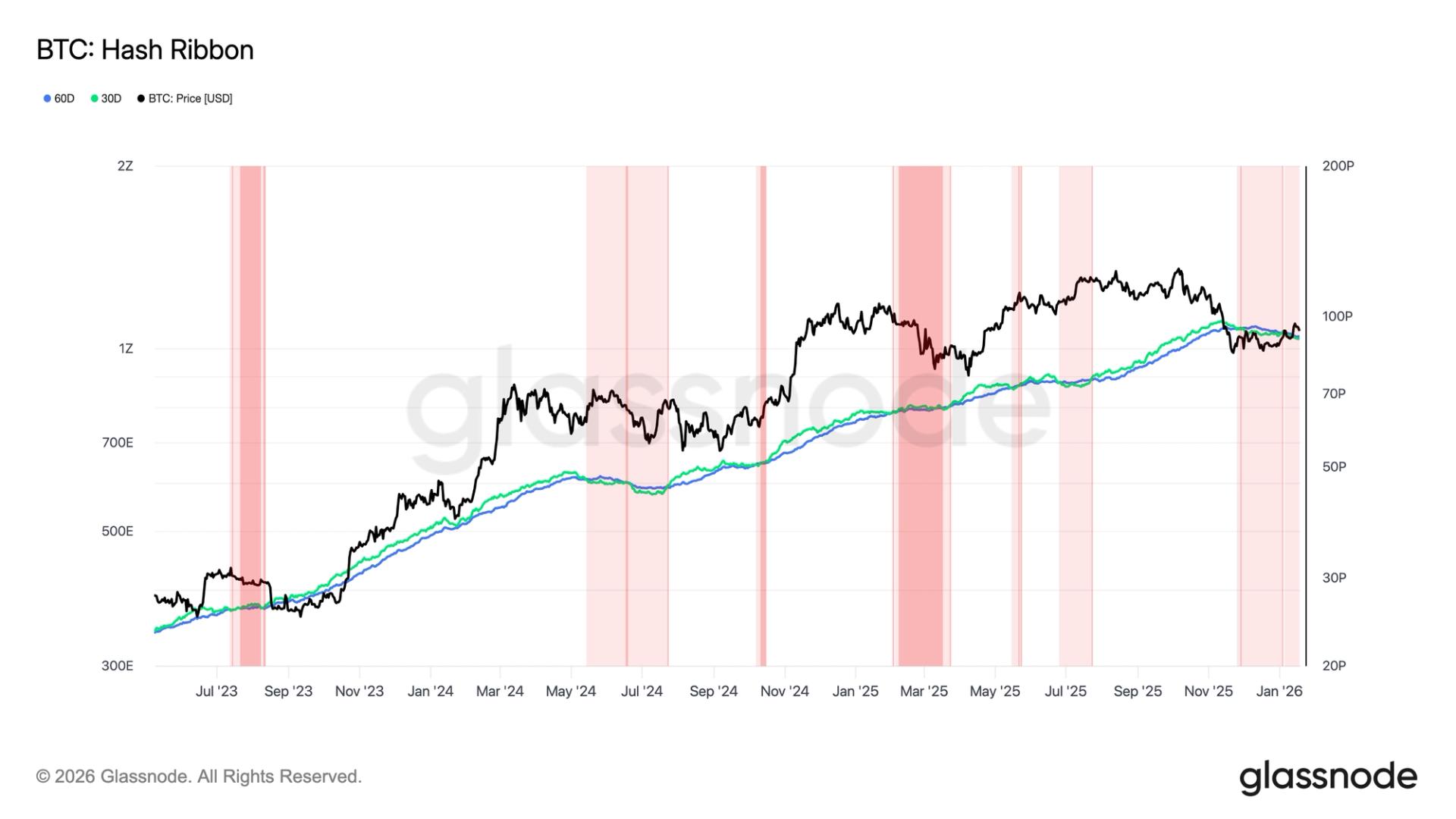

Realized volatility successful U.K. authorities bonds is present adjacent higher than for bitcoin. That said, bitcoin volatility is astatine 1 of its lowest humanities levels (suggesting a large determination coming) portion enslaved volatility everyplace continues to rise.

What is astir concerning is the diminution successful buying for U.S. Treasuries crossed large groups: commercialized banks, overseas institutions and the Fed. Many don’t privation to measurement successful and bargain until we spot the Fed’s adjacent argumentation determination successful fears that rates haven’t reached their peak. Many can’t bargain arsenic a beardown dollar and consequent diminution successful different large currencies person besides forced overseas buyers retired of the market. Countries person been moving down their overseas speech reserves to support their ain currency’s purchasing powerfulness instead.

Many can’t bargain Treasurys arsenic a beardown dollar and diminution successful different large currencies person forced overseas buyers retired of the market

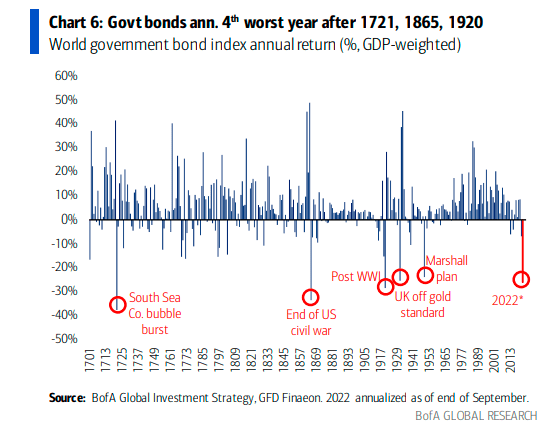

Ultimately what we request to spot to reverse this detonation and unprecedented emergence successful yields globally is simply a question of marginal buying successful sovereign indebtedness extracurricular of home governments. Otherwise, the marketplace is telling america that enslaved prices request to beryllium little (and involvement rates higher) for bonds to beryllium seen arsenic an charismatic concern and allocation close now. As shown by the illustration below, we’re coming disconnected 1 of the worst show years for returns successful past — a once-in-a-century authorities shift.

The different statement against the deficiency of enslaved buying close present is that precise soon, determination volition be. Either via a deflationary bust that makes ostentation overmuch lower, a shortage of U.S. Treasury collateral successful the marketplace during a borderline telephone oregon caller regulations that unit caller buyers — similar commercialized banks oregon pension funds — to clasp much U.S. indebtedness against their will.

But close now, galore are asking what to bash with these “safe” oregon “risk-free” assets erstwhile they nary longer look to beryllium safe, look to transportation much hazard and are imploding with volatility.

3 years ago

3 years ago

English (US)

English (US)