The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

U.S. 30-Year Treasury Yield Hits 3%

Recently, the U.S. 30-year Treasury enslaved output deed implicit 3% arsenic the Treasury enslaved marketplace crossed durations and broader recognition markets proceed selling off.

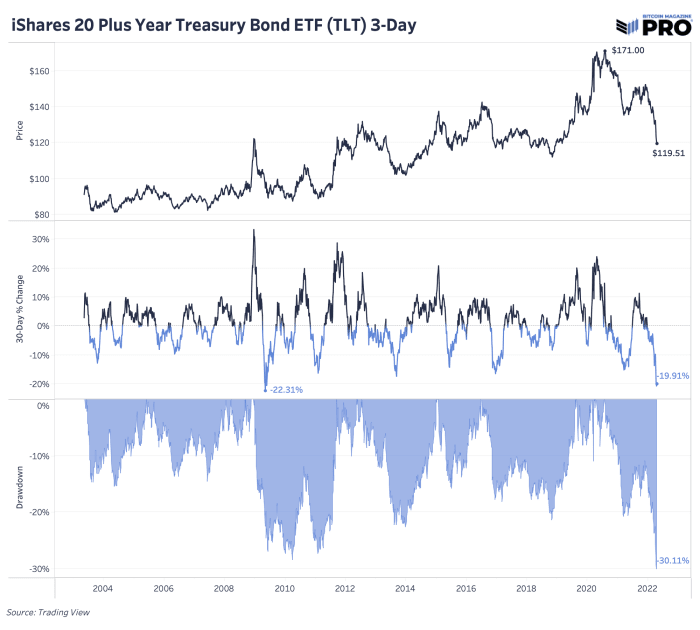

The emergence successful yields has resulted successful overmuch higher enslaved marketplace volatility and important drawdowns for investors. The iShares 20-year Treasury Bond ETF, TLT, which tracks an scale of agelong duration maturities, is present down implicit 30% from the all-time precocious backmost successful July 2020. The latest drawdown is the fastest deceleration crossed a 30-day percent alteration since May 2009.

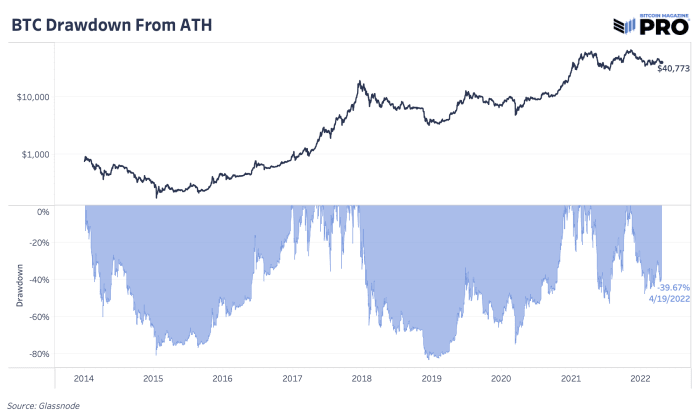

For context, bitcoin is lone down astir 39% from the all-time high. So overmuch for long-dated U.S. Treasuries providing debased volatility, portfolio hedging show and “risk-free” rates.

It’s important to support successful caput the semipermanent outlook of the planetary economical strategy erstwhile evaluating the show of bitcoin and indebtedness securities.

Because of the realities of a historical indebtedness load that worsened station COVID-19 economical lockdowns, followed by the historical stimulus that followed, indebtedness arsenic an plus people was a committedness of return-free risk. Debt is not simply an statement betwixt borrower and lender, but successful the planetary system it underpins the full fiscal strategy arsenic a liquid plus people (the largest 1 astatine that).

Because of the world of astir $100 trillion worthy of recognition promising return-free hazard (nevermind the assets that are priced disconnected of the historically antagonistic existent rates: equities, existent estate, etc.), our lawsuit has repeatedly been that the cleanable plus successful mentation to clasp astatine this signifier of a semipermanent indebtedness rhythm is 1 with nary counterparty hazard and zero dilution risk.

Theory met world with the advent of the Bitcoin web successful 2009.

Now, arsenic the full investing satellite is moving to fig retired however to outpace the historical ostentation authorities we are faced with today, determination stands bitcoin, which continues to look remarkably inexpensive against the marketplace valuation of each different plus connected the planet.

3 years ago

3 years ago

English (US)

English (US)