In a broad valuation of planetary marketplace dynamics, Bloomberg Intelligence expert and Chartered Market Technician (CMT) Jamie Coutts has opined connected the shifting sands of fiscal plus volatility. With bonds perchance falling retired of favour and Bitcoin cementing its spot arsenic a debasement hedge, accepted portfolio models whitethorn beryllium connected the verge of a renaissance.

Major Portfolio Shift Towards Bitcoin?

Coutts tweeted, “It looks similar we are astir to spot a important uptick successful volatility crossed each markets, fixed wherever yields, USD, & planetary M2 are heading. Despite what lies ahead, determination has been a large displacement successful the volatility profiles of planetary assets vs. Bitcoin implicit the past years.”

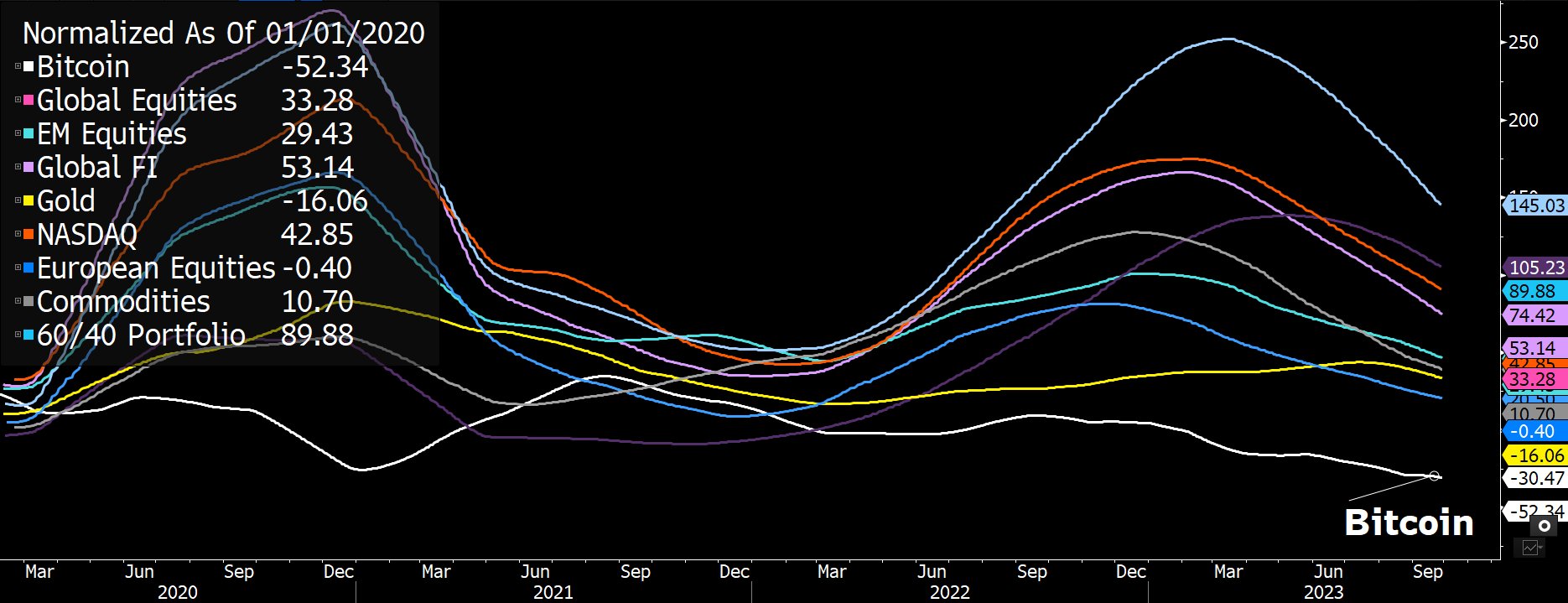

A comparative investigation by Coutts highlighted that since 2020, the volatility profiles of Bitcoin and Gold person declined, portion astir different assets person seen an summation successful volatility.

His breakdown indicates that the accepted 60/40 portfolio volatility is up by 90%, NASDAQ’s volatility has surged by 53%, and planetary equity volatility roseate by 33%; meanwhile, lone Bitcoin’s volatility decreased by 52% arsenic good arsenic Gold’s volatility, which went down by 6%

Normalized volatility | Source: X @Jamie1Coutts

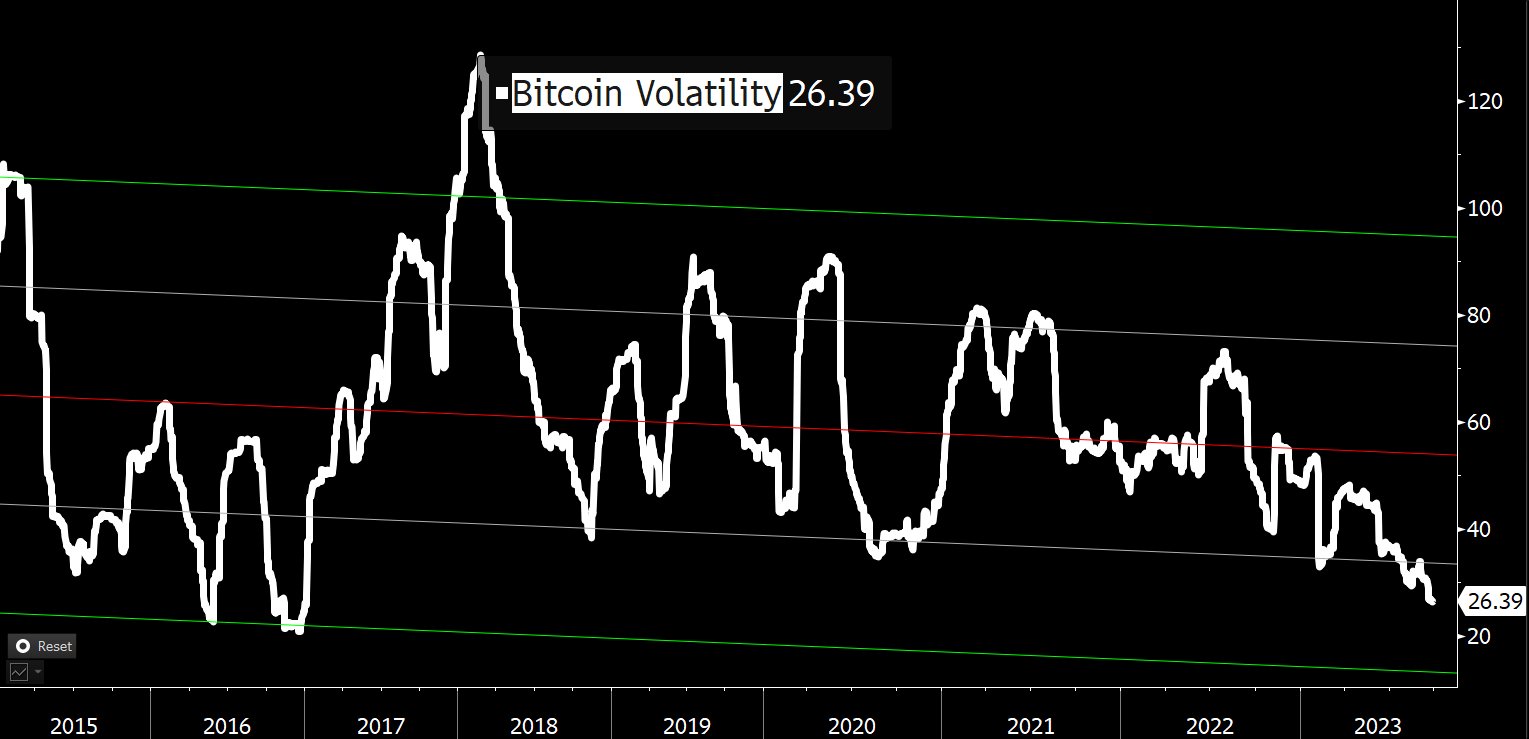

Normalized volatility | Source: X @Jamie1CouttsCoutts further elaborated that pursuing the “hyper-volatile” signifier of Bitcoin during 2011-14, the cryptocurrency’s volatility has been connected a downward trajectory. From a highest supra 120 successful aboriginal 2018, this metric presently stands astatine 26.39.

Bitcoin volatility | Source: X @Jamie1Coutts

Bitcoin volatility | Source: X @Jamie1CouttsHowever, Coutts maintains skepticism implicit Bitcoin’s short-term prospects fixed the deteriorating macro environment: “Given that BTC volatility is adjacent the bottommost of the scope positive a deteriorating macro environment: US dollar (DXY) is up, 10Y Treasury Yield is up, Global M2 wealth proviso is up. It’s hard to spot however BTC (& each hazard assets) tin clasp up with this setup.”

BTC Vs. Global Asset Classes

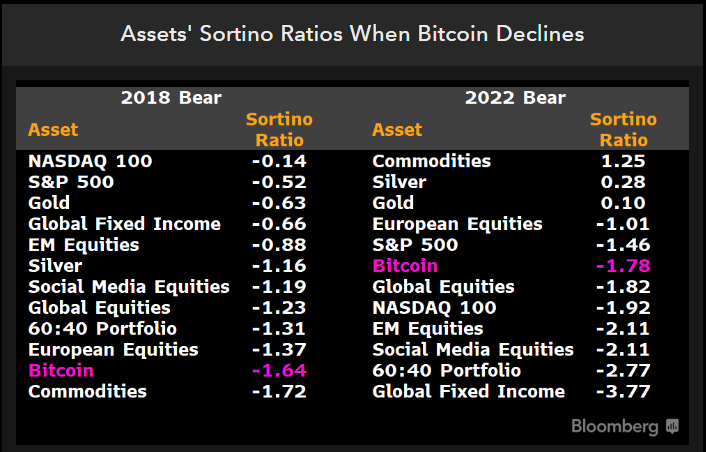

On the agleam side, from an plus allocation perspective, Coutts considers the existent question to beryllium whether “Bitcoin tin adhd worth arsenic a hazard diversifier & amended risk-adjusted returns.” Comparing the risk-adjusted returns utilizing the Sortino ratio during the past carnivore market, Bitcoin’s show is not the best.

In the 2022 carnivore market, Bitcoin’s Sortino ratio is -1.78, positioning BTC supra planetary equities, the NASDAQ 100, and the accepted 60:40 portfolio. However, it trails the S&P 500 (-1.46), European Equities (-1.01), Gold (+0.1), Silver (+0.28), and commodities (+1.25).

Assets Sortino ratios | Source: X @Jamie1Coutts

Assets Sortino ratios | Source: X @Jamie1CouttsElaborating connected the cyclical behaviour of Bitcoin, Coutts added, “The occupation with BTC is the comparatively abbreviated past makes inferences hard and 1 twelvemonth periods are surely not significant. The champion we tin spell connected is aggregate cycles. It’s wide that holding implicit the afloat rhythm has been a winning strategy.”

Evaluating the Sortino ratio implicit the past 3 Bitcoin cycles (2013-2022), Coutts recovered Bitcoin to pb with a people of 2.46, outperforming the NASDAQ 100 (+1.37), S&P 500 (+1.25), and planetary equities (+1.05).

BTC: Top Bet Against Money Printing

In this scenario, Debasement concerns further heighten Bitcoin’s proposition. Coutts emphasized this saying, “And if allocators privation to outpace monetary debasement, implicit astir timeframes, bonds are not the spot to be.” He identified Bitcoin arsenic the foremost prime for portfolio reallocation against monetary debasement.

Citing the immense quality betwixt plus returns concerning wealth proviso maturation (M2) implicit the past 10 years, helium highlighted Bitcoin’s dominance with a staggering ratio of +8,598, followed by NASDAQ (+109), S&P 500 (+25) and planetary equities (-7.5).

Bitcoin risk-adjusted returns implicit aggregate cycles | Source: X @Jamie1Coutts

Bitcoin risk-adjusted returns implicit aggregate cycles | Source: X @Jamie1CouttsIn a concluding statement, Coutts postulated, “In the years up it’s conceivable that allocators statesman to displacement towards amended debasement hedges. BTC is an evident choice.” Moreover, helium suggests that Bitcoin could supplant bonds by securing astatine slightest 1% of the accepted 60/40 portfolio.

At property time, BTC traded astatine $26,433.

BTC hovers beneath the inclination line, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC hovers beneath the inclination line, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)