Wall Street ramped up its vulnerability to bitcoin successful the 2nd quarter, adding positions not lone successful spot bitcoin exchange-traded funds (ETFs) but besides successful U.S. stocks intimately tied to the cryptocurrency’s price, according to caller filings with the Securities and Exchange Commission (SEC).

Brevan Howard astir doubled its presumption successful BlackRock’s iShares Bitcoin Trust (IBIT) during the 2nd quarter, according to a securities filing. The macro-focused hedge money held 37.9 cardinal shares astatine the extremity of June, up from astir 21.5 cardinal successful March.

The involvement was worthy much than $2.6 cardinal based connected IBIT’s closing terms connected June 28, making Brevan Howard 1 of the largest reported organization holders of IBIT alongside Goldman Sachs, which boosted its presumption to $3.3 cardinal successful IBIT and Fidelity’s Wise Origin Bitcoin Trust (FBTC). The banking elephantine besides held $489 cardinal worthy of the iShares Ethereum Trust (ETHA), according to a filing.

Goldman’s ownership of the ETFs isn’t needfully a nonstop wager by its trading table connected bitcoin’s price; rather, it much apt represents positions held by Goldman Sachs Asset Management connected behalf of its clients.

Brevan Howard, champion known for macro trading, however, has agelong been progressive successful the crypto abstraction and operates a dedicated integer plus part called BH Digital. The portion manages billions successful assets and invests successful blockchain infrastructure, decentralized concern and related technologies.

Harvard, Wells Fargo and more

Other large IBIT investors see Harvard University, which reported a $1.9 cardinal stake successful the ETF, and Abu Dhabi’s Mubadala Investment Company, which continues to clasp $681 million.

In presumption of U.S. banks, Wells Fargo nearly quadrupled its holdings of IBIT to $160 million, up from $26 cardinal successful the erstwhile quarter, portion maintaining a $200,000 involvement successful the Grayscale Bitcoin Fund (GBTC).

Cantor Fitzgerald besides boosted its holdings to implicit $250 cardinal portion besides expanding stakes successful crypto-related stocks, including Strategy (MSTR), Coinbase (COIN) and Robinhood (HOOD), among others.

Trading steadfast Jane Street revealed holding a $1.46 cardinal involvement successful IBIT, which represents the largest azygous presumption successful its portfolio aft Tesla (TSLA) astatine $1.41 billion. It accrued its involvement successful MSTR portion reducing its holdings of FBTC.

Spot bitcoin ETFs similar IBIT, which launched successful January, let investors to summation vulnerability to bitcoin’s terms without straight holding the cryptocurrency. That operation offers accepted institutions an avenue to enactment successful the crypto marketplace done acquainted brokerage accounts and custodial arrangements.

Norway buys more

For immoderate overseas entities, gaining vulnerability to bitcoin is easier done U.S.-listed companies that clasp ample amounts of BTC connected their equilibrium sheets.

That’s the attack being taken by Norway’s sovereign wealthiness fund, on with respective different European state-backed investors, which are opting for equity stakes successful crypto-adjacent firms alternatively than holding the crypto directly.

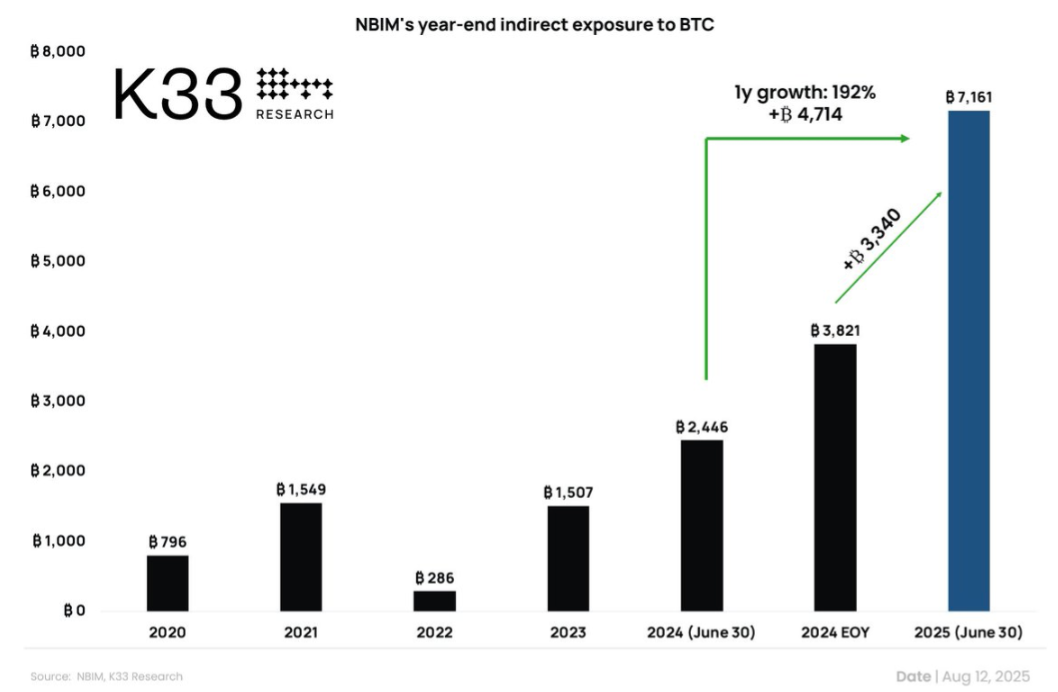

Norges Bank Investment Management (NBIM), the concern limb of the Norwegian cardinal slope and the entity that manages the country’s $2 trillion pension fund, present indirectly holds 7,161 BTC, according to a caller enactment from K33 Research. That fig is up 192% from 2,446 BTC a twelvemonth ago, and up 87% from the 3,821 BTC it held astatine the extremity of 2024.

The largest information of its vulnerability — 3,005 BTC — comes done shares successful Strategy. The remainder is dispersed crossed companies similar Marathon Digital, Coinbase, Block, and Metaplanet. K33 besides counted GME (GameStop) and respective smaller holdings arsenic contributing to the total.

Still, the vulnerability remains tiny successful context. Norway’s money owns stakes successful thousands of companies crossed planetary markets, and the worth of its bitcoin-linked investments is simply a fraction of its full holdings. At a existent marketplace terms of $117,502 per BTC, the fund’s 7,161 BTC is worthy astir $841 cardinal — oregon little than 0.05% of the $2 trillion portfolio.

The crisp summation implicit the past twelvemonth whitethorn awesome increasing organization comfortableness with the plus class, but it doesn’t correspond a large strategical shift—yet.

3 months ago

3 months ago

English (US)

English (US)