On Sept. 16, 1992, the British lb dropped to its all-time low. The time has since go known arsenic “Black Wednesday,” oregon the time George Soros broke the Bank of England.

The historically unchangeable currency mislaid 4.8% of its worth against the U.S. dollar, efficaciously keeping the U.K. retired of the E.U.’s recently formed European Exchange Rate Mechanism (ERM). The state joined the ERM successful an effort to enactment the unification of European economies but efficaciously failed to adhere to the presumption of the ERM.

Britain’s inability to support the lb unchangeable opened the doorway for speculators to abbreviated the currency. George Soros, an capitalist and money manager, amassed 1 of the largest abbreviated positions connected the lb which enabled him to pouch $1 billion.

On Sept. 26, 2022, the British lb experienced a flash clang astir arsenic ample arsenic the 1 connected Black Wednesday, losing 4.3% of its worth against the U.S. dollar.

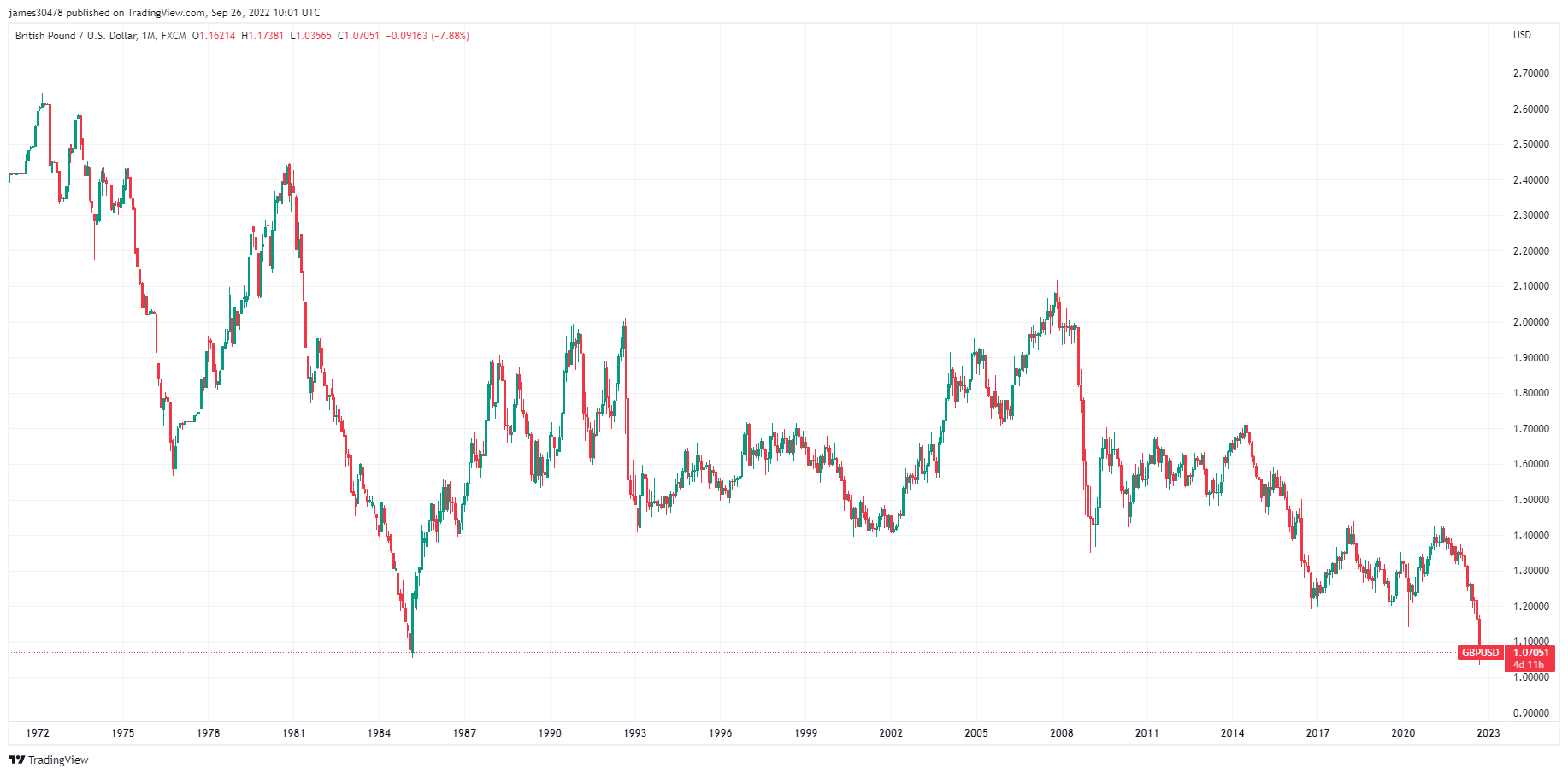

Graph showing the terms of the British lb against the U.S. dollar from 1972 to 2022 (Source: TradingView)

Graph showing the terms of the British lb against the U.S. dollar from 1972 to 2022 (Source: TradingView)One of the main culprits down this clang could beryllium ample traders. Significant options barriers astatine 1.07 pounds to the dollar triggered a cascade that saw the lb driblet done 1.06, 1.05, and 1.04 successful a substance of hours. The lb presently stands astatine conscionable 7 cents supra parity with the U.S. dollar.

Since the opening of the year, the lb crashed implicit 21% against the U.S. dollar and 8% against the euro.

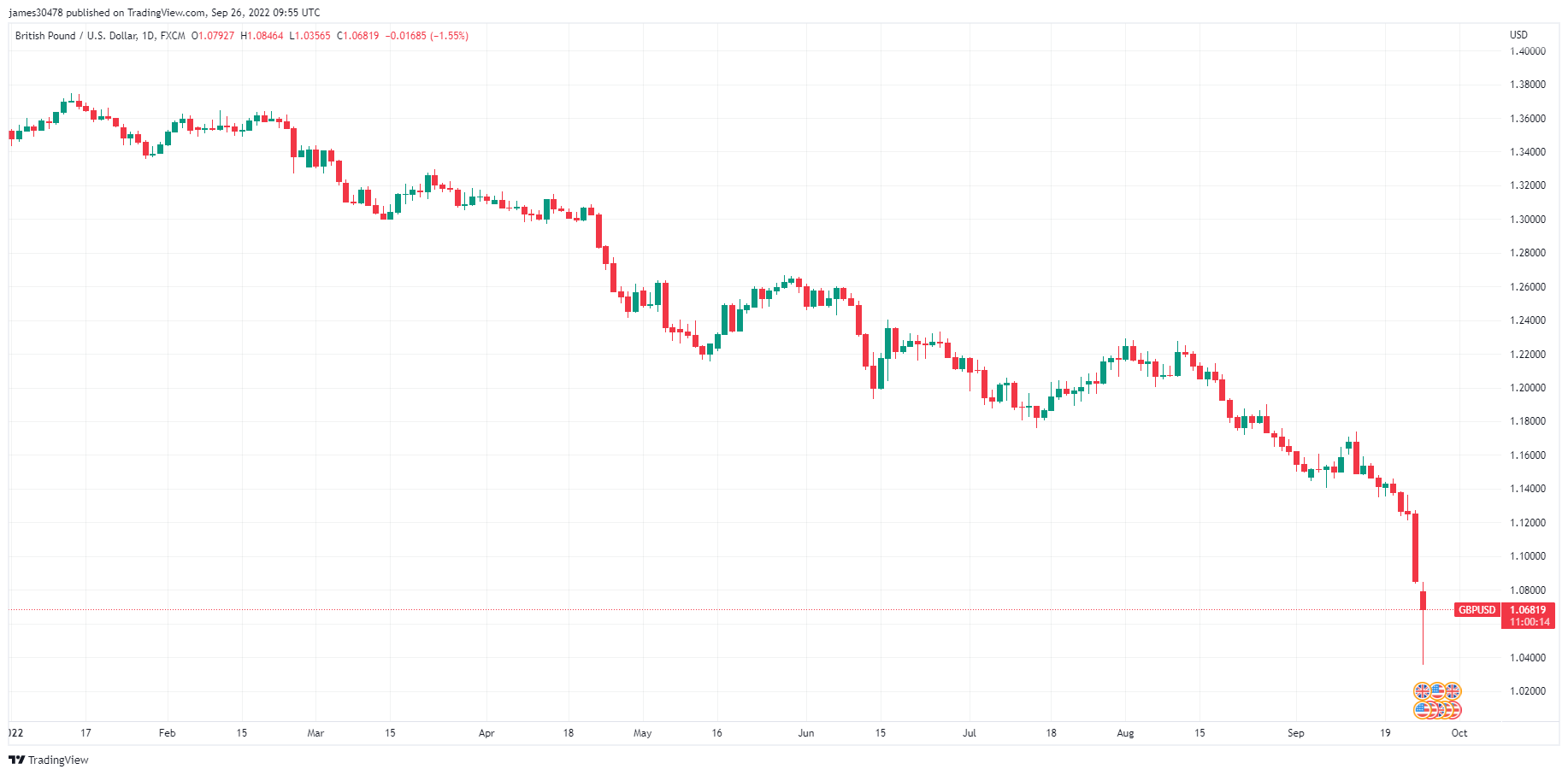

Graph showing the terms of the British lb against the U.S. dollar successful 2022 (Source: TradingView)

Graph showing the terms of the British lb against the U.S. dollar successful 2022 (Source: TradingView)While the pound’s woes mightiness look recent, the currency has been experiencing a dependable driblet for the amended portion of the past 8 centuries.

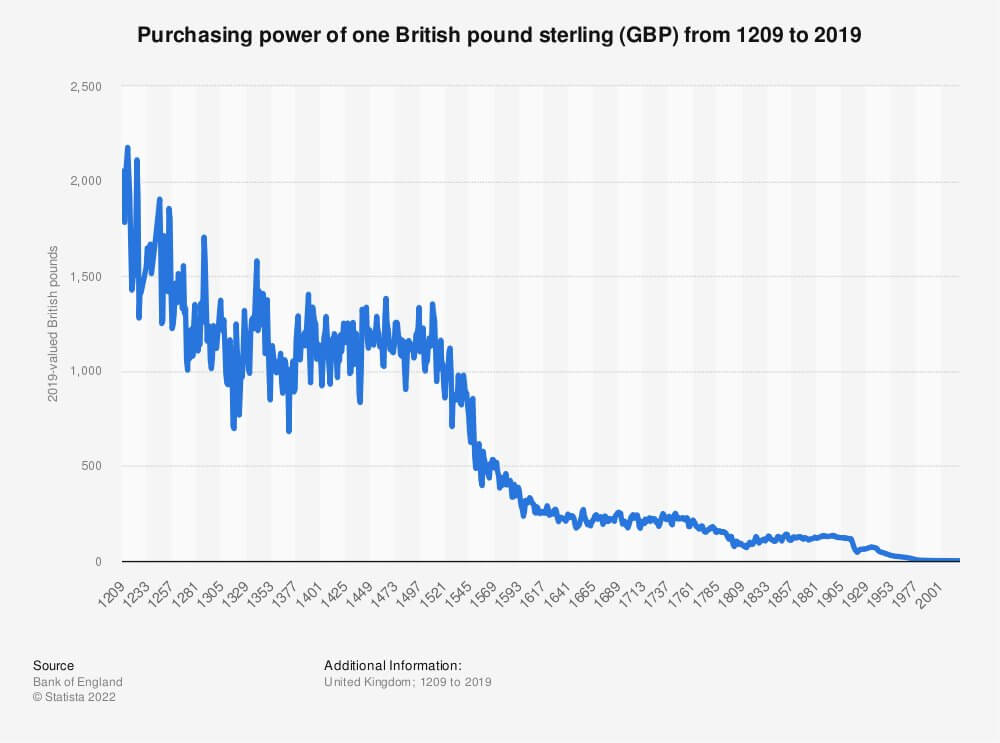

Graph showing the purchasing powerfulness of 1 British lb from 1209 to 2019 (Source: The Bank of England)

Graph showing the purchasing powerfulness of 1 British lb from 1209 to 2019 (Source: The Bank of England)With the lb plummeting to its 30-year low, radical flocked to hard assets to debar large losses. On Sept. 26, the BTC/GBP trading measurement soared implicit 1,200% arsenic British lb holders began aggressively purchasing Bitcoin. This stands successful crisp opposition to the BTC/USD pair, which has seen a comparatively level trading measurement connected centralized exchanges passim the summer.

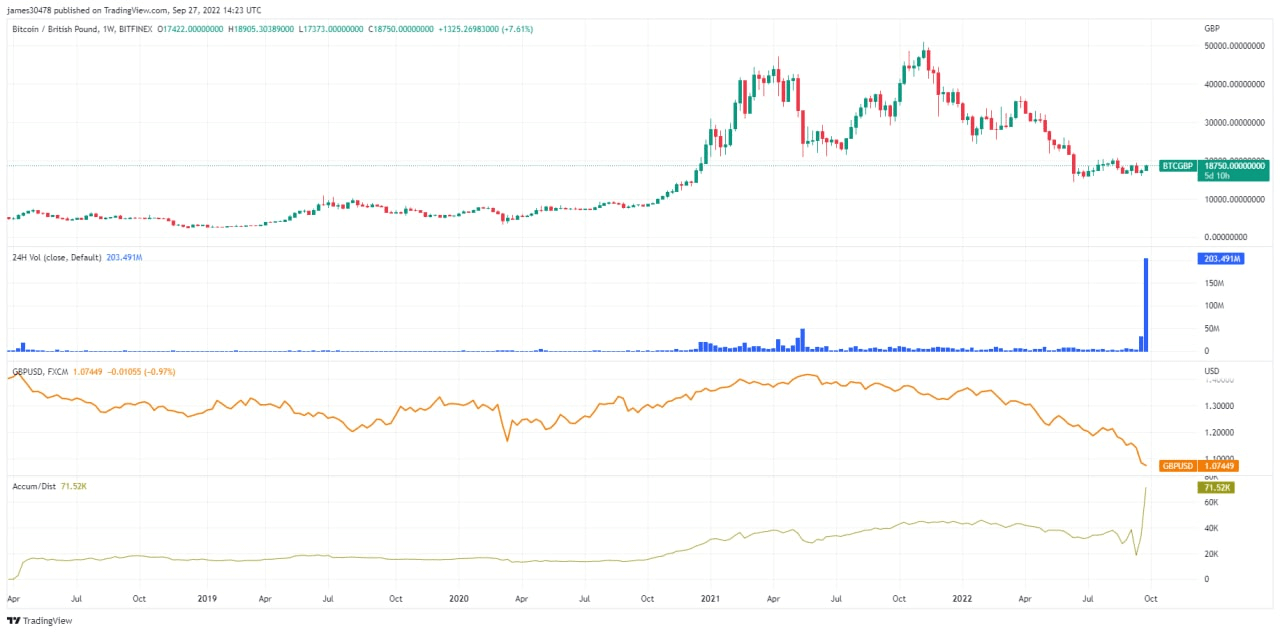

Graph showing the BTC/GBP trading measurement from April 2018 to September 2022 (Source: TradingView)

Graph showing the BTC/GBP trading measurement from April 2018 to September 2022 (Source: TradingView)The rapidly weakening lb posed a monolithic menace to authorities indebtedness markets successful the U.K. The anticipation of systemic hazard to the country’s fiscal stableness forced the Bank of England to instrumentality emergency action and intervene successful the enslaved market. On Sept. 28, the Bank of England announced that it would suspend its programme to merchantability gilts and commencement buying long-dated bonds.

British chancellor Kwasi Kwarteng’s recently imposed tax cuts and borrowing plans further debased the lb and led to a crisp alteration successful U.K. authorities bonds. To support their holdings from risks associated with ostentation and rising involvement rates, astir pension funds put heavy successful semipermanent authorities bonds. The Bank of England’s exigency measures are an effort to supply enactment to thousands of cash-strapped pension funds that are successful danger of failing to conscionable borderline calls.

This is simply a stark reminder that the satellite of accepted concern tin beryllium arsenic unpredictable arsenic the crypto market. Flash crashes and speculation could go a caller world for fiat currencies and commodities galore thought to beryllium resistant to manipulation.

With fiat currencies acting arsenic volatile arsenic debased marketplace headdress cryptocurrencies, the information that 1 Bitcoin inactive remains 1 Bitcoin has ne'er been truthful valid.

The station British lb drops to each clip lows against the dollar appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)