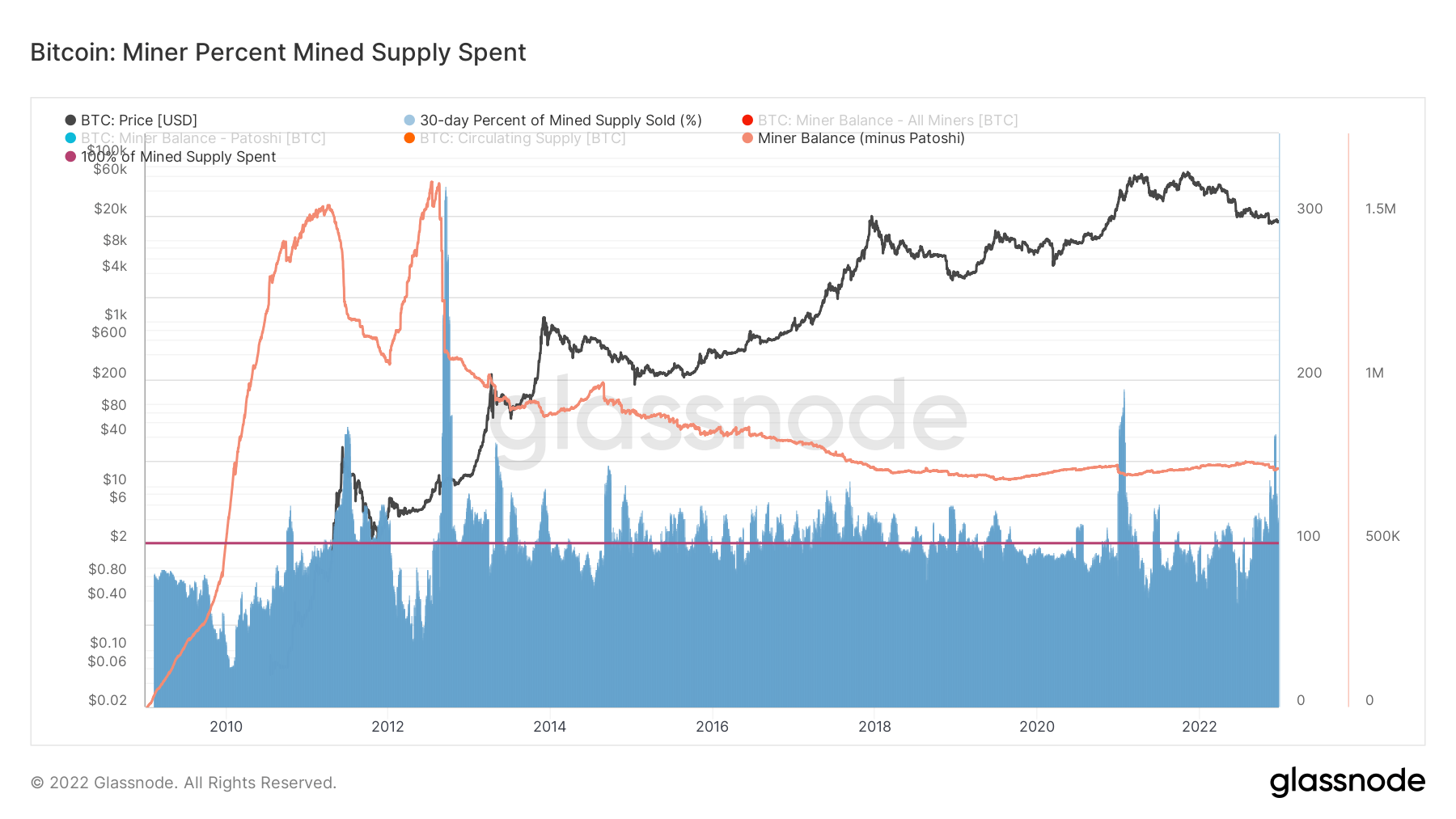

Bitcoin (BTC) miner balances started astatine 1.82 cardinal BTC astatine the opening of the year. Despite peaks of capitulation and important selloff volume, BTC miner wallets inactive beryllium astatine a level 1.8 cardinal BTC.

Mining rewards held successful BTC miners’ wallets saw a sharp decline starting successful August, apt owed to the Poolin exodus. This twelvemonth saw the third-largest BTC selloff by miners implicit a 30-day period, with 112% of mined proviso positive treasury being spent. In contrast, the archetypal and second-largest selloffs occurred during the 2013 and 2021 bull runs, arsenic miners sold their BTC astatine a nett alternatively than a loss.

Bitcoin: Miner Percent Minted Supply Spent / Source: Glassnode

Bitcoin: Miner Percent Minted Supply Spent / Source: GlassnodeThe penetration of Ukraine successful February 2022 caused a planetary vigor crisis, resulting successful precocious costs for BTC miners and wiping retired imaginable profits.

The miner equilibrium presently stands astatine 1.8 cardinal BTC and has remained level implicit the past 5 years, excluding Patoshis coins. This suggests important merchantability unit if miners proceed to conflict into 2023.

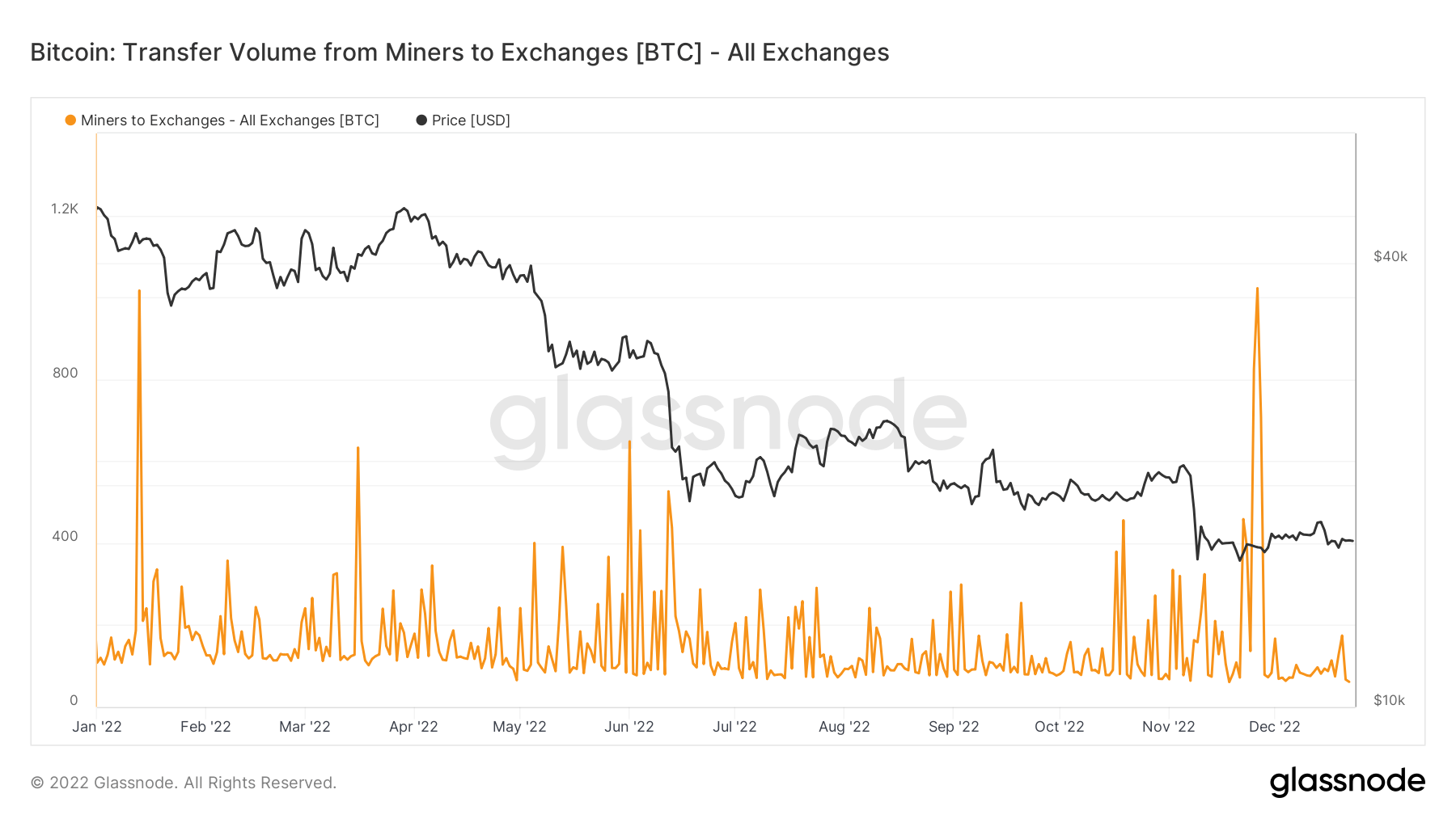

While BTC miners person been offloading their holdings, this is simply miners moving to antithetic wallets alternatively than sending the BTC to exchanges to beryllium sold.

Approximately 200 BTC has been spent regular since 1000 BTC was sold successful precocious November.

Bitcoin: Transfer Volume from Miners to Exchanges / Source: Glassnode

Bitcoin: Transfer Volume from Miners to Exchanges / Source: GlassnodeThrough 2022, miners selling to exchanges has remained minimal, with astir 57,000 BTC sold done the year.

With lone 57,000 BTC being sold retired of a full of 1.8 cardinal BTC and expanding merchantability pressure, it’s worthy considering whether BTC miners are preparing to merchantability successful 2023.

Amid BTC mining institution bankruptcy, record-breaking whale BTC selloffs and miner profitability crisis — 2023 miner capitulation is geared towards large selloffs if merchantability unit continues to mount.

The station BTC miner balances poised for selloff arsenic merchantability unit increases appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)