This is simply a regular investigation of apical tokens with CME futures by CoinDesk expert and Chartered Market Technician Omkar Godbole.

Bitcoin: Risks deeper pullback

Bitcoin’s (BTC) multi-month rally appears to person deed a important wall, with a confluence of bearish signals emerging crossed some play and regular charts.

The play candlestick illustration shows that bulls person failed to found a foothold supra the macro trendline connecting the 2017 and 2021 bull marketplace highs. This failed breakout is supported by weakening momentum, arsenic the MACD histogram, though inactive positive, is importantly little than its highest successful December 2024 erstwhile the macro trendline was archetypal tested.

The bearish sentiment is further reinforced by the 14-week RSI, which has breached its uptrend enactment from the March lows portion continuing to people a bid of little highs since March 2024.

On a shorter-term regular timeframe, the displacement successful momentum is adjacent much pronounced. The three-line interruption chart, a instrumentality designed to filter retired insignificant sound and corroborate inclination changes, has printed 3 consecutive reddish bricks (bars), a classical bearish reversal signal, confirming that sellers person seized control.

The operation of these signals – a failed semipermanent breakout, weakening momentum, and a confirmed short-term reversal – indicates that a deeper correction is present the way of slightest absorption and prices could instrumentality retired the contiguous enactment astatine $11,965, the erstwhile precocious deed successful May, for a trial of dip request astatine $100,000.

Prices need to flooded $122,056 to invalidate the bearish setup.

- Resistance: $120,000, $122,056, $123,181.

- Support: $111,965, $112,301 (the 50-day SMA), $100,000.

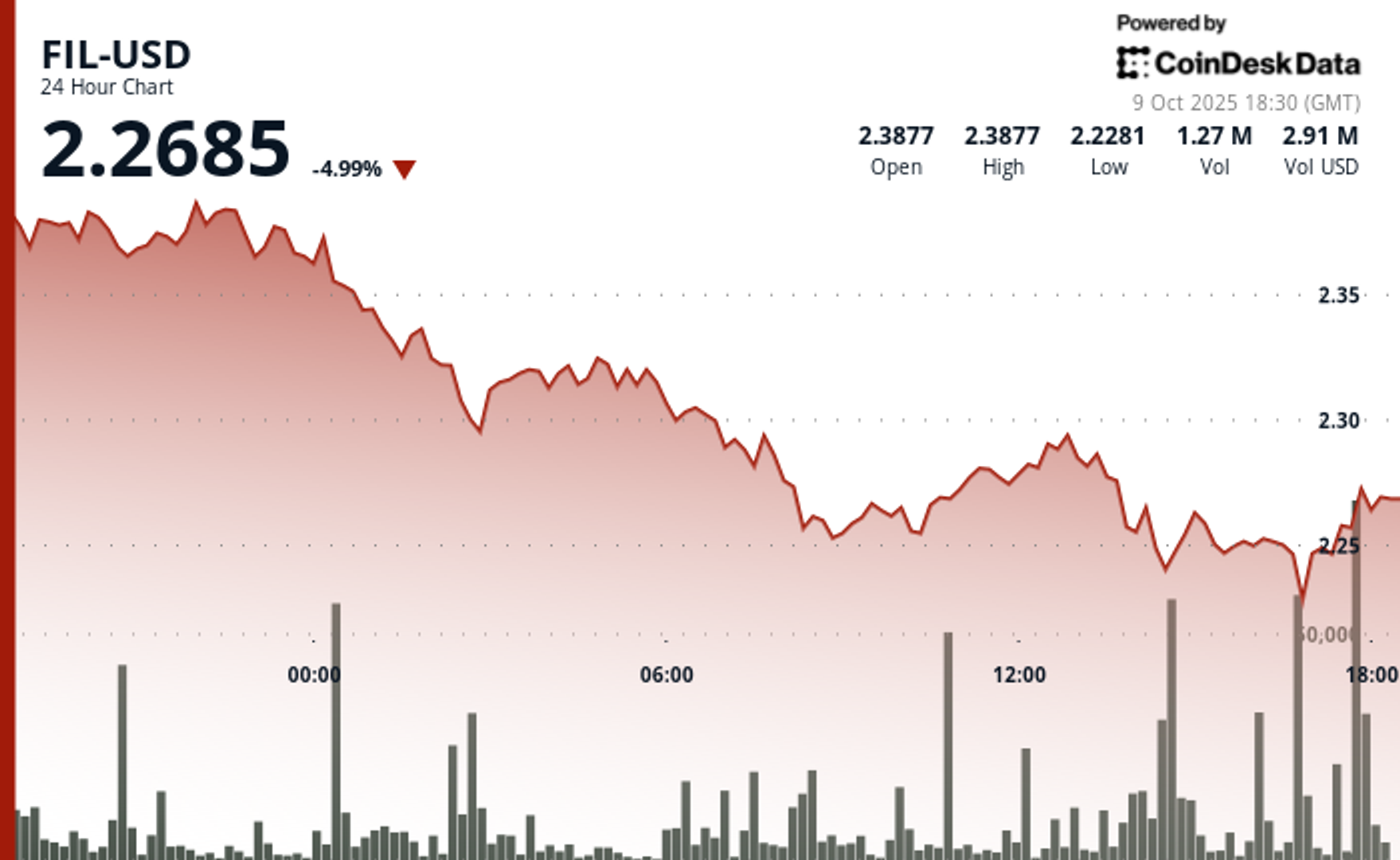

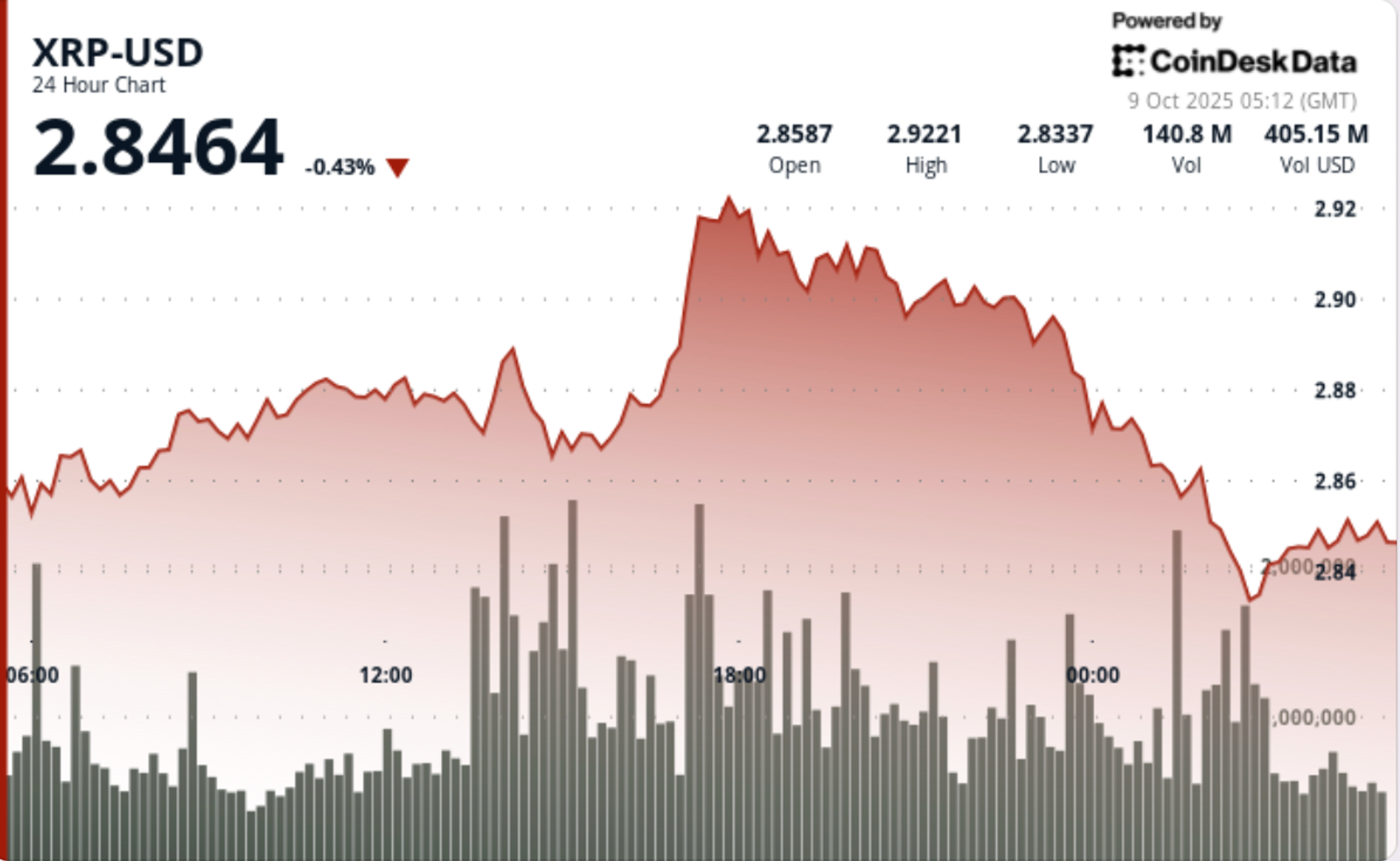

XRP: Challenging downtrend line

While XRP (XRP) is attempting to interruption retired of the downtrend line, which represents the caller correction, the overwhelming momentum from the moving averages crossed some the hourly and regular timeframes suggests that a sustained breakout whitethorn not hap immediately.

On the regular timeframe, the terms has seen a humble bounce, but this rally is capped by the 38.2% Fibonacci retracement level, which is acting arsenic a cardinal resistance. This corrective determination is happening against a bearish backdrop, with some the 5 and 10-day elemental moving averages (SMAs) continuing to inclination south, confirming the downward bias. Further, the 50-, 100-, and 200-hour SMAs are stacked successful a bearish configuration, each trending south, a classical method awesome of a beardown downtrend.

Should we adjacent supra $3.00, the absorption would displacement to the little precocious of $3.33 registered connected July 28.

- Resistance: $3.33, $3.65, $4.00.

- Support: $2.72, $2.65, $2.58.

Ether: Bearish extracurricular week

Ether fell astir 10% past week, forming a ample bearish extracurricular week candle, a important bearish pattern, which indicates that sellers are looking to regain control.

This sentiment is reinforced connected the regular timeframe. The regular candlestick illustration shows that the 5- and 10-day SMAs person executed a bearish cross, confirming a interruption successful the short-term uptrend.

So, portion the terms has seen a humble bounce since Sunday, its spot is questionable. This is further substantiated by the regular three-line interruption chart, which has printed 2 consecutive reddish bricks – a decisive bearish awesome that confirms the inclination has reversed to the downside.

The operation of these semipermanent and short-term charts suggests that the way of slightest absorption is present lower.

- Resistance: $3,941, $4,000, $4,100.

- Support: $3,355, $3,000, $2,879.

Solana: Golden transverse

Solana's caller pullback appears to beryllium gathering a captious test, with bulls successfully defending a cardinal enactment level implicit the past 24 hours. The terms has bounced from the 61.8% Fibonacci retracement of its caller rally, a level often watched by traders arsenic a beardown imaginable terms level successful an uptrend.

Meanwhile, a large semipermanent awesome is connected the horizon: the 50- and 200-day SMAs are nearing a "golden cross." While this is simply a lagging indicator, a palmy transverse would beryllium a almighty semipermanent bullish signal, confirming a large displacement successful momentum and perchance mounting the signifier for a new, sustained uptrend.

For traders, the coming days are critical, with the 61.8% Fib level needing to clasp beardown arsenic enactment portion the impending aureate transverse provides a bullish semipermanent tailwind. Also enactment that contempt the defence of the Fib level, the short-term inclination remains bearish, with the 5- and 10-day Simple Moving Averages (SMAs) continuing to inclination lower.

- Resistance: $175, $187, $200.

- Support: $156, $145, $126.

2 months ago

2 months ago

English (US)

English (US)