Bitcoin drops beneath $37k arsenic the marketplace rethinks the FED ostentation absorption policy. Is this the extremity of Bitcoin arsenic an ostentation hedge?

Cover art/illustration via CryptoSlate

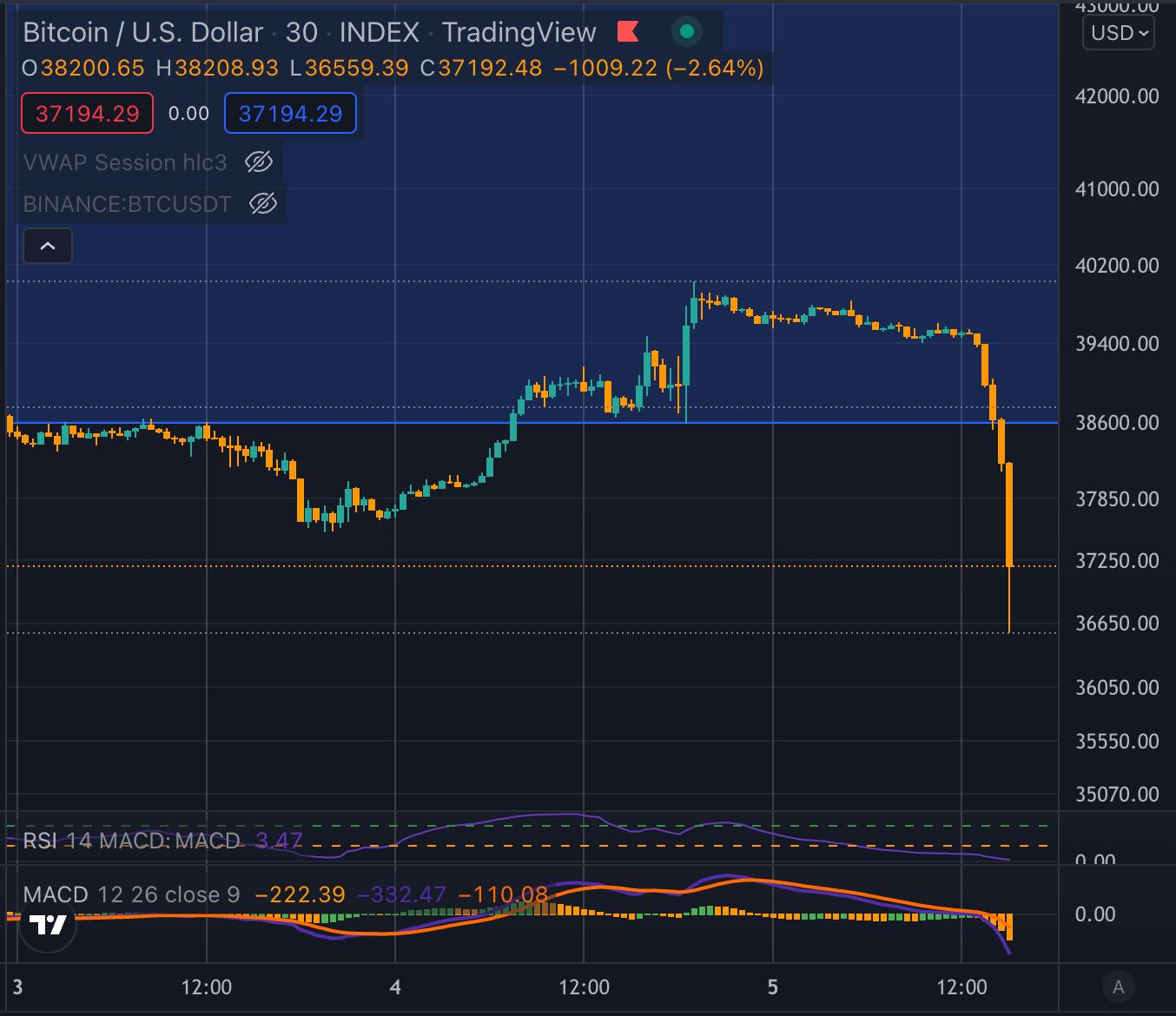

After the post-FED gathering announcement, Bitcoin roseate steeply to trial the $40K resistance. However, marketplace sentiment appears to person shifted contiguous arsenic it dipped backmost beneath $37k. Wild swings successful the crypto marketplace are common, but the quality is that present they look to travel Wall Street arsenic opposed to on-chain information oregon crypto-related news.

Bitcoin follows Wall Street

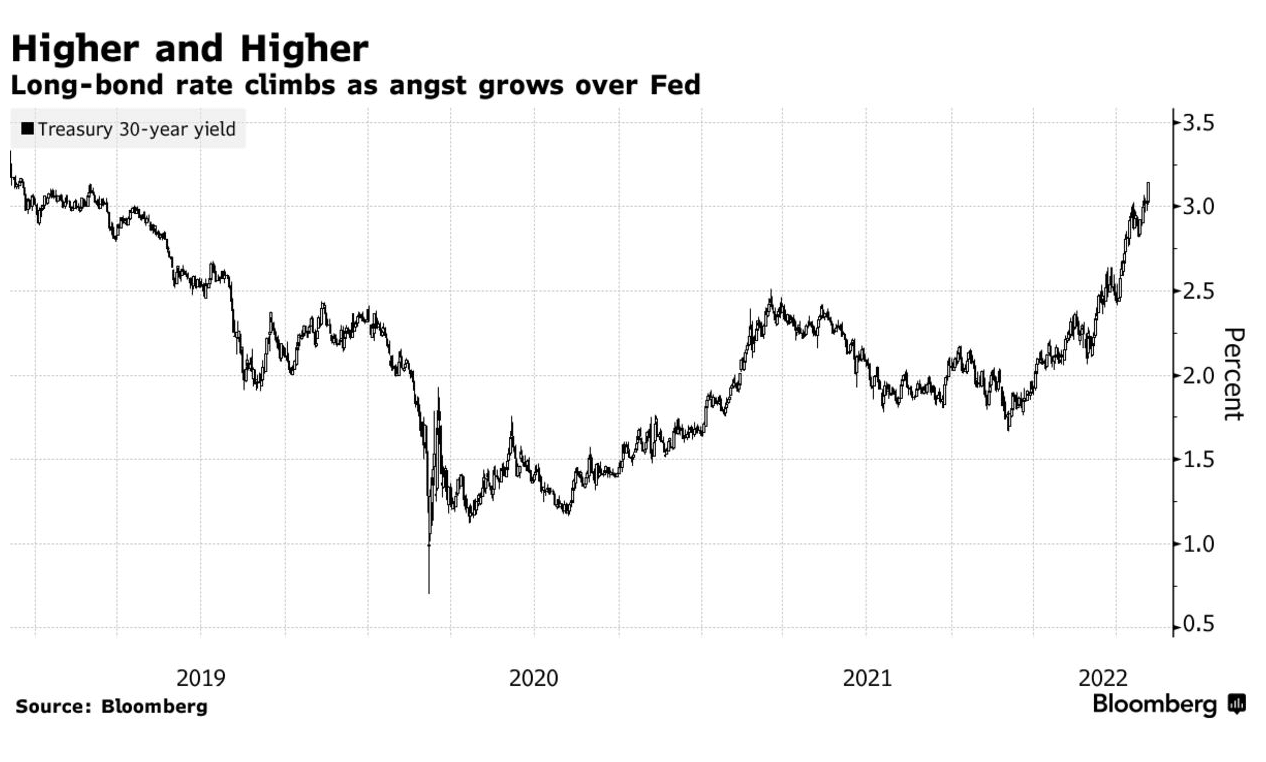

30-year treasury yields roseate astir 3% to the highest level since 2018. The determination caused the Nasdaq to autumn 4% wrong hours, and Bitcoin followed suit, dropping 7% successful a akin period.

Source: Bloomberg

Source: BloombergThe driblet follows a increasing inclination that indicates the crypto marketplace is acting much similar a risk-on tech banal than a wholly abstracted plus class. The FED gathering connected May 5th confirmed a 50bp complaint hike to combat inflation. The banal marketplace reacted positively arsenic Jerome Powell seemingly took a higher 75bp disconnected the table. The statement that this could beryllium bullish for Bitcoin centers astir the information that Bitcoin has the highest LTV ratio successful its history.

This means that much investors are utilizing recognition to put successful Bitcoin. A little than anticipated complaint summation whitethorn suggest that involvement connected loans would not spell up beyond manageable limits. However, immoderate summation successful rates is done to combat ostentation which Powell besides noted was “much excessively high.” If Bitcoin is simply a hedge against inflation, wherefore did it respond positively to quality of a program to combat inflation?

Source: TradingView

Source: TradingViewIs Bitcoin inactive an ostentation hedge?

Bitcoin is famously seen arsenic an ostentation hedge against accepted assets. Cathie Wood of Ark Invest precocious said,

“If ostentation is an issue, Bitcoin is simply a large hedge against inflation…it is simply a hedge against counter-party risk.”

However, this statement whitethorn beryllium becoming harder to travel fixed that Bitcoin reacted adjacent much aggressively than Wall Street to fears that the FED volition not beryllium able to curb inflation. Analysts are opening to question the FEDs strategy and their quality to support ostentation nether control. It is logical to presume that it should not travel the aforesaid inclination for an plus people to beryllium a hedge against something. If Bitcoin falls arsenic ostentation rises, it is nary longer a hedge.

However, Michael Saylor, CEO of Microstrategy, precocious told Bloomberg.

“it’s each timeframe. If you spell backmost 2 years to erstwhile Microstrategy bought in, it’s up 400%… If you’re looking astatine it successful a substance of days, oregon weeks oregon months, the traders power it.”

He seems to presumption adjacent the month-to-month terms enactment of Bitcoin arsenic being controlled by traders. Indeed, Bitcoin has been up 400% since 2020, yet it is besides existent that billions much institutional wealth is present progressive successful crypto.

While galore spot the summation successful concern from accepted corporations arsenic a bullish awesome for Bitcoin, it whitethorn person besides had the adverse effect of correlating it much intimately with accepted assets, astatine slightest successful the abbreviated term. Even the announcement of different $1.5 cardinal successful Bitcoin purchases from LFG has done small to halt Bitcoin from pursuing Wall Street down.

A caller Coinbase Institutional study showed that Ethereum is much intimately correlated to the S&P500 than Bitcoin. Is the aboriginal of Bitcoin, and the crypto markets astatine large, doomed to travel accepted assets, oregon tin it decouple from the day-to-day swings successful the pb up to the 2024 Bitcoin halving?

Over the past 40 days, $ETH has had a higher correlation with the S&P500 than it did with $BTC 📈

Some brainsick stats from the latest Coinbase Institutional report… pic.twitter.com/twUPfbqBdu

— Coin Bureau (guy.eth) (@coinbureau) May 3, 2022

3 years ago

3 years ago

English (US)

English (US)