Bitcoin terms struggled to found a unchangeable absorption successful the past week, arsenic aggravated levels of volatility proceed to stone the market. Following 2 weeks of marketplace correction, the premier cryptocurrency attempted a terms rebound, reaching astir $112,000 earlier retracing to $107,000 terms zone.

Presently, Bitcoin trades successful the $111,000 terms scope aft immoderate dependable gains successful the past 48 hours. Interestingly, a fashionable expert with the X username DaanCrypto has identified an insightful inclination amidst this marketplace uncertainty.

Sideways Bitcoin Market Sets Stage For Explosive Move As Liquidity Builds

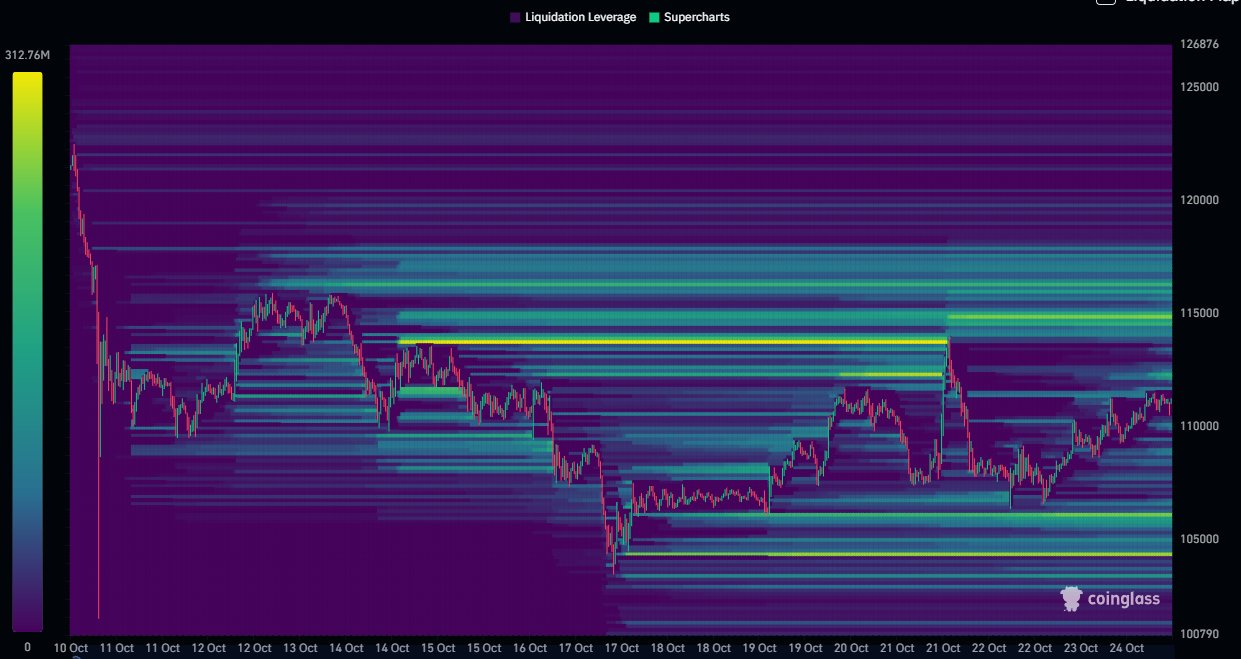

In a post connected Friday, DaanCrypto shared an important on-chain improvement of the Bitcoin marketplace pursuing the highly volatile terms moves successful October 2025. Despite the accordant terms swings, the expert explains that BTC has remained locked successful a section terms scope implicit the past 2 weeks, with its contiguous terms hovering supra the midpoint of this structure.

This sideways enactment has been driven by buyers and sellers repeatedly foiling each other’s attempts to interruption out, thereby preventing the plus from establishing a decisive breakout pattern. Amid the continuous consolidation, untriggered liquidation levels are accumulating conscionable supra and beneath the section terms range.

Source: @DaanCrypto connected X

Source: @DaanCrypto connected XThis signifier is emblematic of Bitcoin’s pre-breakout phases. DaanCrypto explains that the longer the terms consolidates wrong a choky corridor, the much liquidity pools physique up extracurricular it. Notably, erstwhile terms yet sweeps these clusters, it often triggers a cascade of liquidations and halt orders, which substance the adjacent ample terms move.

Using information from Coinglass, DaanCrypto has identified $106,000 arsenic a level with the heaviest attraction of agelong liquidations. Therefore, this terms constituent functions arsenic a captious enactment zone, and a downward wick beneath which could trigger selling forces pushing Bitcoin to deeper levels.

Meanwhile, the $115,000 portion holds a heavy short-side liquidity, meaning a propulsion supra this threshold could substance a accelerated abbreviated compression and propel BTC to higher levels, possibly beyond its existent all-time precocious astatine $126,210.

Bitcoin Still On For A Comeback?

In opposition to fashionable sentiments of an “Uptober” and blooming Q4, Bitcoin has failed to execute a sustainable terms maturation successful October. A report from the Bitcoin Archive states that the crypto asset’s instrumentality successful Q4 2025 is present estimated astatine -2.84%. This fig shows an utmost underperformance arsenic Bitcoin’s mean Q4 is valued astatine 74.77%.

However, with implicit 60 days remaining until the extremity of 2025, determination is inactive ample clip for the premier cryptocurrency to propulsion disconnected a marketplace recovery. After the CPI information met expectations, the chances of an involvement complaint chopped person increased, and an eventual announcement by the Federal Reserve could possibly trigger Bitcoin’s rebound, among different factors.

At property time, Bitcoin continues to commercialized astatine $111,424, reflecting a 3.91% summation successful the past 7 days.

Featured representation from iStock, illustration from Tradingview

2 months ago

2 months ago

English (US)

English (US)