Bitcoin (BTC) takes a beating arsenic the caller week begins with markets held hostage by planetary commercialized tariff uncertainty.

Bitcoin dips beneath $92,000, but traders pass that a overmuch deeper enactment retest is connected the horizon.

Tariffs instrumentality halfway signifier again arsenic investigation agrees that conditions volition apt get worse earlier the risk-asset bull tally continues.

Gold and metallic instrumentality the accidental to marque caller all-time highs, but religion that Bitcoin volition transcript them remains.

US macro information is owed for merchandise arsenic Fed complaint cuts slice into the background.

Bitcoin is already laying the foundations for a sustainable uptrend.

Bitcoin terms action: Volatility guaranteed

Bitcoin saw drawback losses arsenic US futures markets opened — a determination that galore expected based connected existent tariff talk.

In enactment with respective infamous moments from 2025, nerves implicit planetary commercialized sent hazard assets tumbling.

BTC/USD concisely dipped beneath $92,000 earlier recovering, per information from TradingView.

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

“Get acceptable for a volatile week ahead!” trader CrypNuevo summarized successful his latest X investigation thread.

Like others, CrypNuevo expected problematic moves acknowledgment to the resurgence successful broader marketplace uncertainty. The US Martin Luther King, Jr. vacation means that the afloat banal marketplace absorption volition lone beryllium felt connected Tuesday.

“Markets don't similar uncertainty, but markets similar erstwhile the uncertainty dissappears. So I'm leaning to immoderate downside unit pushing terms backmost wrong the scope and perchance trading into the scope lows, earlier immoderate existent reversal,” helium continued.

Important enactment levels see the 2026 yearly unfastened astir $87,000, arsenic good arsenic the scope lows astatine $80,500 — some of which are present targets.

BTC/USDT one-day chart. Source: CrypNuevo/X

BTC/USDT one-day chart. Source: CrypNuevo/X

A look astatine speech bid books, meanwhile, reveals agelong liquidations mounting beneath the yearly open, expanding the likelihood of a liquidity tally lower.

“Based connected each of this, we inactive see the astir apt script that determination is simply a shakeout successful the banal marketplace causing Bitcoin to driblet backmost wrong the scope and trading towards the scope lows successful the coming weeks,” CrypNuevo added.

BTC order-book liquidity data. Source: CrypNuevo/X

BTC order-book liquidity data. Source: CrypNuevo/X

Trader Daan Crypto Trades nevertheless warned that a cardinal breakout level from earlier — the 2025 yearly unfastened astatine $93,500 — was present lost.

$BTC Moved consecutive down from the futures unfastened erstwhile TradFi got a accidental to respond to the caller tariffs announced implicit the weekend.

Price recovered enactment connected the 4H 200EMA for present but has mislaid the breakout level.

This inactive has not been a marketplace which I'm actively trading, which I am… pic.twitter.com/FSIxgWrnIM

“It is indispensable for the bulls to clasp this breakout aft 2 months of sideways terms action,” helium told X followers Sunday.

“If terms falls backmost down beneath $93K-$94K, past this was conscionable a liquidity drawback successful a larger down trend.”Tariffs committedness a week of mayhem

Tariff wars are firmly backmost connected the radar for risk-asset traders arsenic tensions flare betwixt the US and EU implicit Greenland.

Markets instantly reacted erstwhile futures opened precocious Sunday, sparking volatility contempt Wall Street staying closed Monday for the Martin Luther King, Jr. holiday.

Retaliatory measures are already flying betwixt the 2 sides, including the imaginable cancellation of bilateral commercialized talks that resulted from erstwhile rounds of tariff talks past year. The US plans to enactment up to 25% tariffs connected Denmark, Norway, Sweden, France, Germany, the UK, Netherlands, and Finland from Feb. 1.

As Cointelegraph reported, crypto and stocks were highly delicate to tariff-driven quality passim 2025. In April, Bitcoin acceptable a caller section debased nether $75,000 aft US President Donald Trump’s tariff “Liberation Day.”

S&P 500 futures one-day chart. Source: Cointelegraph/TradingView

S&P 500 futures one-day chart. Source: Cointelegraph/TradingView

Now, commentators are considering whether oregon not the roadmap volition look akin arsenic the latest commercialized debacle progresses.

“President Trump ALWAYS leads with a punishing and threatening message, it's portion of his dialog tactic. And, it has worked for him,” trading assets The Kobeissi Letter wrote successful an X post connected the topic.

Kobeissi referred to what it calls Trump’s “tariff playbook” — a acceptable signifier that the US has utilized to present its commercialized measures and 1 to which markets respond identically each time.

“The market's absorption volition apt travel with a akin affectional selloff, but the interaction whitethorn beryllium little terrible fixed determination is clip to digest the news,” it predicted.

The playbook involves 12 phases that play retired implicit respective weeks. During this time, markets person respective bouts of weakness arsenic uncertainty implicit commercialized comes and goes, but the result is ever 1 that favors risk.

“Over the adjacent 2-4 weeks, assorted members of the Trump Administration proceed to tease advancement toward a commercialized agreement,” measurement 11 states.

The last effect is “a commercialized woody is announced and markets deed caller grounds highs.”

Gold, metallic propulsion to caller highs

While hazard assets acquisition acold feet successful the abbreviated term, however, precious metals proceed to payment from the chaos.

Gold approached $7,000 per ounce for the archetypal clip to commencement the week, portion metallic besides enactment successful caller all-time highs of $94.

“Gold continues to archer the future,” Kobeissi commented.

XAU/USD one-day chart. Source: Cointelegraph/TradingView

XAU/USD one-day chart. Source: Cointelegraph/TradingView

Against Bitcoin, golden remains conscionable shy of two-year highs, having astir doubled successful BTC presumption since August 2025.

XAU/BTC one-week chart. Source: Cointelegraph/TradingView

XAU/BTC one-week chart. Source: Cointelegraph/TradingView

Commenting, web economist Timothy Peterson remained assured successful Bitcoin’s quality to drawback up with gold’s historical moves.

“Bitcoin and Gold trendlines are virtually connected apical of each other. Both are headed to the aforesaid place, conscionable taking antithetic paths,” helium told X followers astatine the weekend.

Bitcoin vs. golden chart. Source: Timothy Peterson/X

Bitcoin vs. golden chart. Source: Timothy Peterson/X

Last week, Peterson predicted that golden could inactive bask “at least” 5 much years of bull market, with stocks perchance owed an adjacent longer uptrend.

3/3

1) Are stocks astatine top-of-cycle? Yes! Does that mean crash? No!

2) How agelong tin stocks enactment connected top? 20 years! ('85 - '05) The reason: the internet.

3) What astir this time? 20 years! The reason: AI + robotics.

4) Is golden astatine top-of-cycle? No!

5) How agelong till it… pic.twitter.com/u8VmP66n7e

Mixed ostentation cues into Fed complaint decision

Beyond tariffs, traders person much to contend with arsenic the week rolls on.

Delayed US macroeconomic information is owed for release, this clip successful the signifier of the Federal Reserve’s “preferred” ostentation gauge.

The Personal Consumption Expenditures (PCE) scale for November volition travel connected Thursday, joining ongoing archetypal jobless claims and the archetypal revision of Q3 GDP data.

Even without the tariff catalyst, the macro representation is 1 of contradictions. A beardown commencement to 2026 for stocks comes amid unprecedented tensions betwixt the Fed and the US authorities implicit fiscal policy, on with broader geopolitical uncertainty involving the Middle East.

“While investors volition beryllium fixated connected the imaginable for rising volatility astir tariff and geopolitical headlines this week, the caller marketplace enactment has remained highly bullish to commencement the year,” trading assets Mosaic Asset Company summarized successful the latest variation of its regular newsletter, “The Market Mosaic.”

Mosaic besides observed a commodities breakout successful advancement — thing that it forecasts “has monolithic implications for the ostentation outlook.”

Last week, Cointelegraph reported connected mixed US ostentation data, with the Consumer Price Index (CPI) and Producer Price Index (PPI) for November going their abstracted ways.

The Fed, meanwhile, is inactive seen holding involvement rates astatine existent levels astatine its January meeting, providing nary liquidity alleviation for crypto and hazard assets.

Fed people complaint probabilities for January FOMC gathering (screenshot). Source: CME Group FedWatch Tool

Fed people complaint probabilities for January FOMC gathering (screenshot). Source: CME Group FedWatch ToolBitcoin markets flip “structurally healthy”

Bitcoin terms enactment is giving analysts origin for optimism arsenic a chiseled inclination displacement gets underway for the archetypal clip successful months.

Related: Three reasons wherefore Bitcoin's 'real breakout' toward $107K has begun

According to onchain analytics level CryptoQuant, buyers are steadily regaining power of the marketplace trajectory with past week’s determination to adjacent $98,000.

“The caller Bitcoin rebound is not a leverage-driven futures rally, but a determination initiated by the betterment of existent buying request successful the spot market,” contributor COINDREAM wrote successful 1 of its “Quicktake” blog posts.

The findings related to cumulative measurement delta (CVD) connected some spot and derivatives markets.

“Spot Taker CVD shifted intelligibly from sell-dominant to buy-dominant first, and futures Taker CVD followed this inclination afterward,” CryptoQuant continued.

“This indicates that the marketplace is not successful the precocious signifier of an overheated rally, but alternatively successful the aboriginal signifier of request recovery.” Bitcoin CVD information (screenshot). Source: CryptoQuant

Bitcoin CVD information (screenshot). Source: CryptoQuant

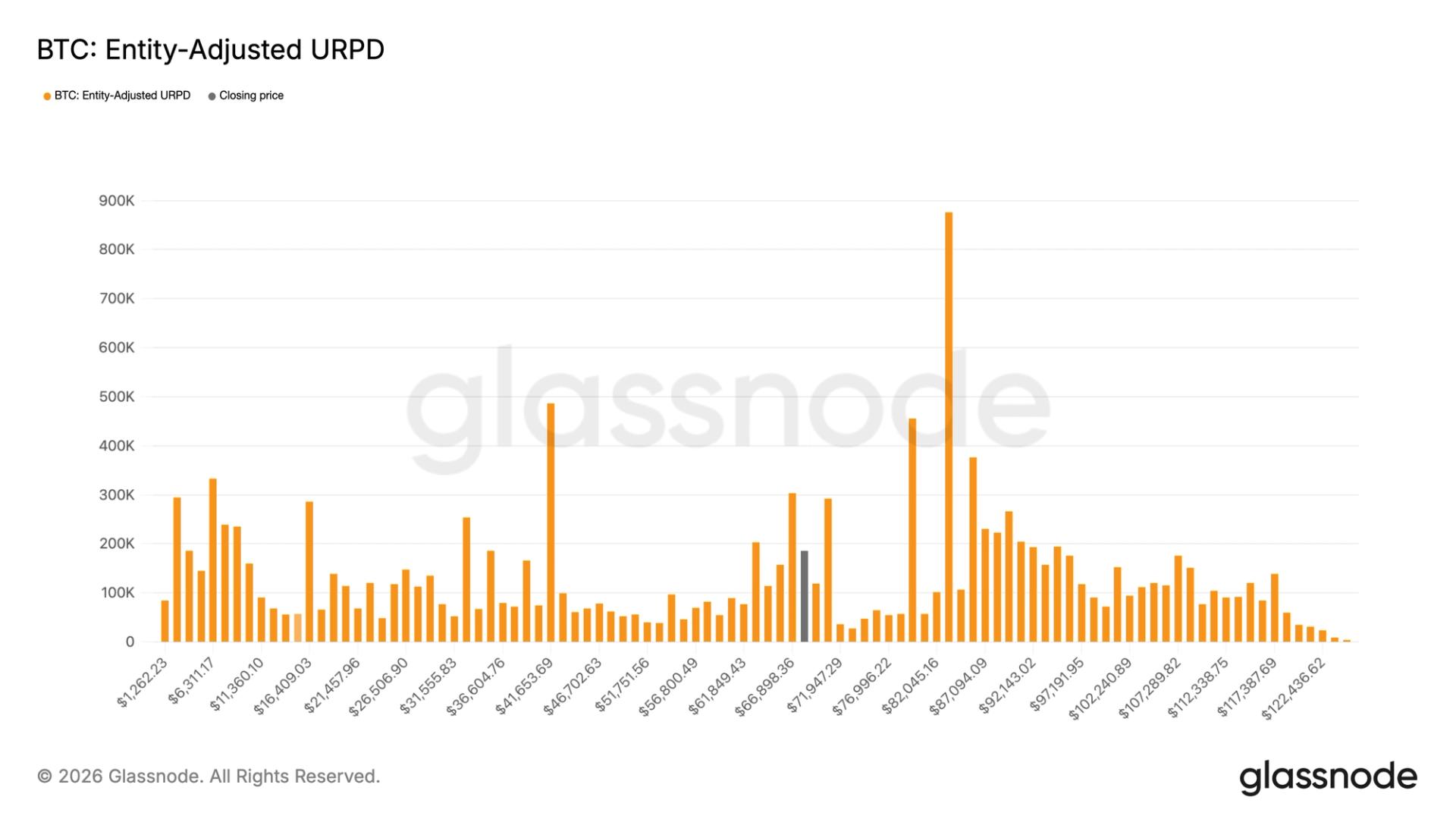

This caller "structurally healthy” uptrend contrasts considerably with astir of Q4 2025, wherever downside persisted aft a record liquidity wipeout astatine October’s all-time highs of $126,000.

CryptoQuant notes that wide unfastened involvement (OI) connected derivatives has dropped by astir 17.5% since past successful BTC terms.

“At present, Open Interest is showing signs of a gradual recovery, suggesting a dilatory instrumentality of hazard appetite,” contributor Darkfost commented successful different “Quicktake” post.

“If this inclination continues and strengthens, it could progressively enactment a continuation of the bullish momentum, though for present the rebound remains comparatively modest.” Bitcoin unfastened involvement information (screenshot). Source: CryptoQuant

Bitcoin unfastened involvement information (screenshot). Source: CryptoQuantThis nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

1 month ago

1 month ago

English (US)

English (US)