This week has been an eventful 1 for Ethereum, with the launch of spot ETH ETFs imminent by the extremity of summer.

The SEC has closed its long-running probe into Ethereum 2.0, determining that the income of ETH did not represent securities transactions. The June 19 determination is simply a culmination of a streak of bully quality for Ethereum, which began a dilatory and dependable consolidation past week.

Ethereum experienced a flimsy upward inclination starting connected June 13, peaking connected June 16 astatine $3,619 earlier dipping backmost down. However, arsenic the terms fluctuation past week was comparatively modest, it suggests a play of consolidation alternatively than utmost volatility. Stability similar this tin often bespeak a marketplace waiting for a important lawsuit oregon quality to trigger a much decisive movement.

Graph showing Ethereum’s terms from June 13 to June 20, 2024 (Source: CryptoSlate ETH)

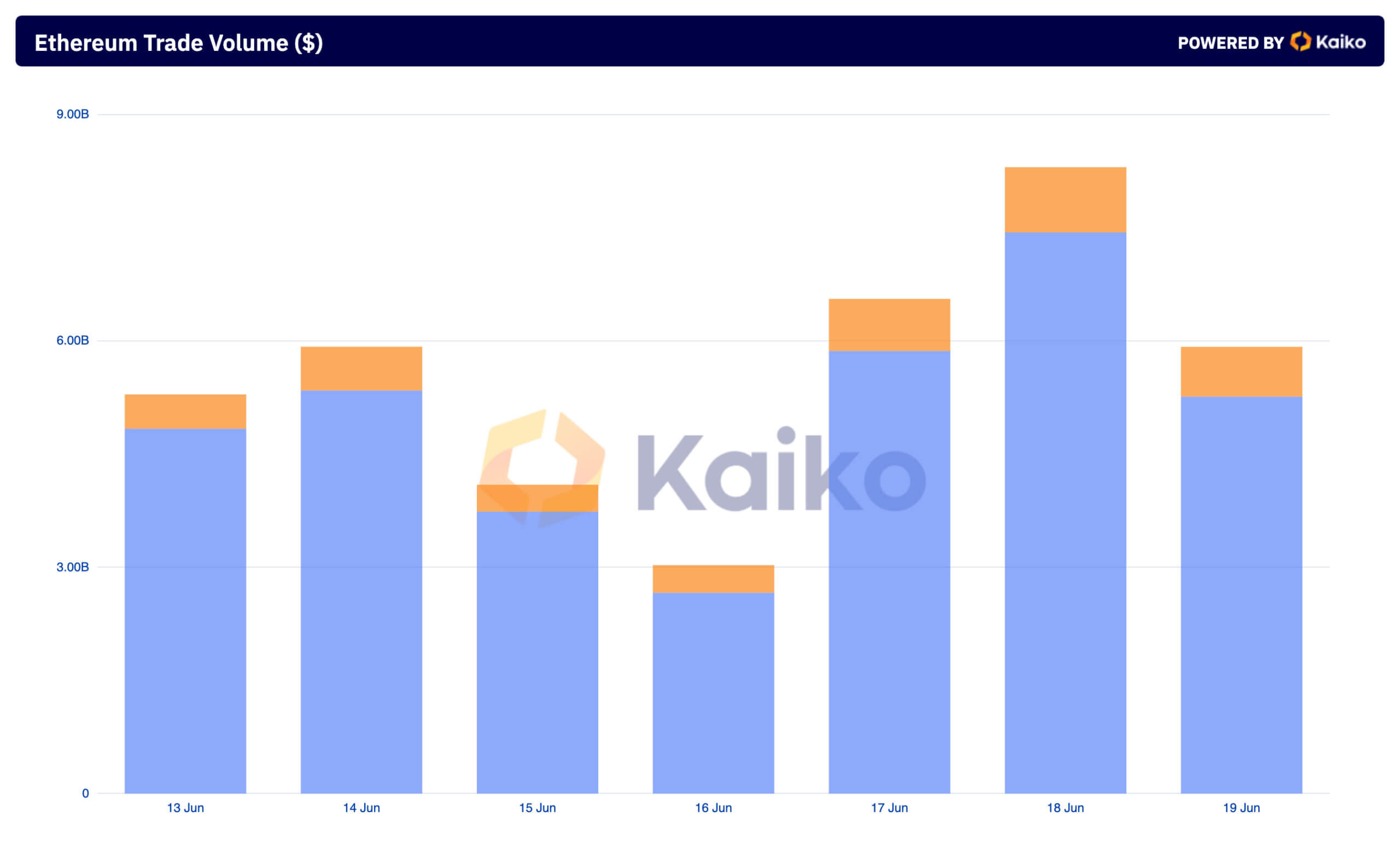

Graph showing Ethereum’s terms from June 13 to June 20, 2024 (Source: CryptoSlate ETH)Despite the deficiency of important volatility, the marketplace saw fluctuating measurement crossed some centralized (CEX) and decentralized exchanges (DEX). Notable spikes were identified connected June 17 and June 18, suggesting periods of importantly heightened trading activity.

The precocious volumes connected June 18, with $7.44 cardinal recorded connected CEXs and $864.67 cardinal connected DEXs, amusement that the regulatory clarity granted to Ethereum contributed importantly to the trading activity.

Chart showing the Ethereum trading measurement connected centralized exchanges (blue) and decentralized exchanges (orange) from June 13 to June 19, 2024 (Source: Kaiko)

Chart showing the Ethereum trading measurement connected centralized exchanges (blue) and decentralized exchanges (orange) from June 13 to June 19, 2024 (Source: Kaiko)The disparity betwixt CEX and DEX volumes provides important penetration into marketplace preferences. Trading volumes connected centralized exchanges person consistently outpaced those connected decentralized ones contempt Ethereum being the go-to DeFi hub.

This shows that contempt the maturation and adoption of DeFi, centralized exchanges inactive predominate the ETH marketplace successful presumption of liquidity and trading activity. However, the dependable volumes we’ve seen crossed decentralized exchanges successful the past fewer weeks constituent to the increasing resilience of this sector, which continues to service an important subset of traders.

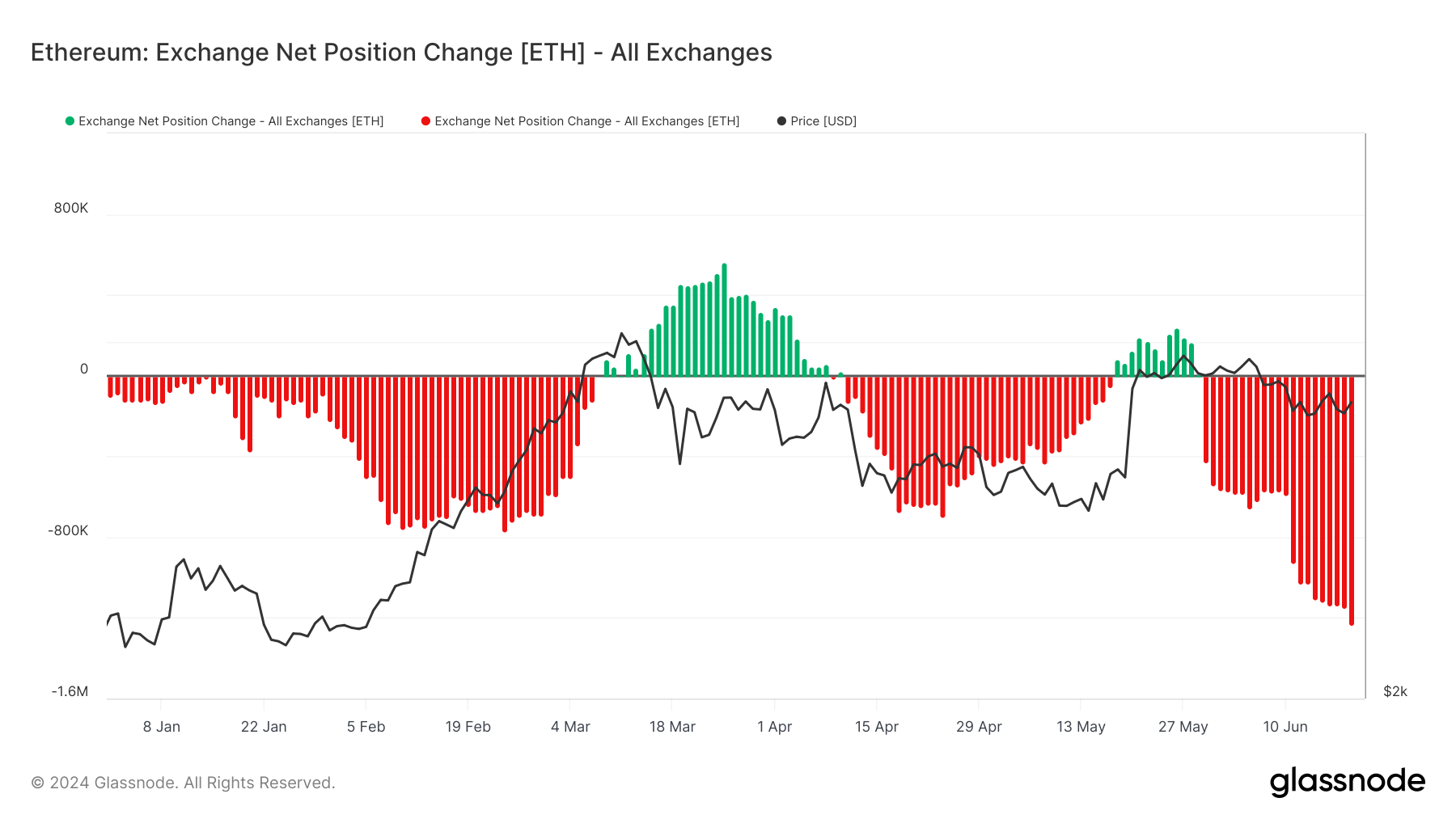

While it’s hard to find a bullish oregon bearish inclination from trading measurement alone, speech balances tin amended foretell existent and upcoming trends. Since the extremity of May, determination has been a accordant alteration successful the magnitude of ETH held successful speech wallets.

Zooming retired to the remainder of the year, we tin spot that the withdrawal inclination dominates, breached lone by 2 comparatively short-lived bursts of speech equilibrium increases successful March and May. On June 19, the marketplace saw the largest 30-day antagonistic alteration successful exchange-held proviso successful astir a year, with 1.234 cardinal ETH leaving exchanges.

Chart showing the 30-day alteration of the proviso of Ethereum held successful speech wallets from Jan. 1 to June 19, 2024 (Source: Glassnode)

Chart showing the 30-day alteration of the proviso of Ethereum held successful speech wallets from Jan. 1 to June 19, 2024 (Source: Glassnode)As with Bitcoin, the accordant alteration successful ETH held successful speech wallets typically aligns with a bullish outlook. Investors often retreat assets from exchanges erstwhile they expect terms appreciation. Holding assets disconnected exchanges reduces the contiguous proviso disposable for trading, creating upward unit connected prices if request remains accordant oregon increases.

This aligns with a erstwhile CryptoSlate analysis, which identified a important summation successful semipermanent Ethereum holders. Long-term holders are typically little acrophobic with short-term volatility and are much focused connected the asset’s cardinal worth and semipermanent maturation prospects.

Investors look to beryllium positioning themselves for imaginable upward movement, apt influenced by the caller affirmative regulatory developments and expanding organization interest. The terms stableness observed whitethorn proceed arsenic the marketplace digests these factors, perchance starring to a breakout if further affirmative quality oregon important developments occur.

However, the market’s absorption to outer factors volition besides play a important relation successful terms movements. Any antagonistic quality oregon regulatory setbacks could dampen the bullish sentiment and summation volatility.

The station Bullish motion for Ethereum arsenic speech balances drop appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)