Bitcoin (BTC) is poised for a imaginable surge aft forming a bullish method signifier and attracting a question of organization investment. The world’s starring cryptocurrency precocious surpassed the $70,000 mark, mounting the signifier for a imaginable breakout that could eclipse its existent all-time precocious of $73,750.

This optimistic outlook comes from expert Ali Martinez, who identified a bull emblem signifier connected Bitcoin’s 4-hour chart. This method indicator typically follows a important terms summation and signifies a consolidation play with a flimsy downward trend. However, the decreasing trading measurement during this signifier suggests a impermanent intermission alternatively than a reversal, perchance starring to a renewed uptrend.

Validating The Bull Flag Pattern: Bitcoin Consolidation Phase Analysis

Bitcoin’s caller dip beneath $61,000 served arsenic a investigating crushed for this theory. The cryptocurrency demonstrated resilience by rebounding into the $67,000-$70,000 range, solidifying the imaginable validity of the bull emblem pattern. This consolidation signifier is important for marketplace participants to reassess their positions and gauge wide capitalist sentiment.

#Bitcoin appears to beryllium breaking retired of a bull emblem connected the 4-hour chart! If $BTC holds supra $70,000, we could spot a surge of astir 10% to a caller all-time precocious of $77,000! pic.twitter.com/MPVB70p9DU

— Ali (@ali_charts) March 28, 2024

The caller dip wasn’t needfully a origin for alarm, explained Martinez. In fact, it could beryllium interpreted arsenic a steadfast consolidation that strengthens the instauration for further growth.

Beyond method analysis, a important displacement successful Bitcoin’s ownership operation is fueling optimism. The long-awaited motorboat of spot Bitcoin Exchange Traded Funds (ETFs) successful the United States has opened the doorway for organization investors. These professionally managed funds, backed by large fiscal institutions, are estimated to clasp a combined 5% of the full Bitcoin supply.

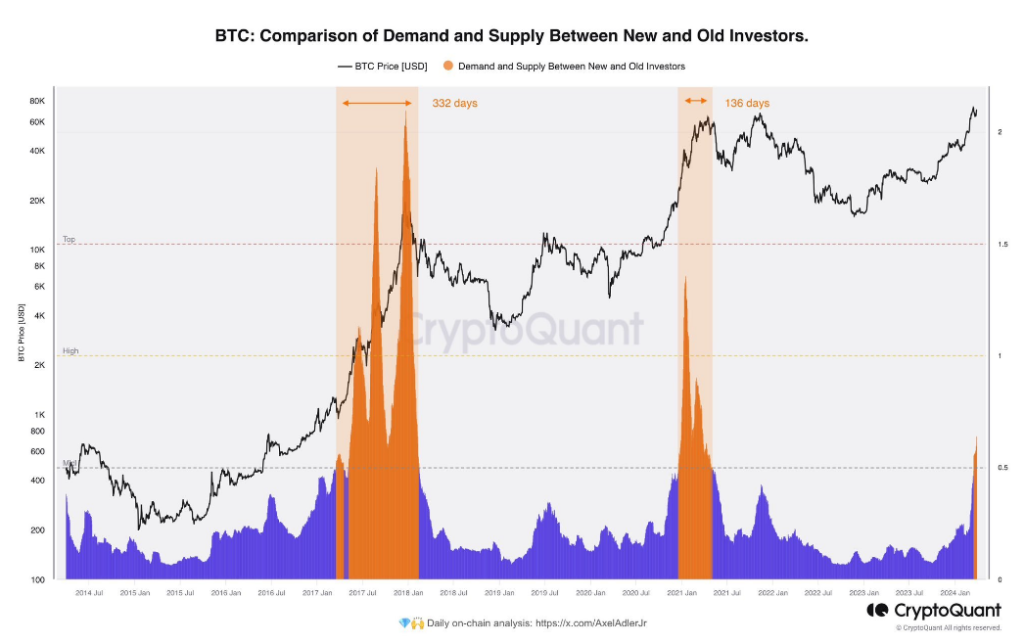

On-chain information further corroborates this organization influx. CryptoQuant, a blockchain analytics firm, reports a deviation from past bull cycles. Traditionally, Bitcoin ownership flowed from existing ample holders (“whales”) to retail investors. However, the existent marketplace rhythm appears to beryllium witnessing a transportation from these whales to caller whales – accepted fiscal institutions.

Bitcoin’s Bullish Price Predictions

The influx of organization superior has emboldened immoderate analysts to marque bullish terms predictions. While Martinez refrained from offering a circumstantial timeframe for the anticipated breakout supra $73,750, others are much forthcoming. Optimistic forecasts scope from $100,000 to $150,000 for Bitcoin by the extremity of 2024, with immoderate adjacent predicting a staggering terms of $500,000 by 2025.

Related Reading: Fantom: Market Slowdown Chops Off 10% From Gains – Here’s Why

However, experts caution against blindly pursuing specified utmost predictions. The cryptocurrency marketplace remains inherently volatile, and method investigation is not a foolproof method for guaranteeing aboriginal terms movements. The semipermanent interaction of organization engagement connected marketplace dynamics is besides yet to beryllium afloat understood.

Despite these words of caution, the confluence of a bullish method signifier and a surge successful organization concern has undeniably created a consciousness of excitement surrounding Bitcoin. As the world’s starring cryptocurrency continues its ascent towards uncharted territory, each eyes are connected whether it tin so interruption caller crushed and found a caller all-time high.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)