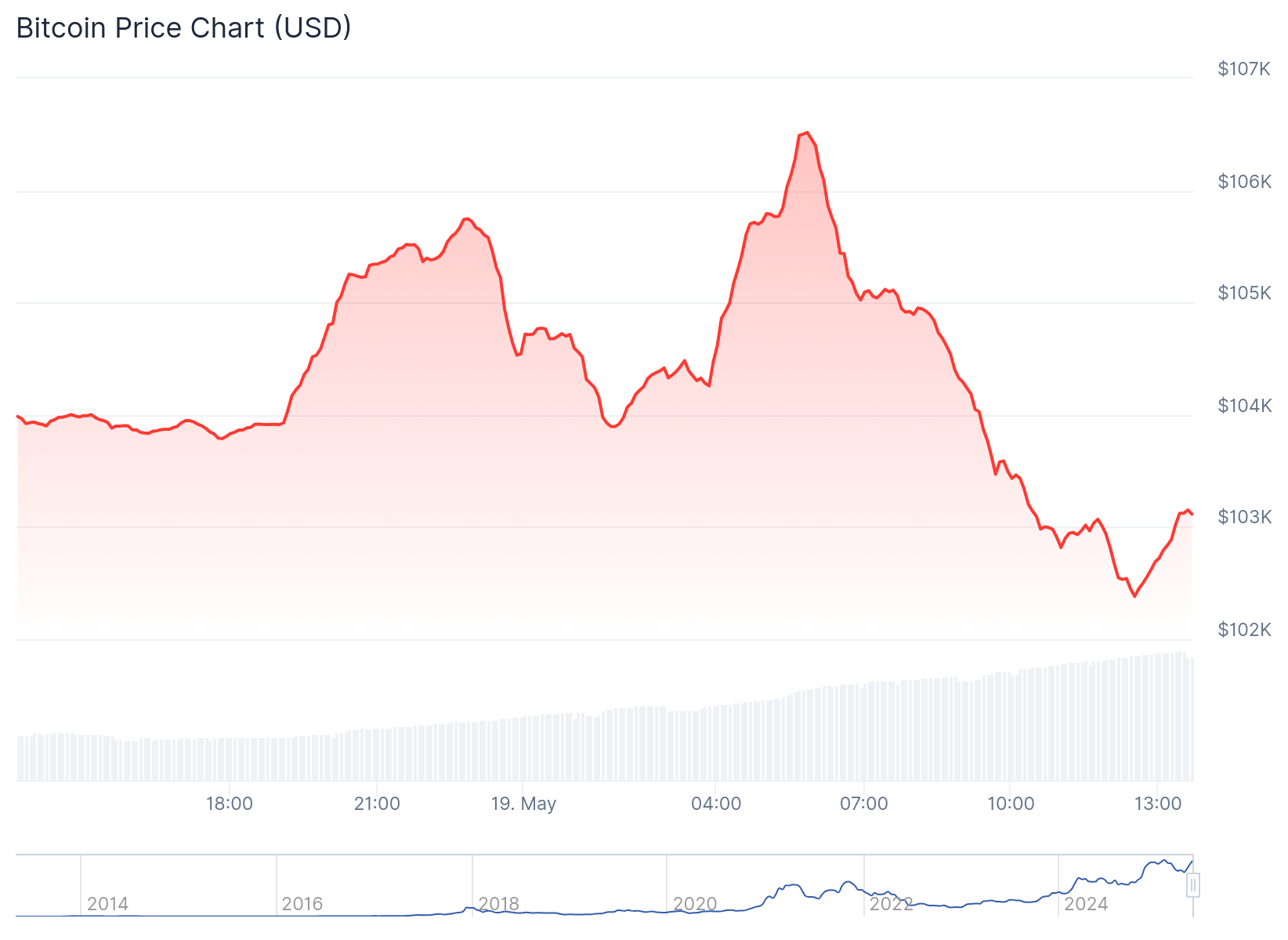

Over $600 cardinal successful crypto derivatives positions person been liquidated since precocious Sunday arsenic bitcoin (BTC) staged a crisp rally past $106,000 successful the wee hours, lone to reverse people and dump backmost to adjacent $103,000, catching some bulls and bears disconnected guard.

The determination began astir 21:00 UTC connected Sunday, erstwhile bitcoin spiked much than $2,500 successful little than an hr — a signifier that tin beryllium attributed to bladed play liquidity and imaginable algorithmic buying triggered by method levels.

Such terms enactment was a textbook abbreviated compression followed by assertive profit-taking oregon stop-run. A abbreviated compression happens erstwhile traders betting against a terms (short sellers) are forced to bargain the plus arsenic it rises, to screen their losses, which pushes the terms adjacent higher and often precise quickly.

The abrupt determination wiped retired over $460 cardinal successful agelong positions and $220 cardinal successful shorts, crossed futures tracking majors similar ether (ETH), solana (SOL), and dogecoin (DOGE).

The liquidation question was notable for occurring during traditionally quiescent play hours, an antithetic lawsuit that marks forced selling oregon buying enactment by a large player.

SOL, DOGE and XRP prices are down much than 4% successful the past 24 hours, data shows, with the broad-based CoinDesk (CD20) down much than 2%.

The volatility follows a week of macro uncertainty, with Moody’s cutting the U.S. recognition standing connected Friday and ostentation fears resurfacing aft mixed economical data. The downgrade besides led to U.S. 30-year treasury yields breaching the 5% mark.

While crypto has broadly benefited from renewed organization inflows and spot ETF momentum, traders stay cautious astatine existent terms levels, as reported.

Bitcoin is level implicit the past week, but the caller nonaccomplishment to clasp supra $106,000 — a cardinal intelligence and method level — whitethorn awesome near-term resistance, FxPro’s Alex Kuptsikevich told CoinDesk past week.

Meanwhile, immoderate traders expect higher volatility successful the days to travel successful a informing motion for those looking to leverage their bets.

“Investors are shifting superior to Bitcoin arsenic concerns turn implicit a pending US spending measure that could adhd trillions successful indebtedness and propulsion for higher Treasury premiums,” Haiyang Ru, co-CEO of the HashKey Business Group, told CoinDesk successful a Telegram message.

“But portion bitcoin hovers conscionable beneath caller highs, we expect much marketplace volatility arsenic traders hole for caller commercialized deals and a last mentation of the fiscal policy,” Ru added.

Read more: U.S. 30-Year Treasury Yield Breaches 5% Amid Moody's Rating Downgrade, Fiscal Concerns

7 months ago

7 months ago

English (US)

English (US)