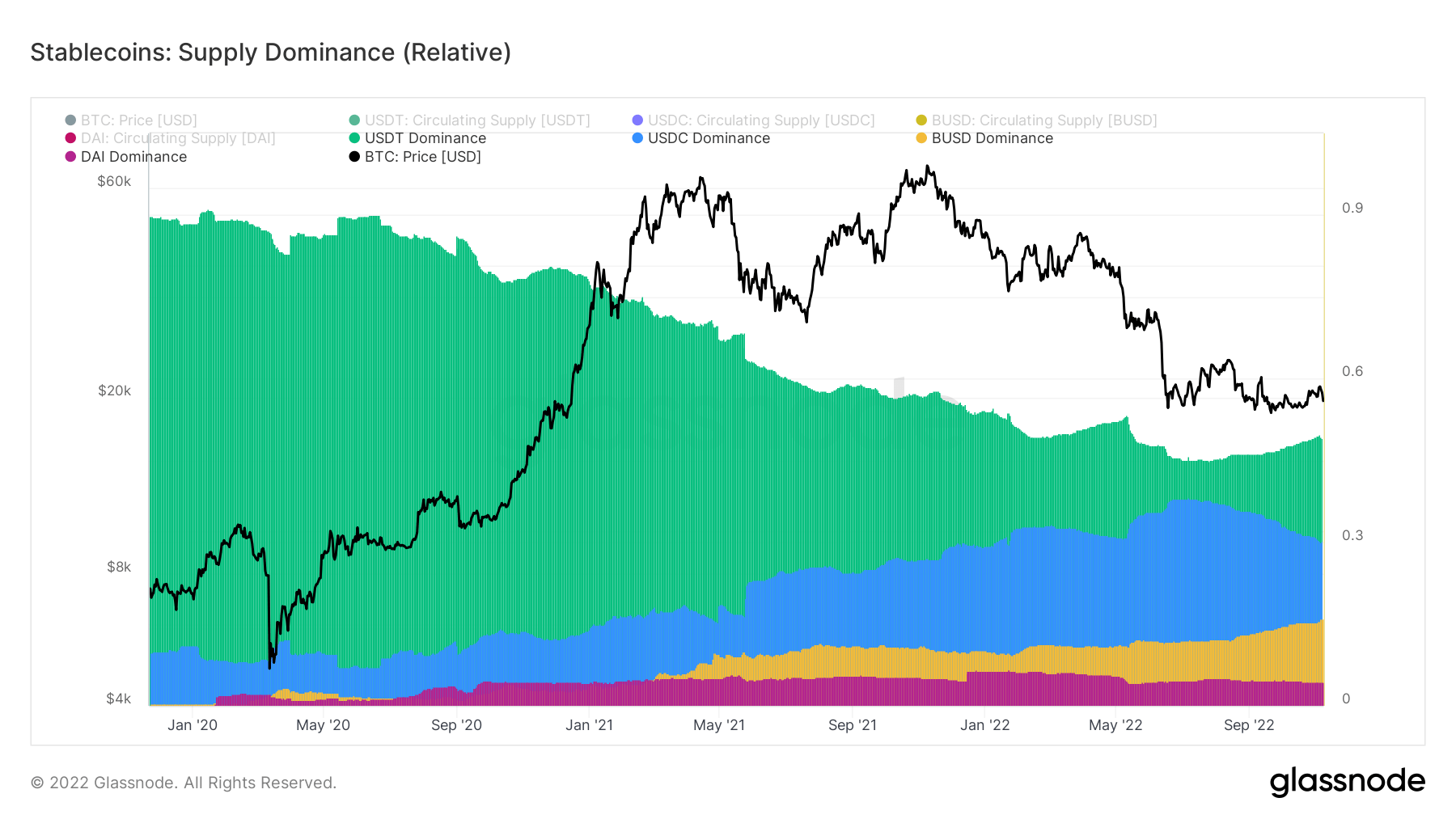

Binance USD (BUSD) is the best-performing stablecoin among the apical 3 stablecoins, arsenic its proviso dominance accrued by 6% connected the year-to-date metrics to 16%.

The Binance-backed stablecoin has seen its proviso turn from $18 cardinal astatine the commencement of the twelvemonth to $22 cardinal arsenic of property time. Its maturation was mostly pushed by Binance’s determination to person the USDC equilibrium of its users into BUSD.

Source: Glassnode

Source: GlassnodeTether proviso dominance drops

Glassnode data, arsenic analyzed by CryptoSlate, showed that Tether’s USDT saw its dominance chopped to 50% from 54%. Tether’s marketplace headdress started the twelvemonth astatine implicit $78 billion, peaking astatine $84 cardinal successful aboriginal May.

Terra’s UST implosion during this play severely impacted spot successful different stablecoins and the broader crypto market.

During this period, USDT experienced a mini slope tally that saw it grant astir $10 cardinal successful redemptions implicit 2 weeks. The stablecoin besides temporarily mislaid its peg arsenic galore questions were being asked astir its reserves.

While Tether has powerfully recovered from this period, increasing its proviso from a debased of$62.17billion to $69 billion, it is inactive down from its May highest of implicit $84 billion.

USDC stay unchanged

The 2nd largest stablecoin by marketplace cap, USD Coin (USDC), saw its dominance stay unchanged astatine 30% connected the year-to-date metric.

USDC survived the Terra way unscathed and concisely ate into Tether’s dominance arsenic its proviso grew from $42 cardinal recorded astatine the opening of the twelvemonth to a highest of $55.90 cardinal successful July

However, its proviso has shrunk by $10 cardinal from that highest to $43 cardinal pursuing Binance’s determination to convert its users’ equilibrium successful USDC, TUSD, and USDP to its autochthonal stablecoin BUSD.

Meanwhile, USDC’s issuer Circle has continued to marque respective moves to regain its erstwhile glory. Circle announced its euro coin (EUROC) stablecoin would beryllium supported connected the Solana blockchain by 2023. Apart from that, it besides started transferring USDC reserves into a Blackrock-managed fund.

The station BUSD proviso dominance grows arsenic USDT’s proviso drops 4% appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)