Bitcoin is weaving done a consolidation signifier since marking a caller all-time precocious of $73,777 successful mid-March. Since then, Bitcoin’s regular closing prices person exhibited important restraint, ne'er sealing supra $71,500 and maintaining a level supra $54,000, though it has seen a large intraday debased touching $49,000. This consolidation signifier has nudged the Fear and Greed Index towards a cautious “fear” people of 30, revealing an ambiance of apprehension amongst traders who find themselves often whipsawed by the volatile marketplace dynamics.

Is $60,000 The New $10,000 For Bitcoin Price?

Despite the prevailing marketplace nerves, immoderate marketplace experts judge that this is simply a imaginable buying opportunity, reminiscent of akin marketplace conditions seen successful 2019. Bloomberg ETF adept James Seyffart remarked via X: “Bitcoin close present astir $50k-$70k implicit the past 6 months kinda sorta reminds of BTC trading astir $7k – $10k from mid 2019 done aboriginal to mid 2020.”

He acknowledges the complexities of comparing humanities and existent charts, emphasizing that portion humanities patterns should not dictate aboriginal outcomes, the comparative dynamics connection insightful parallels. “I evidently cognize not to equate humanities charts with existent charts. one cognize each the differences of the existent terms dynamics etc. $10k was mode further disconnected the $20k+ ATH that 60K is. But spell up — marque amusive of me. I tin instrumentality it,” Seyffart added.

James “Checkmate” Check, a starring on-chain expert and co-founder of Checkonchain, concurred with Seyffart’s observation. “The similarities betwixt the 2024 chop-consolidation, and the 1 we experienced backmost successful 2019 are strange, and uncanny.”

In 2019, the marketplace notably surged from $4,000 to $14,000 wrong 3 months, importantly driven by the PlusToken Ponzi scheme successful China, which absorbed astir 2% of Bitcoin’s full circulating proviso astatine the time. This was followed by a wide sell-off of these acquired coins connected Huobi by the Chinese CCP, contributing to prolonged marketplace choppiness until the crisp downturn successful March 2020.

Drawing a parallel, Check noted that a akin series unfolded successful 2024 erstwhile the marketplace climbed from $40,000 to $73,777, catalyzed by a important uptake successful spot bids from US spot ETFs, absorbing astir 5% of the Bitcoin supply. This was succeeded by important selling activities from the US and German governments, involving astir 70,000 BTC, which contributed to sustained marketplace chop until the 5-August Yen Carry Trade unwind.

“Seriously, it is genuinely bizarre however akin these events are, and this is conscionable based connected the header events. There is adjacent much grounds beneath the surface,” Check concluded. He shared respective on-chain metrics which item the beardown similarities.

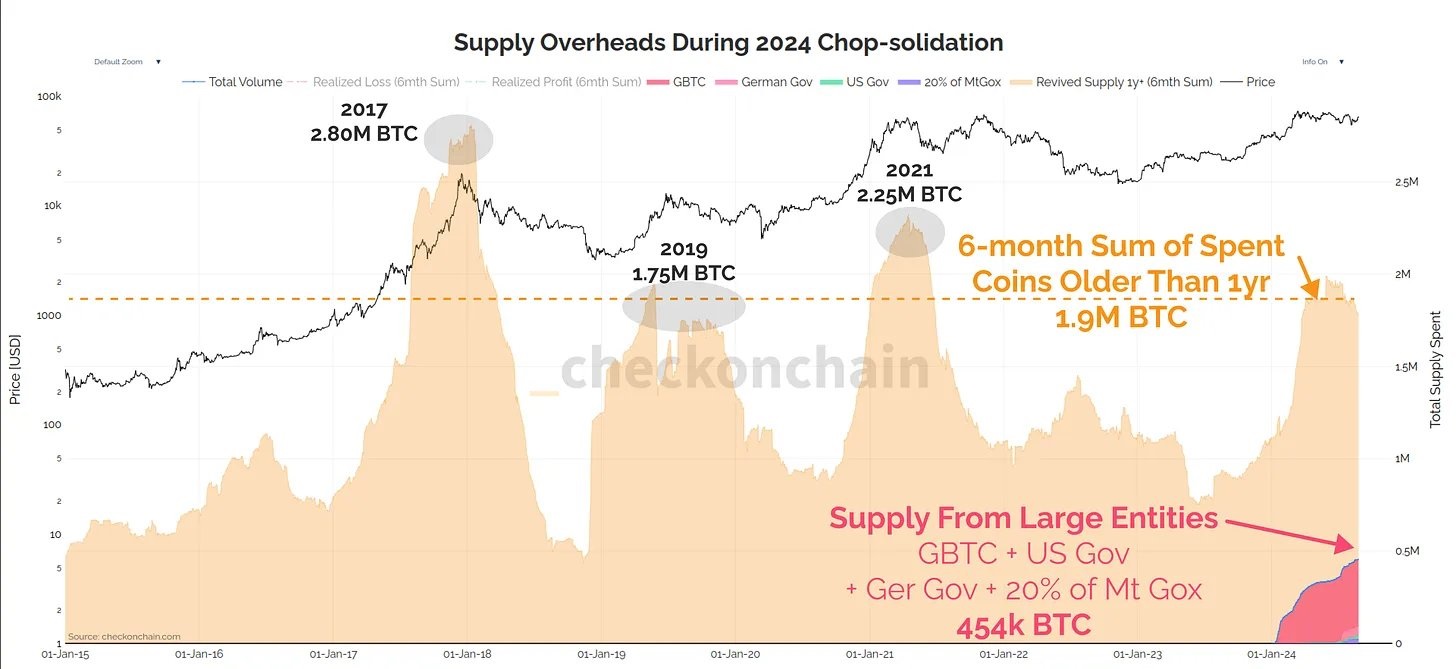

His “Supply Overheads During 2024 Chop-consolidation” illustration showed that the 6-month sum of spent coins older than 1 twelvemonth was rather akin to humanities movements. In 2019, 1.75 cardinal BTC was moved by this cohort; comparably, successful 2024, arsenic of today, 1.9 cardinal BTC has been mobilized. Noteworthy, the ample entities, including the Grayscale Bitcoin Trust (GBTC), German Government, and the US government, accounted for astir 454,000 BTC of this movement.

Supply Overheads During 2024 Chop-consolidation | Source: X @_Checkmatey_

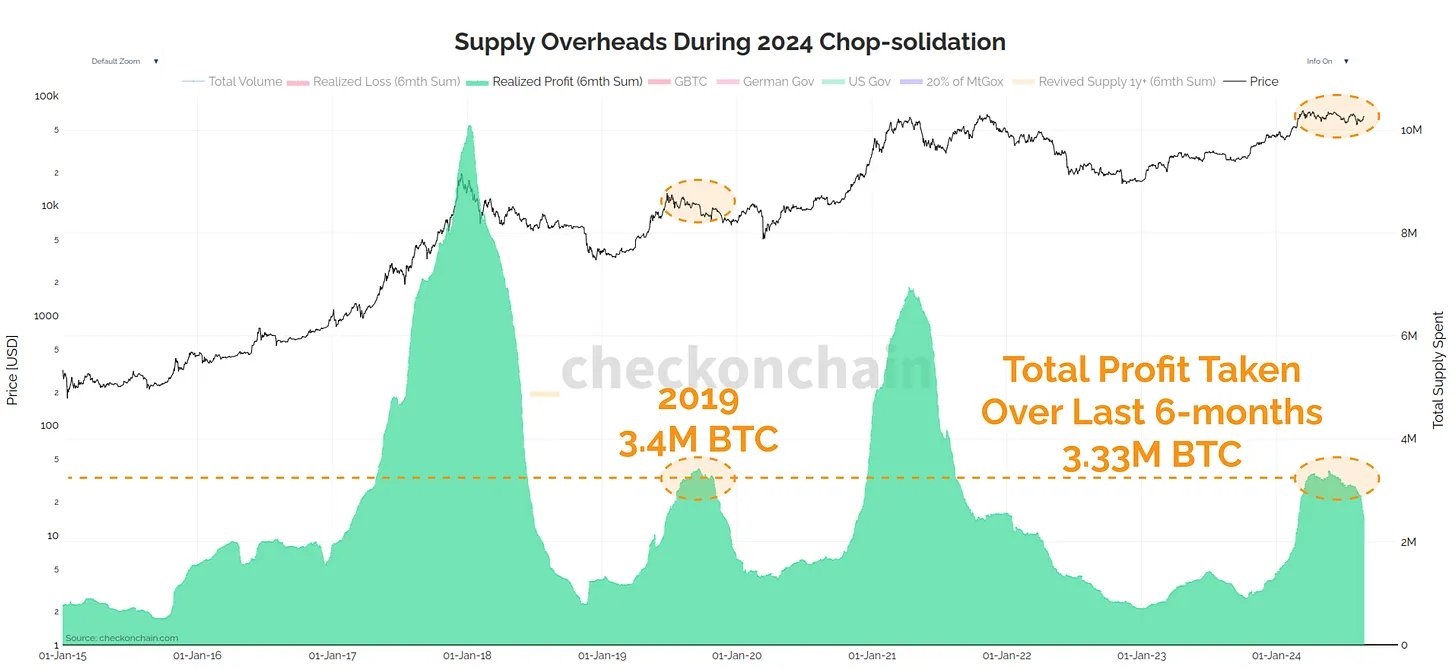

Supply Overheads During 2024 Chop-consolidation | Source: X @_Checkmatey_Additional information from Check’s investigation highlighted the “Realized Profits” during these periods. In 2019, 3.4 cardinal BTC were sold for nett implicit six months. In 2024, this fig stands astatine 3.33 cardinal BTC.

Realized Profit (6 period sum) | Source: X @_Checkmatey_

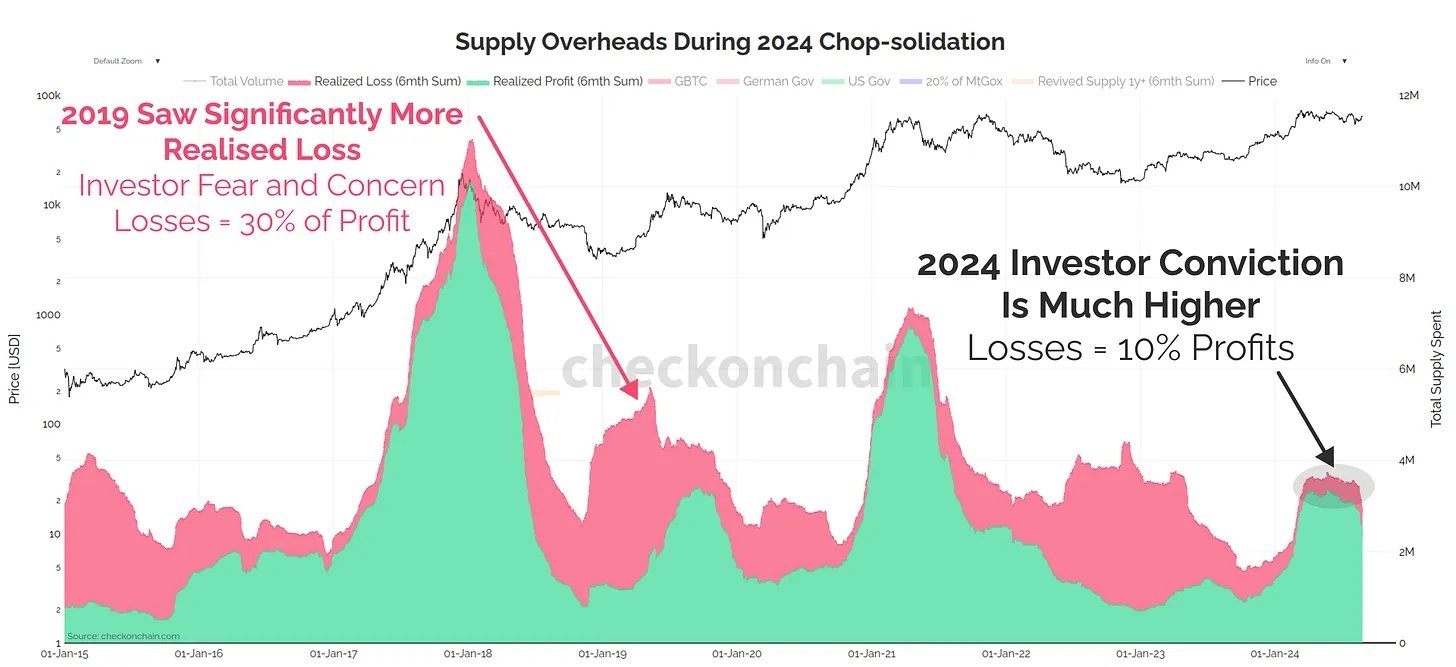

Realized Profit (6 period sum) | Source: X @_Checkmatey_However, the investigation of realized losses provides a stark opposition betwixt the 2 periods. In 2019, losses equaled 30% of the profits, indicating a marketplace fraught with capitalist fearfulness and readiness to merchantability astatine losses. Conversely, successful 2024, losses are lone 10% of the profits. This examination demonstrates however marketplace sentiment has shifted from 2019 to 2024, with investors successful 2024 appearing much assured and little prone to panic selling.

Realized Loss (6 period sum) | | Source: X @_Checkmatey_

Realized Loss (6 period sum) | | Source: X @_Checkmatey_At property time, BTC traded astatine $59,689.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)