While the accustomed volatility has been absent from the derivatives market, the flimsy fluctuations seen successful the past fewer days inactive managed to uncover subtle marketplace trends.

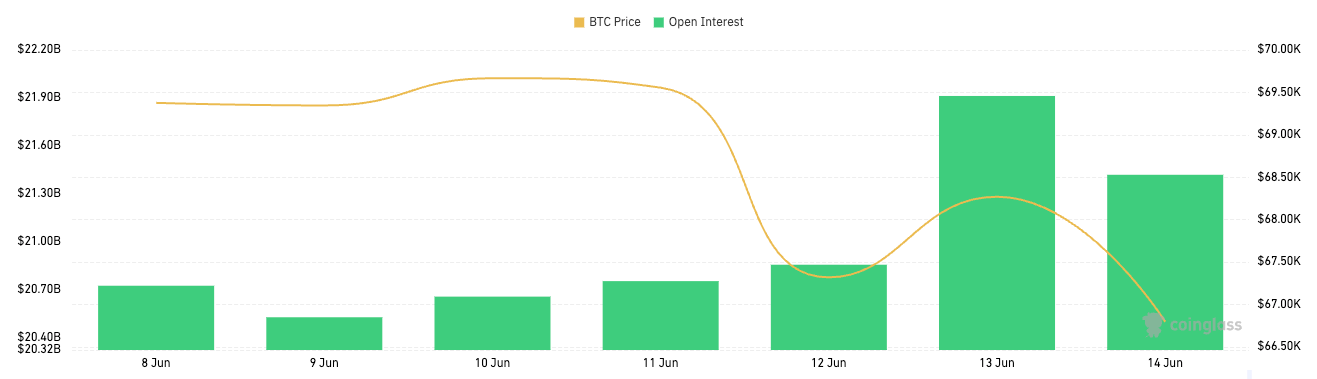

Between June 12 and June 14, Bitcoin options unfastened involvement accrued $20.85 cardinal connected June 12 to $21.91 cardinal connected June 13, earlier decreasing to $21.42 cardinal connected June 14.

Chart showing Bitcoin options unfastened involvement from June 8 to June 14, 2024 (Source: CoinGlass)

Chart showing Bitcoin options unfastened involvement from June 8 to June 14, 2024 (Source: CoinGlass)Open involvement successful Bitcoin futures besides somewhat declined during the period, falling from $35.25 cardinal connected June 12 to $34.17 cardinal connected June 14.

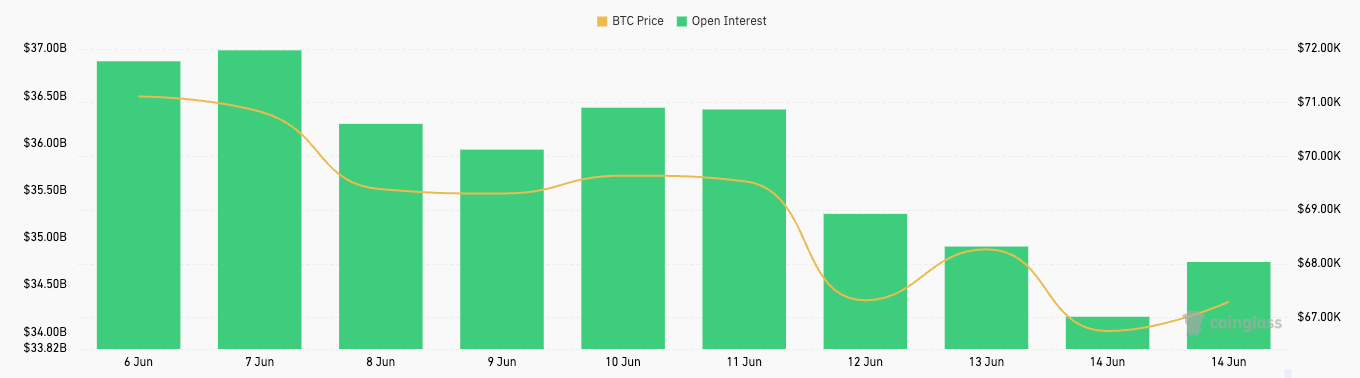

Chart showing Bitcoin futures unfastened involvement from June 6 to June 14, 2024 (Source: CoinGlass)

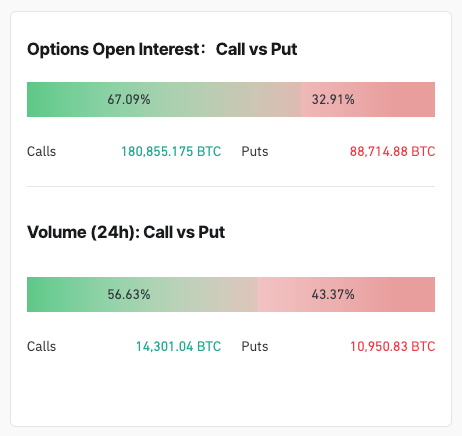

Chart showing Bitcoin futures unfastened involvement from June 6 to June 14, 2024 (Source: CoinGlass)The archetypal summation successful options unfastened interest, followed by a consequent decline, suggests a analyzable marketplace sentiment erstwhile analyzed alongside price. Bitcoin dropped from $69,555 connected June 11 to $66,780 connected June 14, aft a little betterment connected June 13. The predominance of telephone options (67.17%) implicit enactment options (32.83%) arsenic of June 14 indicates an wide bullish sentiment contempt the terms drop. The 24-hour measurement for options connected June 14 besides leaned towards calls (59.88%), reinforcing this bullish outlook adjacent successful a declining terms environment.

The organisation of calls and puts crossed Bitcoin options unfastened involvement and measurement connected June 14, 2024 (Source: CoinGlass)

The organisation of calls and puts crossed Bitcoin options unfastened involvement and measurement connected June 14, 2024 (Source: CoinGlass)These subtle changes successful OI were a effect of a operation of respective factors influencing the broader crypto market. Bitcoin ETFs person experienced mixed inflows and outflows successful the past respective days. The rebound of Bitcoin ETFs with $100 cardinal successful inflows, juxtaposed with a crisp $226 cardinal outflow amid Ethereum ETF news, shows conscionable however large of a deed the marketplace took. This outflow apt contributed to the decreased request for Bitcoin futures, arsenic evidenced by the declining unfastened involvement successful futures.

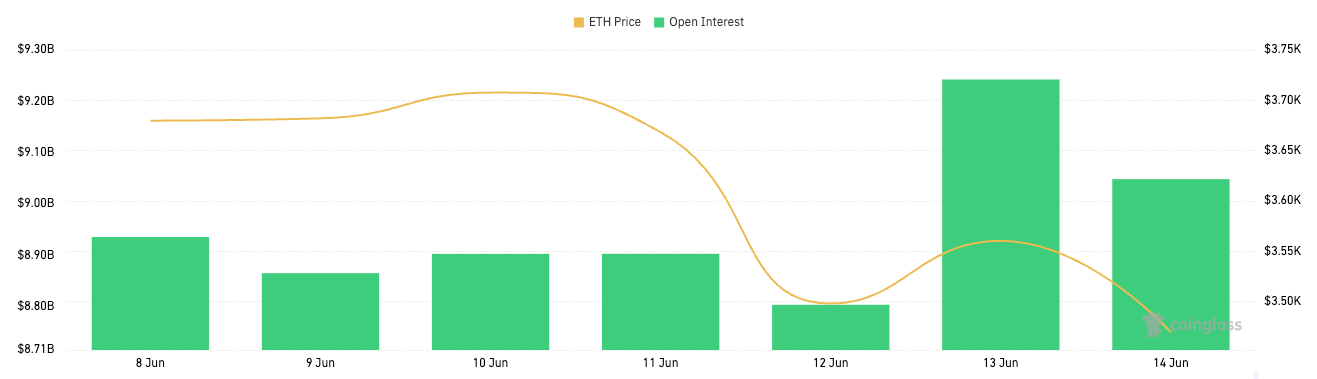

The decisive words from SEC’s Chair Gary Gensler that Ethereum ETFs volition beryllium approved this summertime apt diverted capitalist attraction and superior towards Ethereum, impacting Bitcoin’s derivatives market. This displacement is evident successful Ethereum’s aboriginal and options market, wherever unfastened involvement increases successful the past fewer days bespeak this alteration successful sentiment.

Graph showing Ethereum options unfastened involvement from June 8 to June 14, 2024 (Source: CoinGlass)

Graph showing Ethereum options unfastened involvement from June 8 to June 14, 2024 (Source: CoinGlass)MicroStrategy’s convertible enactment issuance to purchase more BTC besides shaped capitalist sentiment. Michael Saylor’s latest determination demonstrates the company’s unwavering assurance successful Bitcoin, which tin surely power investors participating successful the derivatives market. This power is seen successful their quality to support and summation bullish positions contempt a level price, arsenic seen successful the dominance of telephone options.

ETF outflows person a nonstop interaction connected Bitcoin futures and options markets. Outflows from Bitcoin ETFs tin pb to reduced liquidity and request successful the futures market, causing a alteration successful unfastened interest. This transportation is evident from the data, wherever we observe a diminution successful futures unfastened involvement pursuing important ETF outflows. The narration betwixt ETF flows and futures unfastened involvement shows however important organization information and sentiment are successful driving the market.

Bitcoin’s sideways question and deficiency of important volatility during this play person a dampening effect connected unfastened interest. When the terms remains comparatively stable, traders whitethorn find less opportunities for profit, starring to reduced trading enactment and little unfastened involvement successful futures. The unchangeable terms scope of Bitcoin from June 10 to June 14, with insignificant fluctuations, suggests a play of marketplace consolidation, contributing to the observed diminution successful futures unfastened interest.

The station Calls predominate Bitcoin options contempt terms driblet and ETF outflows appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)